#Nifty to approach 23400, as seasonal correction matures…

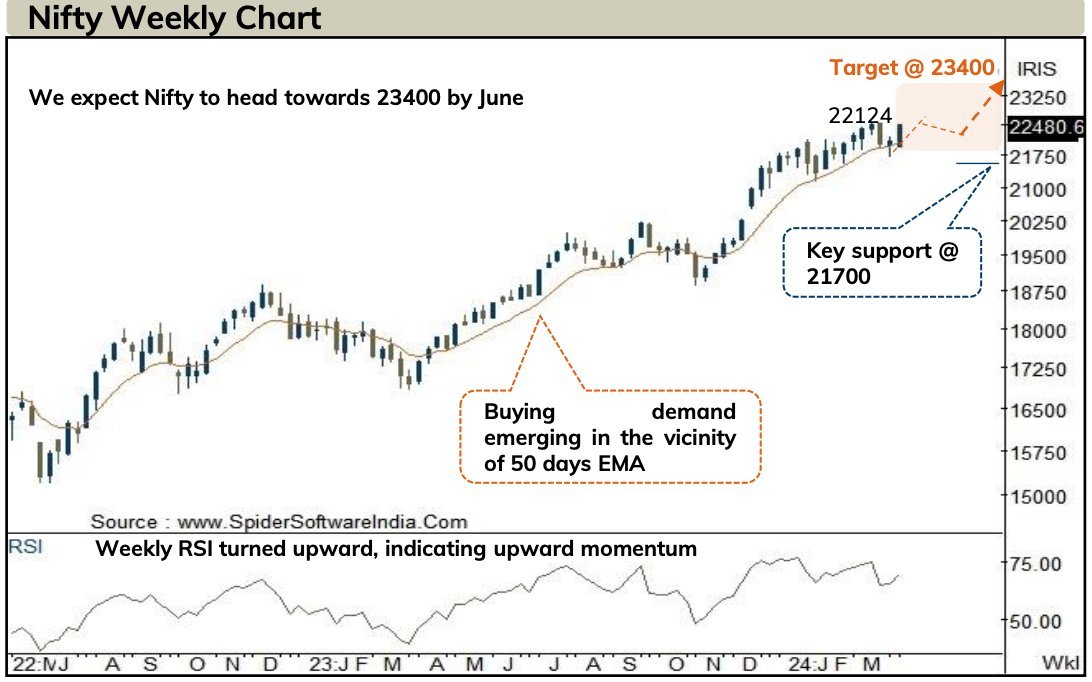

🔸In this edition of our Technical Strategy, we reiterate our constructive stance and expect Nifty to head for target of 23400 by Election outcome while key support is placed at 21700 which we expect to hold.

🔸Here's a 🧵 on 8 reasons why!

❤️ & 🔄 for better reach!

🔸In this edition of our Technical Strategy, we reiterate our constructive stance and expect Nifty to head for target of 23400 by Election outcome while key support is placed at 21700 which we expect to hold.

🔸Here's a 🧵 on 8 reasons why!

❤️ & 🔄 for better reach!

