Not all breakout stocks will ever work ❌

A Thread on how to select breakout stocks ! 👍

Do retweet, like and share 💵

A Thread on how to select breakout stocks ! 👍

Do retweet, like and share 💵

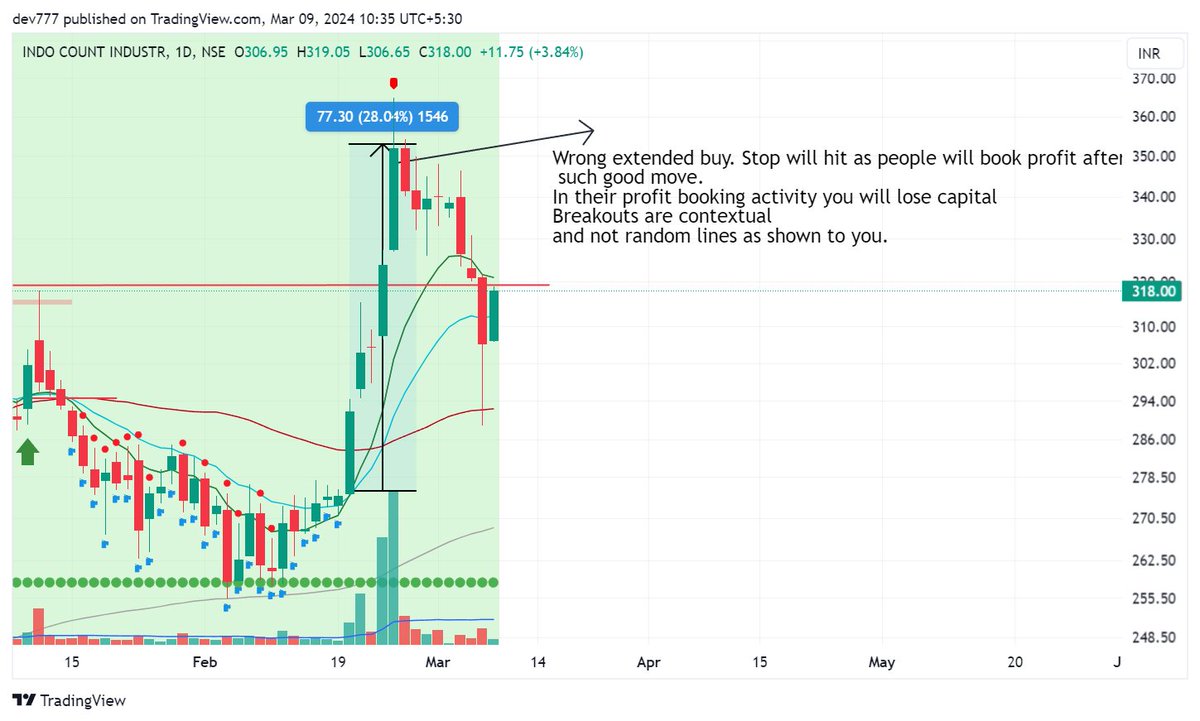

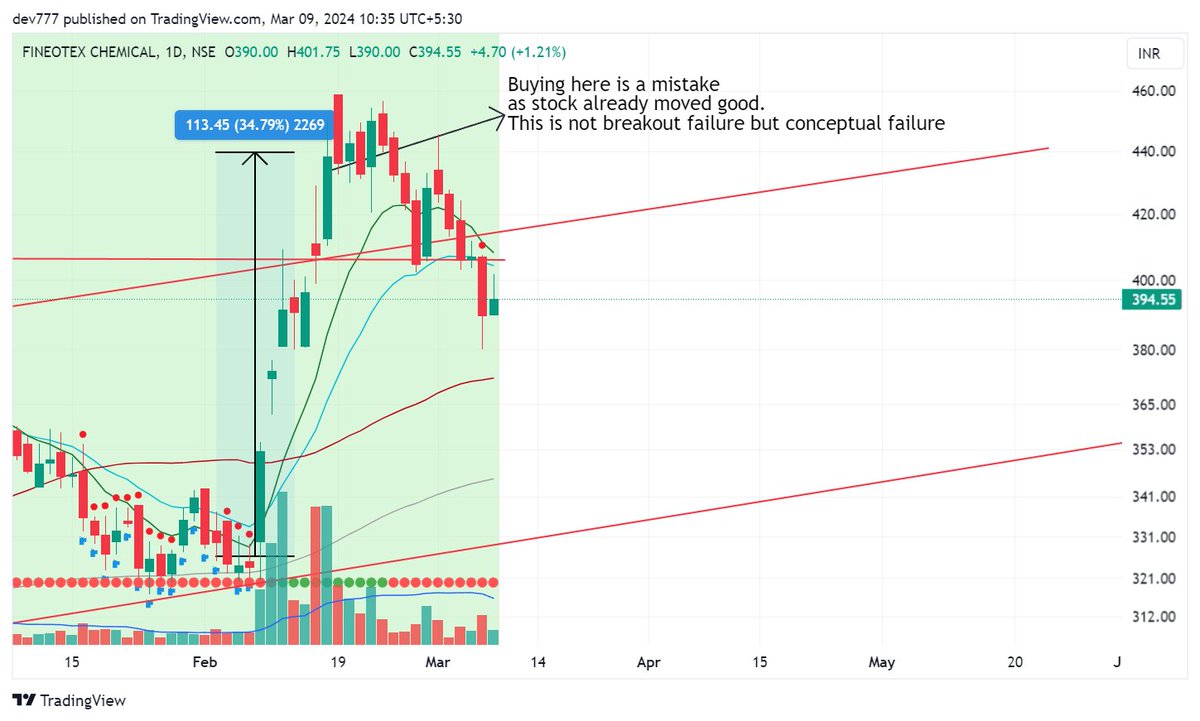

1) One should first understand that when a stock break out your bet is that its moving from a consolidation so randomly drawing and buying every breakout will ruin your money

Consolidation - 5 days, 20 days, 2 days ? Which one ?

(1/n)

Consolidation - 5 days, 20 days, 2 days ? Which one ?

(1/n)

3) Mistakes that people do - Draw up lines and buy. People post 15 breakout stocks daily. If you will track 80% of it will fail as it lacks conceptual understanding but are more focused for likes and gaining followers

The fundamental of breakout is it comes after consolidation so look for it.

Above consolidation period is nothing like sureshot way. We may have outliners . But accuracy will improve and your stock selection too !

The fundamental of breakout is it comes after consolidation so look for it.

Above consolidation period is nothing like sureshot way. We may have outliners . But accuracy will improve and your stock selection too !

Hope these 2 tips will help you improve your accuracy. Always remember breakouts need conceptual clarity to work and not a resistance only to cross. Use it together or you may go wrong too often

Do follow @equialpha and try out above 2 things in your past trades. You will find that mistake common.

Do share and retweet for masses as NOBODY EVER TELL YOU THIS !

Do follow @equialpha and try out above 2 things in your past trades. You will find that mistake common.

Do share and retweet for masses as NOBODY EVER TELL YOU THIS !

Join telegram channel for more analysis and learnings

t.me

t.me

Loading suggestions...