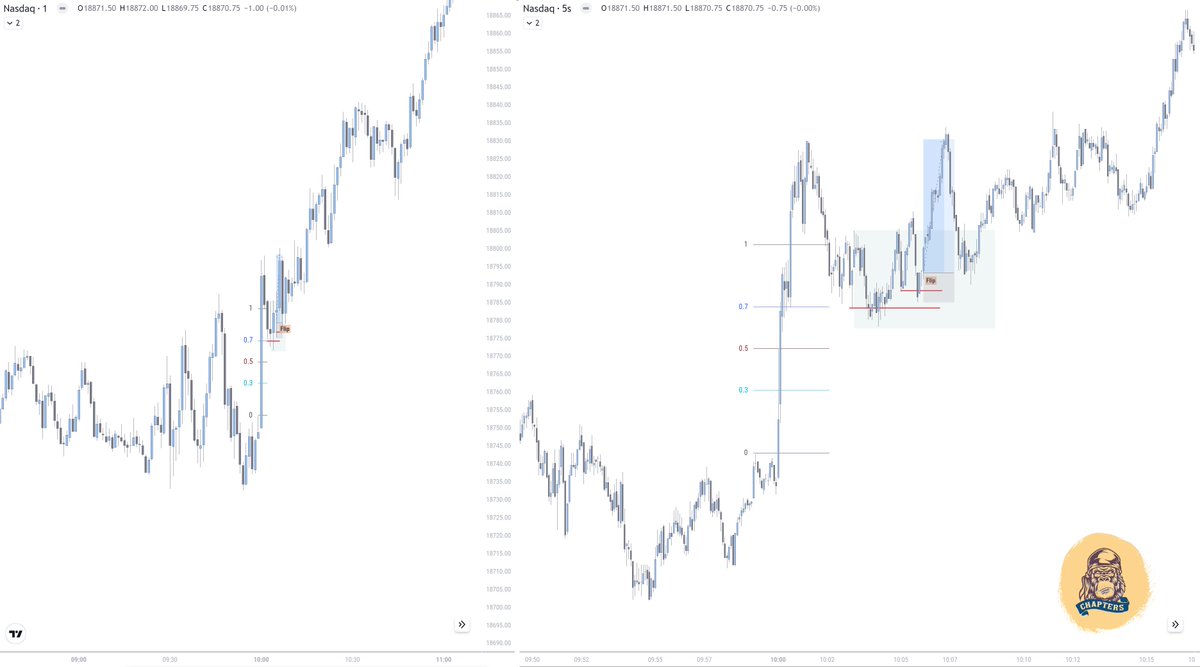

#DTFX

----Anatomy of Today's Price action----

-- A Thread--

(Probably all that someone will ever need to learn

how to read a significant portion of Price Action).

Bookmark

Repost to a friend

Enjoy!

----Anatomy of Today's Price action----

-- A Thread--

(Probably all that someone will ever need to learn

how to read a significant portion of Price Action).

Bookmark

Repost to a friend

Enjoy!

