This thread is structured into 8 different lessons..

L1: Understanding Options

L2: Price Action Basics

L3: Patterns

L4: EMAs & VWAP

L5: Supply & Demand

L6: LVL2 & Tape Reading W/ S&D

L7: Risk/Trade Management

L8: Psychology

L1: Understanding Options

L2: Price Action Basics

L3: Patterns

L4: EMAs & VWAP

L5: Supply & Demand

L6: LVL2 & Tape Reading W/ S&D

L7: Risk/Trade Management

L8: Psychology

L1: Understanding Options 🌟

In this lesson we will be going over..

- Options Basics

- Greeks

- IV

- How To Pick Contracts

In this lesson we will be going over..

- Options Basics

- Greeks

- IV

- How To Pick Contracts

OPTIONS BASICS

Options are derivatives and there's 2 type..

Calls: Bullish Buyer - Bearish Seller

- We play this when we think the price will RISE 📈

Puts: Bearish Buyer - Bullish Seller

- We play this when we think price will FALL 📉

Options are derivatives and there's 2 type..

Calls: Bullish Buyer - Bearish Seller

- We play this when we think the price will RISE 📈

Puts: Bearish Buyer - Bullish Seller

- We play this when we think price will FALL 📉

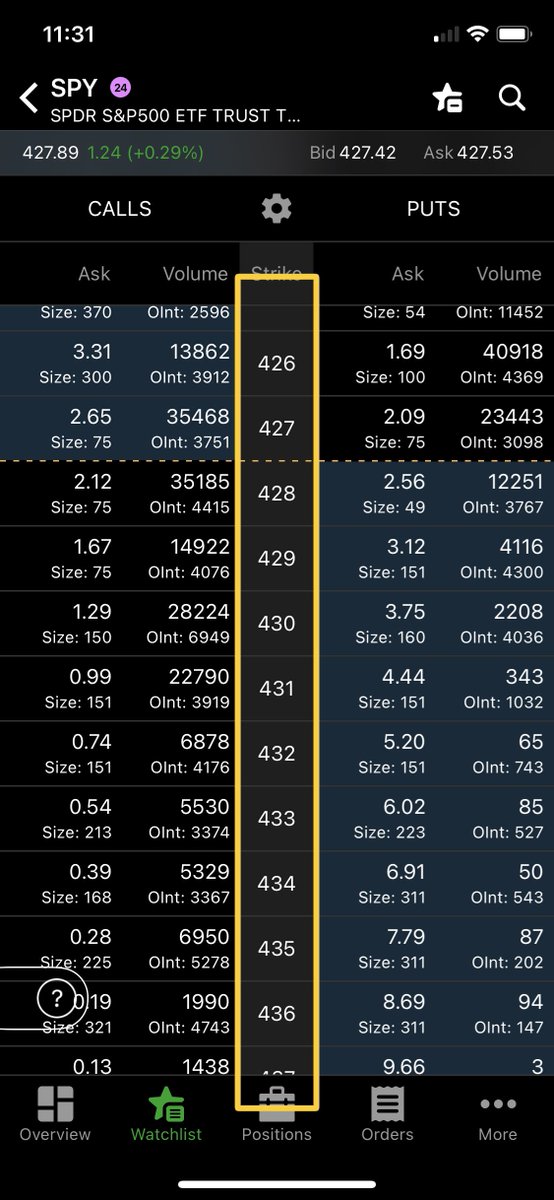

STRIKE PRICE

An option can be converted to buy/sell shares of stock at the options strike price.

This is called exercising contracts. We DON'T do this.

An option can be converted to buy/sell shares of stock at the options strike price.

This is called exercising contracts. We DON'T do this.

THE GREEKS

Delta measures change in option price when stock price moves.

Gamma measures change in change in delta when stock price moves.

Theta measures change in option price every day as the expiration gets closer.

Theta is VERY important.

Delta measures change in option price when stock price moves.

Gamma measures change in change in delta when stock price moves.

Theta measures change in option price every day as the expiration gets closer.

Theta is VERY important.

IMPLIED VOLATILITY (IV)

IV is very confusing topic for new traders. Let's break it down.

IV can be interpreted as the market’s expected magnitude for a stock’s price changes in the future.

IV is very confusing topic for new traders. Let's break it down.

IV can be interpreted as the market’s expected magnitude for a stock’s price changes in the future.

OPTION PRICES DRIVE IV

More buying pressure than selling pressure

= Increase in options prices

= Higher IV

More selling pressure than buying pressure

= Decrease in options prices

= Lower IV

-----

More buying pressure than selling pressure

= Increase in options prices

= Higher IV

More selling pressure than buying pressure

= Decrease in options prices

= Lower IV

-----

When option buyers are willing to pay high premiums and options sellers demand high selling prices, that’s an indication that traders are expecting lots of stock price volatility in the future.

If the opposite occurs that’s an indication that they are NOT expecting volatility.

If the opposite occurs that’s an indication that they are NOT expecting volatility.

IV RANK

IV Rank simply tells us whether IV is high or LOW in the underlying based on the past year of IV data.

0% - IV is the lowest it's been over the past year

50% - IV is at the midpoint over the past year

100% - IV is at the highest over the past year

IV Rank simply tells us whether IV is high or LOW in the underlying based on the past year of IV data.

0% - IV is the lowest it's been over the past year

50% - IV is at the midpoint over the past year

100% - IV is at the highest over the past year

IV PERCENTILE

IV Percentile tells us how often the stock’s IV has been BELOW it’s current IV over the past year.

Example: An IV percentile of 85% means the stock’s IV has been below its current level of IV on 85% of days over the past year.

IV Percentile tells us how often the stock’s IV has been BELOW it’s current IV over the past year.

