My Trading Strategy for Swing Trades

I used this strategy to find a strong reversal with a 1:5 Risk & Reward Trading Setup

Last, I have discussed 5 stocks in which this pattern forming

A Mega Thread 🧵

I used this strategy to find a strong reversal with a 1:5 Risk & Reward Trading Setup

Last, I have discussed 5 stocks in which this pattern forming

A Mega Thread 🧵

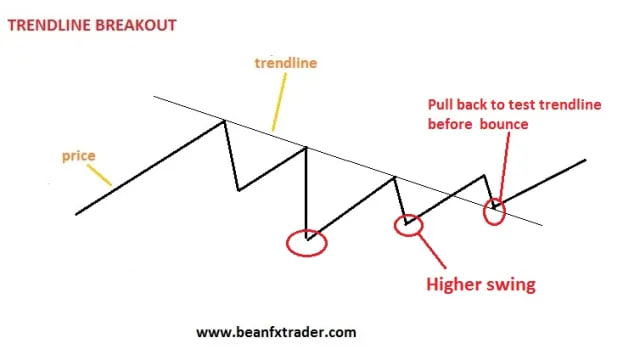

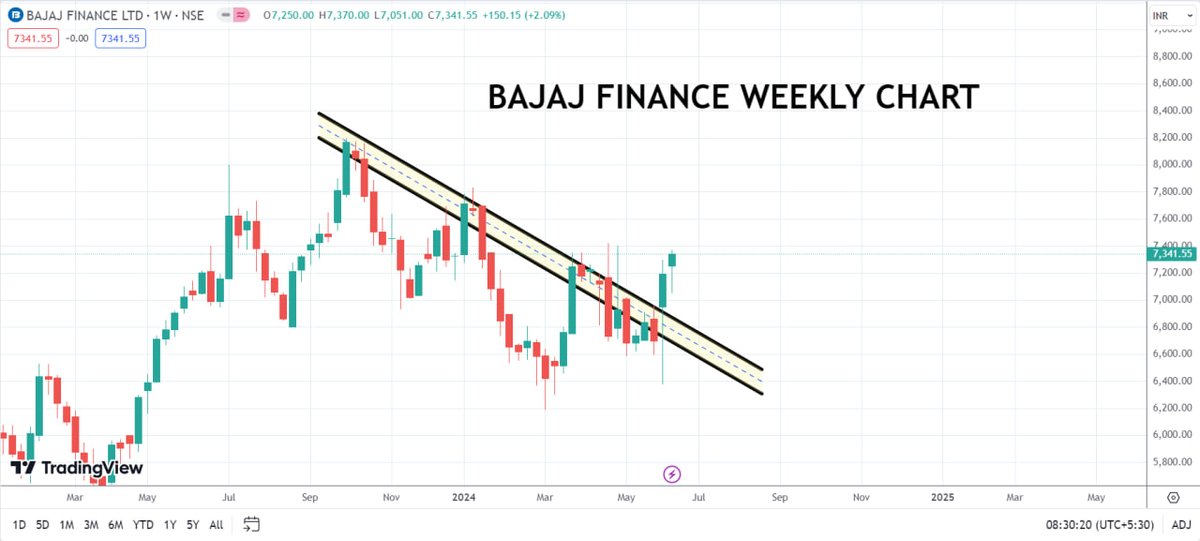

Pattern Formation:

👉 We will wait for a strong downtrend in stock to start falling after that we will try to identify 3 resistance points

👉 We need a minimum 3 resistance points from that level price fall

👉 Mark these 3 points & make a trendline whenever this trendline breaks with Strong Green Candle We can take an entry

👉 We will wait for a strong downtrend in stock to start falling after that we will try to identify 3 resistance points

👉 We need a minimum 3 resistance points from that level price fall

👉 Mark these 3 points & make a trendline whenever this trendline breaks with Strong Green Candle We can take an entry

Risk Management:

Risk management is very important no matter what strategy you are using

Max Stop loss should be 2.5%

RR goes up to 1:4 and above as well

First back test this on 100 charts & after that trade with only 10% of capital after getting confidence & conviction then only trade this setup

Risk management is very important no matter what strategy you are using

Max Stop loss should be 2.5%

RR goes up to 1:4 and above as well

First back test this on 100 charts & after that trade with only 10% of capital after getting confidence & conviction then only trade this setup

Follow My Free Telegram Group

✅ Intraday Strong Stock Breakout & Patterns

✅ Weekend Swing Trading Technical Chart

✅ Built the Right Mindset for Investing and trading

✅ Nifty & Bank Nifty Intraday Support & Resistance with Analysis

✅ Stocks Weekly & Monthly Strong Breakouts

Join II t.me

✅ Intraday Strong Stock Breakout & Patterns

✅ Weekend Swing Trading Technical Chart

✅ Built the Right Mindset for Investing and trading

✅ Nifty & Bank Nifty Intraday Support & Resistance with Analysis

✅ Stocks Weekly & Monthly Strong Breakouts

Join II t.me

Loading suggestions...