If you want to understand someone better then look at their bills and you will find:

- What they prioritize

- What they ignore

- What they value

The same can be said when you look at a country’s bill of household expenses.

- What they prioritize

- What they ignore

- What they value

The same can be said when you look at a country’s bill of household expenses.

Unlike other countries, India does not conduct any periodic official income survey.

Instead, it uses the spending data as a proxy for household incomes and its distribution across different classes and demographics.

Instead, it uses the spending data as a proxy for household incomes and its distribution across different classes and demographics.

This is why the findings of the latest Household Consumption Expenditure Survey (HCES) by the National Sample Survey Organisation (NSSO) is so important.

The HCES is usually held once every five years.

The HCES is usually held once every five years.

The last survey was held in 2017-18.

However, the government, citing poor quality of data because of demonetization and GST, decided not to publish the results.

So after the last survey in 2011-12, the new data is released after 11 years for the year 2022-23.

However, the government, citing poor quality of data because of demonetization and GST, decided not to publish the results.

So after the last survey in 2011-12, the new data is released after 11 years for the year 2022-23.

Now, what does this new data tells us?

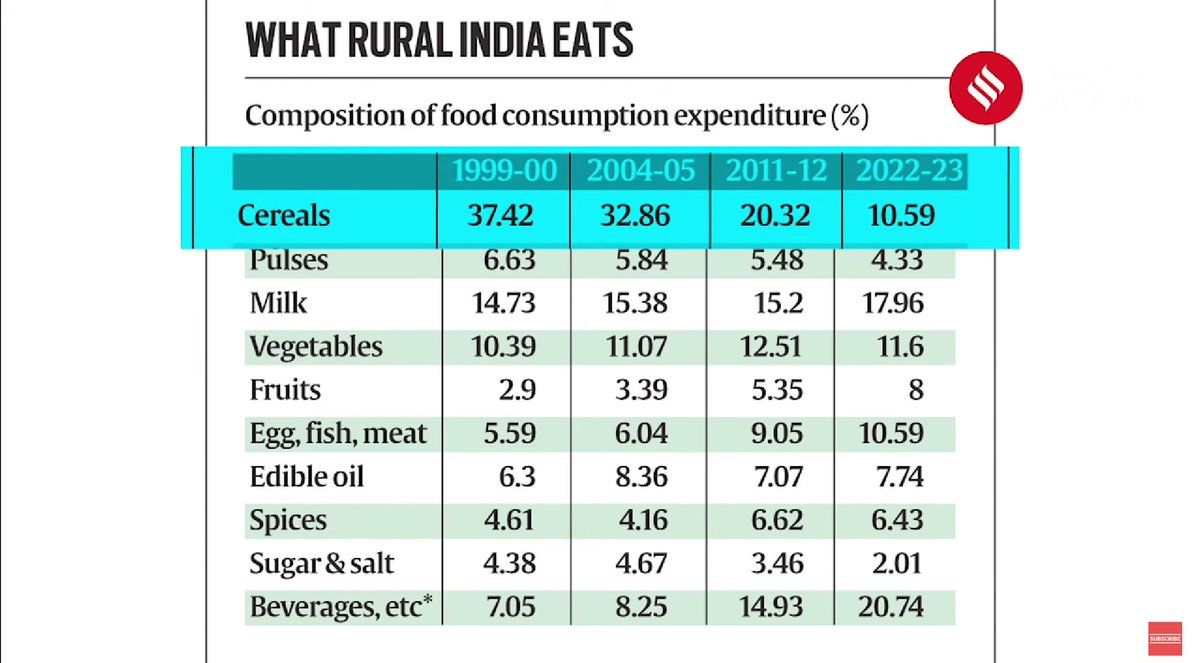

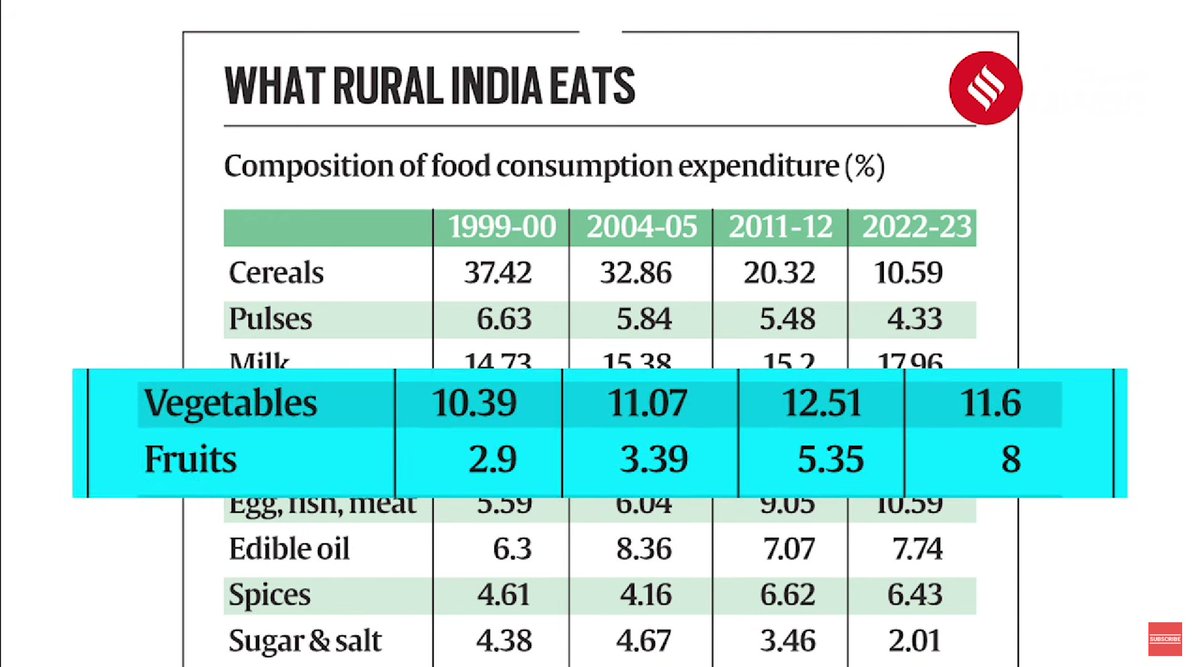

👉 Indians are spending less on food.

For the first time since Independence, the share of food in per capita spending in rural areas has fallen below 50%.

It has fallen down to 46% in 2022-23, compared to 53% in 2011-12.

👉 Indians are spending less on food.

For the first time since Independence, the share of food in per capita spending in rural areas has fallen below 50%.

It has fallen down to 46% in 2022-23, compared to 53% in 2011-12.

And In urban areas, the share of food has declined to 39% from 43% in 2011-12.

Now from an economic standpoint, this is a good thing.

When a country makes economic progress, the share of food in total consumption tends to go down.

Now from an economic standpoint, this is a good thing.

When a country makes economic progress, the share of food in total consumption tends to go down.

This is based on Engel's Law which says that as a household's income increases, the percentage of their income spent on food decreases, but the total amount spent on food increases.

Basically, people are spending more on food.

