Indian jute industry has faced many challenges since the beginning of the 20th century.

Our major threat has emerged from our neighbor, Bangladesh, in many ways:

1️⃣ Partition

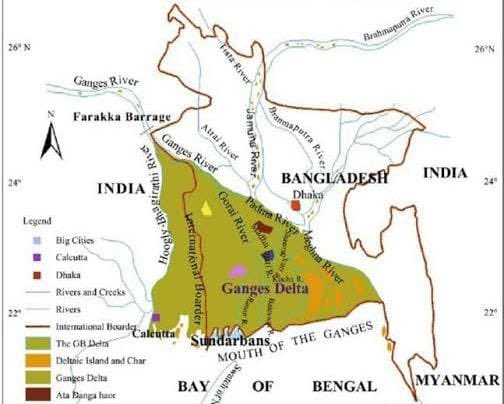

East Bengal, later known as East Pakistan & then as Bangladesh, inherited a significant portion

Our major threat has emerged from our neighbor, Bangladesh, in many ways:

1️⃣ Partition

East Bengal, later known as East Pakistan & then as Bangladesh, inherited a significant portion

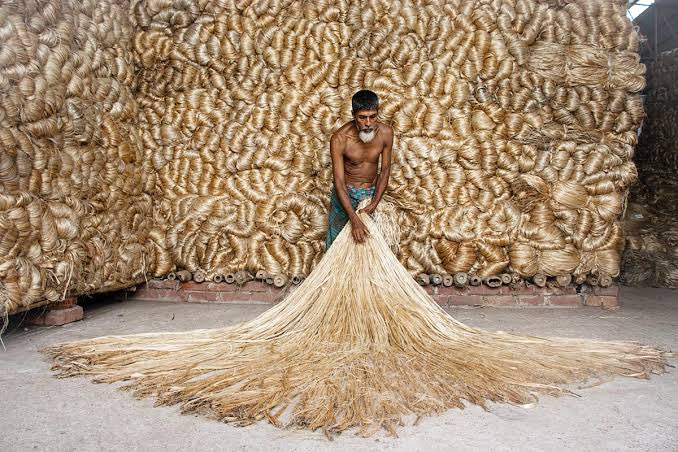

It’s a process in which raw jute stems are submerged in the water to separate the loosened fibers from the jute stalk.

Good quality of water and right temperature is essential for this process as it directly impacts the quality of jute fibers.

Good quality of water and right temperature is essential for this process as it directly impacts the quality of jute fibers.

3️⃣ Low Cost of Production

Bangladesh has successfully lowered its production cost by specializing in jute production & processing.

Better infrastructure, tech adoption & skilled labour are some additional factors which brought down its manufacturing cost.

Bangladesh has successfully lowered its production cost by specializing in jute production & processing.

Better infrastructure, tech adoption & skilled labour are some additional factors which brought down its manufacturing cost.

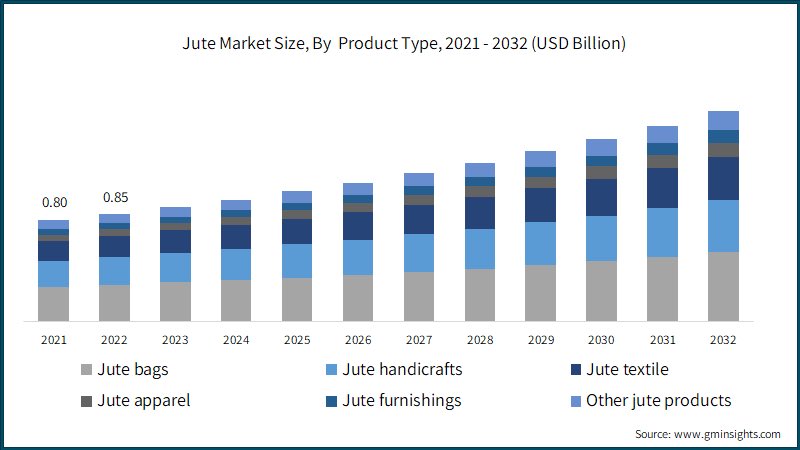

Now, superior quality of raw jute combined with products at a much lesser price is the reason why Bangladesh is the export leader in the world

— and exports an average $1 billion worth of jute every year.

