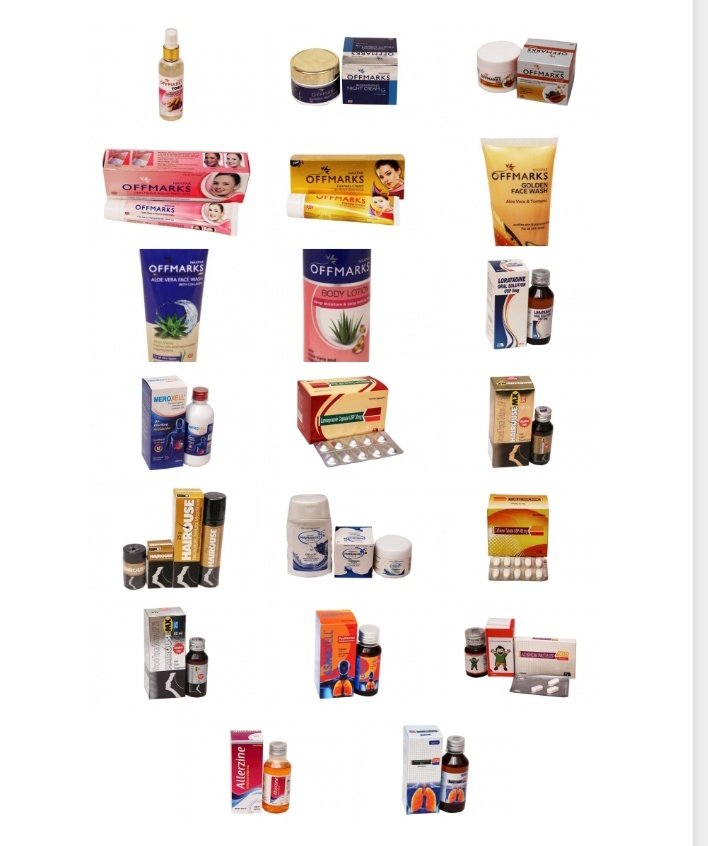

In this Detailed Thread 🧵 we'll look to analyse a Microcap Company 'PARNAX LAB LTD 🧪' Each and every neeche details about this company will be covered in this thread from its Business, to its fundamentals, to its product mix, to its financials, to its

