Nicolas Darvas and his Box Theory ❣️ - An In-Depth Exploration

-Thread🧵

-Thread🧵

Armed with essential readings like 'The Battle for Investment Survival' and 'Tape Reading and Market Tactics,' Darvas delved into market study through newspapers and literature.

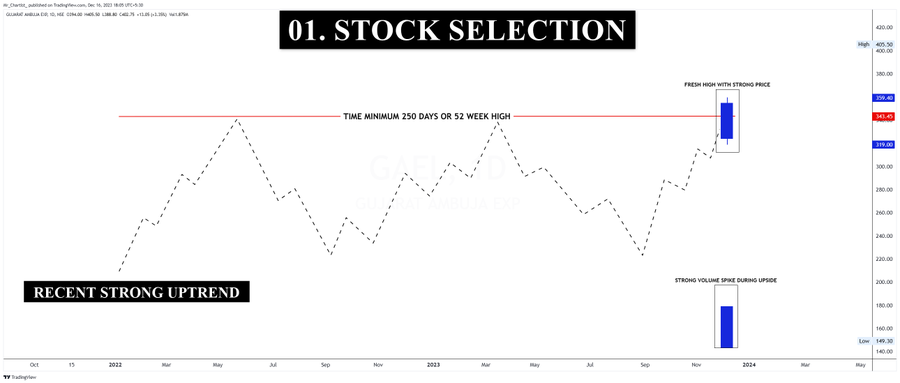

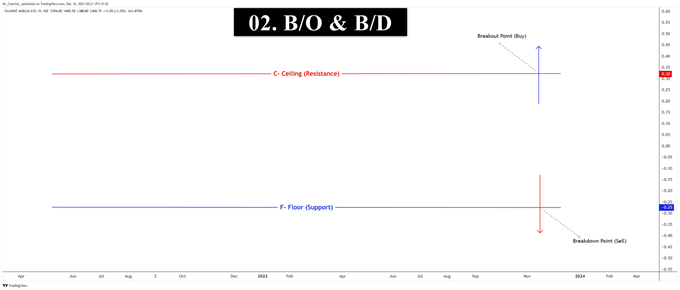

2️⃣ Darvas Box Rules:

- The foundation of Darvas's strategy was grounded in specific rules.

- A stock hitting a new 52-week high marked the beginning.

- Three consecutive days without exceeding the high set of the box.

- The breakout above the box signaled a buy.

- If the box's low was breached, it triggered a sell.

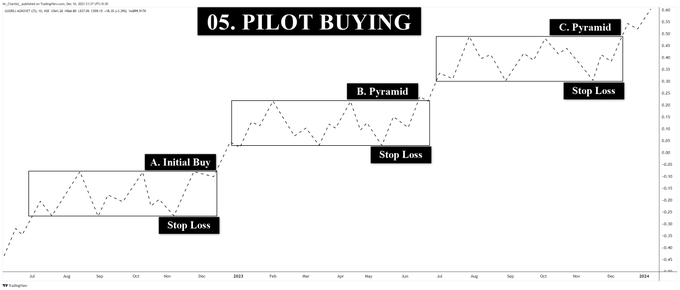

- The strategy encouraged adding to positions as the trade moved favorably.

- The foundation of Darvas's strategy was grounded in specific rules.

- A stock hitting a new 52-week high marked the beginning.

- Three consecutive days without exceeding the high set of the box.

- The breakout above the box signaled a buy.

- If the box's low was breached, it triggered a sell.

- The strategy encouraged adding to positions as the trade moved favorably.

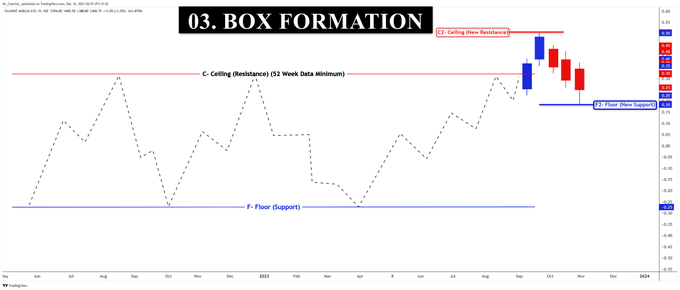

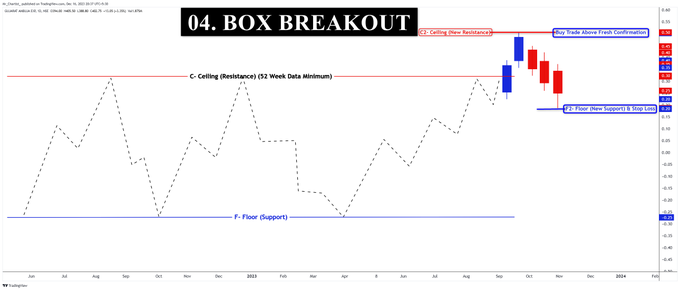

3️⃣ Box Formation:

