Instead of saving money in your bank's saving account, save in a Money Market Fund

Instead of using fixed income funds for long term investing, invest directly in T-bonds via CBK

Instead of using an education policy to save for your kid's education, combine a term life + an investment product like a MMF

Instead of relying entirely on Individual Pension Plans to secure your retirement, create your own personal portfolio as a backup.

Explanations below👇

Instead of using fixed income funds for long term investing, invest directly in T-bonds via CBK

Instead of using an education policy to save for your kid's education, combine a term life + an investment product like a MMF

Instead of relying entirely on Individual Pension Plans to secure your retirement, create your own personal portfolio as a backup.

Explanations below👇

1. Save in a Money Market Fund. Ignore banks' savings and fixed deposit accounts.

Here are the benefits:

1. Earn higher interest rates on your savings above the inflation rate.

2. You can withdraw your money any time you want without penalties unlike in your fixed deposit account.

3. Your money is still secure as MMFs invest in low risk assets meaning you can hardly lose your money

Here are the benefits:

1. Earn higher interest rates on your savings above the inflation rate.

2. You can withdraw your money any time you want without penalties unlike in your fixed deposit account.

3. Your money is still secure as MMFs invest in low risk assets meaning you can hardly lose your money

For MMF recommendations, you can sign up with any of these three:

1. CIC MMF

clients.cic.co.ke

2. Sanlam MMF

invest.sanlameastafrica.com

3. KUZA MMF: client.kuza.africa

1. CIC MMF

clients.cic.co.ke

2. Sanlam MMF

invest.sanlameastafrica.com

3. KUZA MMF: client.kuza.africa

client.kuza.africa:8000/?agent_no=00052

clients.cic.co.ke/unittrust/publ…

Paper Bootstrap Wizard by Creative Tim

Paper Bootstrap Wizard is a fully responsive wizard that is inspired by our famous Paper Kit and com...

invest.sanlameastafrica.com/on-boarding?ag…

On-boarding | Sanlam Investments East Africa Limited

Sanlam Investments East Africa (SIEAL) is a leading fund manager in the region and has a strong reco...

2. For long term investments, try to cut on investment costs as much you can.

Investment costs compound and reduce your returns.

Invest directly into bonds via CBK, to realize higher returns and reduce on investment costs.

Investment costs compound and reduce your returns.

Invest directly into bonds via CBK, to realize higher returns and reduce on investment costs.

3. An education policy combines wealth creation (saving for your child's education) with wealth protection (ensuring your kids complete school in case something happened to you)

While it is a nice product, you end up under insured and under invested, meaning that most times, you don't get the best protection and you also don't get the best on savings for your child's education.

The combination of a term life and a investment product like a MMF solves that.

While it is a nice product, you end up under insured and under invested, meaning that most times, you don't get the best protection and you also don't get the best on savings for your child's education.

The combination of a term life and a investment product like a MMF solves that.

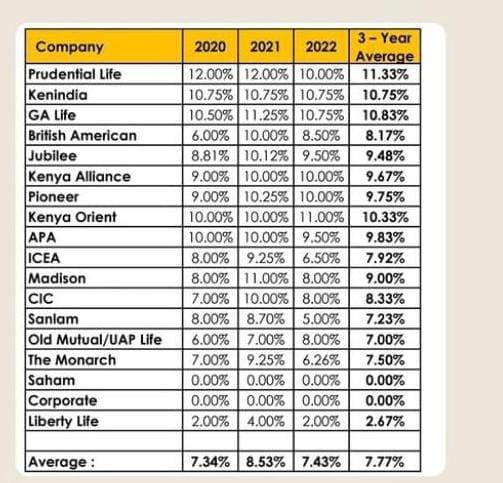

4. Individual pension plans are a great way to plan for your retirement,

but sometimes fund managers experience a hard time managing huge portfolios, and end up registering meager returns as shown below.

As an individual, even with a basic portfolio of 80% bonds and 20% stocks or even 100% bonds, you can still do quite well.

but sometimes fund managers experience a hard time managing huge portfolios, and end up registering meager returns as shown below.

As an individual, even with a basic portfolio of 80% bonds and 20% stocks or even 100% bonds, you can still do quite well.

Loading suggestions...