#ParnaxLab

#ParnaxLab

☑️International Presence:-

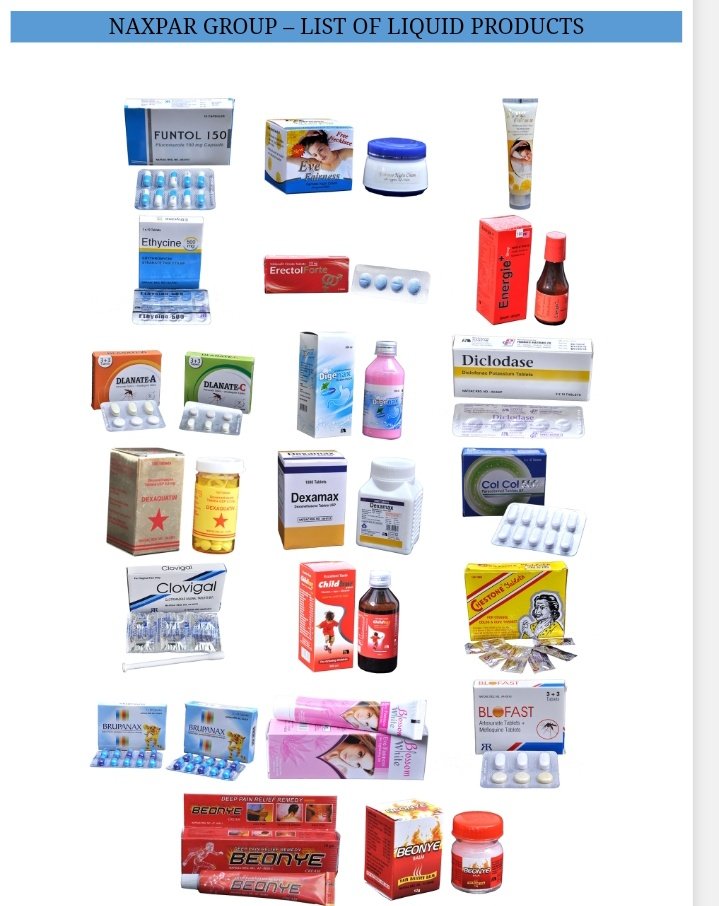

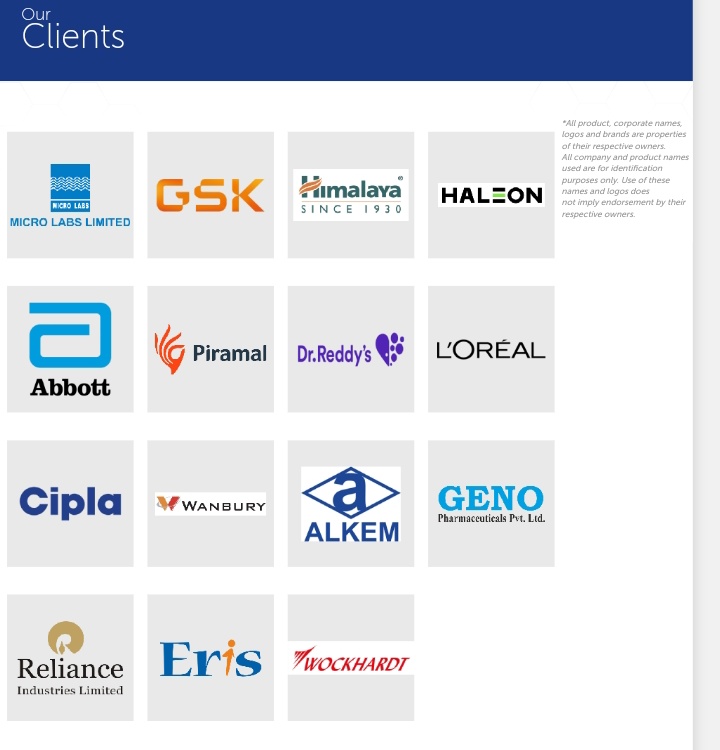

💫Company manufactures finished formulations for multinationals in India and in emerging pharmaceutical markets such as Nigeria, Kazakhstan, Kenya, Mauritius and is planning to venture into markets of South East Asia, CIS, LatAm, etc.

💫Company manufactures finished formulations for multinationals in India and in emerging pharmaceutical markets such as Nigeria, Kazakhstan, Kenya, Mauritius and is planning to venture into markets of South East Asia, CIS, LatAm, etc.

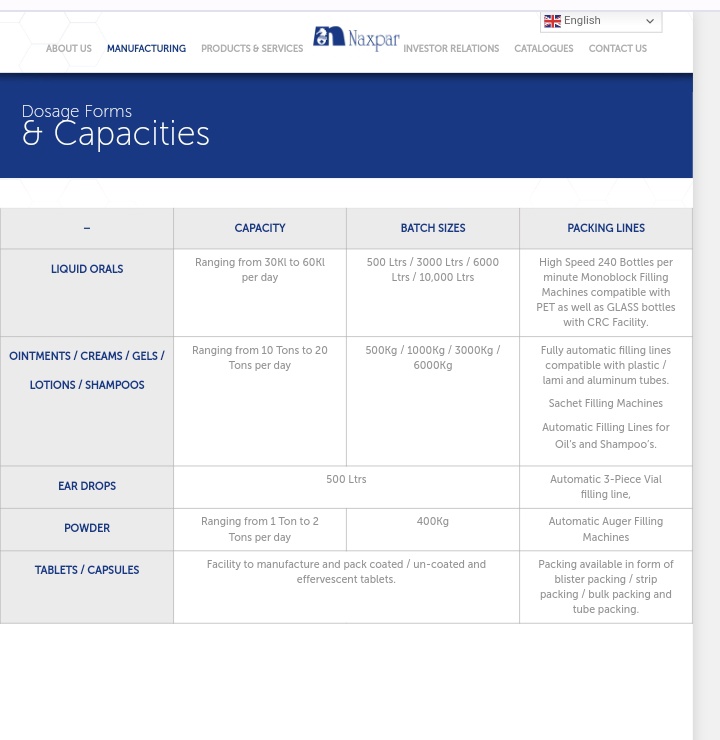

c) Ear Drops ~500 Ltrs

d) Powder ~1 Ton to 2 Tons per day

☑️Revenue Breakup - FY22:

Sale of Goods ~73%,

Sale of Services - Labour Charges ~ 27%

d) Powder ~1 Ton to 2 Tons per day

☑️Revenue Breakup - FY22:

