Indian Data Center Industry Research 🔥🔥

- One of the fastest growing markets & ranked 14th globally

- 151 datacenters in India, with US ranked #1 with 5,375

- India has 880 Mn internet users (2x US & 12x UK)

Read thread below!

(1/n)

Source: Colliers-CII

#datacenter

- One of the fastest growing markets & ranked 14th globally

- 151 datacenters in India, with US ranked #1 with 5,375

- India has 880 Mn internet users (2x US & 12x UK)

Read thread below!

(1/n)

Source: Colliers-CII

#datacenter

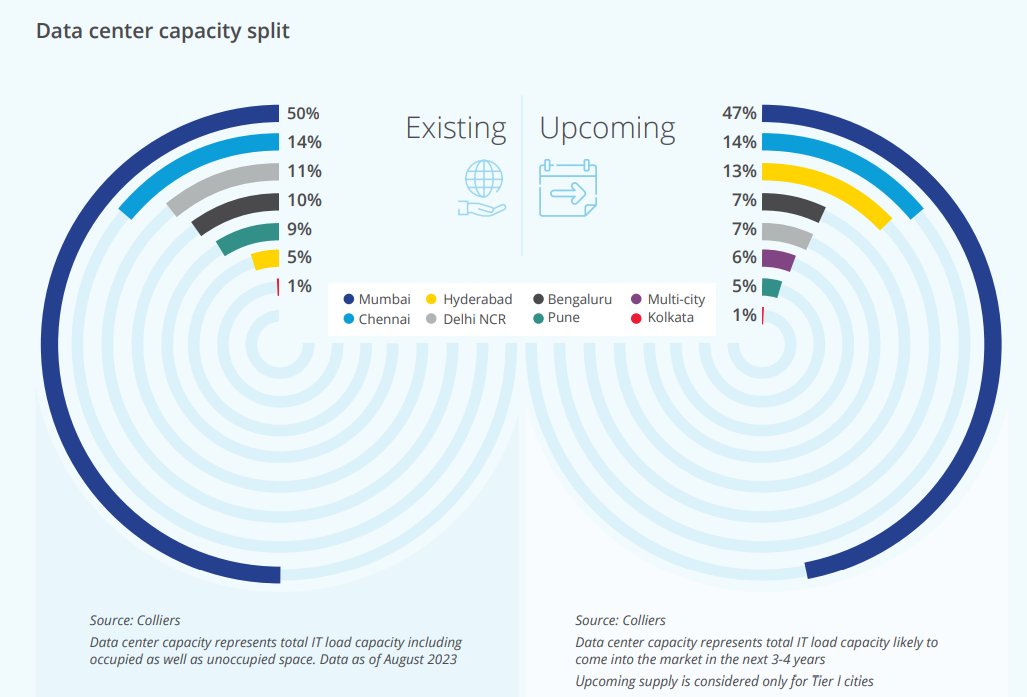

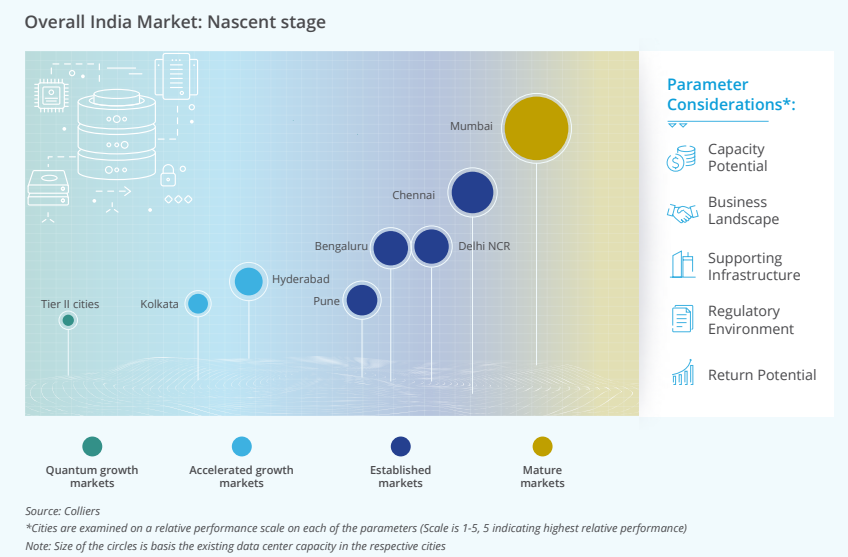

Tier 2 Cities to witness growth

- Only 4% of total DC capacity is located in Tier 2 cities

- As demand for proximity to cust. increases, DC demand would accelerate

- Offer valuable disaster recovery advantages

- Edge DC are seeing traction due to AI, IOT, cloud etc.

(9/n)

- Only 4% of total DC capacity is located in Tier 2 cities

- As demand for proximity to cust. increases, DC demand would accelerate

- Offer valuable disaster recovery advantages

