#Zomato Flips the Script: From Losses to Long-Term Growth Outlook

Here are 8 Reasons why zomato is a #stocktowatch

1⃣Food: How big can it be?

2⃣QC: How big can it be?

3⃣Competitor Threats

4⃣Why #Hyperpure and #Goingout ?

5⃣Are the ‘rich valuations’ justified?

6⃣Triggers for the stock

7⃣Risk-reward skew

8⃣Our Valuation

❤️and🔁this post if you found this insightful!

Here are 8 Reasons why zomato is a #stocktowatch

1⃣Food: How big can it be?

2⃣QC: How big can it be?

3⃣Competitor Threats

4⃣Why #Hyperpure and #Goingout ?

5⃣Are the ‘rich valuations’ justified?

6⃣Triggers for the stock

7⃣Risk-reward skew

8⃣Our Valuation

❤️and🔁this post if you found this insightful!

1⃣Food: How big can it be?

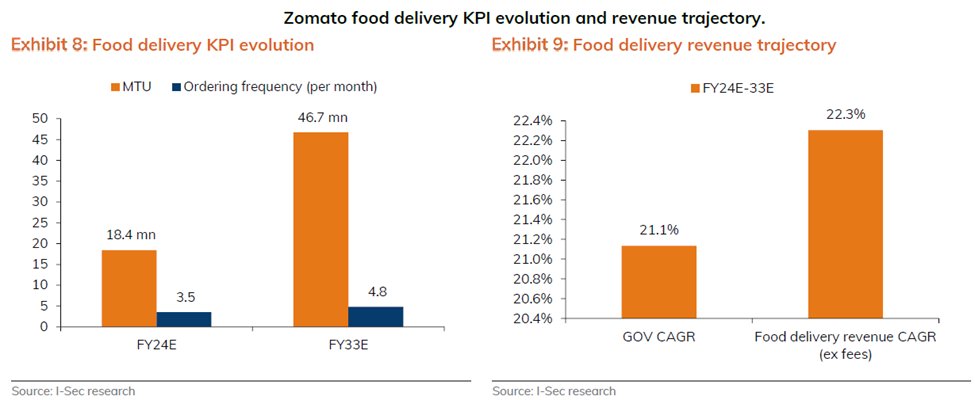

🔸Food delivery market can grow at CAGR>20%YoY to reach USD40bn in FY33E (FY24E ~USD7bn). 🔸#Zomato food business GOV can grow >20%YoY till FY33E even if there is no material gain in market share.

🔸Food delivery EBITDA margin should stabilize at around 6% of GOV.

🔸Ad-revenues should continue to drive up food delivery take rates over the medium term, before it stabilizes at around 21%.

🔸This should drive up contribution margin to 8.5%. Post that, EBITDA margin expansion would be driven by scale benefits as corporate overheads would grow slower than revenues.

🔸Food delivery market can grow at CAGR>20%YoY to reach USD40bn in FY33E (FY24E ~USD7bn). 🔸#Zomato food business GOV can grow >20%YoY till FY33E even if there is no material gain in market share.

🔸Food delivery EBITDA margin should stabilize at around 6% of GOV.

🔸Ad-revenues should continue to drive up food delivery take rates over the medium term, before it stabilizes at around 21%.

🔸This should drive up contribution margin to 8.5%. Post that, EBITDA margin expansion would be driven by scale benefits as corporate overheads would grow slower than revenues.

2⃣QC: How big can it be?

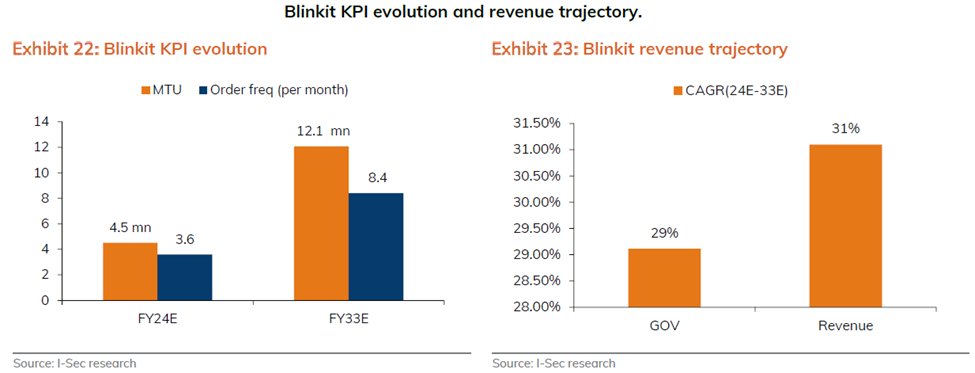

🔸#Quickcommerce market can grow at CAGR>29%YoY to reach USD36bn in FY33E (FY24E ~USD3.6bn).

