Mastering the art of on-chain whale watching could be your ticket to millions.

In recent weeks, insiders have been turning $1k > $1m+ by getting into meme coins EARLY.

🧵: Here are 2 battle-tested strategies I use to track their trades (and find early meme coin alpha).👇

In recent weeks, insiders have been turning $1k > $1m+ by getting into meme coins EARLY.

🧵: Here are 2 battle-tested strategies I use to track their trades (and find early meme coin alpha).👇

Crypto's information landscape is heavily asymmetrical.

Insiders are often privy to intel that massively affect a token's price - launches, promos, partnerships & more.

Using this info, they often front-run retail investors by strategically timing their investments.

Insiders are often privy to intel that massively affect a token's price - launches, promos, partnerships & more.

Using this info, they often front-run retail investors by strategically timing their investments.

Now, these insiders become "whales", where they leverage their network and connections to find more early investment opportunities.

It's a classic cycle, where the whales get richer at the expense of retail.

It's a classic cycle, where the whales get richer at the expense of retail.

But there's a way to get ahead of this curve.

And that's by using one of blockchain's biggest advantages: transparency.

With the right tools, you can track what the big whales are buying and selling at all times.

And that's by using one of blockchain's biggest advantages: transparency.

With the right tools, you can track what the big whales are buying and selling at all times.

Before we get into my 2 strategies, let's look at some examples.

1. $10m trade.

2. $20m trade.

3. $9m trade.

These are examples of bigger trades, but I've also seen a plethora of smaller $1m profits from a bankroll of <$5k, and in some cases, <$1k.

Although some may of gotten EXTREMELY lucky, it's more probable that they had some kind of insider information.

Although some may of gotten EXTREMELY lucky, it's more probable that they had some kind of insider information.

Here are two practical strategies to help you track insider whale wallets easily.👇