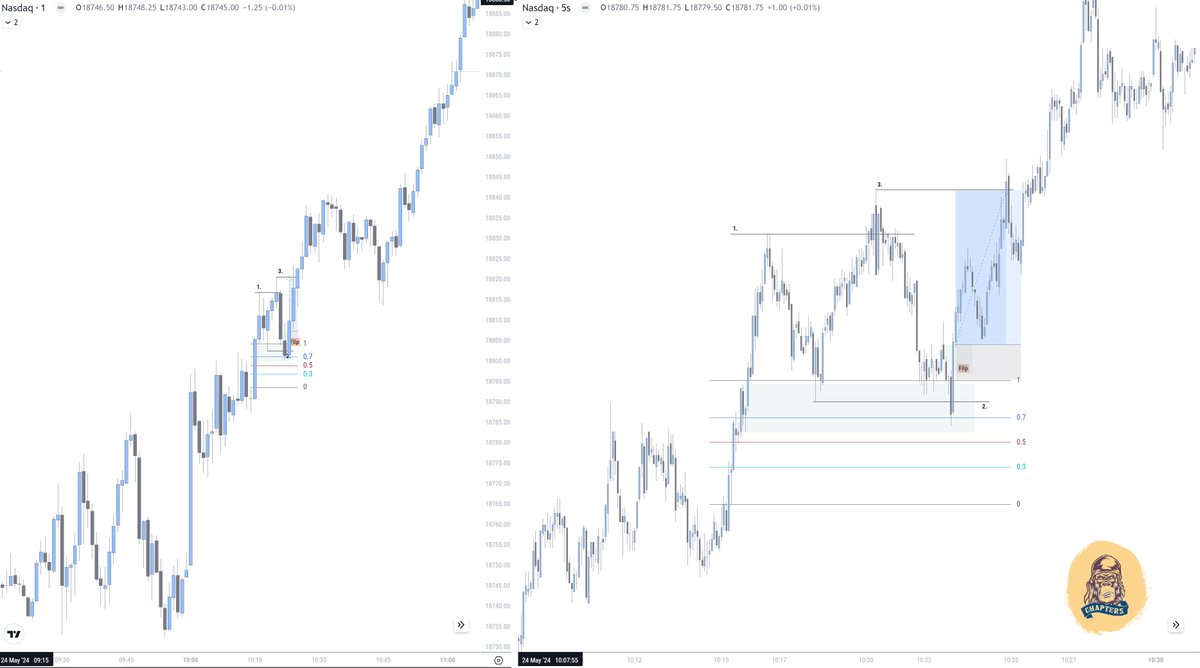

3. Dave Pro Tip: "When price breaks a high (1) and returns to the low that broke the high (2), the first target in your long should be the high that delivered the low to you (3)." "Sauce: If it stops at the target then rejects, the low will taken." #DTFX

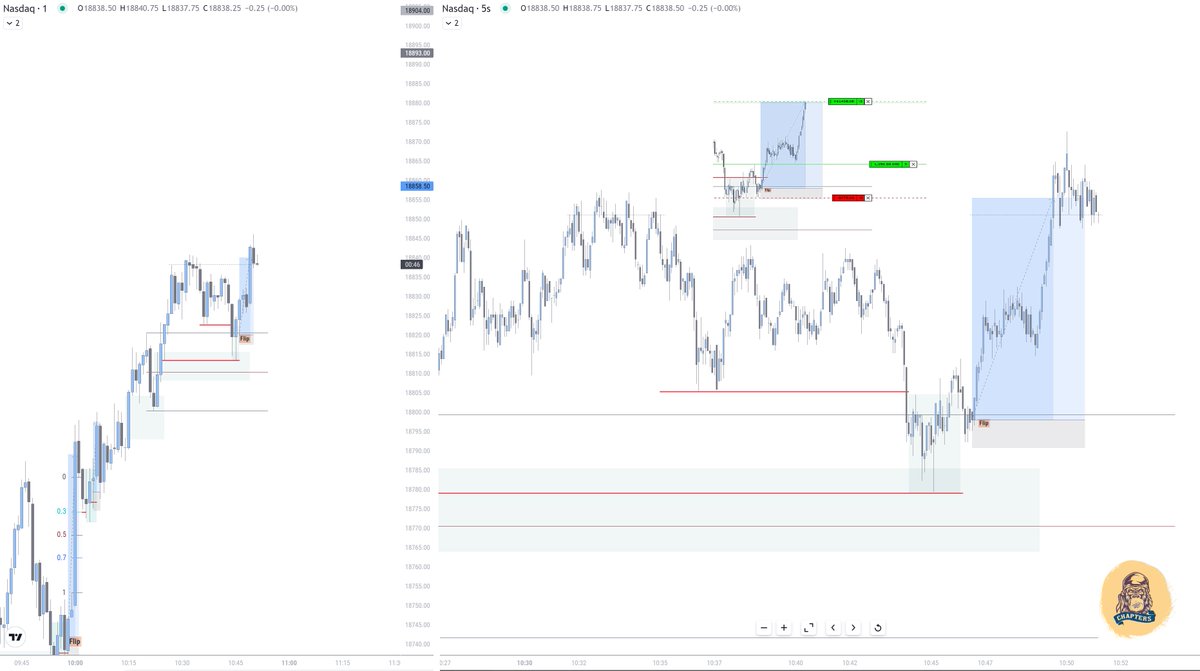

PS:

These concepts are learned from the teachings by @DaveTeachesFX.

These are my understandings of the concepts; some errors may occur.

This is a read of today's price action. Trading and risk management are up to you.

Go backtest! Lol

Enjoy!

These concepts are learned from the teachings by @DaveTeachesFX.

These are my understandings of the concepts; some errors may occur.

This is a read of today's price action. Trading and risk management are up to you.

Go backtest! Lol

Enjoy!

Loading suggestions...