Example: An IV percentile of 85% means the stock’s IV has been below its current level of IV on 85% of days over the past year.

IV CRUSH & EARNINGS

IV Crush is when options premium collapse due to a sudden decrease in IV. This tends to happen most often when playing EARNINGS.

Playing earnings is VERY dangerous and IV should ALWAYS be taken into consideration.

IV Crush is when options premium collapse due to a sudden decrease in IV. This tends to happen most often when playing EARNINGS.

Playing earnings is VERY dangerous and IV should ALWAYS be taken into consideration.

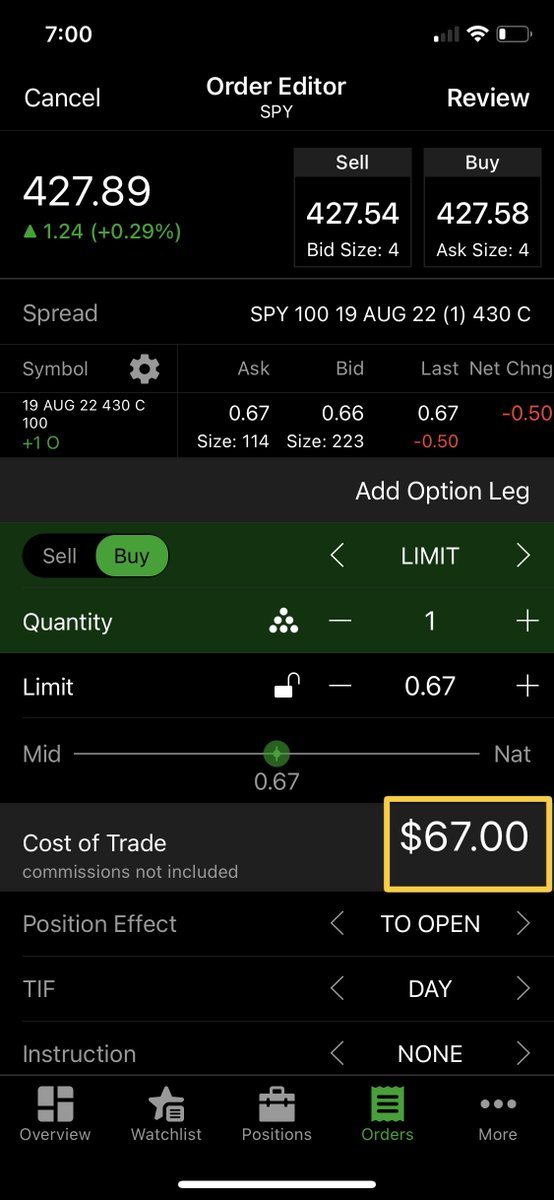

HOW TO PICK CONTRACTS - EXPIRATION DATES

If you’re day trading you typically want to pick the closest expiration (after 0dte), if you’re swinging you want to pick the time frame you think your swing will last.

If you’re a beginner don’t play 0dte’s, thank me later.

If you’re day trading you typically want to pick the closest expiration (after 0dte), if you’re swinging you want to pick the time frame you think your swing will last.

If you’re a beginner don’t play 0dte’s, thank me later.

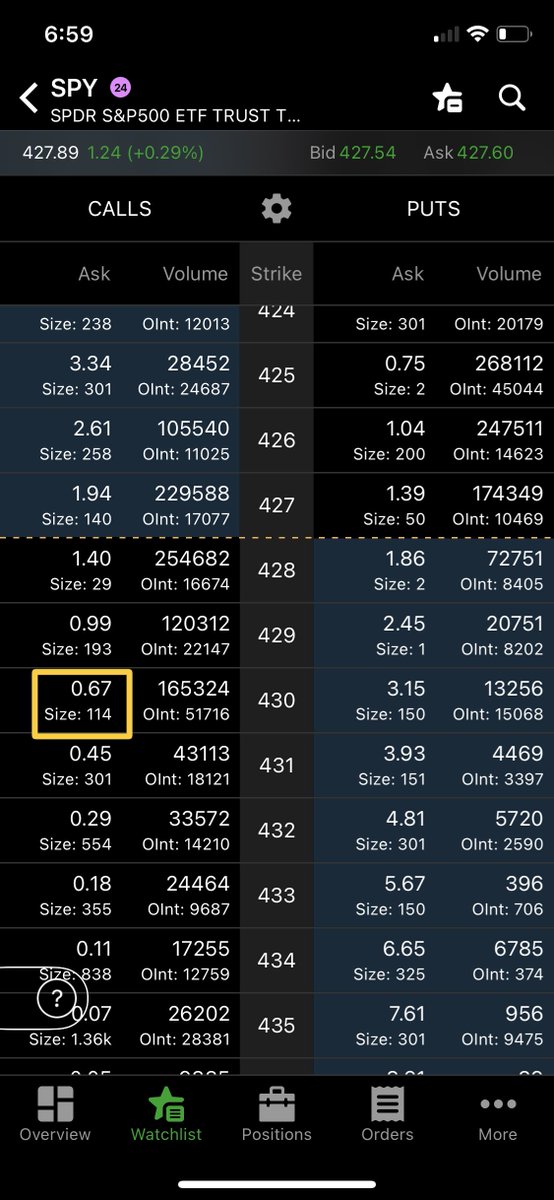

HOW TO PICK CONTRACTS - VOLUME

You NEED contracts with volume.

Volume is what makes your contracts move, if you have little volume on your contracts, they’re not gonna move nicely.

Volume is also what’s going to help you enter & exit your position as quickly as possible.

You NEED contracts with volume.

Volume is what makes your contracts move, if you have little volume on your contracts, they’re not gonna move nicely.

Volume is also what’s going to help you enter & exit your position as quickly as possible.

