#MintPlainFacts | Regulators and policymakers are alarmed about the gold loan market, with the RBI restricting IIFL Finance and the finance ministry urging banks to review their gold loan portfolios due to concerns about collateral adequacy and repayment methods.

Read here: read.ht

Read here: read.ht

#MintPlainFacts | Gold loans, once a mainstay of mainly NBFCs, soared during covid, which affected life in India from March 2020 onwards, and its aftermath.

Read here: read.ht

Read here: read.ht

#MintPlainFacts | The incentive to take gold loans was driven by two factors. One, a move by RBI to increase the loan-to-value ratio of non-agricultural gold loans from 75% to 90%. Thus, for ₹100 worth of gold, lenders could issue a loan worth ₹90, against ₹75 previously. Two, a sharp jump in the price of gold itself.

Read here: read.ht

Read here: read.ht

#MintPlainFacts | Although banks steadily expanded their gold loan portfolios, NBFCs still account for around 60% of gold loans.

Read here: read.ht

Read here: read.ht

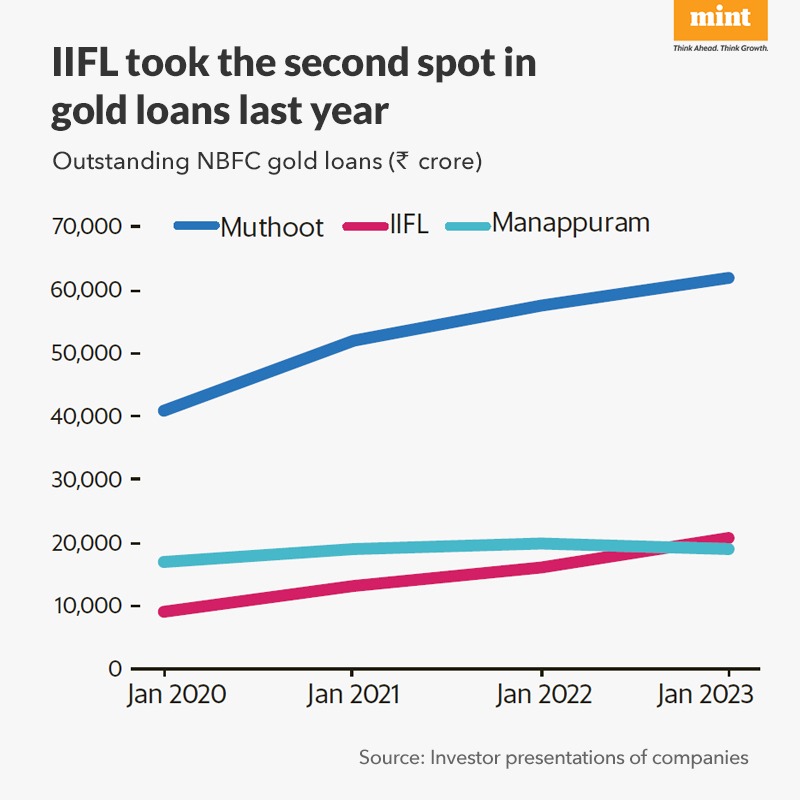

#MintPlainFacts | But it did cause the regulator to sit up and take notice. Between them, the top three gold loan companies—Muthoot, IIFL and Manappuram—account for close to three-quarters of the gold loans given by NBFCs that were outstanding as of March 2023

Read here: read.ht

Read here: read.ht

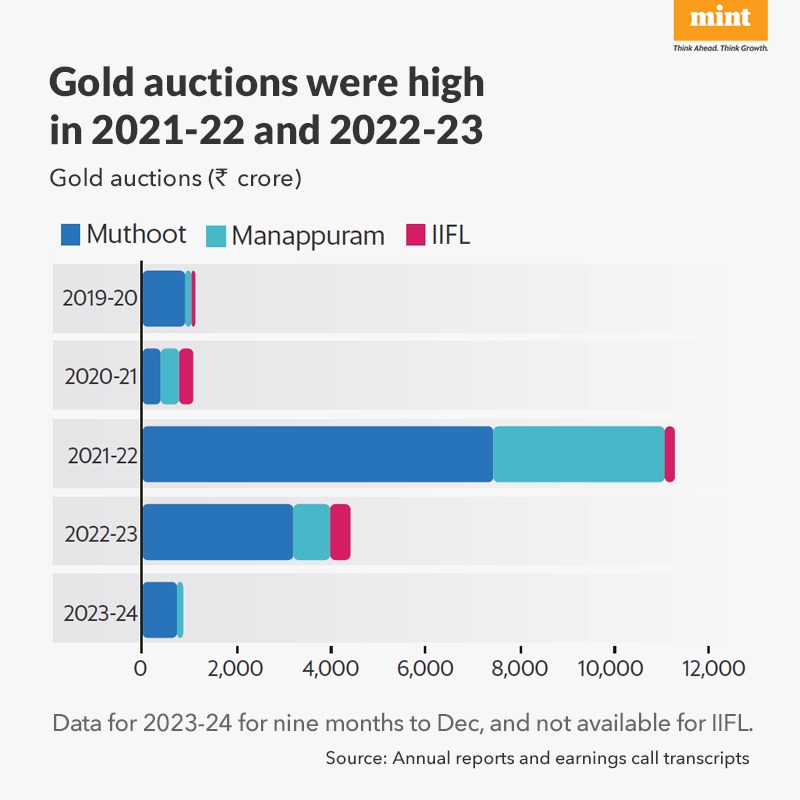

#MintPlainFacts | The sentimental value attached to gold in Indian society makes defaulting on gold loans rare. A rise in default rates is sign of distress among borrowers.

Read here: read.ht

Read here: read.ht

Loading suggestions...