Sale of Goods ~73%,

Sale of Services - Labour Charges ~ 27%

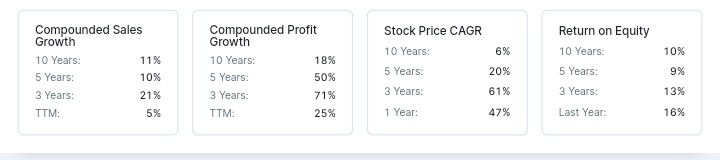

Fundamental Analysis♎⚖️

✅Market Capitalisation:- Rs 105 Cr(Microcap)

✅Stock PE:- 11.9(Undervalued)

✅Industry PE:- 30.7

✅Book Value:- Rs 58.6

✅Dividend Yield:- 0%

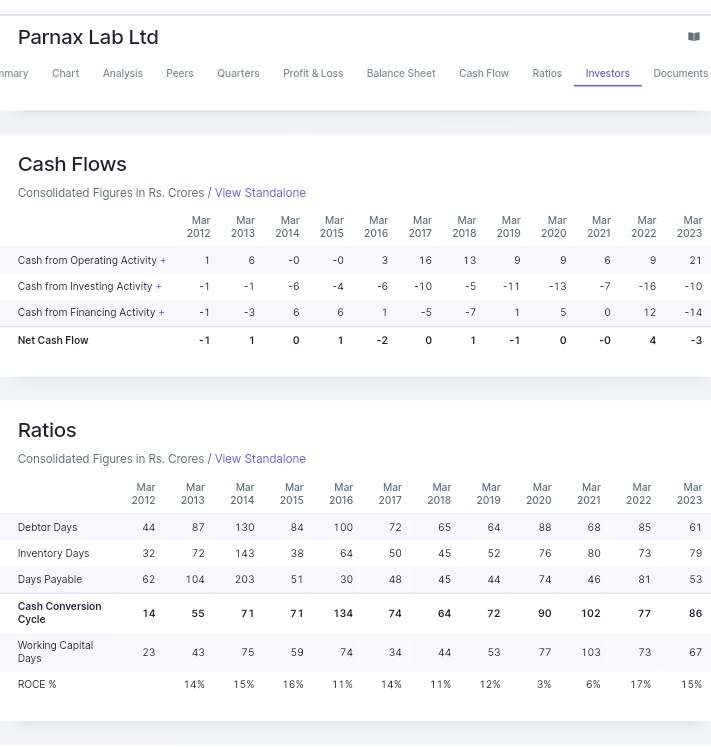

✅ROCE:- 14.8%

✅ROE:- 15.9%

✅Face Value:- 10

✅Intrinsic Value:- Rs 68.5

✅Graham No:- Rs 101

✅Market Capitalisation:- Rs 105 Cr(Microcap)

✅Stock PE:- 11.9(Undervalued)

✅Industry PE:- 30.7

✅Book Value:- Rs 58.6

✅Dividend Yield:- 0%

✅ROCE:- 14.8%

✅ROE:- 15.9%

✅Face Value:- 10

✅Intrinsic Value:- Rs 68.5

✅Graham No:- Rs 101

in Parnax above Rs 110+ CBS

✅21 Months old Breakout is possible in Parnax Lab above Rs 117+ CBS

✅Above Rs 117 CBS it will go into an uncharted territory and face the next resistance at Rs 170+

✅The ATH(All time Highs) of the Parnax is placed at Rs 190(ATH came in Nov-2011)

✅21 Months old Breakout is possible in Parnax Lab above Rs 117+ CBS

✅Above Rs 117 CBS it will go into an uncharted territory and face the next resistance at Rs 170+

✅The ATH(All time Highs) of the Parnax is placed at Rs 190(ATH came in Nov-2011)