HOW TO PICK CONTRACTS - BID/ASK SPREAD

You want to look for contracts with small bid/ask spreads.

This allows you to get in and out quicker + get in at a reasonable average.

You want to look for contracts with small bid/ask spreads.

This allows you to get in and out quicker + get in at a reasonable average.

HOW TO PICK CONTRACTS - OPEN INTEREST

Open interest shows the amount of OPEN contracts being held at a certain strike price.

It shows how much INTEREST is in the certain strike.

Open interest is a key indicator when it comes to swinging.

Open interest shows the amount of OPEN contracts being held at a certain strike price.

It shows how much INTEREST is in the certain strike.

Open interest is a key indicator when it comes to swinging.

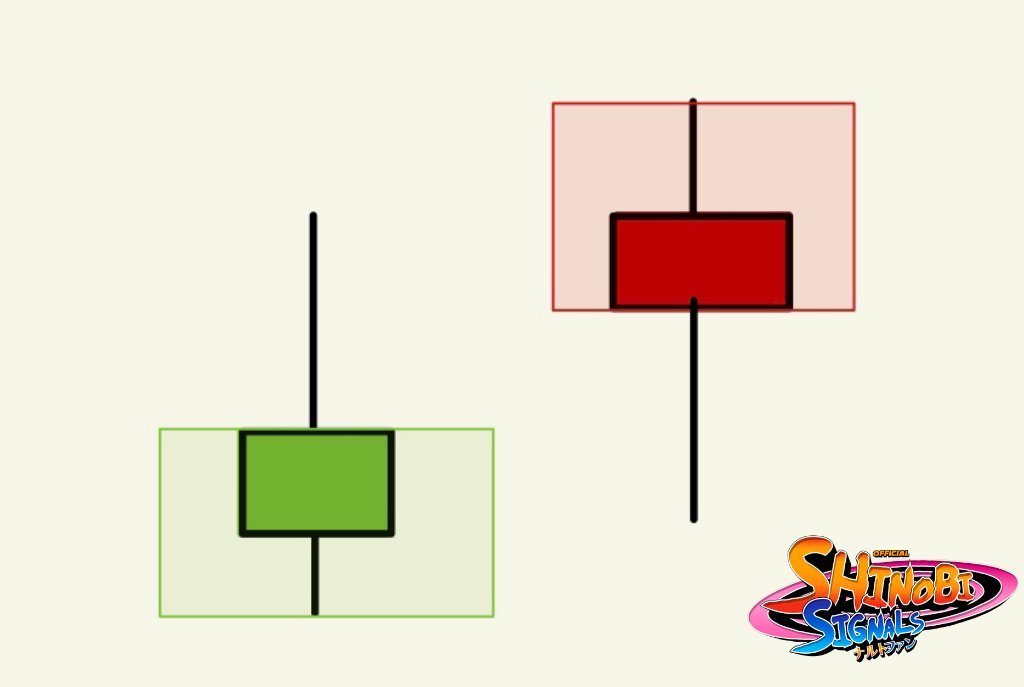

L2: Price Action Basics 🌟

In this lesson we will be going over the basics of..

- Candlestick Anatomy

- Volume

- Trends

- Support & Resistance

In this lesson we will be going over the basics of..

- Candlestick Anatomy

- Volume

- Trends

- Support & Resistance

VOLUME

Volume simply represents the amount shares being traded in a specific time period. So if you're looking at the 1hr time frame and see 10m in volume that means there were 10 million shares bought/sold in 1hr.

Volume simply represents the amount shares being traded in a specific time period. So if you're looking at the 1hr time frame and see 10m in volume that means there were 10 million shares bought/sold in 1hr.

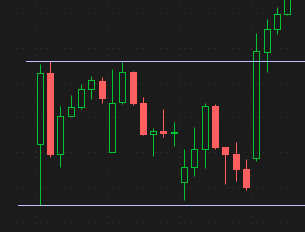

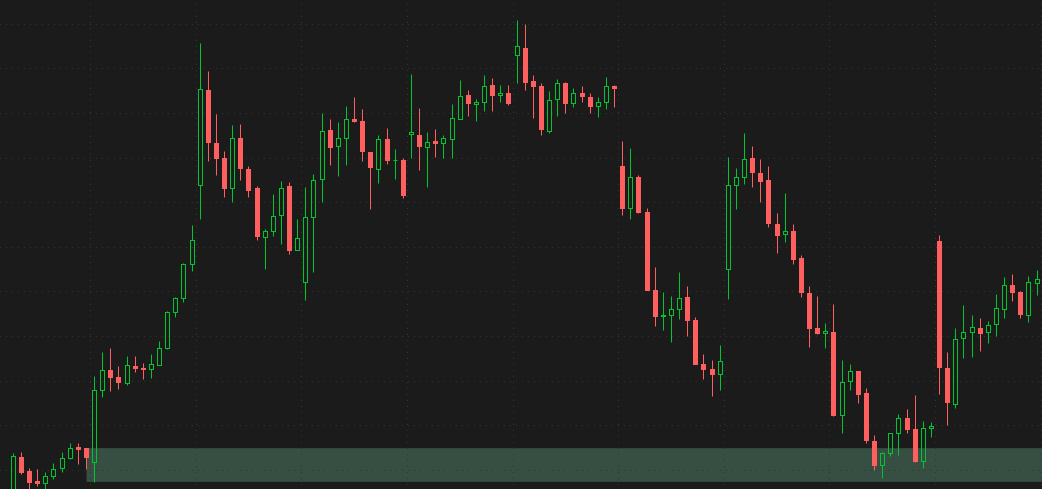

TRENDS

There's 3 different stages a market can be in.