🔸#Blinkit GOV can grow >29%YoY till FY33E despite no material gain in market share.

🔸EBITDA margin for Blinkit should stabilise at around 4.8% of GOV.

🔸We note a higher headroom for take rate improvement in this business given two drivers: i.e.

👉ad-revenue growth

👉mix improvement,

🔸#Quickcommerce market can grow at CAGR>29%YoY to reach USD36bn in FY33E (FY24E ~USD3.6bn).

🔸#Blinkit GOV can grow >29%YoY till FY33E despite no material gain in market share.

🔸EBITDA margin for Blinkit should stabilise at around 4.8% of GOV.

🔸We note a higher headroom for take rate improvement in this business given two drivers: i.e.

👉ad-revenue growth

👉mix improvement,

3⃣Competitor Threats

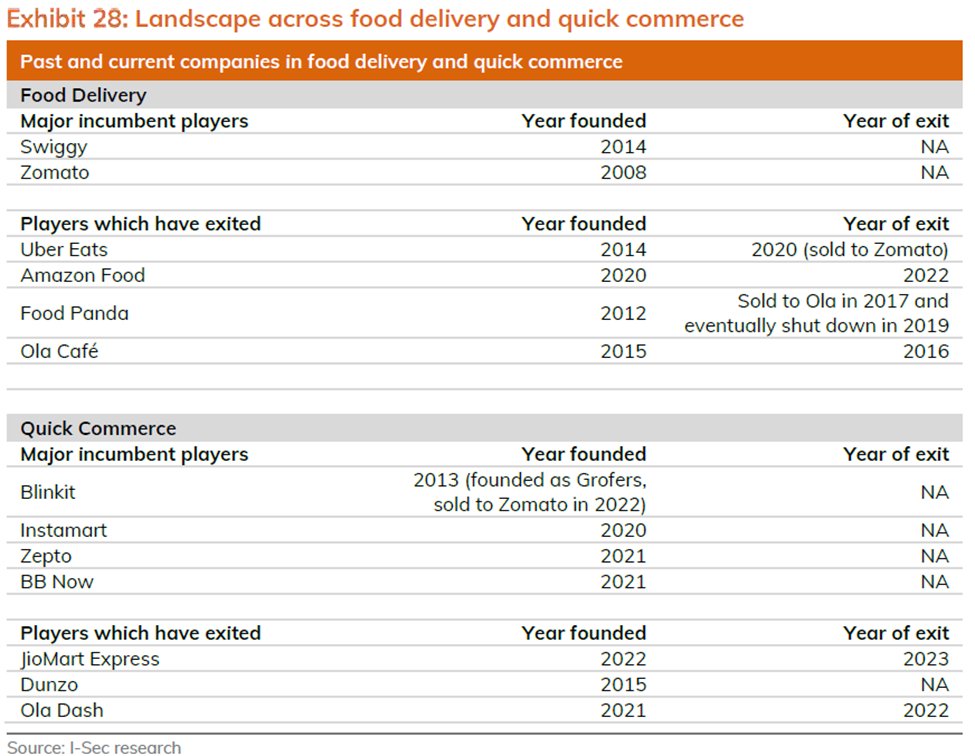

🔸Food delivery is now reasonably established as a ‘duopoly of scale’ given multiple attempts to disrupt the food delivery business have already fizzled out.

🔸A case could be made for a new entrant into #quickcommerce, given the localized nature of the business and the relative success of #Zepto.

🔸Zepto’s playbook will be difficult for large companies to replicate as evidenced by multiple exits from the space.

🔸Food delivery is now reasonably established as a ‘duopoly of scale’ given multiple attempts to disrupt the food delivery business have already fizzled out.

🔸A case could be made for a new entrant into #quickcommerce, given the localized nature of the business and the relative success of #Zepto.

🔸Zepto’s playbook will be difficult for large companies to replicate as evidenced by multiple exits from the space.

4⃣Why #Hyperpure and #Goingout ?

🔸#Hyperpure has scaled rapidly but it is unlikely to be comparable to food delivery or quick commerce in the foreseeable future.

🔸Hyperpure is a strategic initiative to deepen their relationship with restaurants.

🔸These services are specially appreciated by restaurants who compete with the large QSR chains (pizza, burger etc).

