In this Detailed Thread 🧵 we'll look to analyse a SMALLCAP Company 'RUSHIL DECOR LTD 🛋️' Each and every neeche details about this company will be covered in this thread from its Business, to its fundamentals, to its product mix, to its financials, to its

#RushilDecor

#RushilDecor

Signor.

💫It has a portfolio of 500+ designs and 50+ textures and finishes under this segment.

💫It has a network of ~50 distributors and ~2,000 dealers across India.

☑️PVC BOARDS SEGMENT (2% of Revenues)

💫The company entered into the production of PVC Boards through its

💫It has a portfolio of 500+ designs and 50+ textures and finishes under this segment.

💫It has a network of ~50 distributors and ~2,000 dealers across India.

☑️PVC BOARDS SEGMENT (2% of Revenues)

💫The company entered into the production of PVC Boards through its

facility which started operations in 2018.

💫It operates through its existing distribution channels of its laminates segment.

☑️MANUFACTURING CAPABILITIES

💫Presently, the company owns 6 manufacturing facilities across Gujarat, Karnataka and Andhra Pradesh.

💫It operates through its existing distribution channels of its laminates segment.

☑️MANUFACTURING CAPABILITIES

💫Presently, the company owns 6 manufacturing facilities across Gujarat, Karnataka and Andhra Pradesh.

Its capacities are:-

✔️Laminates:- 35 lakhs sheets P.a.

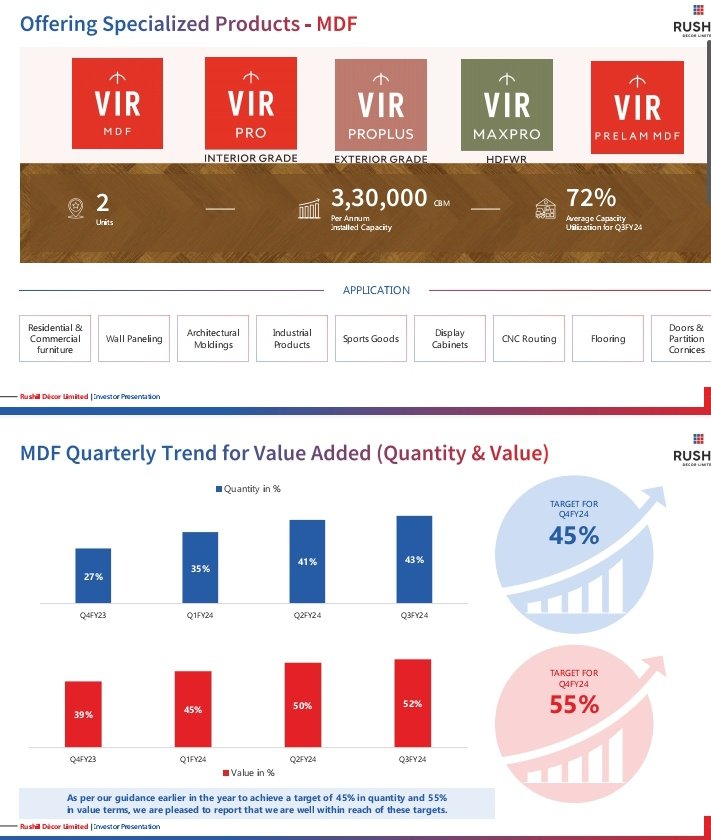

✔️MDF Boards:- 1100 CBM Per Day

✔️PVC:- 5760 TPA

☑️Recent Expansion

💫The company undertook major expansion plan to build a new manufacturing unit for thin & thick MDF Boards in Andhra Pradesh with a capacity of 800 CBM

✔️Laminates:- 35 lakhs sheets P.a.

✔️MDF Boards:- 1100 CBM Per Day

✔️PVC:- 5760 TPA

☑️Recent Expansion

💫The company undertook major expansion plan to build a new manufacturing unit for thin & thick MDF Boards in Andhra Pradesh with a capacity of 800 CBM

Per day.