1. Uptrend: Market is making higher highs and higher lows.

2. Consolidation: Market is trading sideways.

3. Downtrend: Market is putting in lower highs and lower lows.

Let's go over an example of each one.

There's 3 different stages a market can be in.

1. Uptrend: Market is making higher highs and higher lows.

2. Consolidation: Market is trading sideways.

3. Downtrend: Market is putting in lower highs and lower lows.

Let's go over an example of each one.

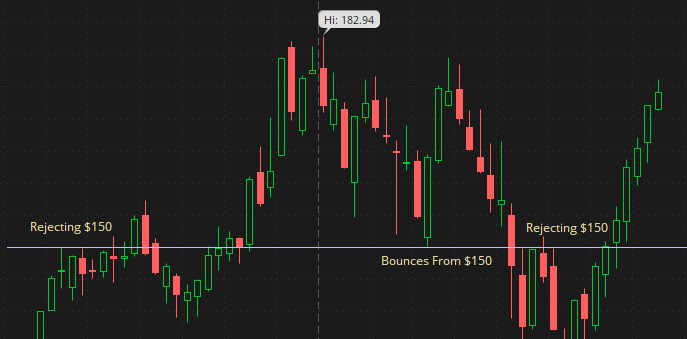

WHAT ARE KEY LEVELS?

Key levels are AREAS on a chart where a pause, reversal, or breakout is expected due to the amount of supply & demand tied to them.

Key levels are referred to as a level but you should always see them as a general AREA.

Key levels are AREAS on a chart where a pause, reversal, or breakout is expected due to the amount of supply & demand tied to them.

Key levels are referred to as a level but you should always see them as a general AREA.

HOW DO WE FIND KEY LEVELS?

Key levels should be able to stand out to you, you shouldn't have to dig deep trying to find them. Every key level should also have MEANING behind it. For example is your level where a reversal happened, HOD or LOD, lots of rejection or bounces, etc.

Key levels should be able to stand out to you, you shouldn't have to dig deep trying to find them. Every key level should also have MEANING behind it. For example is your level where a reversal happened, HOD or LOD, lots of rejection or bounces, etc.

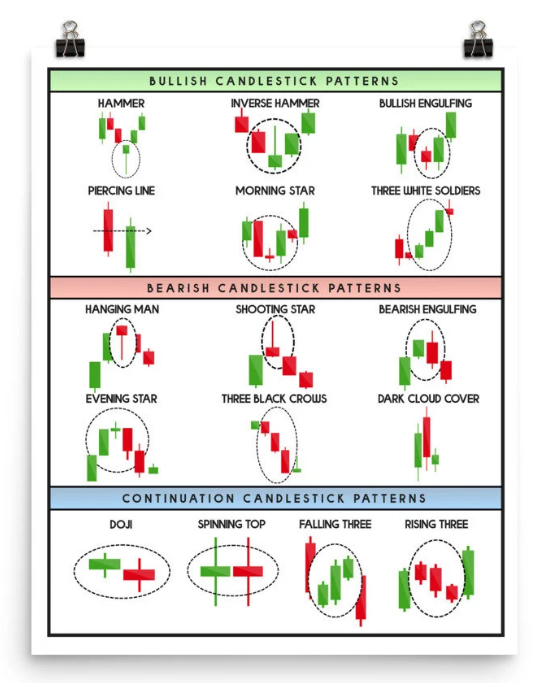

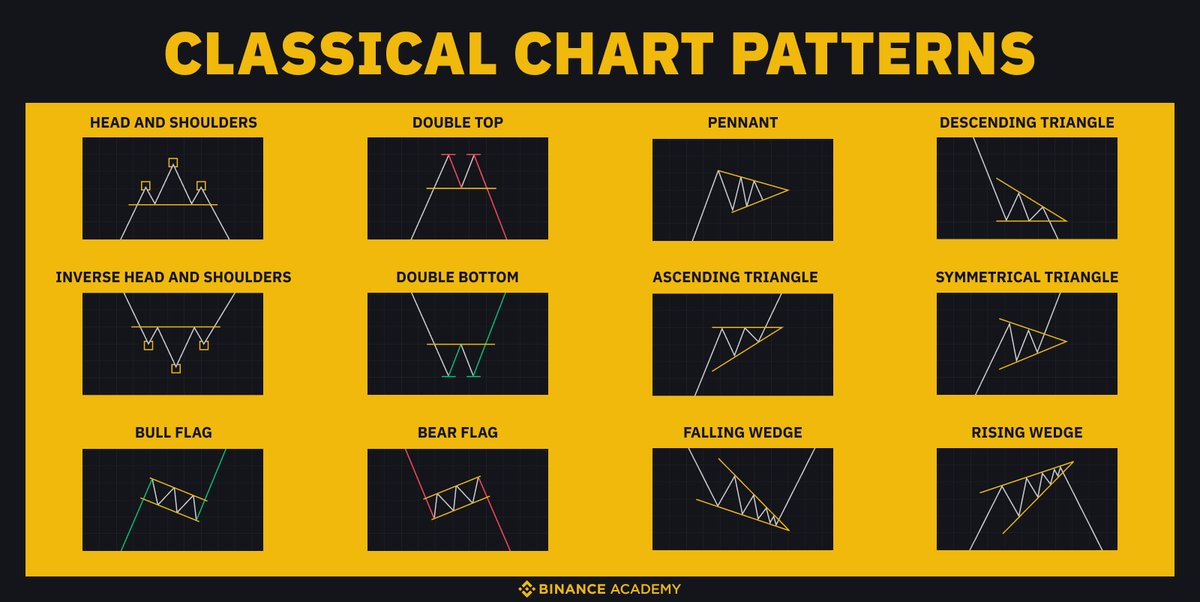

L3: Patterns 🌟

In this lesson we will be going over..

