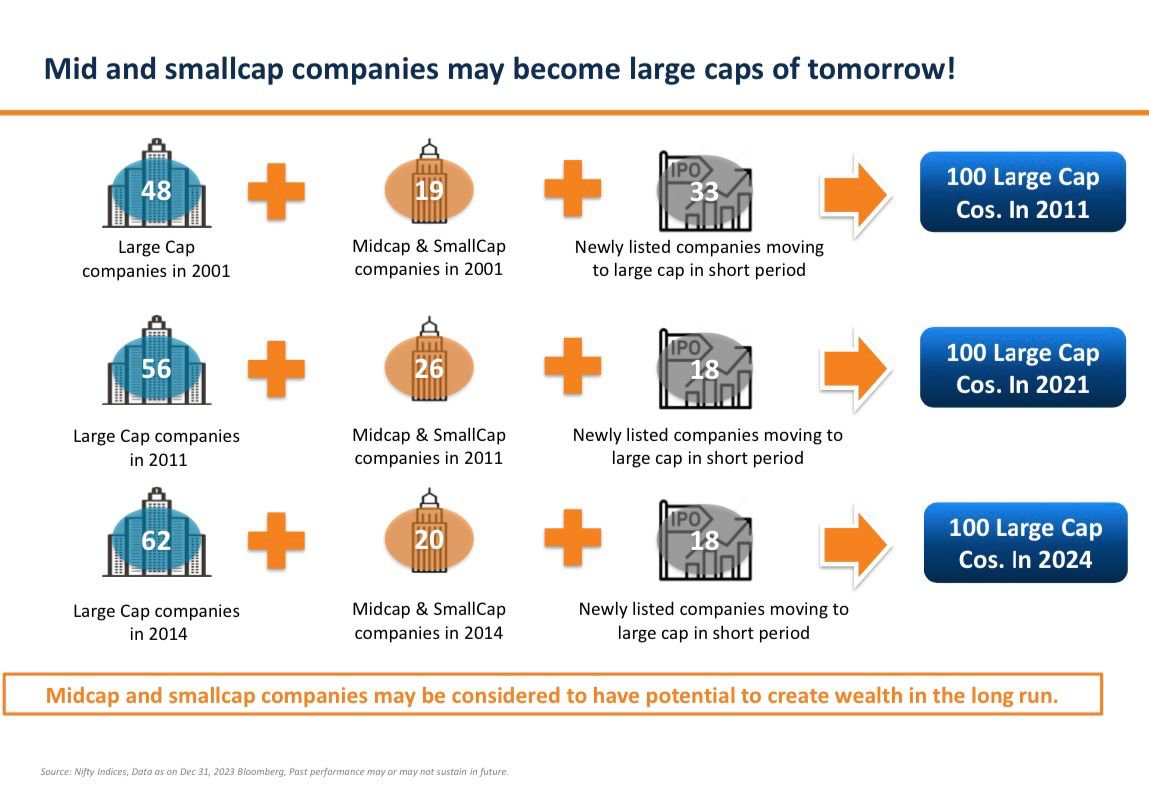

Even though they’re stable, large caps seem to have hit a ceiling and witness smaller growth compared to midcap and smallcap.

Because these are heavy machines that move slowly.

Because these are heavy machines that move slowly.

Now that we’re done with the goodie goodie part, let’s also talk about what drives people away from small caps even though they know they may get higher returns here?

See, with too much exposure to smallcaps, comes huge risks.

There’s usually

— more volatility,

— less liquidity because there are not enough buyers, and

— weak and fragile balance sheets.

There’s usually

— more volatility,

— less liquidity because there are not enough buyers, and

— weak and fragile balance sheets.

Then what’s the best way to lower this risk while aiming for high returns?

