Several Indian states have claimed that they have not been receiving their fair share as per the present scheme of tax devolution

But What is Tax Devolution?

Let’s Explore from #UPSC Prelims - 2024 Standpoint

Solve PYQ in the last

A Thread 🧵

But What is Tax Devolution?

Let’s Explore from #UPSC Prelims - 2024 Standpoint

Solve PYQ in the last

A Thread 🧵

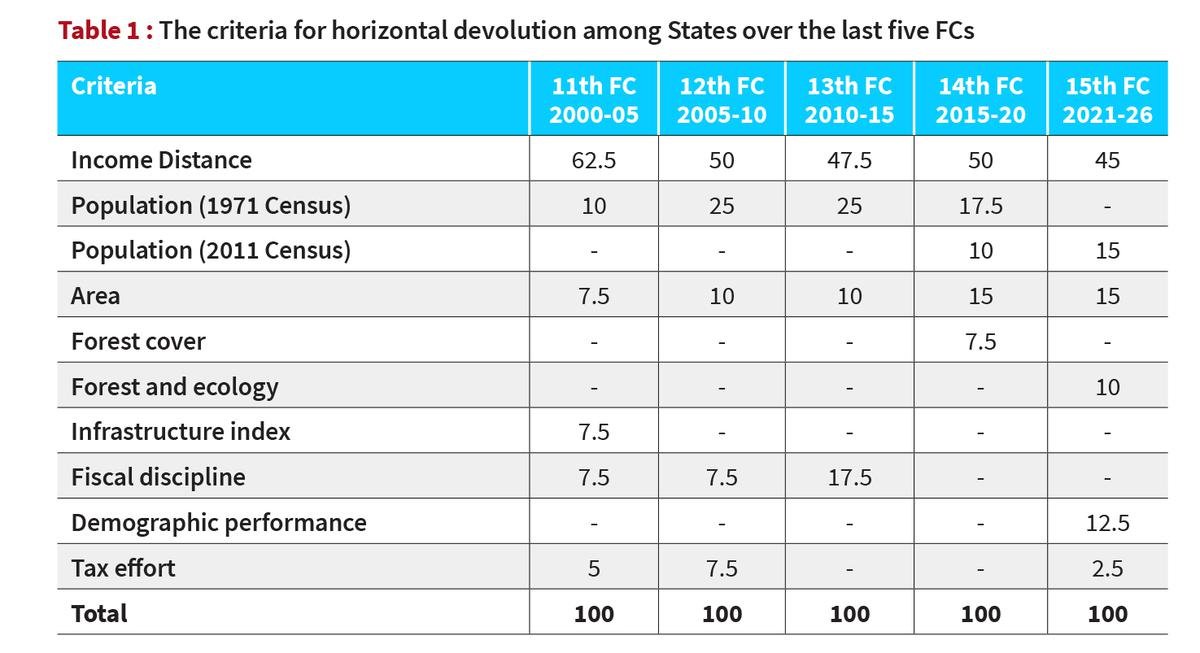

What is Tax Devolution?

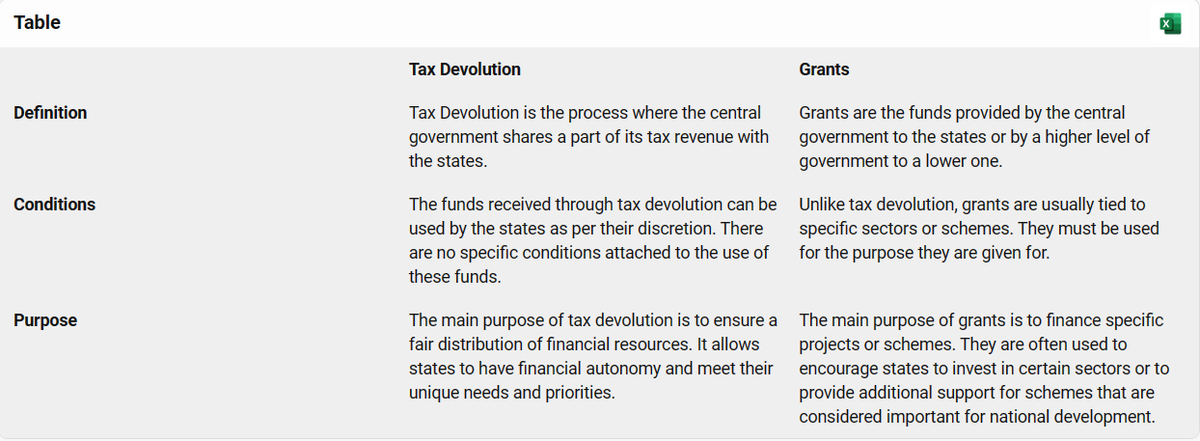

- Tax Devolution is the process of distributing tax revenues between the central government and the state governments

- It is a constitutional mechanism designed to allocate the proceeds of certain taxes among the Union and the states fairly and equitably

- Article 280(3)(a) of the Constitution of India mandates this process

- The Finance Commission (FC) is responsible for making recommendations regarding the division of the net proceeds of taxes between the Union and the states. This is a key aspect of fiscal federalism in India

- Tax Devolution is the process of distributing tax revenues between the central government and the state governments

- It is a constitutional mechanism designed to allocate the proceeds of certain taxes among the Union and the states fairly and equitably

- Article 280(3)(a) of the Constitution of India mandates this process

- The Finance Commission (FC) is responsible for making recommendations regarding the division of the net proceeds of taxes between the Union and the states. This is a key aspect of fiscal federalism in India

Why is Tax Devolution Important?