- Chart & Candlestick Patterns

- The Reality of Patterns

- How You Should Actually Use Patterns

In this lesson we will be going over..

- Chart & Candlestick Patterns

- The Reality of Patterns

- How You Should Actually Use Patterns

THE REALITY OF PATTERNS

The truth about patterns is that you can't just learn the patterns and then proceed to play the actual pattern every time you see it, because most of the time, chances are they won't play out.

This isn't sustainable.

The truth about patterns is that you can't just learn the patterns and then proceed to play the actual pattern every time you see it, because most of the time, chances are they won't play out.

This isn't sustainable.

HOW YOU SHOULD ACTUALLY USE PATTERNS

Patterns allow you to back up or shift your thesis. This is the proper way to use them. If you're in a bullish position and you see a bullish pattern forming, this allows you to have more confidence in your trade.

Same thing the opposite way.

Patterns allow you to back up or shift your thesis. This is the proper way to use them. If you're in a bullish position and you see a bullish pattern forming, this allows you to have more confidence in your trade.

Same thing the opposite way.

L4: EMAs & VWAP 🌟

In this lesson we will be going over..

- EMAs

- VWAP

- Reality of Indicators

In this lesson we will be going over..

- EMAs

- VWAP

- Reality of Indicators

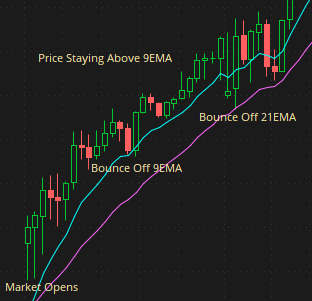

EMAs

EMAs (Exponential Moving Average) is an indicator that tracks recent price trend of a specific time period.

I use the 9 & 21 EMAs.

There's many different ways to use the EMAs, I personally use them to stay in my trade longer but also to enter/exit sometimes too!

EMAs (Exponential Moving Average) is an indicator that tracks recent price trend of a specific time period.

I use the 9 & 21 EMAs.

There's many different ways to use the EMAs, I personally use them to stay in my trade longer but also to enter/exit sometimes too!

REALITY OF INDICATORS

The same as patterns, indicators should not be used solely by themselves. They are here to help guide your thesis and manage your trades. Pair VWAP or EMAS with your own system and you have extra confluence!

The same as patterns, indicators should not be used solely by themselves. They are here to help guide your thesis and manage your trades. Pair VWAP or EMAS with your own system and you have extra confluence!

L5: SUPPLY & DEMAND 🌟

In this lesson we will be going over..

- How To Find Zones

- How To Execute Zones

- How To Outsmart Retail Traders

In this lesson we will be going over..

- How To Find Zones

- How To Execute Zones

- How To Outsmart Retail Traders

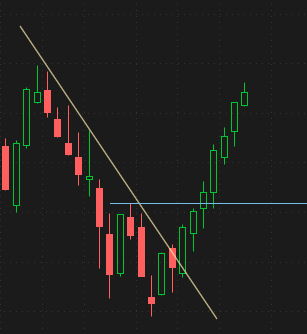

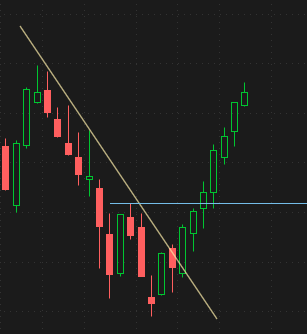

WHY TRADE SUPPLY & DEMAND?

When trading in the stock market, one must understand that it is heavily influenced by INSTITUTIONS and ALGORITHMS. To remain profitable in the market, one must trade like an institution.

When trading in the stock market, one must understand that it is heavily influenced by INSTITUTIONS and ALGORITHMS. To remain profitable in the market, one must trade like an institution.

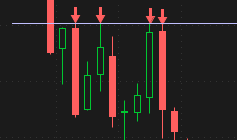

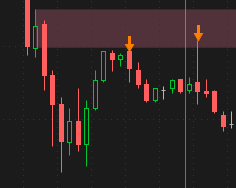

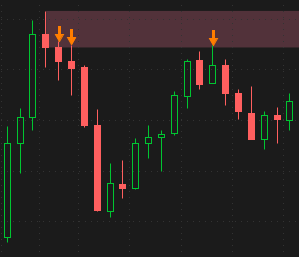

WHAT IS SUPPLY?

Supply is where there is a quantity of shares yet to be sold (limits yet to be filled) at a certain area. This tends to lie in areas where the stock had previously sharply sold off due to sell orders being filled.

Supply is where there is a quantity of shares yet to be sold (limits yet to be filled) at a certain area. This tends to lie in areas where the stock had previously sharply sold off due to sell orders being filled.

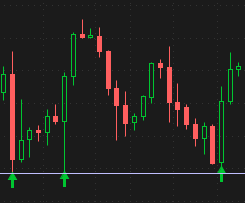

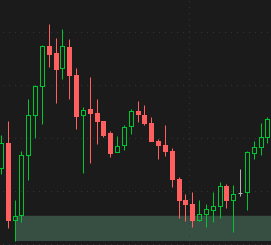

WHAT IS DEMAND?

Demand is where there is a quantity of shares yet to be bought (limits yet to be filled) at a certain area. This tends to lie in areas where the stock previously rallied aggressively due to buy orders being filled.

Demand is where there is a quantity of shares yet to be bought (limits yet to be filled) at a certain area. This tends to lie in areas where the stock previously rallied aggressively due to buy orders being filled.

WHAT ARE LIMIT ORDERS?

Limit orders are orders that HAVE NOT been filled yet. This is how institutions trade, they set their limit orders at supply where they have sell orders, and limit orders at demand where they have buy orders.