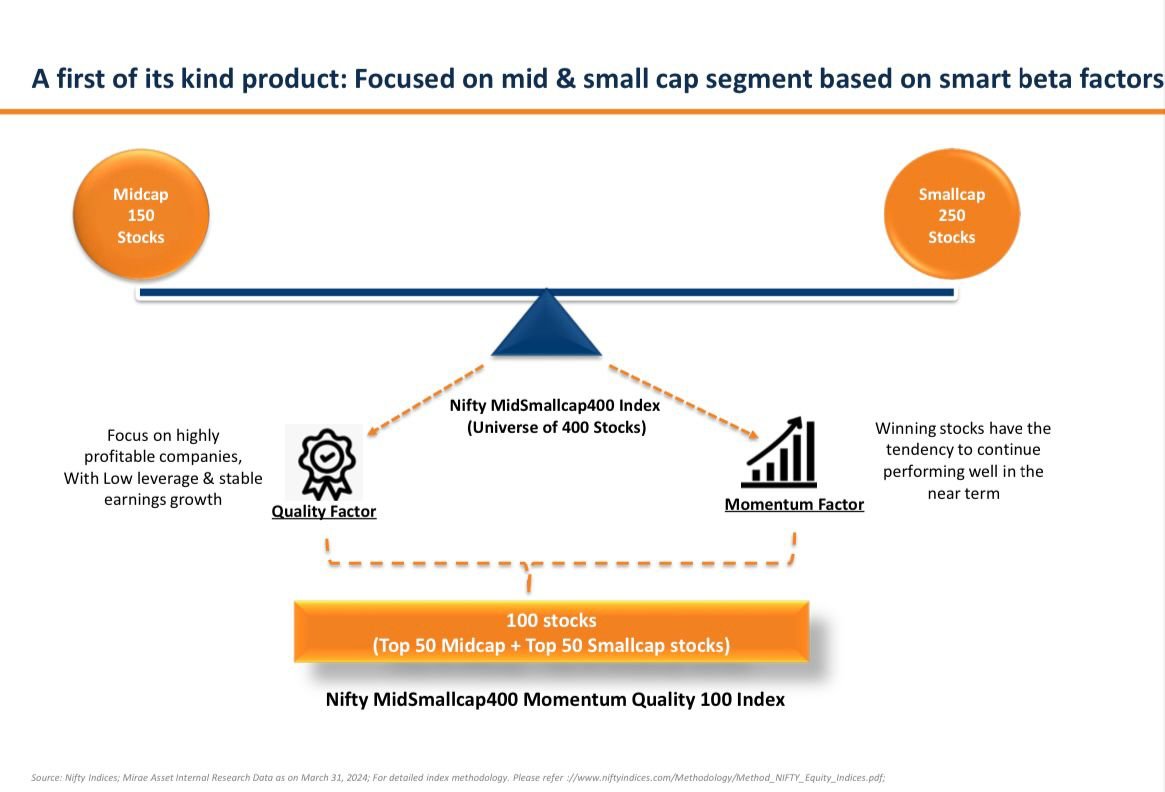

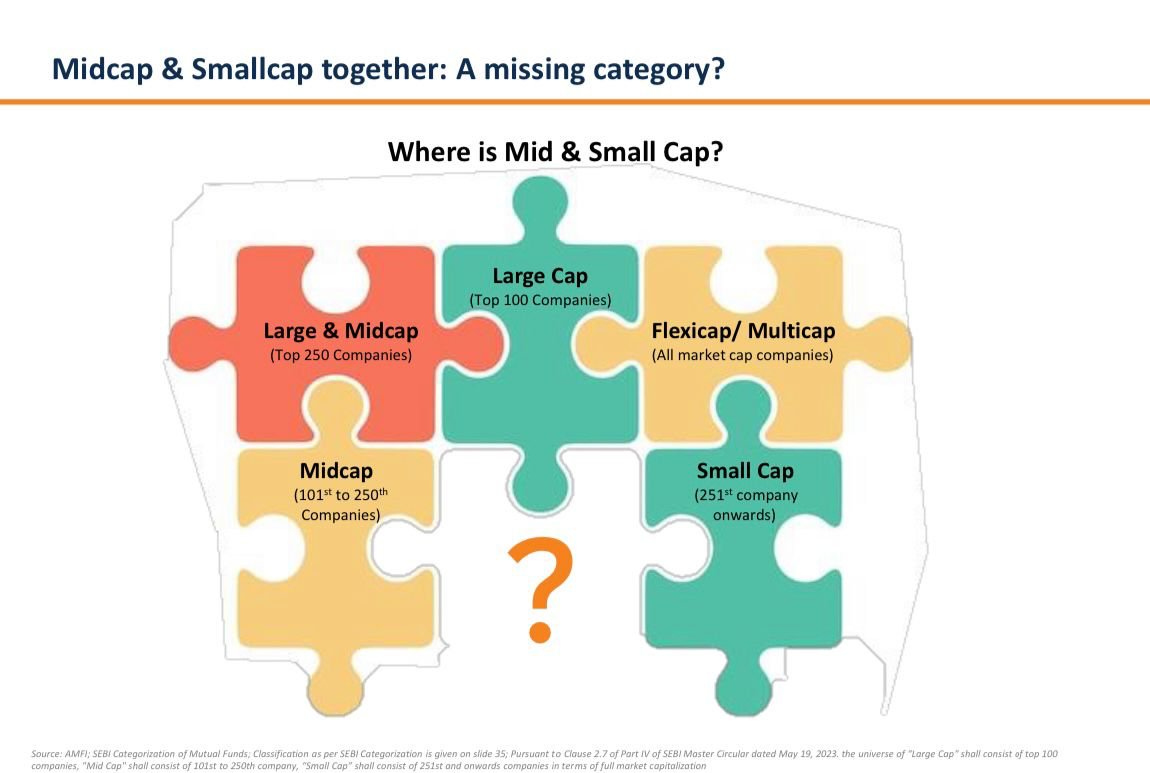

By capturing the best of both midcap and smallcap.

So that you don’t miss out on high growth potential of smallcaps and also get the benefit of relative stability that midcaps bring.

By capturing the best of both midcap and smallcap.

So that you don’t miss out on high growth potential of smallcaps and also get the benefit of relative stability that midcaps bring.

But choosing mid and small cap stocks can be really tricky unless you have an in-depth understanding of the company.

Picking individual stocks might also result in over-concentration in individual bets that might not work.

Picking individual stocks might also result in over-concentration in individual bets that might not work.