- The Darvas Box formation was a meticulous process.

- C2 New Resistance: An unbroken high after three days.

- F2 New Support: The low of the candle is not breached for the next three sessions.

- C becomes the Ceiling/Resistance, F the Floor/Support—forming the Darvas Box.

- The concept of the box is a visual representation of market sentiment and stability.

- The Darvas Box formation was a meticulous process.

- C2 New Resistance: An unbroken high after three days.

- F2 New Support: The low of the candle is not breached for the next three sessions.

- C becomes the Ceiling/Resistance, F the Floor/Support—forming the Darvas Box.

- The concept of the box is a visual representation of market sentiment and stability.

6️⃣ Trail Stop-Loss:

- After a box breakout, trail stop-loss to the floor of the latest box.

- Keep trailing on subsequent floors.

- Exit when the price falls below the floor of the recent box.

- Trailing SL mechanism helps capture gains while protecting profits during reversals.

- After a box breakout, trail stop-loss to the floor of the latest box.

- Keep trailing on subsequent floors.

- Exit when the price falls below the floor of the recent box.

- Trailing SL mechanism helps capture gains while protecting profits during reversals.

7️⃣ Box Characteristics:

- No rigid rules for box height and width.

- Stocks can remain within the box for any number of days after forming the C.

- The flexibility in box characteristics accommodates various market conditions and trading styles.

- Darvas's adaptive approach makes his strategy applicable in different market scenarios.

- No rigid rules for box height and width.

- Stocks can remain within the box for any number of days after forming the C.

- The flexibility in box characteristics accommodates various market conditions and trading styles.

- Darvas's adaptive approach makes his strategy applicable in different market scenarios.

8️⃣ Ideal Market Conditions:

- Darvas Box thrives in strong bull markets.

- Profit potential is high in a trending market.

- Risky under bearish or sideways market conditions.

- Recognizing ideal market conditions is crucial for successful implementation, showcasing the strategy's sensitivity to the overall market environment.

- Darvas Box thrives in strong bull markets.

- Profit potential is high in a trending market.

- Risky under bearish or sideways market conditions.

- Recognizing ideal market conditions is crucial for successful implementation, showcasing the strategy's sensitivity to the overall market environment.

9️⃣ Common Pitfalls:

- Avoid buying breakouts into stocks not near highs.

- Caution against applying the strategy during bear markets.

- Beware of excessive scaling when adding to positions.

- Use the Darvas Box judiciously within sideways markets.

- These pitfalls underscore the importance of contextual awareness and highlight potential pitfalls that traders may encounter during implementation.

- Avoid buying breakouts into stocks not near highs.

- Caution against applying the strategy during bear markets.

- Beware of excessive scaling when adding to positions.

- Use the Darvas Box judiciously within sideways markets.

- These pitfalls underscore the importance of contextual awareness and highlight potential pitfalls that traders may encounter during implementation.

📈 Key Takeaways:

- Darvas Box is a simple yet powerful strategy for trending markets.

- Adapt the strategy to prevailing market conditions for optimal results.

- Understanding box formation and breakout rules is crucial for effective trading.

- The strategy's success lies in its adaptability, disciplined execution, and risk management principles.

Happy trading! 📈💼

#DarvasBox #StockMarket #TechincalAnalysis #Trading #Investing

- Darvas Box is a simple yet powerful strategy for trending markets.

- Adapt the strategy to prevailing market conditions for optimal results.

- Understanding box formation and breakout rules is crucial for effective trading.

- The strategy's success lies in its adaptability, disciplined execution, and risk management principles.

Happy trading! 📈💼

#DarvasBox #StockMarket #TechincalAnalysis #Trading #Investing

Loading suggestions...