Limit orders are orders that HAVE NOT been filled yet. This is how institutions trade, they set their limit orders at supply where they have sell orders, and limit orders at demand where they have buy orders.

WHY DO S/D ZONES WORK?

Institutions have previous limit orders set from before. Once you identify where you think they have their orders, once it reaches the zone, the orders fill, and go through with your thesis.

Institutions have previous limit orders set from before. Once you identify where you think they have their orders, once it reaches the zone, the orders fill, and go through with your thesis.

If you're having trouble finding these areas, understand this. The market is always in either 2 stages, balanced or imbalanced market.

Balanced market is when b/s are agreeing on price. Imbalanced market is when one side has taken control.

The transition is your zone.

Balanced market is when b/s are agreeing on price. Imbalanced market is when one side has taken control.

The transition is your zone.

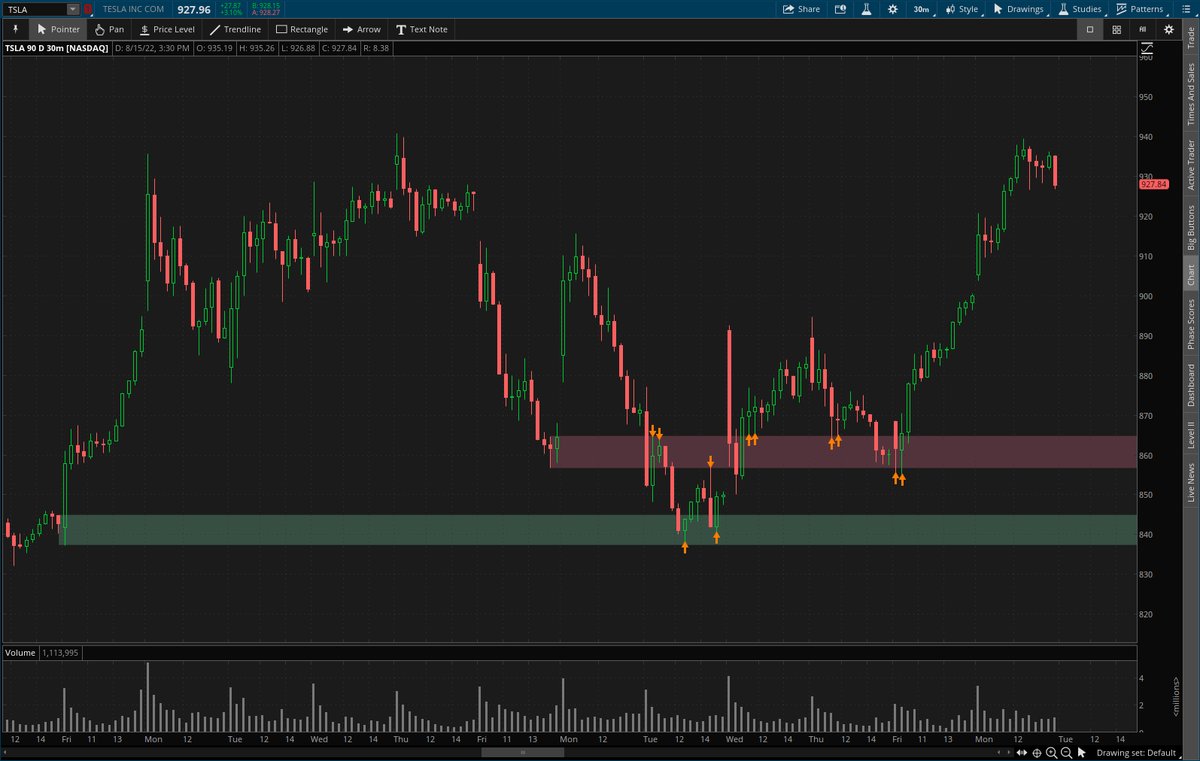

ZONES GET WEAKER

Our zones represent limit buy/sell orders. As price touches our zone MORE, our zone gets weaker because there are LESS orders because they're being filled.

This is very important when playing S/D because if a zone is weak, it will lead to a S/D flip.

Our zones represent limit buy/sell orders. As price touches our zone MORE, our zone gets weaker because there are LESS orders because they're being filled.

This is very important when playing S/D because if a zone is weak, it will lead to a S/D flip.

HELPFUL TIPS

1. Watch LVL2/T&S as confluence in the zone. This allows you to know if buyers/sellers are present.

2. Scale into your zone.

3. Look at the lower time frames to spot a reversal.

1. Watch LVL2/T&S as confluence in the zone. This allows you to know if buyers/sellers are present.

2. Scale into your zone.

3. Look at the lower time frames to spot a reversal.

L6: LVL2 & TAPE W/ S&D 🌟

In this lesson we will be going over..

- How To Use LVL2/T&S

- How To Use LVL2/T&S W/ S&D

In this lesson we will be going over..

- How To Use LVL2/T&S

- How To Use LVL2/T&S W/ S&D

WHY YOU SHOULD USE LVL2/T&S

People use indicators like VWAP, EMAs, etc. The reality is that most indicators are LAGGING indicators. There is only 1 leading indicator and that is LVL2/T&S. This is what is creating the candles in front of you. This gives us an EDGE.

People use indicators like VWAP, EMAs, etc. The reality is that most indicators are LAGGING indicators. There is only 1 leading indicator and that is LVL2/T&S. This is what is creating the candles in front of you. This gives us an EDGE.

When tied with supply & demand, it allows us to see if buyers are sitting at our demand, and sellers are sitting at our supply.

WHAT IS LVL2?

LVL2 data provides us with real time supply and demand info of a stock through the amount of open buy and sell LIMIT orders.

Limit orders are orders that have NOT been filled yet.