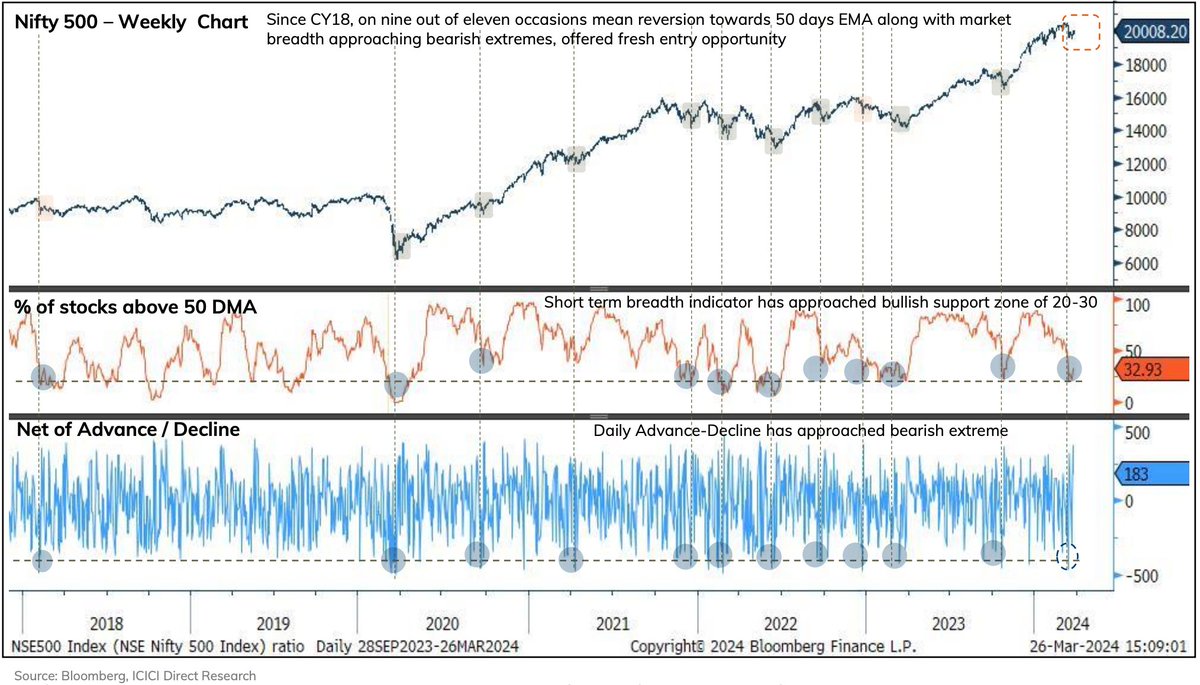

1⃣ #Nifty has been consolidating in 1000 points range since mid-January thereby cooling off overbought readings.

🔸Percentage of stocks above 50day ema (20%) along with net of daily AdvanceDecline (-460) has approached bearish extreme readings which usually coincides with bottom formation.

🔸Bottom up chart study of Nifty constituents projects further upsides across multiple sectors as many stocks have approached key supports after healthy retracement and expected to resume their structural uptrend.

🔸Percentage of stocks above 50day ema (20%) along with net of daily AdvanceDecline (-460) has approached bearish extreme readings which usually coincides with bottom formation.

🔸Bottom up chart study of Nifty constituents projects further upsides across multiple sectors as many stocks have approached key supports after healthy retracement and expected to resume their structural uptrend.