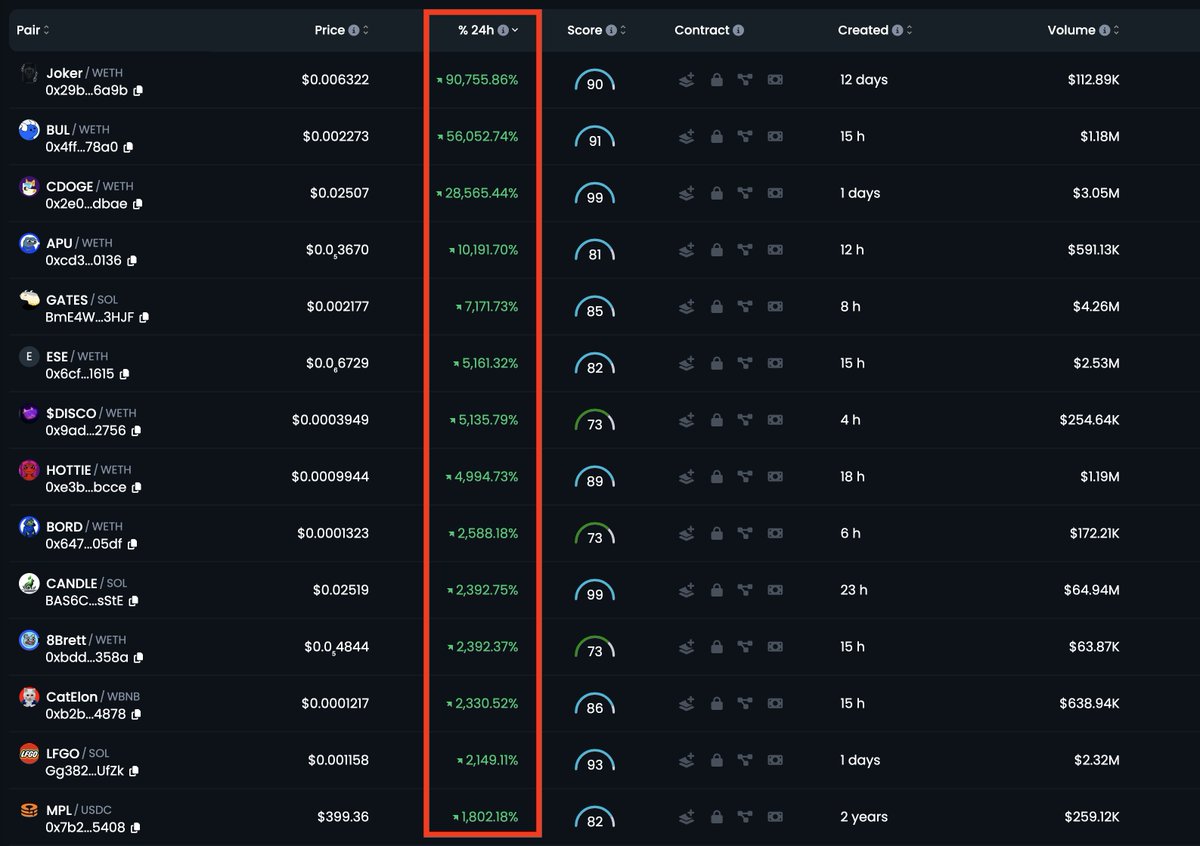

1. Using @DEXToolsApp

• Go to the pairs section of DEXTools

• Find top gainers from 'Hot Pairs' or the 'Daily Gainers' section.

Check which tokens remain on these lists for 3-4 consecutive days. This is a clear signal that they have significant hype.

• Go to the pairs section of DEXTools

• Find top gainers from 'Hot Pairs' or the 'Daily Gainers' section.

Check which tokens remain on these lists for 3-4 consecutive days. This is a clear signal that they have significant hype.

This means you'll need to be watching this list daily.

Make it a part of your routine, and take notes each day to build a data set.

To make things easier, you can focus on a singular chain, like Solana or Base.

Make it a part of your routine, and take notes each day to build a data set.

To make things easier, you can focus on a singular chain, like Solana or Base.

I wrote a guide last year which I believe will be immensely helpful when it comes to meme coin due diligence/investing.

I recommend reading it as a refresher.

I recommend reading it as a refresher.