So, it becomes very difficult as a retail investor to play safe and choose the right smallcaps for yourself.

Now, let’s say you’ve decided to choose a mutual fund instead of individual stocks for this reason.

Now, let’s say you’ve decided to choose a mutual fund instead of individual stocks for this reason.

But then, you get stuck between trying to invest in index funds which are passively-managed and have so many companies, that your returns get diluted.

But what if we told you that the best of both worlds is actually possible?

But what if we told you that the best of both worlds is actually possible?

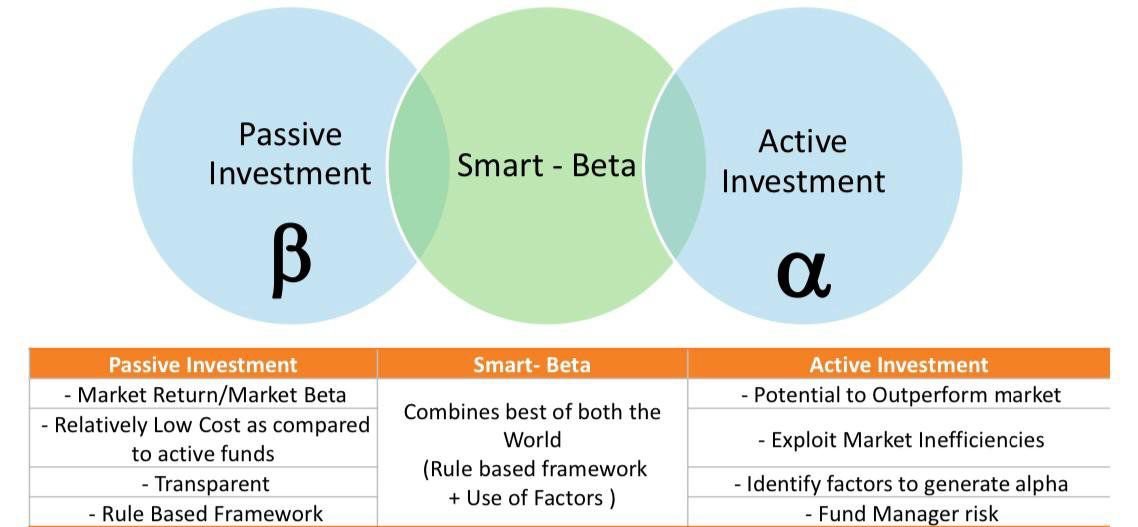

This is the reason why Smart Beta funds are gaining popularity all over the world.

