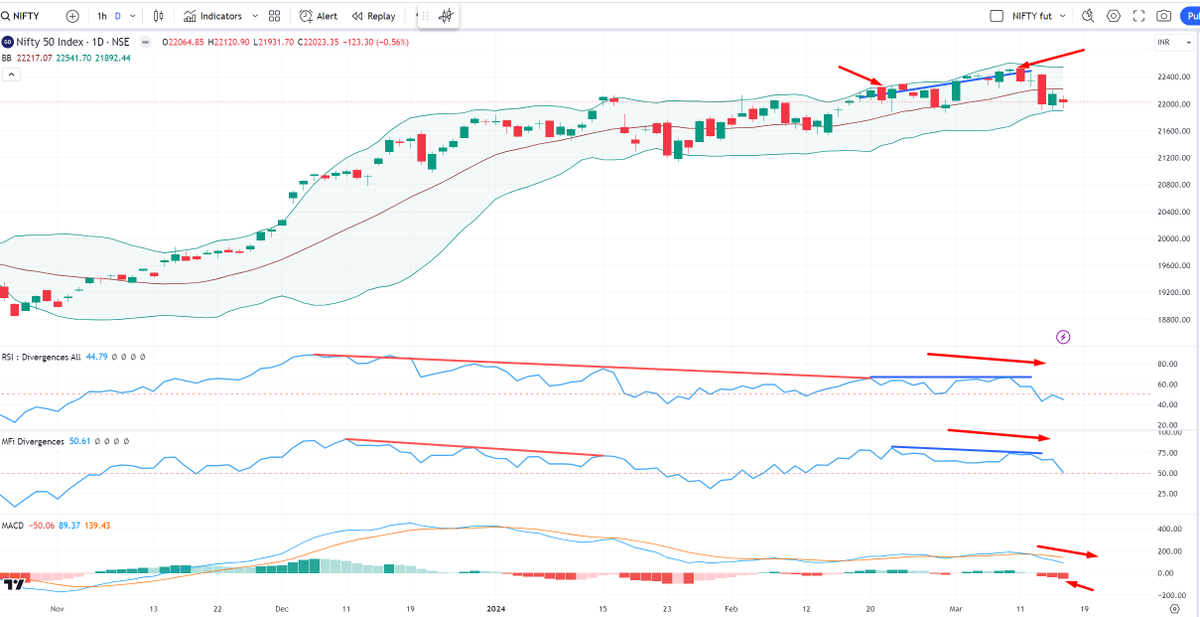

Positional analysis on Nifty. These are just pointers from charts and indicators which should be kept in mind for the rest of this March expiry

Typo. Read 22200-22300 as resistance

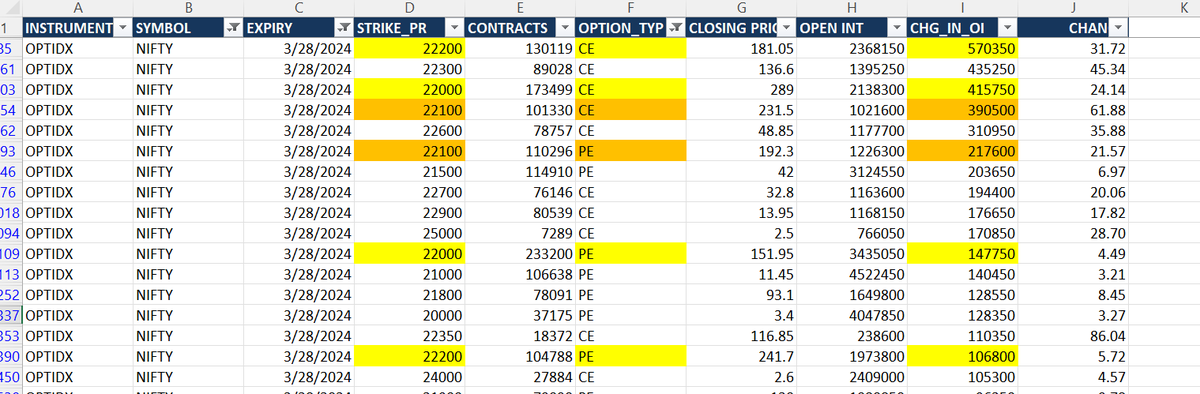

On Nifty monthly chain. 22000-22300 strikes saw OI buildup where calls sold outnumbers puts sold on this strike by a large margin, so strong bearish pressure from this zone.

22000pe now has the highest OI on the PE side on monthly strikes.

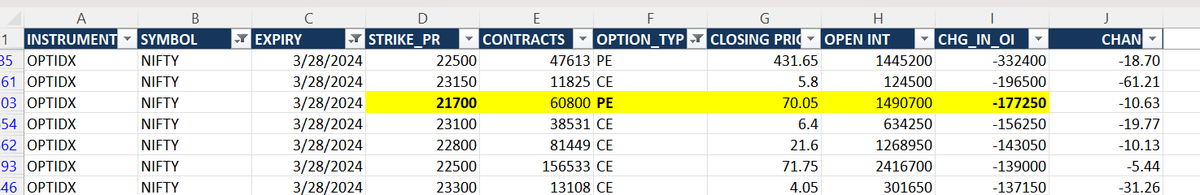

What strikes is the liquidation of the 21700pe, that's the unusual action

22000pe now has the highest OI on the PE side on monthly strikes.

What strikes is the liquidation of the 21700pe, that's the unusual action

Loading suggestions...