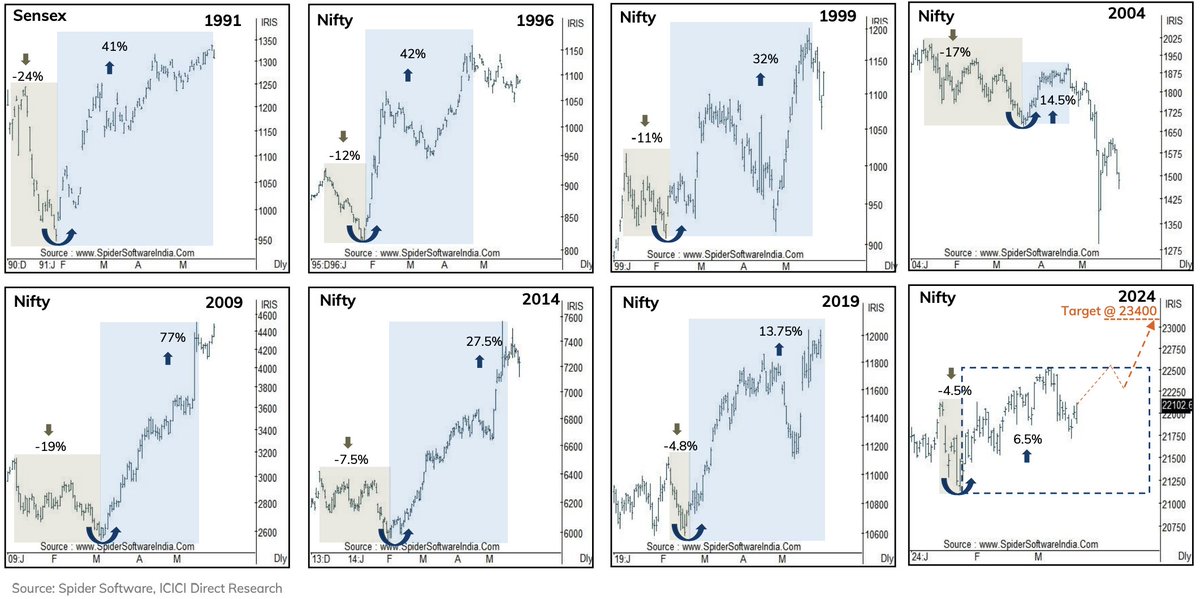

2⃣ Historically, first quarter bottom paves the way for rally run up to the Election!

🔸Empirically, in an election year first quarter bottom has offered fresh entry opportunity on all 7 out of 7 occasions over past three decades, which paved the way to ride next leg of up move garnering double digit returns in the run up to General Election.

🔸In current scenario, with 5% correction already in place we expect index to maintain the same rhythm and head towards 23400 by June.

🔸Empirically, in an election year first quarter bottom has offered fresh entry opportunity on all 7 out of 7 occasions over past three decades, which paved the way to ride next leg of up move garnering double digit returns in the run up to General Election.

🔸In current scenario, with 5% correction already in place we expect index to maintain the same rhythm and head towards 23400 by June.

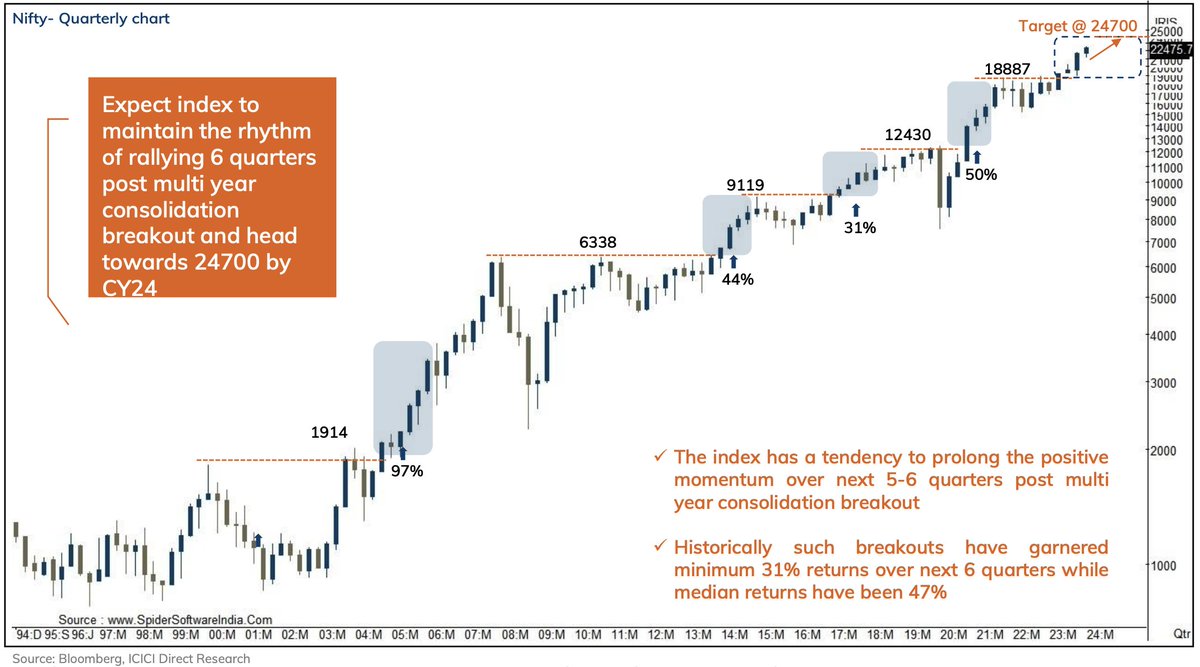

3⃣ #Nifty shines in an “Election year”

🔸It has been observed that benchmark indices have performed well in election years despite spikes in volatility.