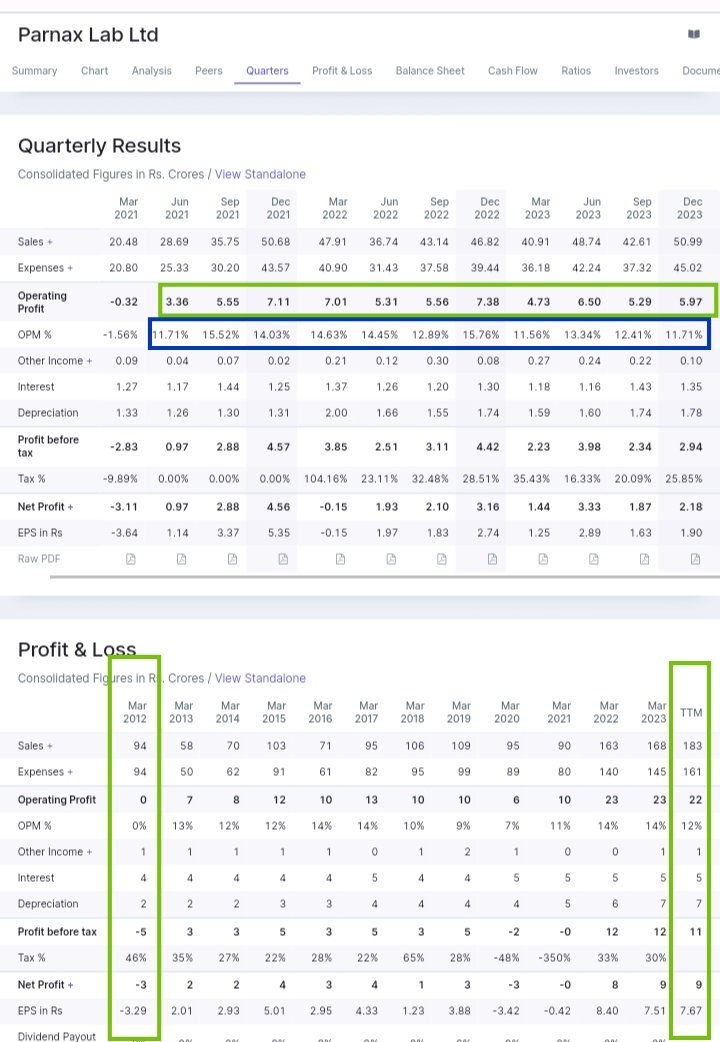

✅If Parnax Lab sees a Sales of Rs 190+ Cr in FY24 then this will be its highest ever Sales in its Business History

✅Parnax Lab Operating Profits of FY24(Presumably Assuming that Q4 Operating Profits will be a repeat of Q3) Parnax Lab has the potential to do Rs 23.73 Cr

✅Parnax Lab Operating Profits of FY24(Presumably Assuming that Q4 Operating Profits will be a repeat of Q3) Parnax Lab has the potential to do Rs 23.73 Cr

In the Pharmaceutical Industry)

✅Since this is a very small company they do not do any Concall but one thing to note here is that the company has been able to double its Revenue in the past 3 Years

✅In FY21 its Revenue was only at Rs 90 Cr and now in TTM Basis its Revenue is

✅Since this is a very small company they do not do any Concall but one thing to note here is that the company has been able to double its Revenue in the past 3 Years

✅In FY21 its Revenue was only at Rs 90 Cr and now in TTM Basis its Revenue is

Rs 193 Cr

✅If the company maintains the increasing Sales trajectory and acheives a decent OPM% Growth in FY25 Financial Year then its valuations will become much more justified and undervalued

✅At its ATH of Rs 190 Parnax used to do only Rs 94 Cr Sales and its Margins was 0%

✅If the company maintains the increasing Sales trajectory and acheives a decent OPM% Growth in FY25 Financial Year then its valuations will become much more justified and undervalued

✅At its ATH of Rs 190 Parnax used to do only Rs 94 Cr Sales and its Margins was 0%

And its Operating Profits was at Rs 0 Cr

✅Now, it is doing Rs 193 Cr Sales(As per FY24 TTM) and Operating Profits is at Rs 23.74 Cr and Margins is hovering at 12-14%

✅Parnax is currently available at about 52% discounts from the ATH of Rs 190+

✅Now, it is doing Rs 193 Cr Sales(As per FY24 TTM) and Operating Profits is at Rs 23.74 Cr and Margins is hovering at 12-14%

✅Parnax is currently available at about 52% discounts from the ATH of Rs 190+

✅Promoters+ Big Investors are Holding 73.92% Stake or 78 Cr worth Shares. The public are holding 27 Cr worth Shares or 26.08% Stake

✅A Pharma company with Rs 193 Cr sales, Rs 23 Cr operating profits and 12-14% Margin available at just 105 Cr Market Cap is a very fair deal 🤝

✅A Pharma company with Rs 193 Cr sales, Rs 23 Cr operating profits and 12-14% Margin available at just 105 Cr Market Cap is a very fair deal 🤝

Disclaimer : Kindly consult your FA before buying / Selling any shares. This analysis is only for educational purposes and not recommendations.

Don't Buy on the basis of this thread 🧵 if you make profits you gonna not share with me likewise I'll not be responsible for loss too

Don't Buy on the basis of this thread 🧵 if you make profits you gonna not share with me likewise I'll not be responsible for loss too

Try to Retweet ♻️ this thread 🧵 so that it reaches more market participants as this company is very unknown. This thread took about 7 Hours time to be made so try to Retweet it so that it motivates me to bring more such Business thread in the future.

Loading suggestions...