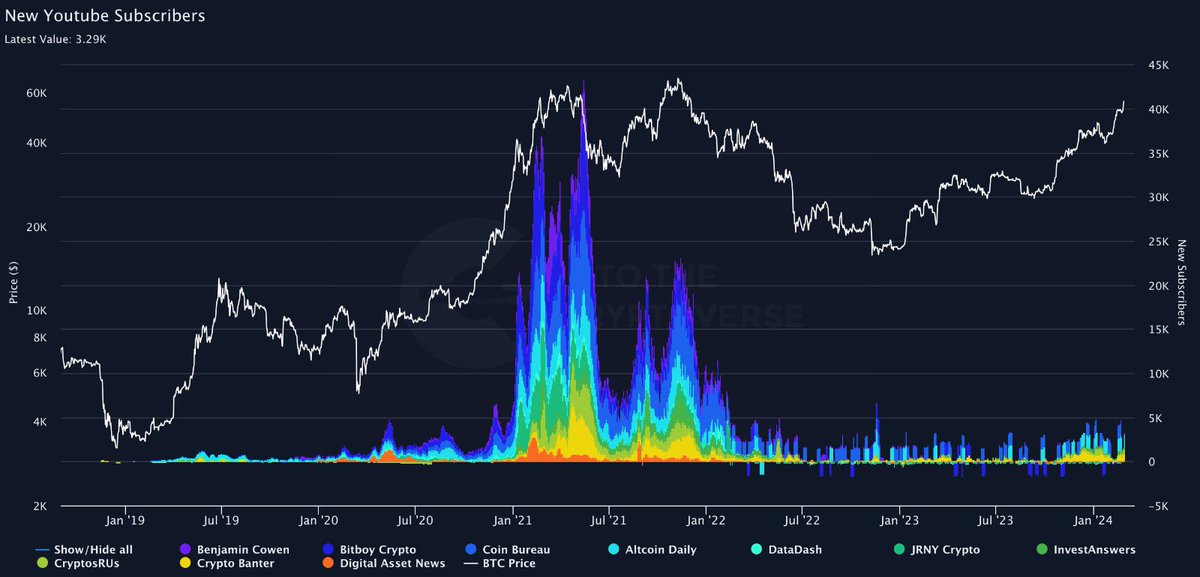

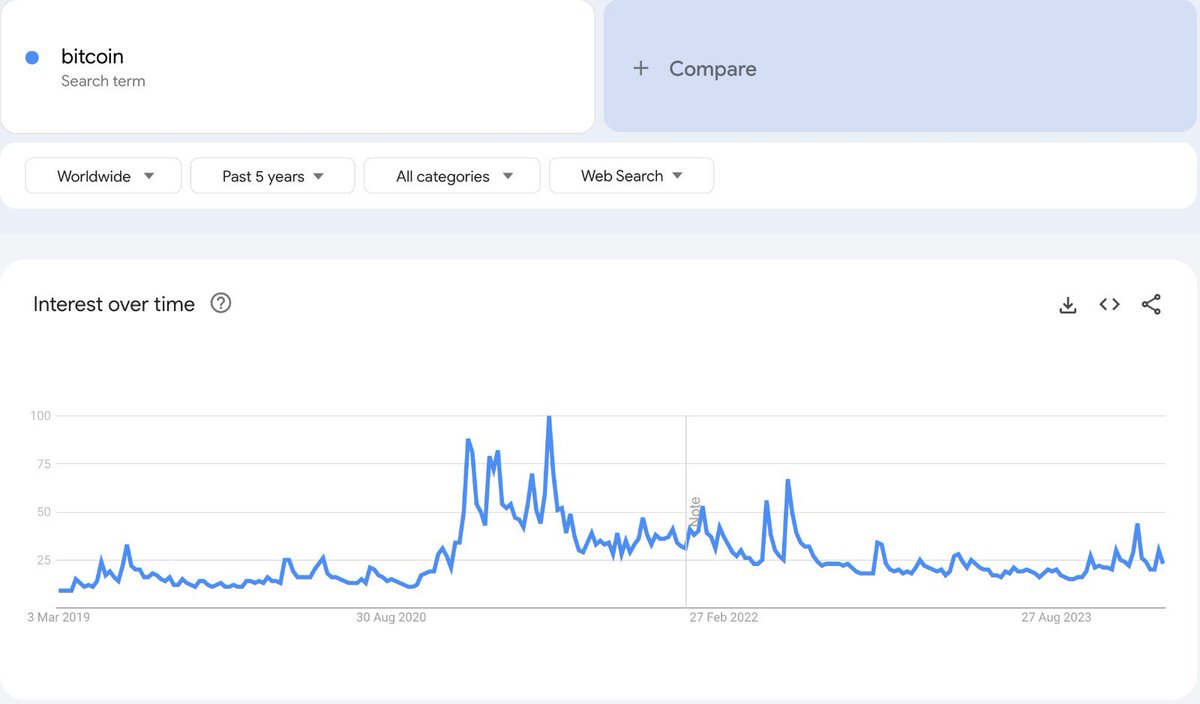

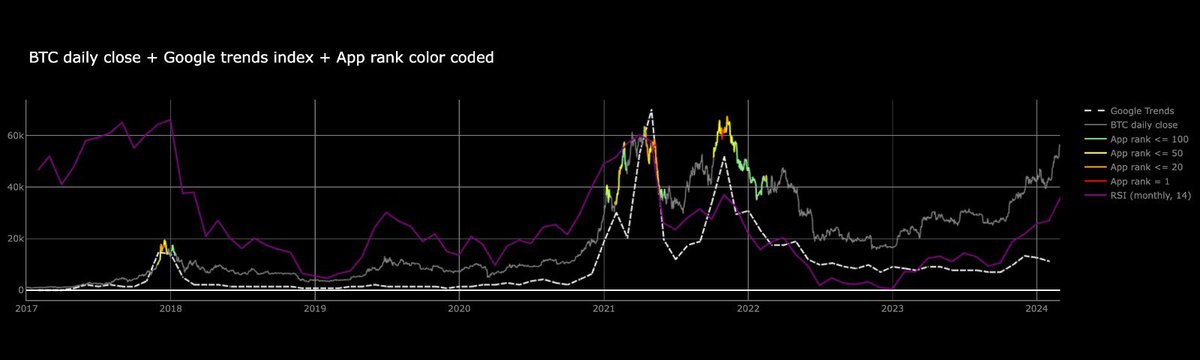

#Bitcoin is approaching All-Time Highs, but the scary part is - retail isn't even back yet.

It may feel like you're late, but in reality you're STILL early.

Want proof? Check out the 5 indicators below. 👇🧵

It may feel like you're late, but in reality you're STILL early.

Want proof? Check out the 5 indicators below. 👇🧵

5. The final point is more anecdotal, but it's a strange feeling that $BTC is almost at new highs, yet:

• Celebrities are nowhere to be seen (in 2021 everyone and their dog was posting)

• There's much less public advertising

• Friends/family aren't texting nonstop

• Celebrities are nowhere to be seen (in 2021 everyone and their dog was posting)

• There's much less public advertising

• Friends/family aren't texting nonstop

As you can see, there is still a lot to be excited about.

It may not feel like it, but we are truly here "before the masses".

If you enjoyed this post, follow me @milesdeutscher for more crypto guides, analysis, opportunities & more.

It may not feel like it, but we are truly here "before the masses".

If you enjoyed this post, follow me @milesdeutscher for more crypto guides, analysis, opportunities & more.

Loading suggestions...