🔸Going by four decade history, median returns in election year has been 17%.

🔸Therefore, one should use volatility during election year as a buying opportunity.

🔸It has been observed that benchmark indices have performed well in election years despite spikes in volatility.

🔸Going by four decade history, median returns in election year has been 17%.

🔸Therefore, one should use volatility during election year as a buying opportunity.

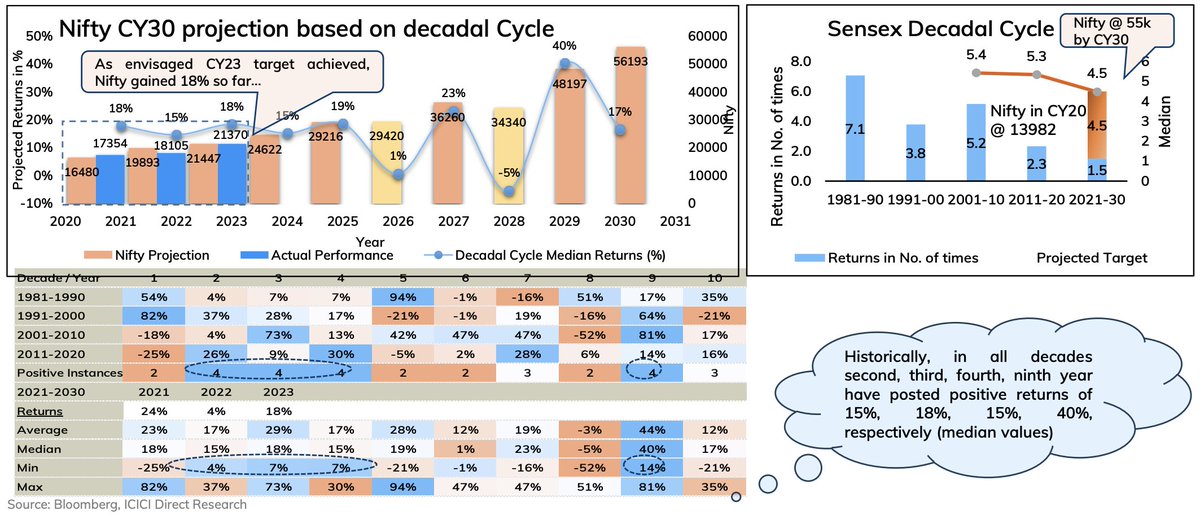

5⃣Seconded by our “Decadal Theory”

🔸Since inception in 1979, #Sensex returns for each of the four decades has been 4x (median value). The study helps investors to form a larger perspective and stay the course during times of turbulence.

🔸 Projection for current decade (CY21-30) on the basis of CY20 close (#Nifty:13982) works out to around 55,000.

🔸Empirically, fourth year of the decade has always been positive with acceleration in returns to higher teens (median values).

🔸It is worth noting that such returns do not come in a linear fashion and corrections of around 15% along the way have always been a buying opportunity.

🔸Since inception in 1979, #Sensex returns for each of the four decades has been 4x (median value). The study helps investors to form a larger perspective and stay the course during times of turbulence.

🔸 Projection for current decade (CY21-30) on the basis of CY20 close (#Nifty:13982) works out to around 55,000.

🔸Empirically, fourth year of the decade has always been positive with acceleration in returns to higher teens (median values).

🔸It is worth noting that such returns do not come in a linear fashion and corrections of around 15% along the way have always been a buying opportunity.

6⃣ #Banknifty: Structural uptrend to bolster

🔸Since July 2022 on multiple occasions buying demand emerged in the vicinity of 52 weeks EMA.

🔸Price action over two years is in a rising channel.

🔸Expect index to head towards milestone of 51000 by June and gradually resolve higher towards upper band of channel @ 54000 over by December.

🔸Key support at 45000.

🔸Since July 2022 on multiple occasions buying demand emerged in the vicinity of 52 weeks EMA.

🔸Price action over two years is in a rising channel.

🔸Expect index to head towards milestone of 51000 by June and gradually resolve higher towards upper band of channel @ 54000 over by December.

🔸Key support at 45000.

Loading suggestions...