As a scalper, I anticipate price to react, retrace, or reverse from specific levels.

Amongst those levels are inefficiencies / key liquidity that overlap with the OTE level - a sensitive area.

In my personal experience, the best OTE setups form during the New York KZ.

Amongst those levels are inefficiencies / key liquidity that overlap with the OTE level - a sensitive area.

In my personal experience, the best OTE setups form during the New York KZ.

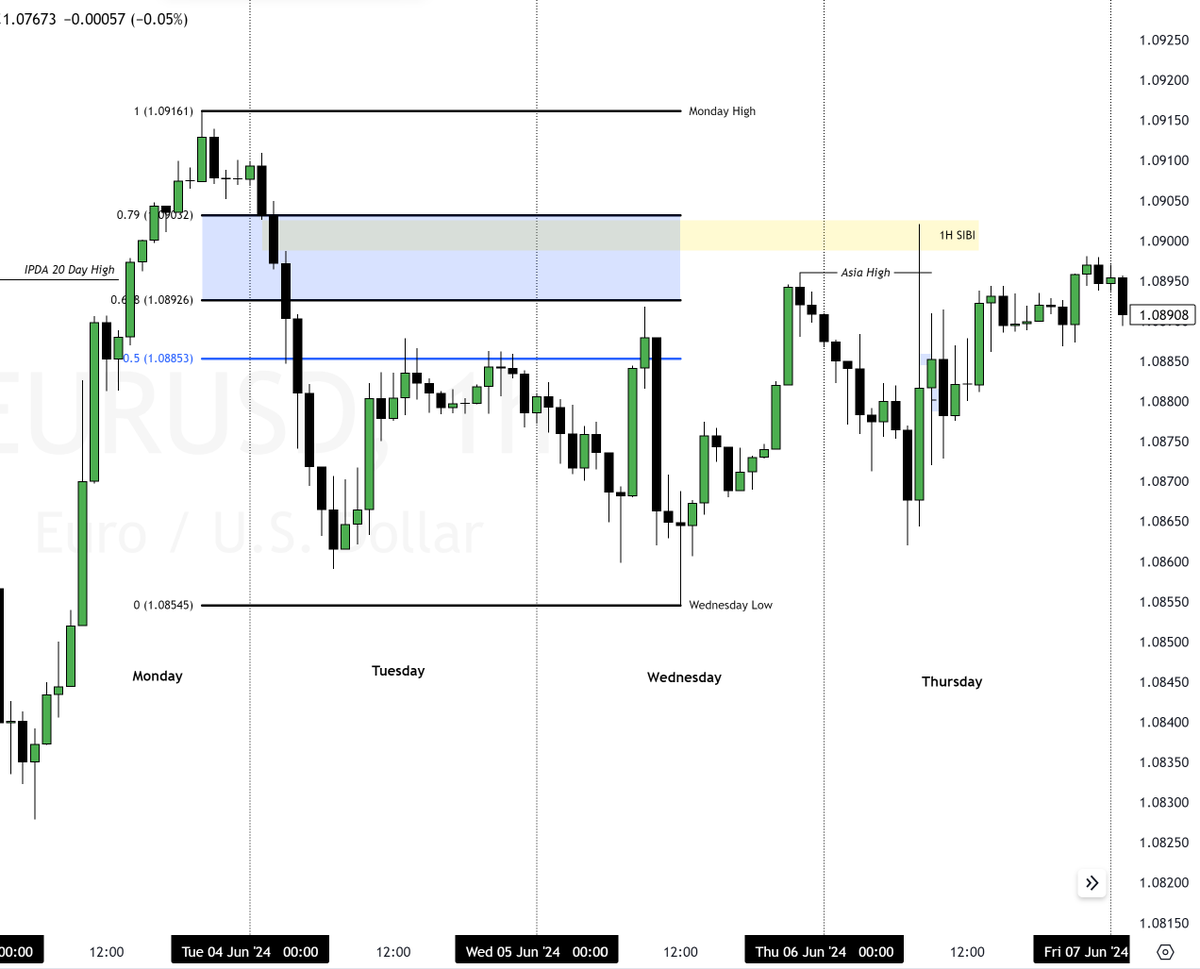

Monday 03 June

Entry: 5 min BISI.