LVL2 data provides us with real time supply and demand info of a stock through the amount of open buy and sell LIMIT orders.

Limit orders are orders that have NOT been filled yet.

On TOS you have to multiply the BS/AS numbers by 100. On other brokers/platforms it may not be the same case.

For example..

3 on the bid = 300 shares @ 429.42

8 on the ask = 800 shares @ 429.45

For example..

3 on the bid = 300 shares @ 429.42

8 on the ask = 800 shares @ 429.45

WHAT IS T&S? (TIME & SALES)

T&S also known as the "tape" shows all orders that are FILLED. LVL2 shows unfilled orders, the tape shows filled orders.

So the limit orders you see on LVL2, will potentially be filled and shown on the tape.

T&S also known as the "tape" shows all orders that are FILLED. LVL2 shows unfilled orders, the tape shows filled orders.

So the limit orders you see on LVL2, will potentially be filled and shown on the tape.

HOW TO READ THE TAPE

The tape is also divided into 3 columns.

1- Time: The time the transaction took place.

2- Price: The price the transaction took place.

3- Size: How many shares were bought/sold.

You want to pay attention to the price and size of each order.

The tape is also divided into 3 columns.

1- Time: The time the transaction took place.

2- Price: The price the transaction took place.

3- Size: How many shares were bought/sold.

You want to pay attention to the price and size of each order.

Let's breakdown why the price the order went through at is important.

Below Bid: Aggressive selling pressure.

Bid: Strong selling pressure.

Between B/A: Neutral.

Ask: Strong buying pressure.

Above Ask: Aggressive buying pressure.

Below Bid: Aggressive selling pressure.

Bid: Strong selling pressure.

Between B/A: Neutral.

Ask: Strong buying pressure.

Above Ask: Aggressive buying pressure.

LVL 2 allows us to identify where buyers are sitting at providing us a "floor" (support) and where sellers are sitting at providing us a "wall" (resistance).

Using LVL2 and the tape with the supply and demand strategy allows us to have confluence in our S&D zones.

Using LVL2 and the tape with the supply and demand strategy allows us to have confluence in our S&D zones.

When we see BIDS stacking up at our demand zone with little to no sellers on the ASK side, this allows to be confident that buyers are present.

When we see ASK stack up at our supply zone with little to no buyers on the BID side, this allows to be confident sellers are present.

When we see ASK stack up at our supply zone with little to no buyers on the BID side, this allows to be confident sellers are present.

When watching the tape it is important to see the orders on the LVL2 get FILLED. If you see the orders on the LVL keep disappearing this could mean it's not true order and instead a flashing order.

Let's go over two important LVL2/T&S tips..

Let's go over two important LVL2/T&S tips..

FLASHING ORDER

A flashing order is when there is a big buyer/seller on the LVL2 and before their price gets tested, they remove their order.

They do this because they want to scare traders like you, if someone sees a big order on the opposing side they will panic and sell.

A flashing order is when there is a big buyer/seller on the LVL2 and before their price gets tested, they remove their order.

They do this because they want to scare traders like you, if someone sees a big order on the opposing side they will panic and sell.

HIDDEN BUYERS/SELLERS

Ever wonder why a stock can't get past a certain level but there's no sign of sellers on the LVL2/T&S? This is because there's a hidden seller accumulating orders before the move.

Same thing for the opposing side.

Ever wonder why a stock can't get past a certain level but there's no sign of sellers on the LVL2/T&S? This is because there's a hidden seller accumulating orders before the move.

Same thing for the opposing side.

Now that you understand LVL2/T&S and also some key tips.

