4. Research Right and Hold Tight

Most people aren’t traders by choice.

Their research before establishing a position is insufficient.

Thus, small changes in price and rather unimportant news are intimidating enough to panic-sell.

Best Protection: Extensive Research

Most people aren’t traders by choice.

Their research before establishing a position is insufficient.

Thus, small changes in price and rather unimportant news are intimidating enough to panic-sell.

Best Protection: Extensive Research

7. Inactivity is Hard but Necessary

You’re bombarded with news every day.

You’ll hear that everything will go south thousands of times. The same goes for bullish news.

Remaining unaffected by this has been the most profitable thing to do historically.

Stay the course.

You’re bombarded with news every day.

You’ll hear that everything will go south thousands of times. The same goes for bullish news.

Remaining unaffected by this has been the most profitable thing to do historically.

Stay the course.

Summary:

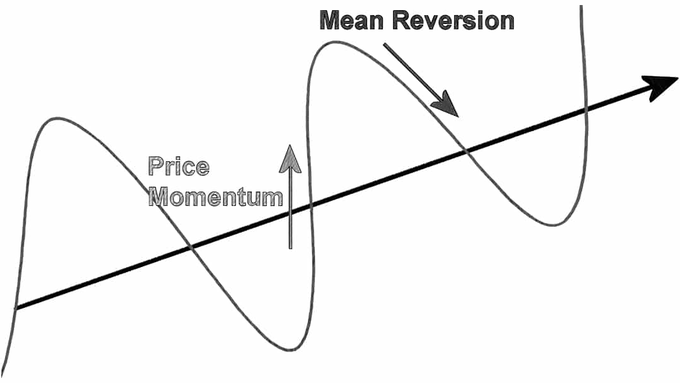

1. Everything Reverses to its Mean

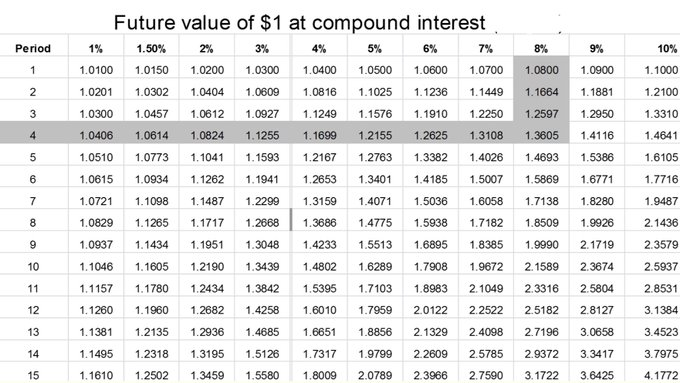

2. Time is your Friend

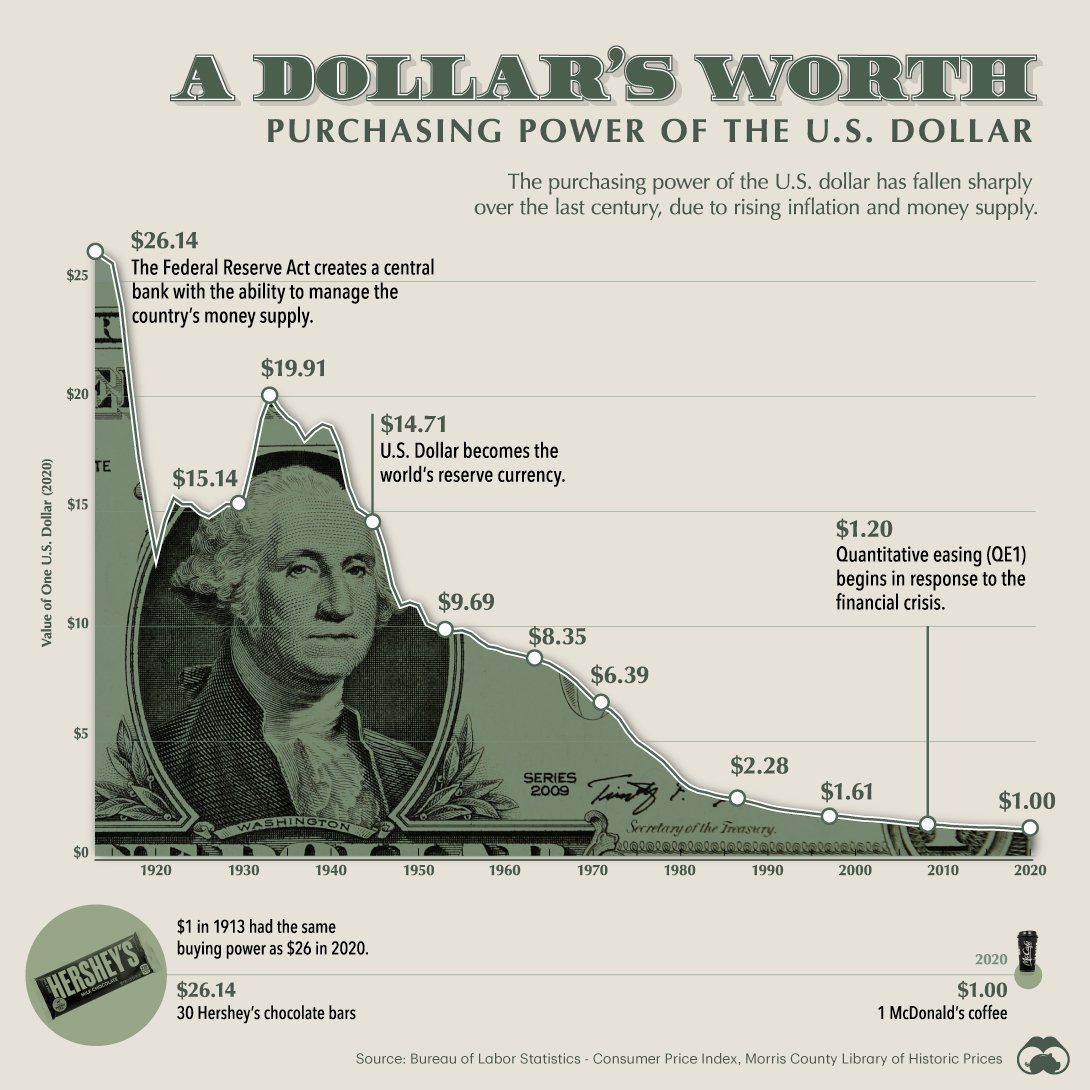

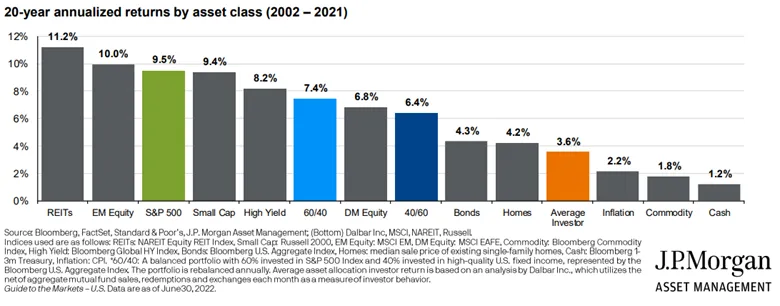

3. Investing is without Alternative

4. Buy Right and Hold

5. Buy the Haystack, not the Needle

6. Have Realistic Expectations

7. Inactivity is King

1. Everything Reverses to its Mean

2. Time is your Friend

3. Investing is without Alternative

4. Buy Right and Hold

5. Buy the Haystack, not the Needle

6. Have Realistic Expectations

7. Inactivity is King

If you learned something, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing, and visit my Website ;)

Have a great day!

Follow me @MnkeDaniel to learn more about Investing, and visit my Website ;)

Have a great day!

جاري تحميل الاقتراحات...