💫The total cost of the project was Rs 341 Crores which was funded through a debt of Rs 280 Crores and equity infusion of Rs 40 Crores through internal accurals.

💫The unit started regular commercial production from March 2021.

💫The total cost of the project was Rs 341 Crores which was funded through a debt of Rs 280 Crores and equity infusion of Rs 40 Crores through internal accurals.

💫The unit started regular commercial production from March 2021.

Fundamental Analysis♎⚖️

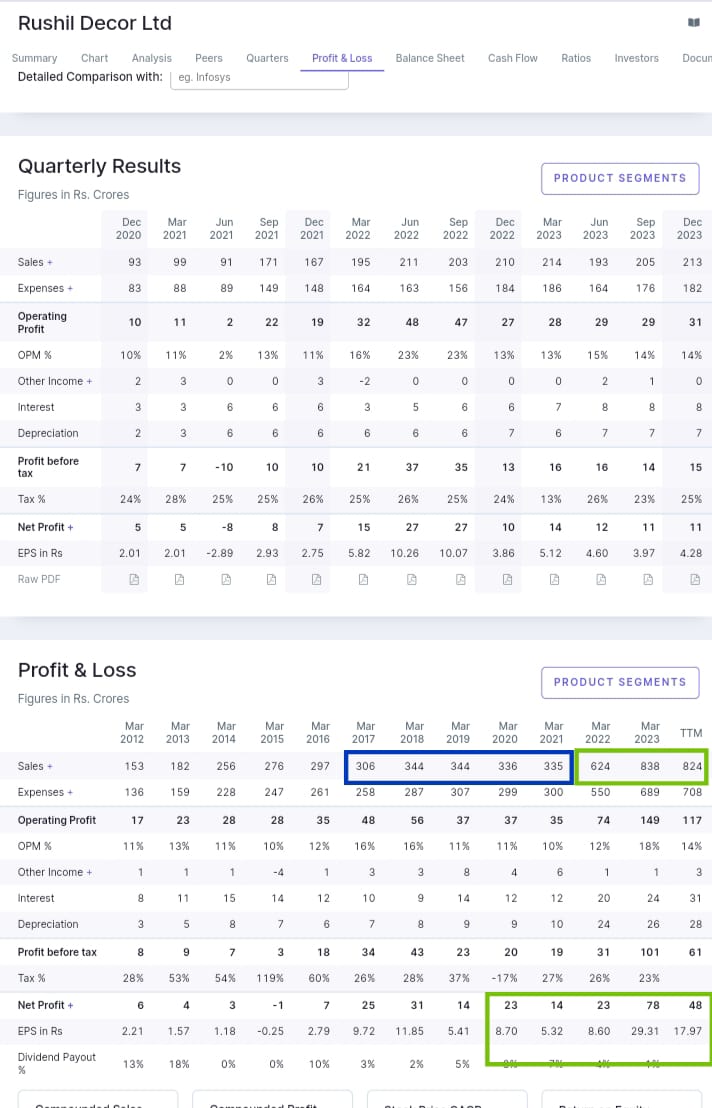

✅Market Capitalisation:- Rs 779 Cr(Smallcap)

✅Stock PE:- 16.3(Undervalued)

✅Industry PE:- 28.6

✅Book Value:- Rs 185

✅Dividend Yield:- 0.17%

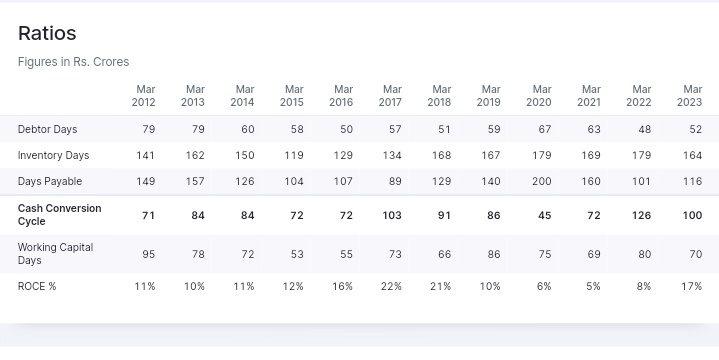

✅ROCE:- 16.9%

✅ROE:- 23.9%

✅Face Value:- 10

✅Intrinsic Value:- Rs 173

✅Graham No:- Rs 274

✅Market Capitalisation:- Rs 779 Cr(Smallcap)