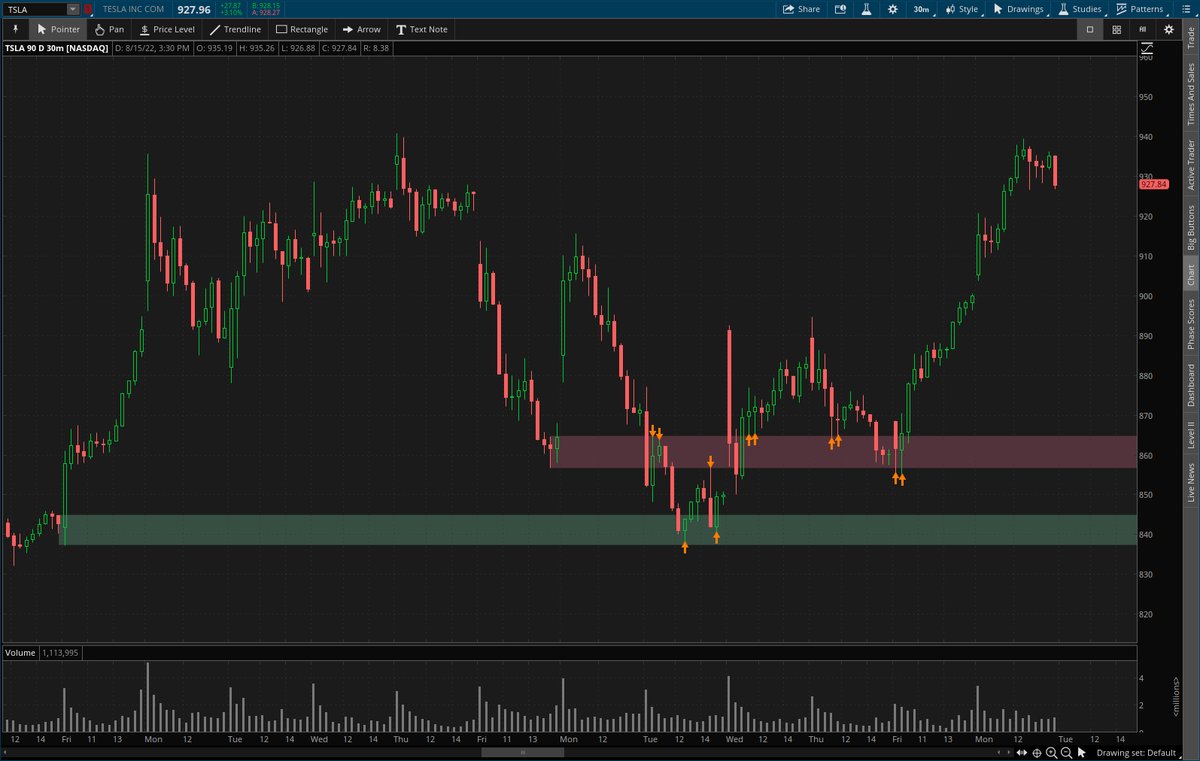

Let's see this in action. I will be showing an example of $TSLA from last week bouncing off demand and buyers showing up on the LVL2 and filling on the T&S.

Let's see this in action. I will be showing an example of $TSLA from last week bouncing off demand and buyers showing up on the LVL2 and filling on the T&S.

Reading the tape will not be easy at first, it moves fast and you will have to train your eyes to catch the big orders, but just like everything, it takes time and once you have it down you will become a beast. Put LVL2 and S&D together and you have yourself an amazing system!

L7: RISK/TRADE MANAGEMENT 🌟

In this lesson we will be going over..

- Truth About Stop Losses

- Position Sizing

- Trimming Profits At 10%

- Having A Set Of Rules

In this lesson we will be going over..

- Truth About Stop Losses

- Position Sizing

- Trimming Profits At 10%

- Having A Set Of Rules

THE TRUTH ABOUT STOP LOSSES

Most people tend to have a hard stop loss on their option contract, get stopped out, and then get mad when the position goes their way.

Your stop loss should be based off the CHART not the contract. This allows you get stopped out when the setup...

Most people tend to have a hard stop loss on their option contract, get stopped out, and then get mad when the position goes their way.

Your stop loss should be based off the CHART not the contract. This allows you get stopped out when the setup...

invalidates and not when you turn red on your position.

Something very important correlates with this and that is your POSITION SIZING. You should be properly sized to see your position see your stop loss on the chart and not your contract.

Tip: Size for 0.

Something very important correlates with this and that is your POSITION SIZING. You should be properly sized to see your position see your stop loss on the chart and not your contract.

Tip: Size for 0.

TRIM PROFITS AT 10%

A lot of traders let their position green positions turn red because they hold for too long. Get in the habit of taking a trim at 10% and having your slightly above or at break even.

This will help you manage risk but also secure some money.

A lot of traders let their position green positions turn red because they hold for too long. Get in the habit of taking a trim at 10% and having your slightly above or at break even.

This will help you manage risk but also secure some money.

HAVE A SET OF RULES

So often I see people trade without a set of rules, and when they do have a set of rules they don't follow them. Why have a set of rules just to break them? Have them written in front of you to remind yourself of them.

Here are some key reminders..

So often I see people trade without a set of rules, and when they do have a set of rules they don't follow them. Why have a set of rules just to break them? Have them written in front of you to remind yourself of them.

Here are some key reminders..

1. Take profit + stop loss + exit is all you need to know and stay focused on. Everything else is NOISE.

2. No setup, no trade. Take trades that follow your system ONLY.

3. Have confidence in your trades. Even if you're a beginner, you will never learn if you don't make mistakes.

2. No setup, no trade. Take trades that follow your system ONLY.

3. Have confidence in your trades. Even if you're a beginner, you will never learn if you don't make mistakes.

L8: PSYCHOLOGY 🌟

To end of this master thread... In this lesson we will be going over..

- Psychology Mistakes You Should Avoid

- Tips To Stop These Emotions In Trading

- How To Control Your Emotions

To end of this master thread... In this lesson we will be going over..

- Psychology Mistakes You Should Avoid

- Tips To Stop These Emotions In Trading

- How To Control Your Emotions

PSYCHOLOGY MISTAKES YOU SHOULD AVOID

1. Moving your PT out of greed

2. Chasing market moves out of FOMO

3. Overtrading out of emotions/anger to make up for losses or mistakes

4. Thinking you can outsmart the market because of 1-2 good plays

5. Focusing energy on the wrong things

1. Moving your PT out of greed

2. Chasing market moves out of FOMO

3. Overtrading out of emotions/anger to make up for losses or mistakes

4. Thinking you can outsmart the market because of 1-2 good plays

5. Focusing energy on the wrong things

TIPS TO STOP THESE EMOTIONS IN TRADING

1. Move stop to break even once you are at or above 10% profit to ensure a green trade.

2. Take a break. One day, 0 trades, will give you a clear conscious.

3. Put your rules in front of you to keep them in your sights while you trade.

1. Move stop to break even once you are at or above 10% profit to ensure a green trade.

2. Take a break. One day, 0 trades, will give you a clear conscious.

3. Put your rules in front of you to keep them in your sights while you trade.

HOW TO CONTROL YOUR EMOTIONS

1. Identify roots of the problem. Uncover the hidden flaws.

2. Map The Pattern. Identify your overall view of emotional activity.

3. Correct the problem. This is where you tackle the problem.

4. Repeat.

1. Identify roots of the problem. Uncover the hidden flaws.

2. Map The Pattern. Identify your overall view of emotional activity.

3. Correct the problem. This is where you tackle the problem.

4. Repeat.

That is it for this MASTER thread. If you found value in this in any way, please make sure to ❤ & ♻ to show love and help others that could use this thread find it.

I love you all. #ConsistentCrusaders ❤

I love you all. #ConsistentCrusaders ❤

Loading suggestions...