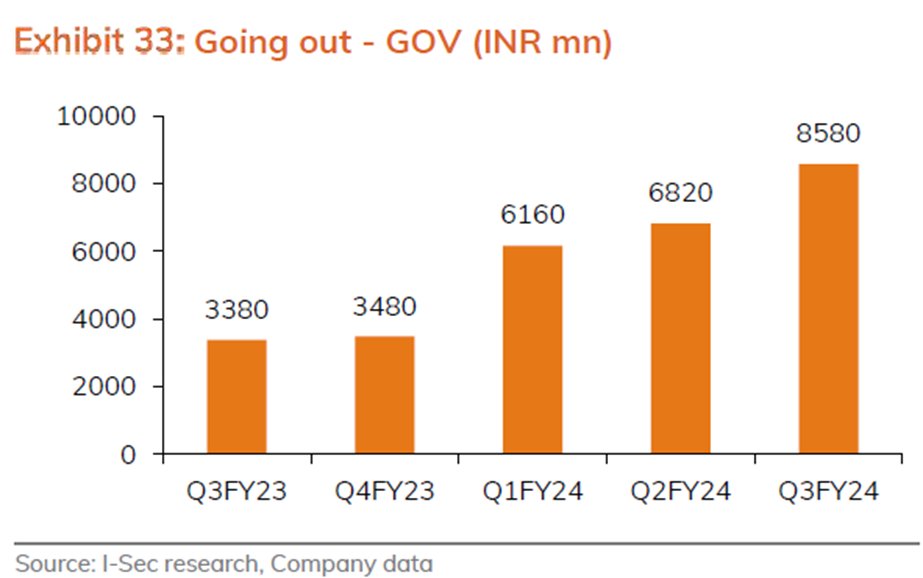

🔸The ‘going out’ business is being developed to create a more holistic offering to ‘dining out’ clients and to increase wallet share from existing customers. 🔸However, scalability is likely to take time in our view.

🔸#Hyperpure has scaled rapidly but it is unlikely to be comparable to food delivery or quick commerce in the foreseeable future.

🔸Hyperpure is a strategic initiative to deepen their relationship with restaurants.

🔸These services are specially appreciated by restaurants who compete with the large QSR chains (pizza, burger etc).

🔸The ‘going out’ business is being developed to create a more holistic offering to ‘dining out’ clients and to increase wallet share from existing customers. 🔸However, scalability is likely to take time in our view.

5⃣Are the ‘rich valuations’ justified?

🔸#Zomato is trading at a premium to global peers, which is justified given the higher revenue and EBITDA CAGRs.

🔸Zomato stock movement is in line with that of #Doordash over the last 6 month period, which indicates improving investor sentiment towards consumer tech stocks globally.

🔸Even at our target price of INR300, we value the food delivery business at 60x 1yr fwd EV/EBITDA and Blinkit at 85x 1 yr fwd EV/EBITDA.

🔸These multiples, though elevated have in the past sustained for fast growing consumer franchises in #India.

🔸#Zomato is trading at a premium to global peers, which is justified given the higher revenue and EBITDA CAGRs.

🔸Zomato stock movement is in line with that of #Doordash over the last 6 month period, which indicates improving investor sentiment towards consumer tech stocks globally.

🔸Even at our target price of INR300, we value the food delivery business at 60x 1yr fwd EV/EBITDA and Blinkit at 85x 1 yr fwd EV/EBITDA.

🔸These multiples, though elevated have in the past sustained for fast growing consumer franchises in #India.

6⃣Triggers for the stock

🔸Food delivery adj. EBITDA margin crossing 4% of GOV watermark (3-4 months)

🔸Market share gains in food delivery in Hindi heartland states given the ‘veg only’ delivery fleet (3-4 months),

🔸#Quickcommerce turning profitable at the adj EBITDA level (3-6 months)

🔸#Fed rate cuts which could trigger large #FII inflows into the stock (6-12 months).

🔸Food delivery adj. EBITDA margin crossing 4% of GOV watermark (3-4 months)

🔸Market share gains in food delivery in Hindi heartland states given the ‘veg only’ delivery fleet (3-4 months),

🔸#Quickcommerce turning profitable at the adj EBITDA level (3-6 months)

🔸#Fed rate cuts which could trigger large #FII inflows into the stock (6-12 months).

