On 31 March 2015, BookMyShow had an average of 42 million visits & 4.5 million tickets sold per month.

Now mind you, this was the time before Jio Boom hit India & internet became easily accessible everywhere.

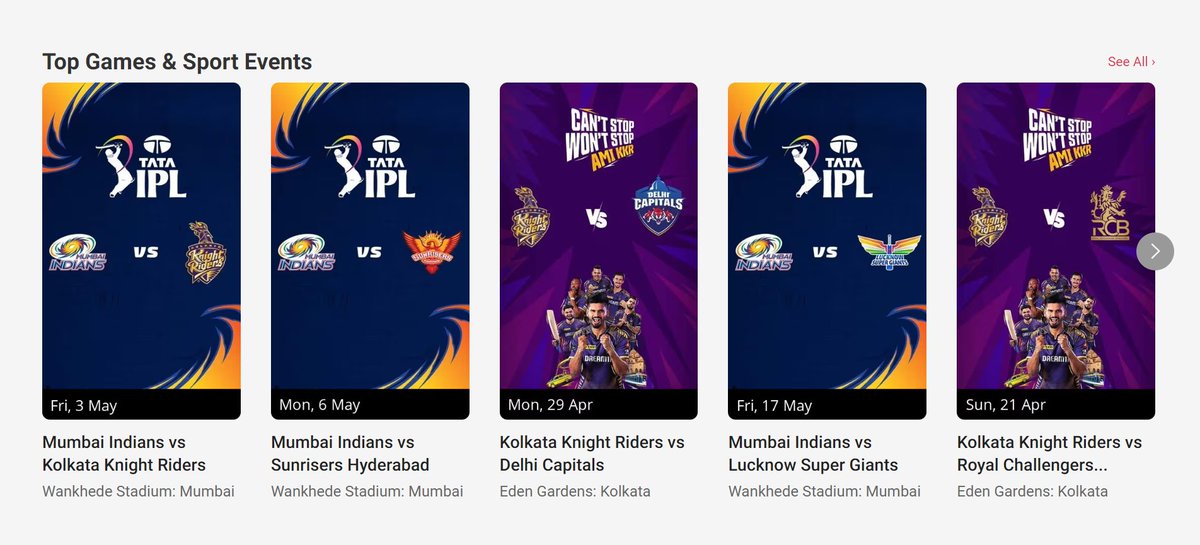

In 2017, 9 out of 10 IPL teams’ tickets were available on BookMyShow.

Now mind you, this was the time before Jio Boom hit India & internet became easily accessible everywhere.

In 2017, 9 out of 10 IPL teams’ tickets were available on BookMyShow.

You see, Paytm already had a presence in hotel and flight ticketing business, but the use case for movies and events with wallets was much more.

That’s because people may not travel more than 3-4 times a year, but go to movies or events twice a month or so.

That’s because people may not travel more than 3-4 times a year, but go to movies or events twice a month or so.

So, the repeat use case and uncrowded market became a reason for Paytm to go all in on the online entertainment ticketing business.

When Paytm entered the movie ticketing business in 2016, the market in India was estimated to be worth nearly $2 billion.

When Paytm entered the movie ticketing business in 2016, the market in India was estimated to be worth nearly $2 billion.

And it was growing at 10% annually.

However, the ONLINE movie ticketing market was only 15% of the overall domestic market.

Even with BookMyShow, the market was underserved.

However, the ONLINE movie ticketing market was only 15% of the overall domestic market.

Even with BookMyShow, the market was underserved.

So in 2016, Paytm tapped into its existing 122 million user base, and used its tried & tested driver of marketability

— DISCOUNTS!

See, BookMyShow also used the same tactic when the business was new and people hadn’t tried the product.

— DISCOUNTS!

See, BookMyShow also used the same tactic when the business was new and people hadn’t tried the product.

But giving discounts isn’t a viable strategy, as a fine line between price and quality has to be maintained.