Target: Friday High (+40 pips) | 2.6R.

Other Confluences:

- London Low taken.

- SMT with GBPUSD.

- Price below Midnight & Weekly Open.

#EURUSD

Entry: 5 min BISI.

Target: Friday High (+40 pips) | 2.6R.

Other Confluences:

- London Low taken.

- SMT with GBPUSD.

- Price below Midnight & Weekly Open.

#EURUSD

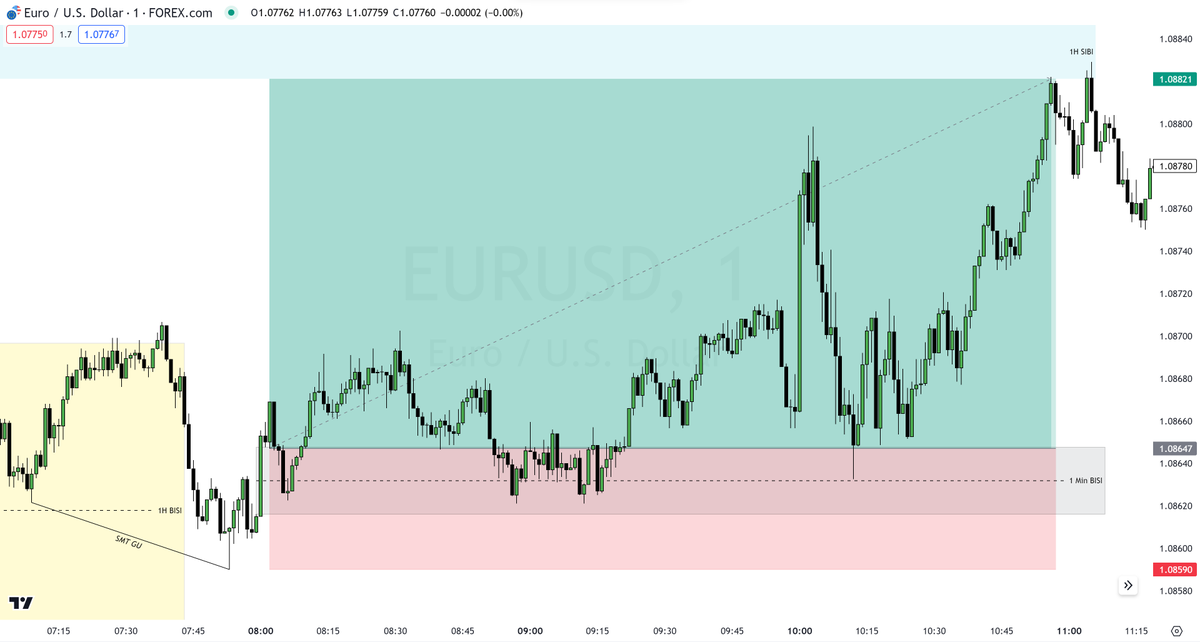

Tuesday 4 June

Entry: 1 Min BISI.

Target: 1H SIBI Low (+17 pips) | 3R.

Other Confluences:

- Intraday Low swept.

- SMT with GBPUSD.

- Price below Midnight Open.

#EURUSD

Entry: 1 Min BISI.

Target: 1H SIBI Low (+17 pips) | 3R.

Other Confluences:

- Intraday Low swept.

- SMT with GBPUSD.

- Price below Midnight Open.

