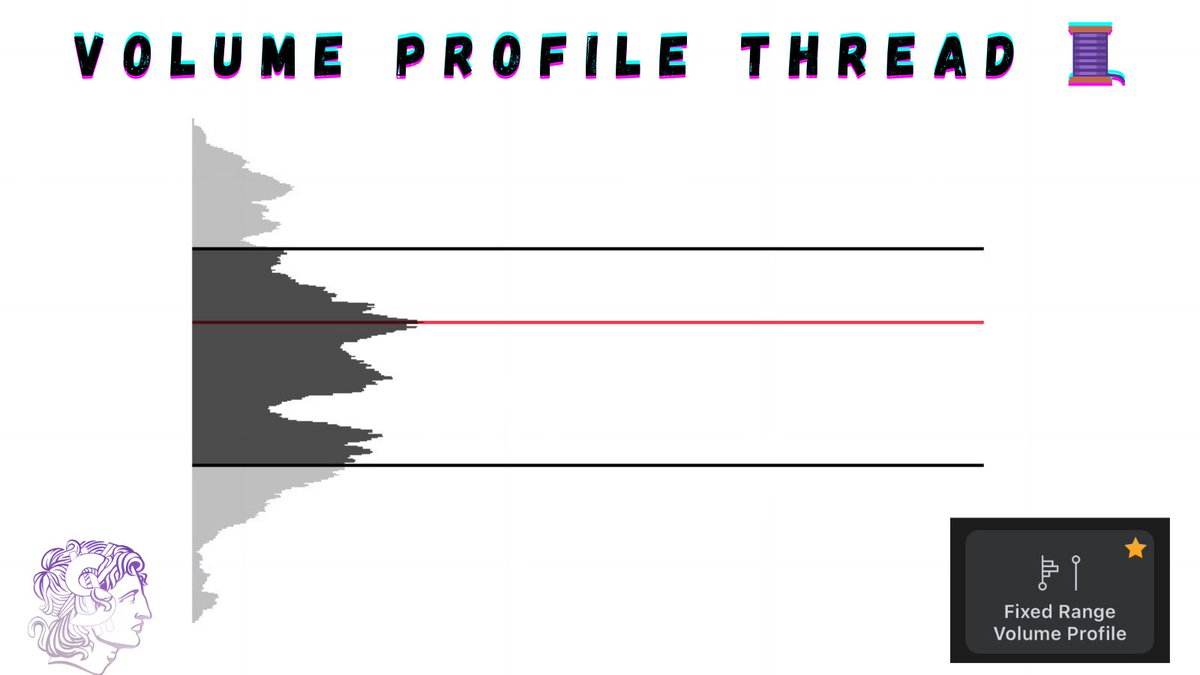

These are the 5 most important components of a volume profile.

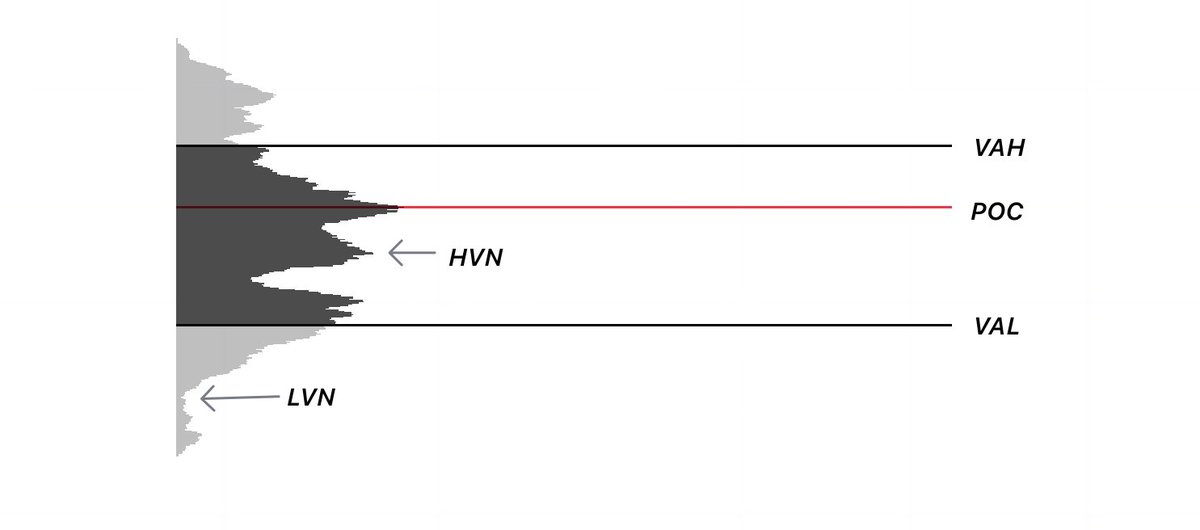

Value Area (VA)- This is the darkened part of the VP between the VAH, and the VAL. This is where 68% of the total volume was traded.