Smart Beta funds are a hybrid of passive and active funds — they have factors or rules to select stocks from a particular index.

Smart Beta funds are a hybrid of passive and active funds — they have factors or rules to select stocks from a particular index.

And factor investing is basically a strategy to identify and invest based on these definable traits (factors)

— to target a desired performance profile, reduce volatility, and enhance diversification.

— to target a desired performance profile, reduce volatility, and enhance diversification.

The aim of factors is to enable generation of potentially excess returns over the market.

They can be used in isolation or combination to create a unique basket of stocks and smart beta is one subset of factor investing.

They can be used in isolation or combination to create a unique basket of stocks and smart beta is one subset of factor investing.

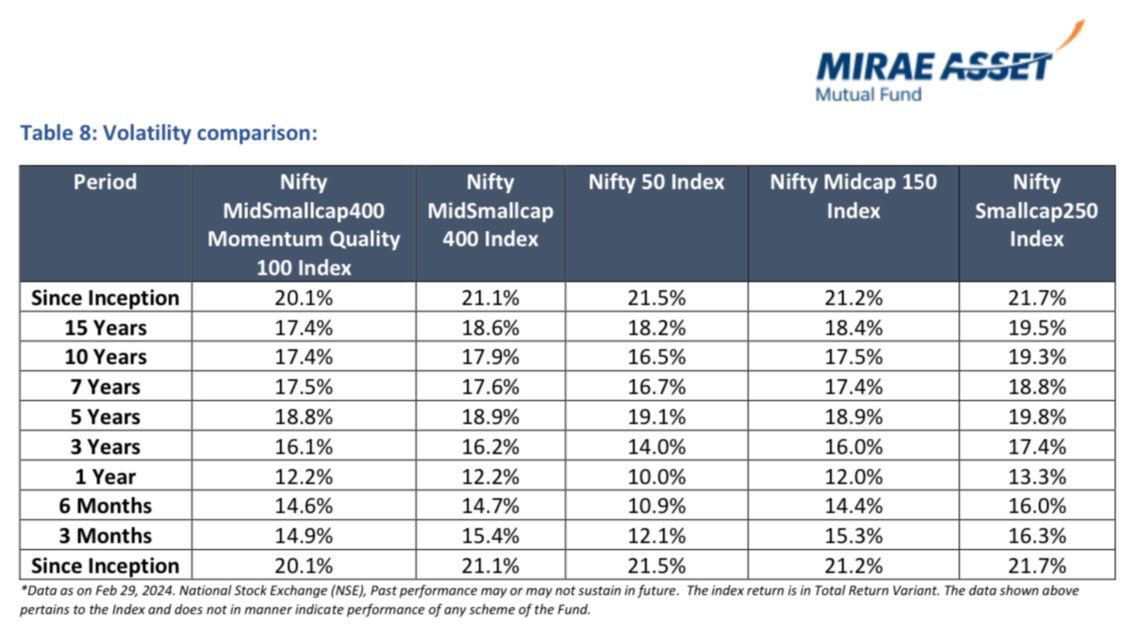

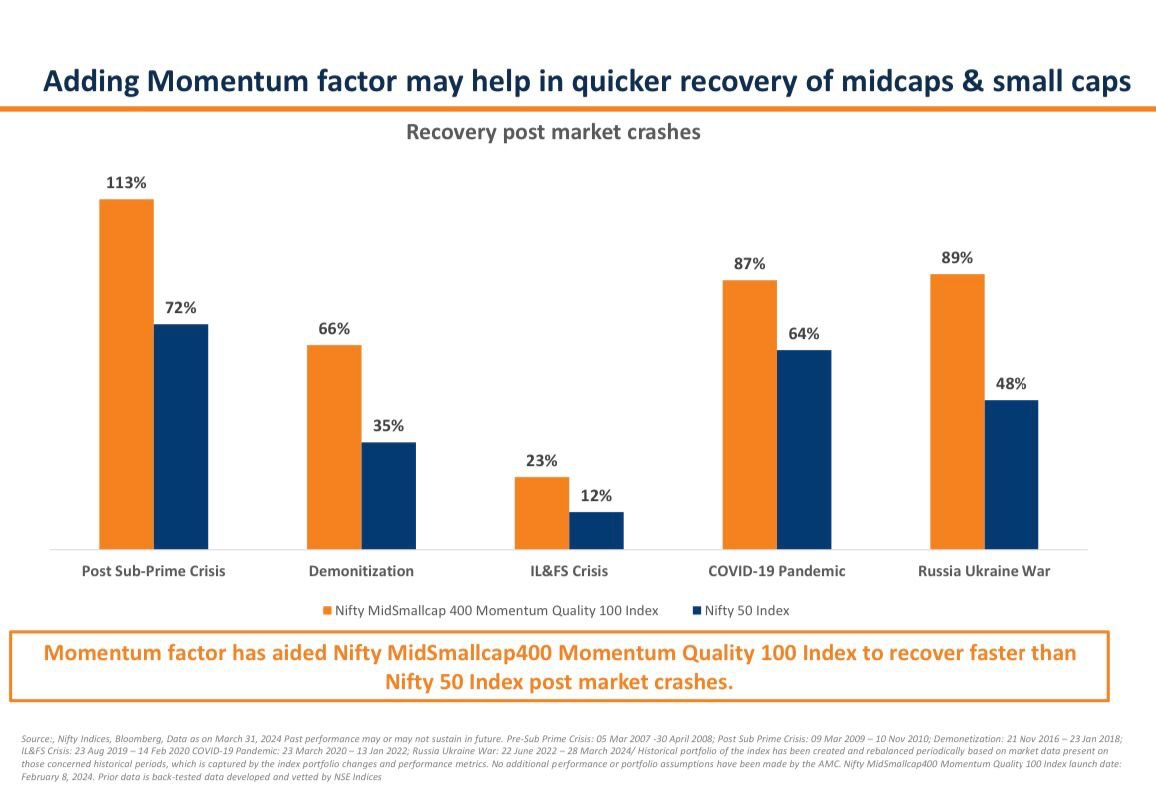

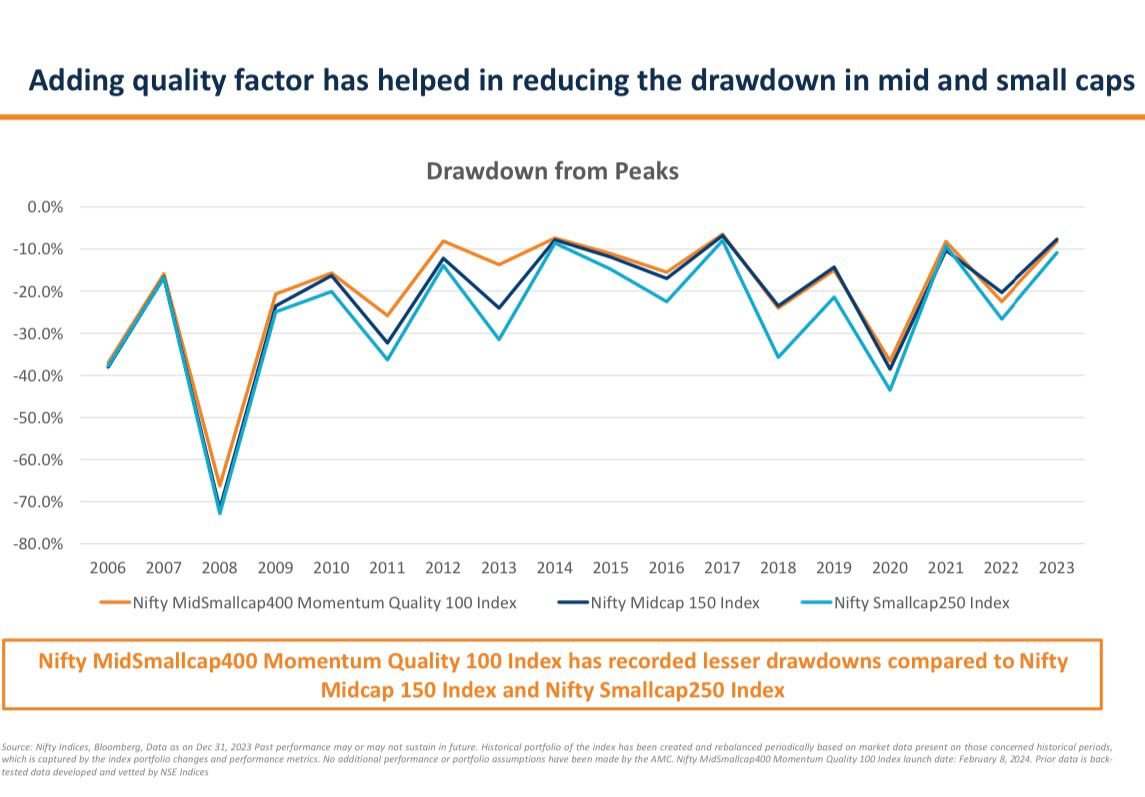