From there on, Paytm focused on getting new users and BookMyShow focused on other high margin businesses.

From there on, Paytm focused on getting new users and BookMyShow focused on other high margin businesses.

You see, the average transaction value is quite low on a movie ticket, so BookMyShow needed to diversify into high margin businesses.

The advantage of non-movie entertainment segments (sports and live events) is that the average ticket prices are much higher

The advantage of non-movie entertainment segments (sports and live events) is that the average ticket prices are much higher

They wanted to become a one-stop gateway to any kind of entertainment.

But what if there are no live events and movie shows to go to? How would an entertainment ticketing company survive then?

When pandemic hit in 2020, the entertainment industry was hit hard.

But what if there are no live events and movie shows to go to? How would an entertainment ticketing company survive then?

When pandemic hit in 2020, the entertainment industry was hit hard.

The service is called BookMyShow Stream.

In 2020, BookMyShow Stream became the fastest Transactional-Video-On-Demand (TVoD) platform in India to cross 100,000 streams

— sold within just one and a half month since its launch.

In 2020, BookMyShow Stream became the fastest Transactional-Video-On-Demand (TVoD) platform in India to cross 100,000 streams

— sold within just one and a half month since its launch.

In FY23, BookMyShow had a net profit of ₹85.72 Cr compared to a loss of ₹92.2 Cr in FY22.

The operating revenue increased threefold to ₹976 Cr in FY23 from ₹277 Cr in FY22.

In FY22, 62% of the revenue came from online ticketing & 24% from its live event business.

The operating revenue increased threefold to ₹976 Cr in FY23 from ₹277 Cr in FY22.

In FY22, 62% of the revenue came from online ticketing & 24% from its live event business.

But after pandemic, when people started going out, BookMyShow expanded on its live events business.

And the revenue generated from this business went from only ₹25 Cr in FY22 to ₹237 Cr in FY23.

And the revenue generated from this business went from only ₹25 Cr in FY22 to ₹237 Cr in FY23.

The entry of Paytm surely disrupted the market of BookMyShow.

But the market is way too big and BookMyShow wasn’t going to lose because of some competitor's entry.

But the market is way too big and BookMyShow wasn’t going to lose because of some competitor's entry.

Take fashion for example.

The industry is so big that even with all the big brands like Myntra, Ajio, Amazon, and Flipkart, it falls short of fulfilling the demand.

The industry is so big that even with all the big brands like Myntra, Ajio, Amazon, and Flipkart, it falls short of fulfilling the demand.

Paytm diversified into fashion, electronics, sports, and more as well, a couple of years ago

What happened to the Flipkarts and Amazons of the world? They kept on growing!

As of now, BookMyShow is operating in 650+ towns and cities, and 5,000+ screens in India.

What happened to the Flipkarts and Amazons of the world? They kept on growing!

As of now, BookMyShow is operating in 650+ towns and cities, and 5,000+ screens in India.

And Paytm Insider commands a 44.76% market share, while BookMyShow holds 55.24% in live events for FY23.

BookMyShow has faced many knockdowns since its inception.

But it has always survived by keeping customer needs the priority.

BookMyShow has faced many knockdowns since its inception.

But it has always survived by keeping customer needs the priority.

If you liked this read, do RePost🔄 the 1st post

and follow us @FinFloww for such reads every Monday, Wednesday and Friday!

and follow us @FinFloww for such reads every Monday, Wednesday and Friday!

Get our WhatsApp newsletter: whatsapp.com

Subscribe to WHAT THE FLOWW?, our email newsletter where we dive deeper into such concepts: soshals.app

CORRECTION:

In FY22, 91% of the revenue came from online ticketing & only 9% from its live event business.

And in FY23 (after the pandemic), 62% of the revenue came from online ticketing & 24% from its live event business.

In FY22, 91% of the revenue came from online ticketing & only 9% from its live event business.

And in FY23 (after the pandemic), 62% of the revenue came from online ticketing & 24% from its live event business.

Loading suggestions...