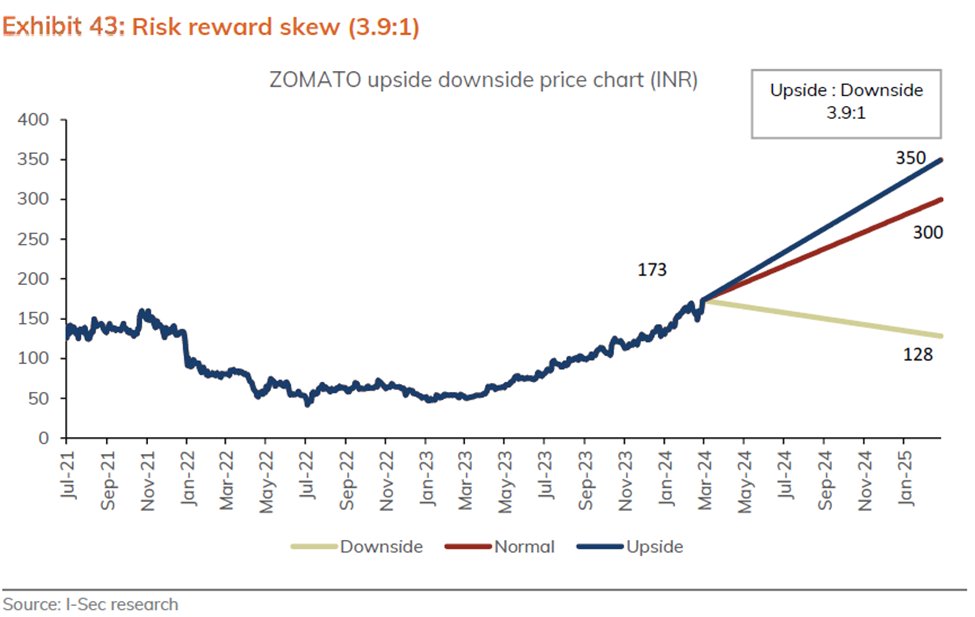

7⃣Risk-reward skew

🔸Despite the recent #rally in the share price, we think that the risk reward skew remains compelling for 🔸#Zomato, given the strong improvement in underlying metrics over the period.

🔸We see the stock trading at INR350 per share in our bull-case scenario and INR128 in our bear-case, implying a risk reward skew of 3.9:1 to the upside.

🔸Despite the recent #rally in the share price, we think that the risk reward skew remains compelling for 🔸#Zomato, given the strong improvement in underlying metrics over the period.

🔸We see the stock trading at INR350 per share in our bull-case scenario and INR128 in our bear-case, implying a risk reward skew of 3.9:1 to the upside.

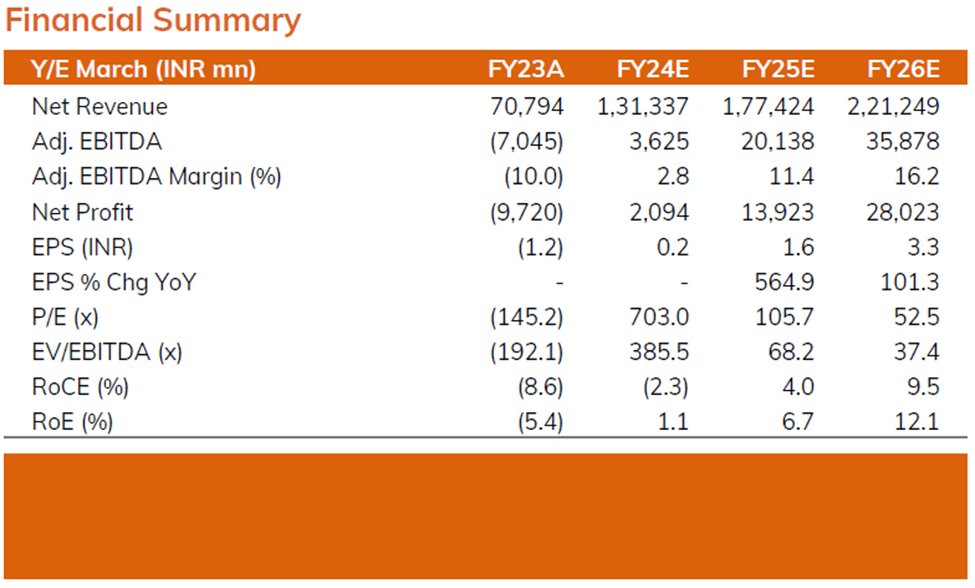

8⃣Our Valuation

🔸We re-iterate our #BUY rating on #Zomato and increase our 3-stage DCF-based target price to INR 300 from INR 182 as we significantly increase our long term explicit forecasts, given the improved visibility on sustained growth trajectory and sustained improvement in profitability metrics.

🔸Zomato remains our top pick in the Indian internet space. We have also reduced our WACC to 12% from 12.5% earlier given the drastic reduction in volatility over the last 1 year.

🔸We re-iterate our #BUY rating on #Zomato and increase our 3-stage DCF-based target price to INR 300 from INR 182 as we significantly increase our long term explicit forecasts, given the improved visibility on sustained growth trajectory and sustained improvement in profitability metrics.

🔸Zomato remains our top pick in the Indian internet space. We have also reduced our WACC to 12% from 12.5% earlier given the drastic reduction in volatility over the last 1 year.

🚨Key risks

🔸Slowdown in discretionary spending

🔸Negative externalities disrupting business operations.

🔸Slowdown in discretionary spending

🔸Negative externalities disrupting business operations.

Loading suggestions...