And even if we consider that to be a one-off scenario, this index has consistently shown similar volatility to its parent index.

This shows that the filtration mechanism put at place is such that even if 100 are selected out of 400, the volatility doesn’t get affected.

This shows that the filtration mechanism put at place is such that even if 100 are selected out of 400, the volatility doesn’t get affected.

But how has it been able to generate relatively high returns along with low volatility?

Because the combination of quality and momentum factors works like a see-saw. It creates a balance.

Because the combination of quality and momentum factors works like a see-saw. It creates a balance.

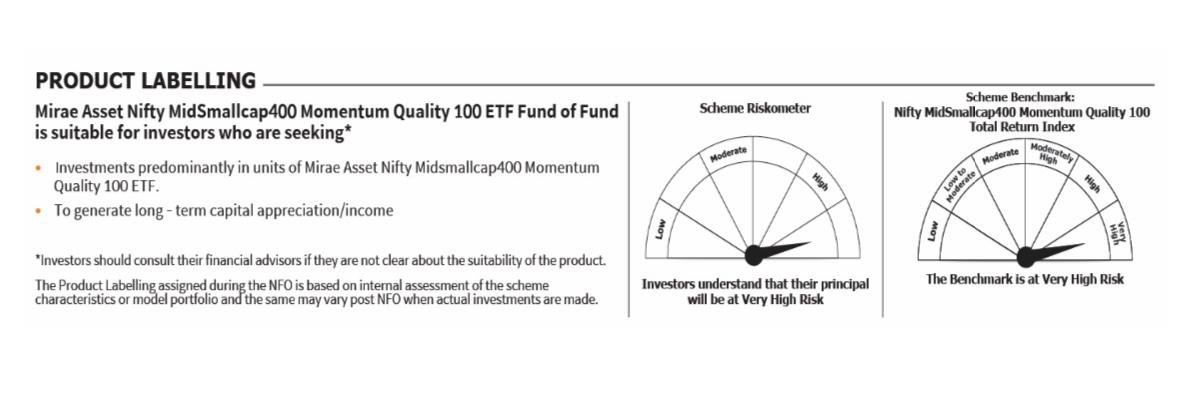

So, all in all, if you’re scared to invest in small and midcaps directly, but you still want to take advantage of India's growth driven by these companies, MidSmallcap funds can be a good alternate option.

Check out Mirae Asset Nifty MidSmallcap400 Momentum Quality 100 ETF Fund of Fund here and invest now👇

bit.ly

bit.ly

Disclaimer:

Large Cap 1st to 100th companies in terms of full market capitalization. Mid Cap: 101th to 250th company in terms of full market capitalization. Smallcap: 251st companies onwards in terms of full market capitalization. Top 100 stocks are selected in terms of mid cap and small cap category.

For further information about other schemes (product labelling and performance of the fund) please visit the website of the AMC: miraeassetmf.co.in

Please consult your financial advisor or mutual fund distributor before investing.

Large Cap 1st to 100th companies in terms of full market capitalization. Mid Cap: 101th to 250th company in terms of full market capitalization. Smallcap: 251st companies onwards in terms of full market capitalization. Top 100 stocks are selected in terms of mid cap and small cap category.

For further information about other schemes (product labelling and performance of the fund) please visit the website of the AMC: miraeassetmf.co.in

Please consult your financial advisor or mutual fund distributor before investing.

Loading suggestions...