It's just that disposable incomes have gone up, people are spending comparatively more on medical care, education, and convenience.

People are going up the value chain.

It's just that disposable incomes have gone up, people are spending comparatively more on medical care, education, and convenience.

People are going up the value chain.

And spending money on things that enhance their quality of life like — smartphones, refrigerators, automobiles.

👉 The rural-urban gap is now closing.

When the same survey of household expenditure survey was conducted in 2004-05, the difference between rural and urban spending was 91%

There’s still a significant gap but the gap has now come down to 68.9% in 2022-23.

When the same survey of household expenditure survey was conducted in 2004-05, the difference between rural and urban spending was 91%

There’s still a significant gap but the gap has now come down to 68.9% in 2022-23.

Rapid urbanization is taking place. And spending power in the country has gone up by 3 times.

In 2011-12 the average monthly consumption in rural areas was about Rs 1,430 and now it has gone up to 3,773.

That’s a 164% rise in expenditure.

In 2011-12 the average monthly consumption in rural areas was about Rs 1,430 and now it has gone up to 3,773.

That’s a 164% rise in expenditure.

While the consumption In urban India increased by only 146%.

2-wheeler vehicles, mobile phones, TV, fridge and FMCG goods have penetrated the rural markets at a much faster pace in the last decade.

And this, in turn, has led to more money being spent on fuel and electricity.

2-wheeler vehicles, mobile phones, TV, fridge and FMCG goods have penetrated the rural markets at a much faster pace in the last decade.

And this, in turn, has led to more money being spent on fuel and electricity.

As a result, the share of non-food items in consumption spending by rural households has increased sharply from 43.02% in 2009-10 and 53.62% in 2022-23.

The expenditure survey by HCES is key to gauging demand in the economy.

The expenditure survey by HCES is key to gauging demand in the economy.

The government will also use this data to readjust items considered for calculating retail inflation and gross domestic product data.

If you liked this read, do RePost🔄 the 1st post

and follow us @FinFloww for such reads every Monday, Wednesday and Friday!

and follow us @FinFloww for such reads every Monday, Wednesday and Friday!

Get our WhatsApp newsletter: whatsapp.com

Subscribe to WHAT THE FLOWW?, our weekly email newsletter where we dive deeper into such concepts: soshals.app

Loading suggestions...