Point of control (POC)- This specific level is where the most amount of volume has been traded. There is also untested POCs levels from previous ranges and impulse moves. These are called NPOC. Otherwise referred to as naked point of control.

High volume node- The “spikes” are areas in price where there were high volume and created acceptance through a level. When trading these HVN we should use them as support and resistance.

Low volume node- These are areas where price traveled through the level quickly. When retested they can act as support and resistance as well.

Value Area (VA)- This is the darkened part of the VP between the VAH, and the VAL. This is where 68% of the total volume was traded.

Point of control (POC)- This specific level is where the most amount of volume has been traded. There is also untested POCs levels from previous ranges and impulse moves. These are called NPOC. Otherwise referred to as naked point of control.

High volume node- The “spikes” are areas in price where there were high volume and created acceptance through a level. When trading these HVN we should use them as support and resistance.

Low volume node- These are areas where price traveled through the level quickly. When retested they can act as support and resistance as well.

Auction Market Theory (AMT)-

This theory is that price is always searching for “fair value” in the market. It is technically where buyers and sellers are both satisfied with the price.

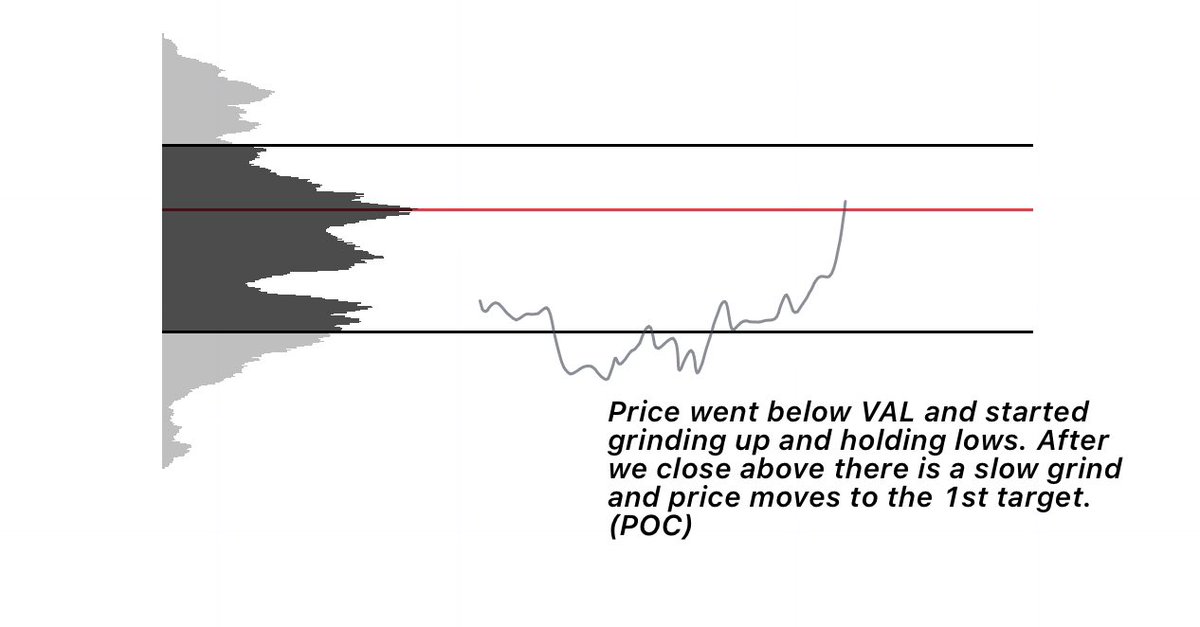

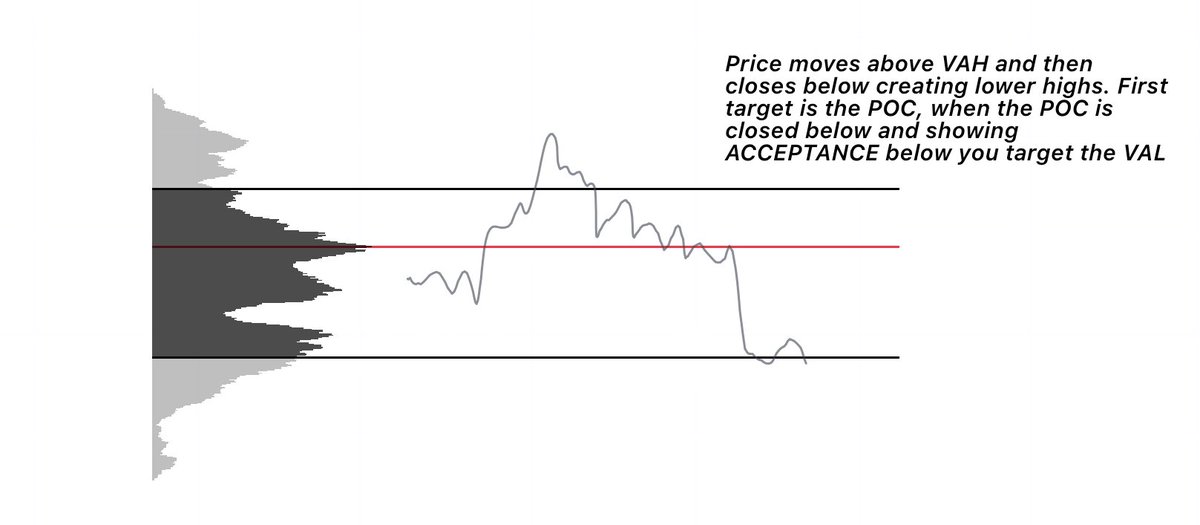

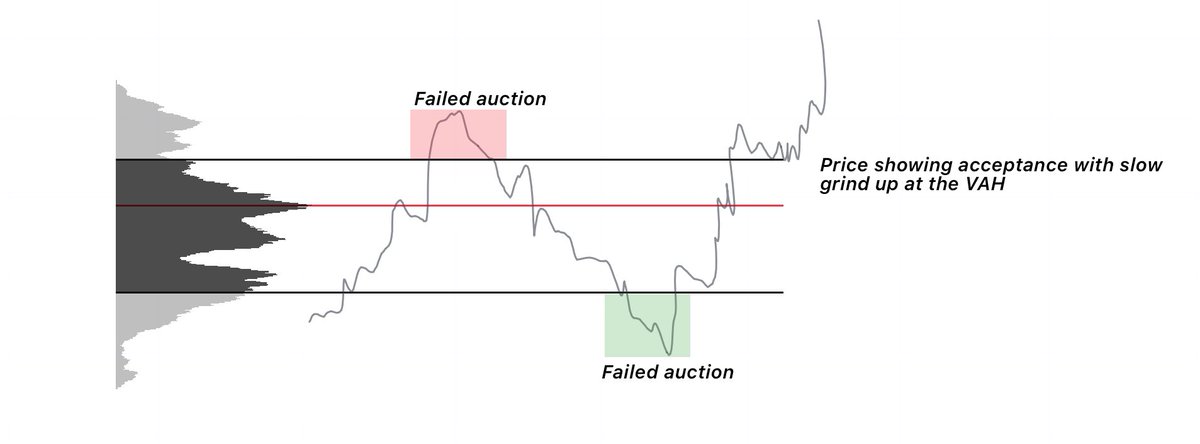

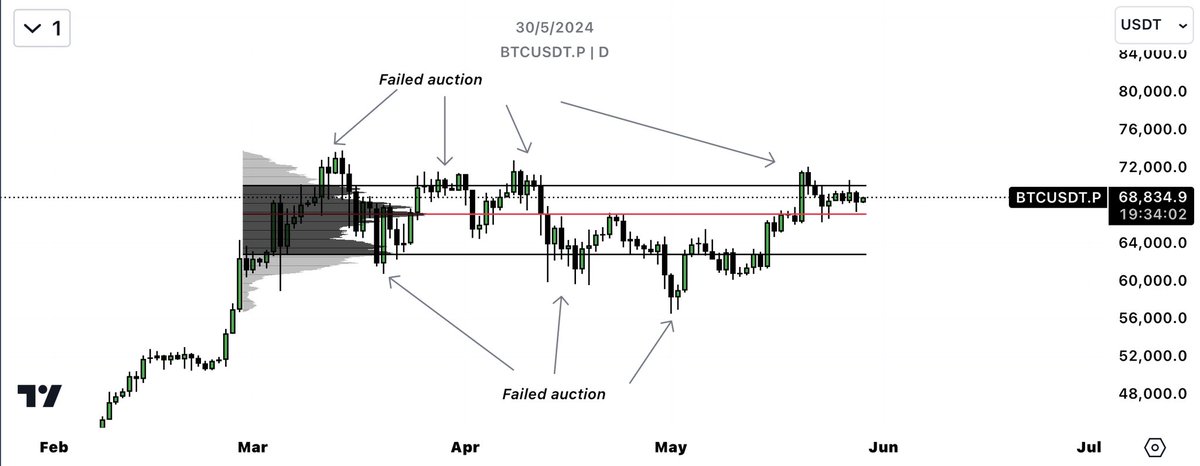

Failed Auction- In my personal opinion this is the most important “model” for trading volume profiles. When price is outside of VAH & VAL you look for deviation in the opposite direction. You need to look for low volume, no change in delta, and OI not increasing.

Acceptance- Price breaks out of the value area with high volume, delta change, OI following, and slow grinding up creating very little gaps

This theory is that price is always searching for “fair value” in the market. It is technically where buyers and sellers are both satisfied with the price.

Failed Auction- In my personal opinion this is the most important “model” for trading volume profiles. When price is outside of VAH & VAL you look for deviation in the opposite direction. You need to look for low volume, no change in delta, and OI not increasing.

Acceptance- Price breaks out of the value area with high volume, delta change, OI following, and slow grinding up creating very little gaps

If this helped you learn something new today drop a follow and check the link in my bio for daily signals and educational content 🫶

Loading suggestions...