✅Stock PE:- 16.3(Undervalued)

✅Industry PE:- 28.6

✅Book Value:- Rs 185

✅Dividend Yield:- 0.17%

✅ROCE:- 16.9%

✅ROE:- 23.9%

✅Face Value:- 10

✅Intrinsic Value:- Rs 173

✅Graham No:- Rs 274

✔️A new leg of Rally 💹 will begin in RUSHIL DECOR above Rs 400+ CBS the next Resistance is placed at Rs 560 above Rs 600 RUSHIL DECOR has the potential to March till its 2017 ATH of Rs 927+

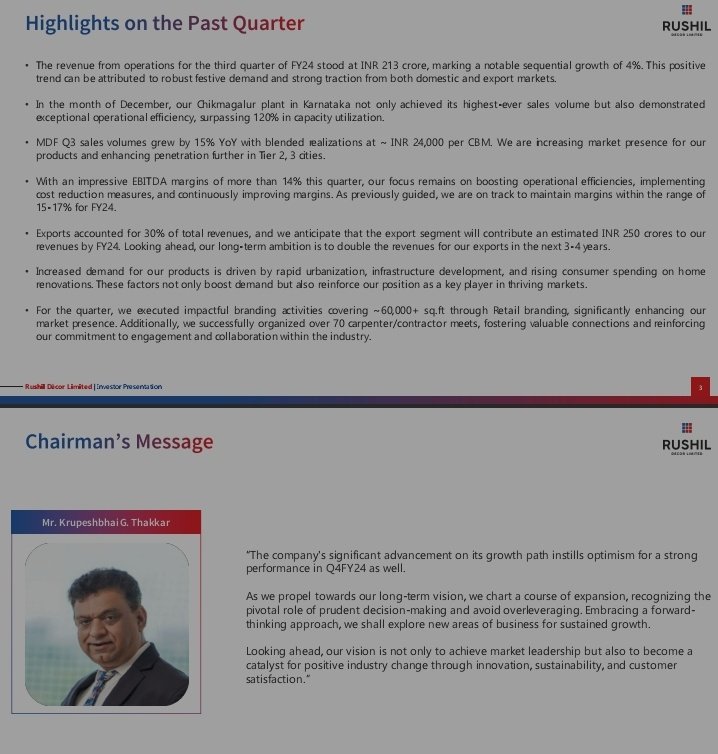

(Presumably Assuming that Q3 Operating Profits to be a repeat of Q3FY24) RUSHIL has the potential 💎💎 to do Rs 120 Cr Operating Profits in FY24