— and exports an average $1 billion worth of jute every year.

Now, besides facing heightened competition in the global market, our nation’s jute industry has been confronting numerous other challenges:

👉 Obsolete Tech

Many of our jute mills have been suffering from outdated machinery and inefficient production processes.

👉 Obsolete Tech

Many of our jute mills have been suffering from outdated machinery and inefficient production processes.

👉 Adoption of Substitutes

It majorly happened after the development and widespread adoption of synthetic substitutes like polypropylene and nylon.

Over time, these materials became more appealing to the consumers

It majorly happened after the development and widespread adoption of synthetic substitutes like polypropylene and nylon.

Over time, these materials became more appealing to the consumers

Despite the challenges, the government of India is undertaking significant measures because:

Firstly, numerous livelihoods depends on this industry.

It supports more than 40 lakh farm families and provides daily bread & butter to more than 5 lakh industrial workers.

Firstly, numerous livelihoods depends on this industry.

It supports more than 40 lakh farm families and provides daily bread & butter to more than 5 lakh industrial workers.

Now, let’s take a look at the measures:

A) In 2021, Ministry of Textiles announced an Umbrella Scheme of National Jute Board for Development & Promotion of Jute Sector

— National Jute Development Program (NJDP) with a total outlay of ₹485 Cr for implementation during 2021-26.

A) In 2021, Ministry of Textiles announced an Umbrella Scheme of National Jute Board for Development & Promotion of Jute Sector

— National Jute Development Program (NJDP) with a total outlay of ₹485 Cr for implementation during 2021-26.

It has various sub-schemes like:

1️⃣ Jute Raw Material Bank (JRMB)

This scheme was devised to ensure the continuous supply and sale of raw materials.

JRMB directly sources raw materials from certified jute mills and manufacturers at cost-effective rates.

1️⃣ Jute Raw Material Bank (JRMB)

This scheme was devised to ensure the continuous supply and sale of raw materials.

JRMB directly sources raw materials from certified jute mills and manufacturers at cost-effective rates.

3️⃣ Capital Subsidy for Acquisition of Plants and Machinery (CSAPM) for Jute Diversified Products (JDPs)

The CSAPM scheme offers a 30% incentive on the cost of eligible machinery/equipment acquired and installed for modernization and/or upgrading to MSME JDP units.

The CSAPM scheme offers a 30% incentive on the cost of eligible machinery/equipment acquired and installed for modernization and/or upgrading to MSME JDP units.

4️⃣ Scholarship scheme for girl children of workers of Jute Mills/MSME JDP Units

Under this scheme, girl children of workers of jute mills are provided with a scholarship of

- ₹5,000 for secondary education, and

- ₹10,000 for higher Secondary education.

Under this scheme, girl children of workers of jute mills are provided with a scholarship of

- ₹5,000 for secondary education, and

- ₹10,000 for higher Secondary education.

— including artisans, entrepreneurs, & millers.

B) Imposition of Anti-Dumping Duties

Dumping is when a country or company sells a product to another country at a price below its domestic market value.

This can hurt the profits of local businesses in the importing country.

B) Imposition of Anti-Dumping Duties

Dumping is when a country or company sells a product to another country at a price below its domestic market value.

This can hurt the profits of local businesses in the importing country.

And so, in 2017, India imposed anti-dumping duties ranging from ranging from $19 to $352 on certain jute products being imported from Bangladesh & Nepal for a 5-yr period.

But despite this, there is continued dumping of these products, so it got extended for another 5 yrs.

But despite this, there is continued dumping of these products, so it got extended for another 5 yrs.

C) Increase in MSP

The MSP of raw jute has been increased to ₹5050/quintal in 2023-24 from ₹4750/quintal in 2022-23.

It ensures a minimum of 50% as a margin of profit for jute growers.

The MSP of raw jute has been increased to ₹5050/quintal in 2023-24 from ₹4750/quintal in 2022-23.

It ensures a minimum of 50% as a margin of profit for jute growers.

Loading suggestions...