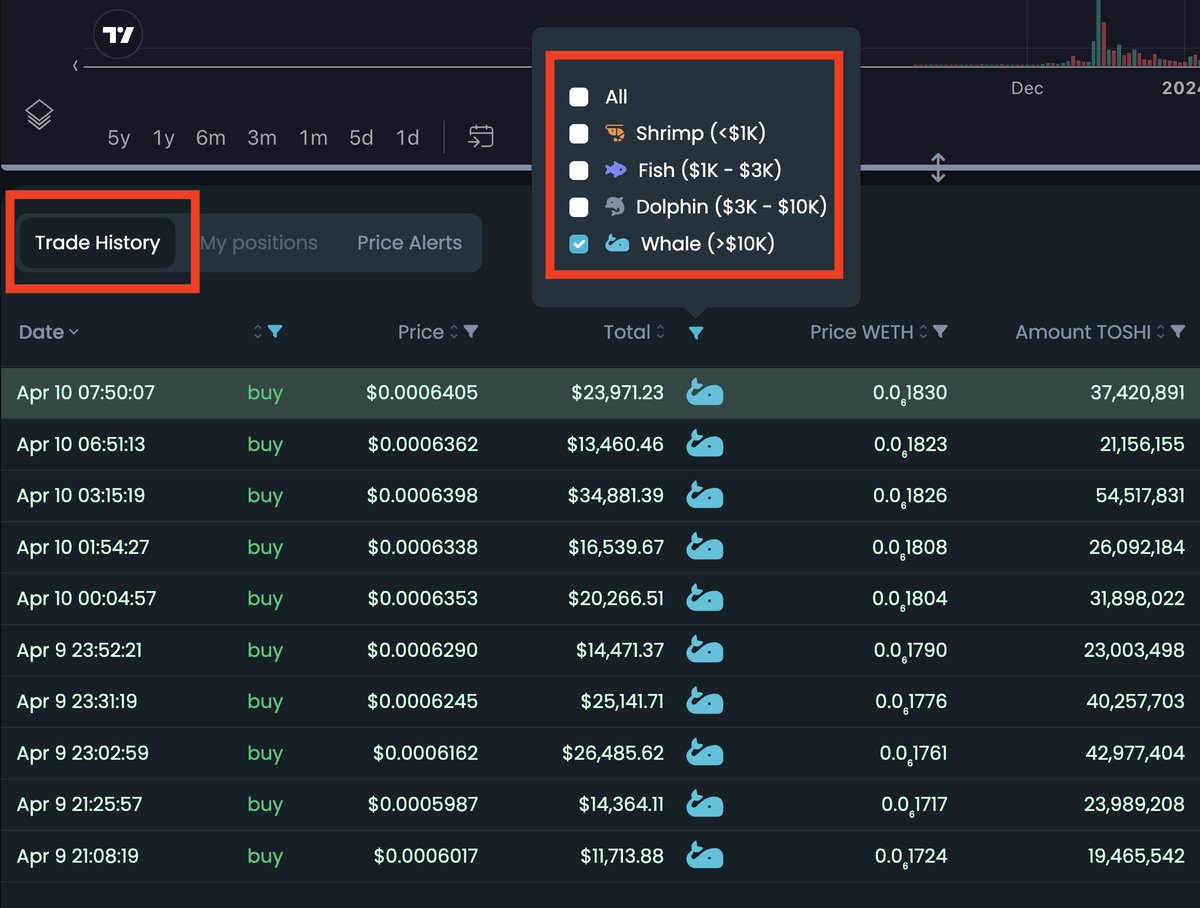

Next, check if these whales are active and have consistent trading activity.

This is where block explorers like @etherscan, @solscanofficial etc. come in handy.

Look for patterns in transaction history so you can identify "smart money".

This is where block explorers like @etherscan, @solscanofficial etc. come in handy.

Look for patterns in transaction history so you can identify "smart money".

Here is a video to make it easier.

Add these wallets to the block explorer's watchlist so that you can:

• Follow their trades & transactions

• Be alerted as they build positions in new tokens

Applications like @DeBankDeFi & @StepFinance_ help immensely with this.

• Follow their trades & transactions

• Be alerted as they build positions in new tokens

Applications like @DeBankDeFi & @StepFinance_ help immensely with this.

Just remember, it's important to understand that not all whales are created equal.

Some whales might have large holdings of a token but may be historically unprofitable or have low returns on their investments.

Some whales might have large holdings of a token but may be historically unprofitable or have low returns on their investments.

Therefore, you need to use a mix of on-chain analysis & critical thinking to identify the right wallets to track.

While block explorers help you perform a rudimentary analysis, you need more advanced tools to filter out the true gems easily.

Which brings me to the next tool.👇

While block explorers help you perform a rudimentary analysis, you need more advanced tools to filter out the true gems easily.

Which brings me to the next tool.👇

2. @ArkhamIntel

Arkham Intelligence offers a comprehensive suite of wallet & contract tracking tools for advanced whale watchers.

With Arkham, you can get a detailed overview of a wallet's token holdings, exchange usage, and transaction history.

Arkham Intelligence offers a comprehensive suite of wallet & contract tracking tools for advanced whale watchers.

With Arkham, you can get a detailed overview of a wallet's token holdings, exchange usage, and transaction history.

But the best way to find winning wallets is digging around the data.

@DeFiMinty outlines a great strategy to find potential whale wallets through Arkham.

@DeFiMinty outlines a great strategy to find potential whale wallets through Arkham.

As you can see, @DEXToolsApp & @ArkhamIntel each have their strengths & limitations.

But actually, they're highly complementary.

But actually, they're highly complementary.

You can use both in tandem to build a holistic whale tracking strategy:

• DEXTools for finding tokens with momentum & the whale wallets

• Arkham for snapshots, rich analytics, & real-time alerts

• DEXTools for finding tokens with momentum & the whale wallets

• Arkham for snapshots, rich analytics, & real-time alerts

Once again, remember: not all whale wallets will be winners.

You will need to do some trial and error to find wallets with high hit rates.

However, once you have a list, you can consider copy trading them with a small portfolio.

You will need to do some trial and error to find wallets with high hit rates.

However, once you have a list, you can consider copy trading them with a small portfolio.

It takes time and persistence to master these on-chain tools, but once you do - it's very rewarding!

Hopefully this thread pushes you in the right direction.

Hopefully this thread pushes you in the right direction.

I'll keep you up to date with new strategies as I find them (follow me @milesdeutscher for more content like this).

If you found this thread helpful, I'd appreciate if you could Like/Repost the quote below. 💙

If you found this thread helpful, I'd appreciate if you could Like/Repost the quote below. 💙

Loading suggestions...