- Edge DC are seeing traction due to AI, IOT, cloud etc.

(9/n)

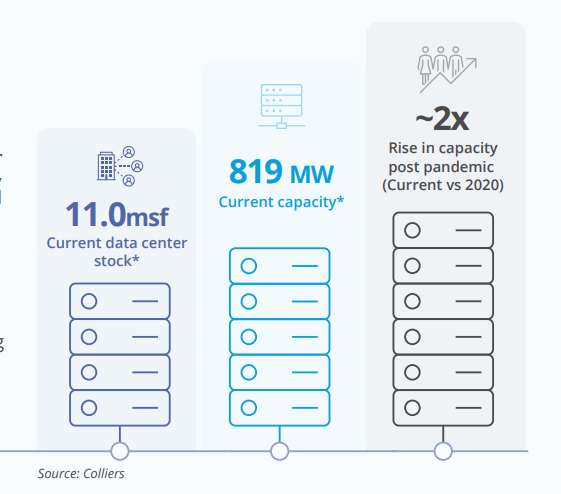

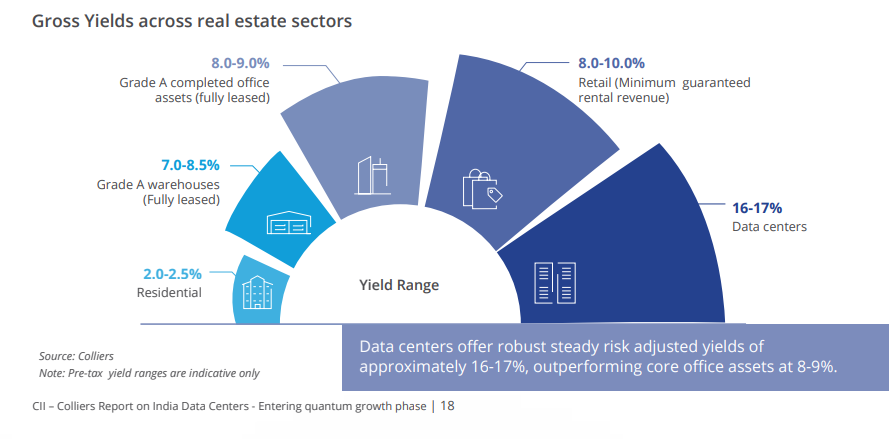

Market Opportunity - Potential of 10Bn USD in 3 years - 40% higher than 2020-2022 period

DC Land to cross 23 msf by 2026 catering to total capacity of 1.8 GW

Green penetration of DC rising -

20% of current cap. is LEED certified

61% rise in green DC cap. from 2020

(11/n)

DC Land to cross 23 msf by 2026 catering to total capacity of 1.8 GW

Green penetration of DC rising -

20% of current cap. is LEED certified

61% rise in green DC cap. from 2020

(11/n)

Follow, like and repost for more such research of other sectors.😀😀🔥🔥🔥🔥

I have covered semiconductor industry as well in other post. Have a look at it too.

x.com

#datacenter

#anantraj

#e2e

#netweb

#apar

#technoelectric

I have covered semiconductor industry as well in other post. Have a look at it too.

x.com

#datacenter

#anantraj

#e2e

#netweb

#apar

#technoelectric

Loading suggestions...