- It ensures equitable distribution of national resources

- It empowers states to meet their unique needs and priorities

- It promotes fiscal discipline and efficiency at the state level

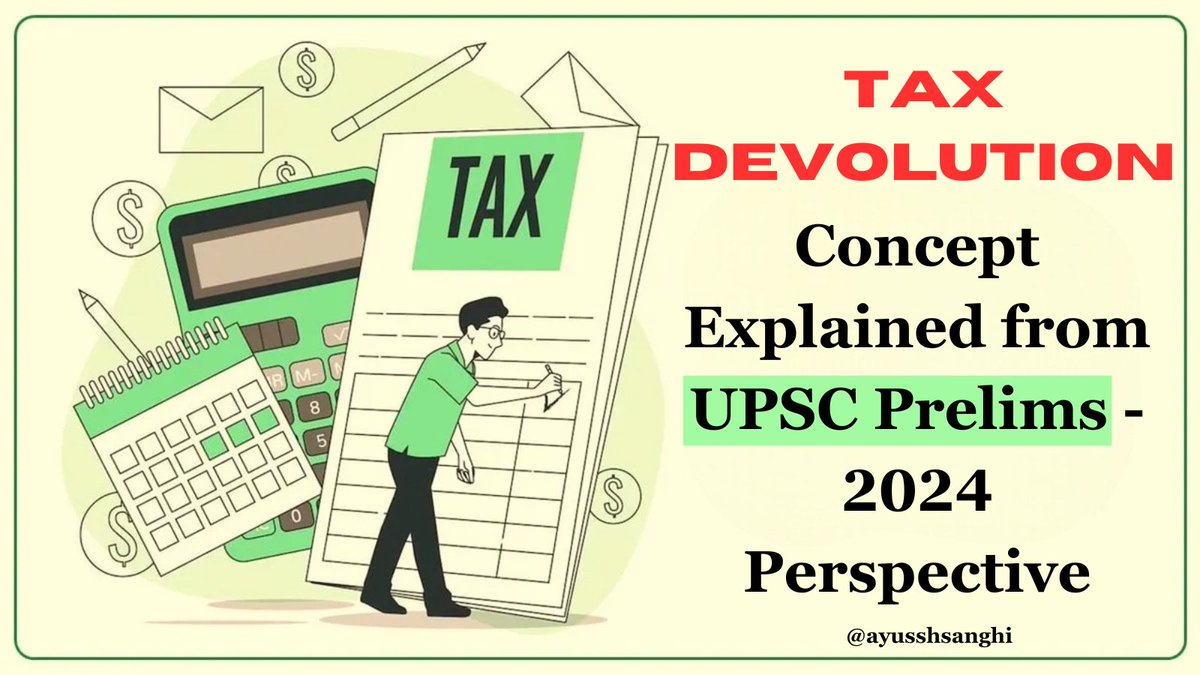

How is the Devolution Percentage Determined?

- The Finance Commission, a constitutional body, recommends the percentage of tax devolution

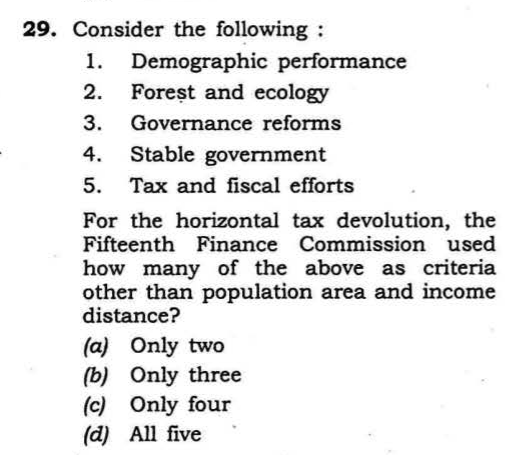

- Factors considered include population, income distance, area, forest cover, and more

- It ensures equitable distribution of national resources

- It empowers states to meet their unique needs and priorities

- It promotes fiscal discipline and efficiency at the state level

How is the Devolution Percentage Determined?

- The Finance Commission, a constitutional body, recommends the percentage of tax devolution

- Factors considered include population, income distance, area, forest cover, and more

Like this thread? follow for more such unique but important topics from UPSC Prelims - 2024 Standpoint @ayusshsanghi

Loading suggestions...