Inheritance tax might be a bitter pill to swallow — a tax imposed on the transfer of property and assets from a deceased to their beneficiary.

The concept of inheritance tax is not American.

The concept of inheritance tax is not American.

Since then, it has been repealed and reintroduced to fund other wars by many countries.

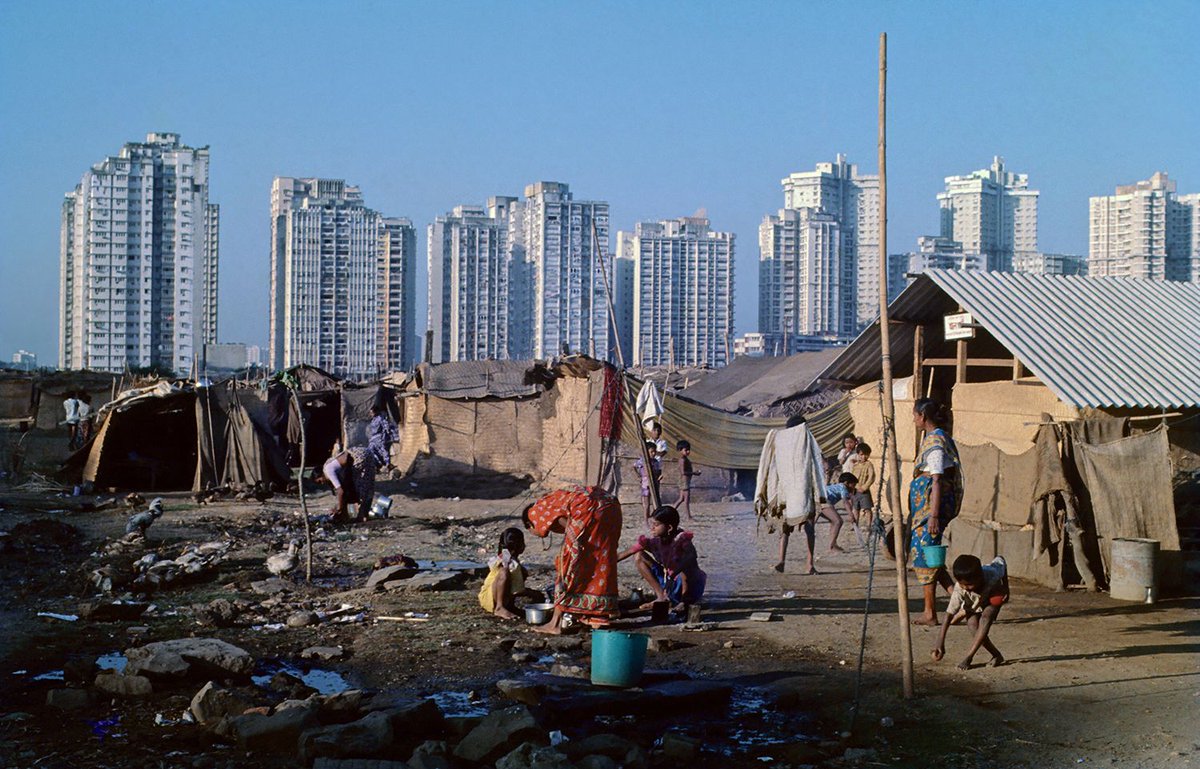

Even India tried and tested an estate tax (somewhat similar to an inheritance tax) in 1953 hoping to reduce wealth inequality but the results were unexpected.

Even India tried and tested an estate tax (somewhat similar to an inheritance tax) in 1953 hoping to reduce wealth inequality but the results were unexpected.

1️⃣ The unduly high costs of administration and compliance could not justify their meagre tax contribution of 0.25% to the entire tax revenue.

2️⃣ Moreover, the simultaneous levying of estate and wealth taxes lead to the problem of double taxation.

2️⃣ Moreover, the simultaneous levying of estate and wealth taxes lead to the problem of double taxation.

With the common aim of preventing the concentration of wealth in the hands of a few, these major economies also introduced an inheritance taxation system.

These tax systems generated considerable tax revenue for the government over the years.

These tax systems generated considerable tax revenue for the government over the years.

In fact, the “Carnegie effect” even incentivized large wealth holders to donate more to charities during their lifetime rather than pay inheritance tax at death.

While it seemed altruistic, the billionaires kept thriving!

While it seemed altruistic, the billionaires kept thriving!

Loopholes in the tax code, tax evasion tactics, offshore transfers along with tax planning strategies such as gifts & trust structures

— ended up undermining the effectiveness of the system.

— ended up undermining the effectiveness of the system.

There are many arguments raised by several economists time & time again that a developing nation such as India should not levy inheritance tax.

But why?

A few reasons are jotted down below.

But why?

A few reasons are jotted down below.

How?

Successful entrepreneurs not only pass their knowledge, skills & business acumen to future generations but also their wealth.

So by creating a barrier to passing on family business & entrepreneurial ventures, innovative ideas may not be preserved by successive generations.

Successful entrepreneurs not only pass their knowledge, skills & business acumen to future generations but also their wealth.

So by creating a barrier to passing on family business & entrepreneurial ventures, innovative ideas may not be preserved by successive generations.

👉 Double taxation- The double taxation principle is one of the primary arguments against its implementation.

See the assets being passed on through inheritance have often been subject to taxation during the original owner’s lifetime

— either through income or capital gain tax.

See the assets being passed on through inheritance have often been subject to taxation during the original owner’s lifetime

— either through income or capital gain tax.

So levying any other tax on the same assets when they are being transferred to the heirs is perceived as unfair

— and also discourage wealth accumulation, intergenerational transfers along with savings & investments.

— and also discourage wealth accumulation, intergenerational transfers along with savings & investments.

👉 Concerns over wealth redistribution- Those rich enough to travel abroad are coincidentally also rich enough to move their assets abroad.

But really, Offshore Banking and Foreign Investment in Real Estate or Securities become the easy tax cop-out.

But really, Offshore Banking and Foreign Investment in Real Estate or Securities become the easy tax cop-out.

— work hard to build up assets, pay income taxes, and then, when it's time for their children to inherit those assets, they'd have to pay taxes on them again.

Now we need to understand that the enforcement of an inheritance tax would have major political consequences in India.

Now we need to understand that the enforcement of an inheritance tax would have major political consequences in India.

For starters, it is argued that there won’t be a diminution in the country’s capital as a whole but while the inheritance tax seems right at the macro level,

— individual ownership is a micro concept that could turn the voters against such a policy and invite protests.

— individual ownership is a micro concept that could turn the voters against such a policy and invite protests.

So if not inheritance tax, then what?

With a lack of conclusive evidence surrounding this concept of taxation, it appears more sensible to focus on alternatives

— like progressive taxation rather than giving in to volatile political noise.

With a lack of conclusive evidence surrounding this concept of taxation, it appears more sensible to focus on alternatives

— like progressive taxation rather than giving in to volatile political noise.

If you liked this read, do RePost🔄 the 1st post

and follow us @FinFloww for such reads every Monday, Wednesday and Friday!

and follow us @FinFloww for such reads every Monday, Wednesday and Friday!

Join the 22,408 members who have subscribed to our WhatsApp Newsletter: whatsapp.com

Subscribe to WHAT THE FLOWW?, our weekly email newsletter where we dive deeper into such concepts: soshals.app

Loading suggestions...