#EURUSD

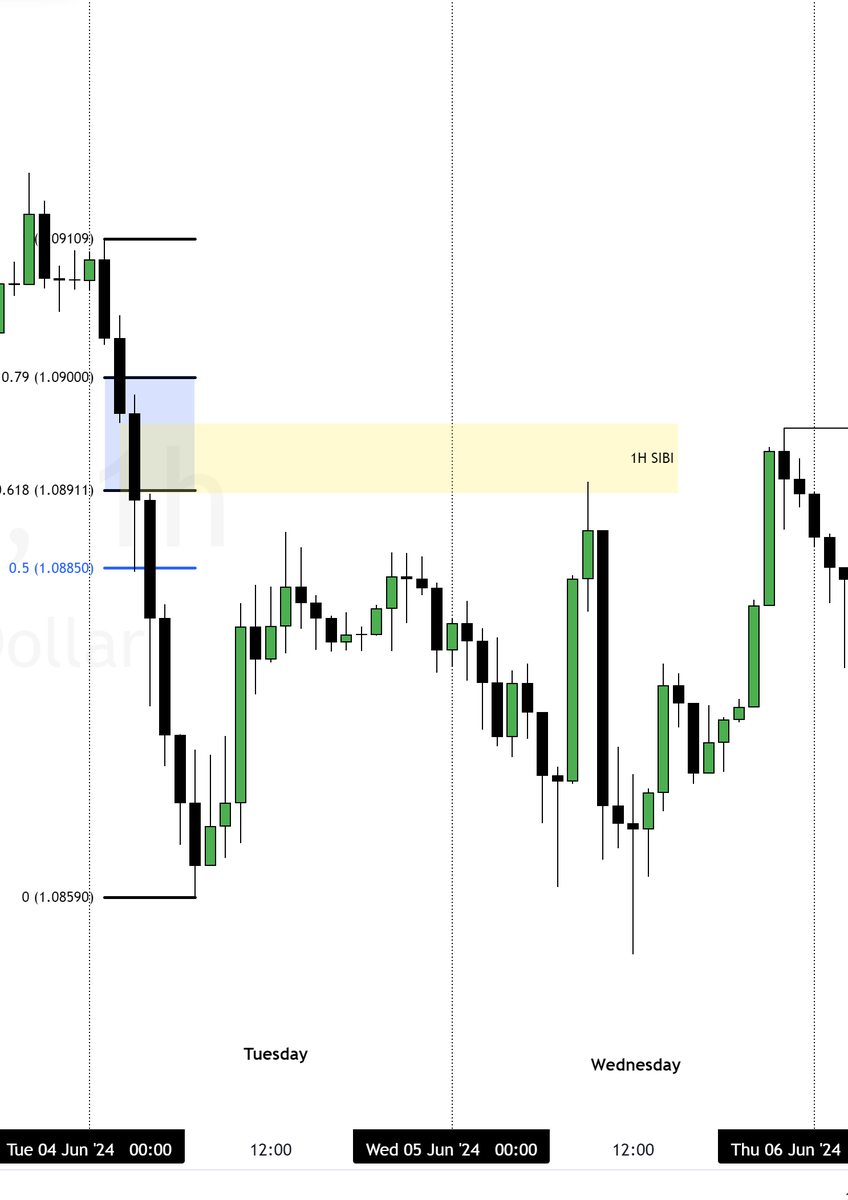

Wednesday 05 June

Entry: 1 Min SIBI.

Target: Intraday Low (+23 pips) | 4.3R.

Other Confluences:

- SMT with GBPUSD.

- Price above Midnight & Weekly Open.

#EURUSD

Entry: 1 Min SIBI.

Target: Intraday Low (+23 pips) | 4.3R.

Other Confluences:

- SMT with GBPUSD.

- Price above Midnight & Weekly Open.

#EURUSD

Train your eyes to spot these retracements and learn which dealing ranges to use.

Remember, everything is measured and controlled in these markets.

Once you see it, you can't unsee it..

Remember, everything is measured and controlled in these markets.

Once you see it, you can't unsee it..

جاري تحميل الاقتراحات...