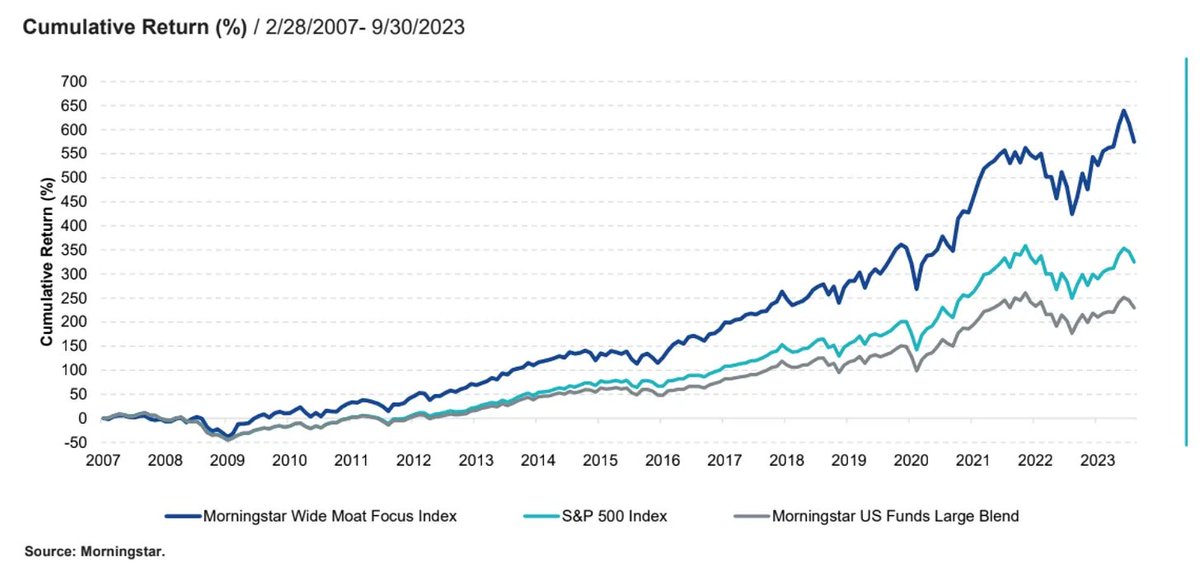

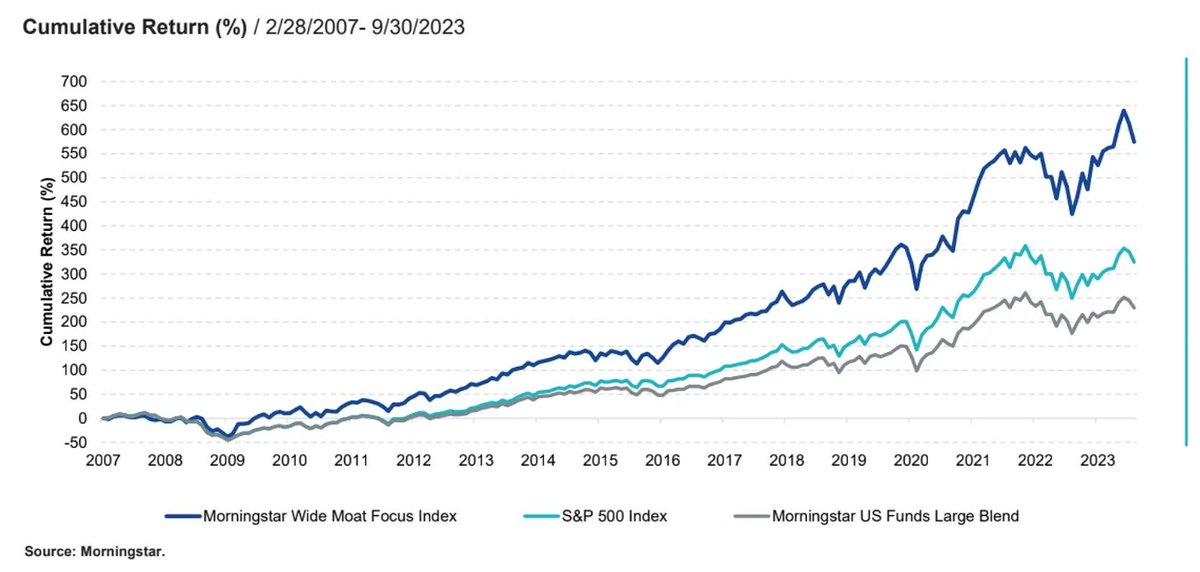

2. A moat is essential

Quality investors will never invest in The Next Big Thing.

Instead, you buy companies that have already won.

You can find companies with a moat by using these criteria:

- Pricing power (high and sustainable Gross Margin)

- ROIC > 15%

Quality investors will never invest in The Next Big Thing.

Instead, you buy companies that have already won.

You can find companies with a moat by using these criteria:

- Pricing power (high and sustainable Gross Margin)

- ROIC > 15%

5. Pricing power

Pricing power is a very attractive characteristic

It's like a free growth source for a company

And it's a great protection against inflation too!

Pricing power is a very attractive characteristic

It's like a free growth source for a company

And it's a great protection against inflation too!

6. Use a checklist

Charlie Munger once said: "No wise pilot, no matter how great his talent and experience, fails to use his checklist."

The checklist used in the book will allow you to find great companies

Charlie Munger once said: "No wise pilot, no matter how great his talent and experience, fails to use his checklist."

The checklist used in the book will allow you to find great companies

7. Reinvestment opportunities

The more reinvestment opportunities a company has, the better

Compounding machines are quality stocks with plenty of room for organic growth

The more reinvestment opportunities a company has, the better

Compounding machines are quality stocks with plenty of room for organic growth

9. Use a stock screener

You can use these criteria to find great companies:

- Revenue growth > 5%

- Earnings growth > 7%

- FCF/Earnings > 80%

- ROIC > 15%

- Net Debt/FCF < 5

- Debt/Equity < 80%

You can use these criteria to find great companies:

- Revenue growth > 5%

- Earnings growth > 7%

- FCF/Earnings > 80%

- ROIC > 15%

- Net Debt/FCF < 5

- Debt/Equity < 80%

9. Valuation

A wonderful company at a fair price. That's exactly what you want as a quality investor

We use 3 methods:

- Look at the evolution of the company's forward PE

- Earnings Growth Model

- Reverse DCF

A wonderful company at a fair price. That's exactly what you want as a quality investor

We use 3 methods:

- Look at the evolution of the company's forward PE

- Earnings Growth Model

- Reverse DCF

10. Build your portfolio

Finally, you can build your portfolio based on these 3 steps:

1. Buy wonderful companies

2. Led by excellent managers

3. Trading at fair valuation levels

Finally, you can build your portfolio based on these 3 steps:

1. Buy wonderful companies

2. Led by excellent managers

3. Trading at fair valuation levels

That's it for today.

If you liked this, you'll LOVE this e-book with 100 examples of quality stocks.

Grab it here: compounding-quality.ck.page

If you liked this, you'll LOVE this e-book with 100 examples of quality stocks.

Grab it here: compounding-quality.ck.page

Loading suggestions...