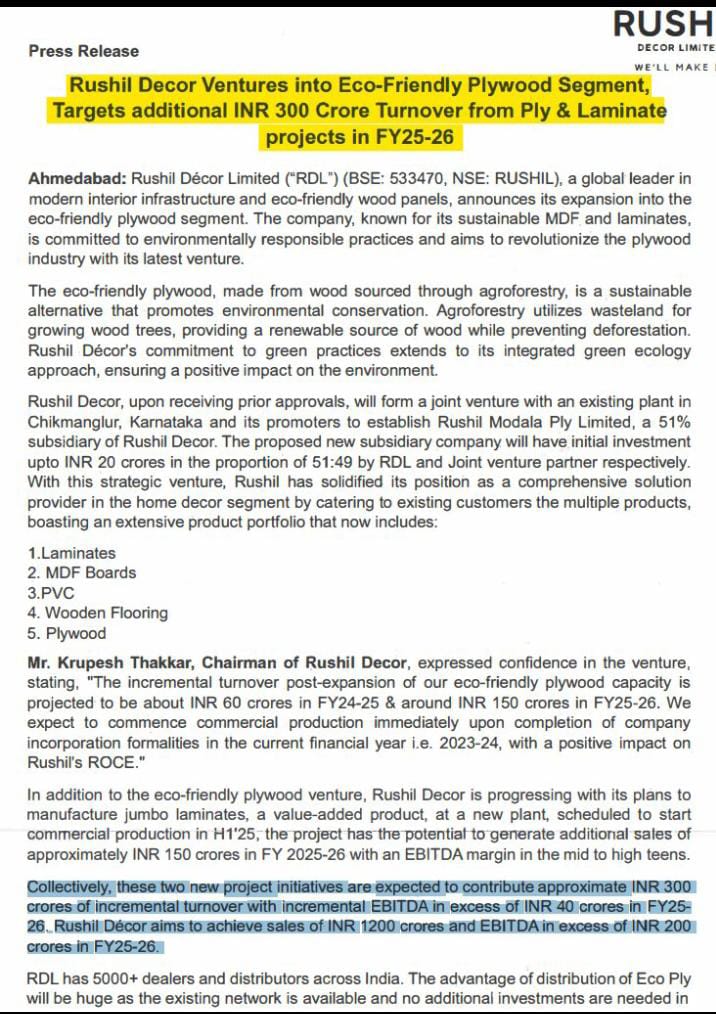

✔️As per Management guidance as per the recent filling to the Regulatory body. RUSHIL DECOR has ventured into Eco-friendly Plyboard

✔️As per Management guidance as per the recent filling to the Regulatory body. RUSHIL DECOR has ventured into Eco-friendly Plyboard

then it means that its Sales will increase by about 45% 💹 and its Operating Profits will increase by about 66% 💹 from the FY24 levels

✔️After achievement of Desired Sales and Operating Profits and reducing all the Interests, Depreciation and Taxes; RUSHIL DECOR future

✔️After achievement of Desired Sales and Operating Profits and reducing all the Interests, Depreciation and Taxes; RUSHIL DECOR future

Expected EPS will be around 40+(This is just an illustrative figure derived as per the past performance and management guidance)

✔️Rushil Decor as per the next 2 Years Earnings growth is available at just 7.35 PE Ratio this makes Rushil Decor very cheap as its current Industry

✔️Rushil Decor as per the next 2 Years Earnings growth is available at just 7.35 PE Ratio this makes Rushil Decor very cheap as its current Industry

✔️In FY23, Rushil Decor witnessed a Sales of Rs 838 Cr it means its Sales increased by about 34.40% on YOY Basis.

✔️If the company achieves Rs 1200 Cr Sales and Operating Profits in FY26 then it will be RUSHIL highest ever Sales and Operating Profits in the Business History.

✔️If the company achieves Rs 1200 Cr Sales and Operating Profits in FY26 then it will be RUSHIL highest ever Sales and Operating Profits in the Business History.

✔️Rushil Decor ATH came in FY17 When its Sales was only at Rs 306 Cr and Operating Profits was only at Rs 48 Cr

✔️At its ATH market rewarded it with 95 PE Ratio if Rushil acheives Rs 1200 Cr Revenue and Rs 200 Cr Operating Profits then its Sales will increase by about

✔️At its ATH market rewarded it with 95 PE Ratio if Rushil acheives Rs 1200 Cr Revenue and Rs 200 Cr Operating Profits then its Sales will increase by about

Expecting its EPS to be at 40 what will be the expected share price. Calculate it on your own self.

40 (EPS) * 25 PE Ratio= ??

40 (EPS) * 25 PE Ratio= ??

Try to Retweet ♻️ this thread 🧵 so that it reaches more market participants as this company is very unknown. This thread took about 5 Hours time to be made to try to Retweet it so that it motivates me to bring more such Business thread in the future.

Disclaimer : Kindly consult your FA before buying / Selling any shares. This analysis is only for educational purposes and not recommendations.

Don't Buy on the basis of this thread 🧵 if you make profits you gonna not share with me likewise I'll not be responsible for loss too.

Don't Buy on the basis of this thread 🧵 if you make profits you gonna not share with me likewise I'll not be responsible for loss too.

Loading suggestions...