1. A Snapshot

In contrast to the income statement, the balance sheet isn’t showing the results over a period.

It is a snapshot at a given point in time.

In financial reports, it’s often compared to the state of the balance sheet a year ago.

In contrast to the income statement, the balance sheet isn’t showing the results over a period.

It is a snapshot at a given point in time.

In financial reports, it’s often compared to the state of the balance sheet a year ago.

2. Purpose

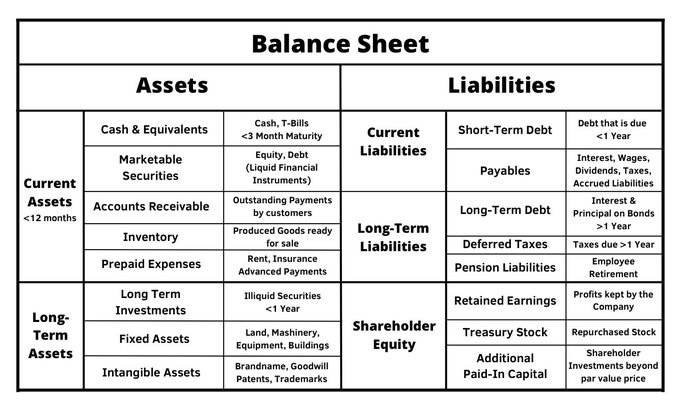

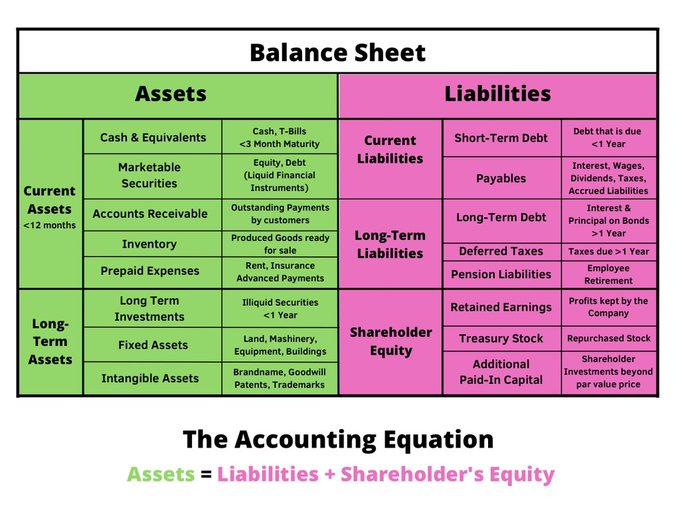

The Balance sheet generally tells you about the financial health of a company.

You get to know what assets the company owns and how they were financed.

We’ll look deeper into that later.

The Balance sheet generally tells you about the financial health of a company.

You get to know what assets the company owns and how they were financed.

We’ll look deeper into that later.

Apart from the liabilities, there’s also Shareholder’s Equity.

This money would go to the shareholders if the company was liquidated.

(After all debts are paid)

This also explains the retained earnings position, which often confuses people.

This money would go to the shareholders if the company was liquidated.

(After all debts are paid)

This also explains the retained earnings position, which often confuses people.

People often think of Assets as the “good” side and of Liabilities as the “bad” one.

That’s why people are confused when earnings are on the “bad” side.

I wouldn’t use these labels. Just remember, assets are what the company owns, liabilities what they owe.

That’s why people are confused when earnings are on the “bad” side.

I wouldn’t use these labels. Just remember, assets are what the company owns, liabilities what they owe.

You can think of retained earnings as saved-up money.

Money that the company didn’t spend on reducing debt but also didn’t pay to shareholders.

So basically, they owe that money to shareholders.

That’s why it’s on the Liabilities side of the balance sheet.

Money that the company didn’t spend on reducing debt but also didn’t pay to shareholders.

So basically, they owe that money to shareholders.

That’s why it’s on the Liabilities side of the balance sheet.

4. Analysis

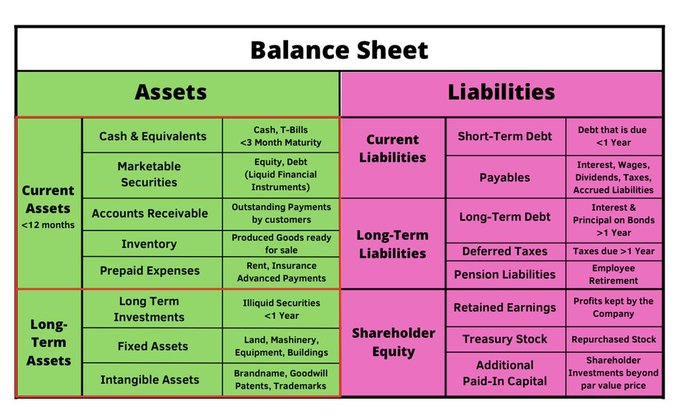

Now you have a pretty good overview of the balance sheet.

But how do you figure out if the company is healthy or not?

By comparing the parts of the balance sheet that have impactful connections.

Let’s take a look at them.

Now you have a pretty good overview of the balance sheet.

But how do you figure out if the company is healthy or not?

By comparing the parts of the balance sheet that have impactful connections.

Let’s take a look at them.

4.1 Debt-to-Equity

One important connection is between debt and equity.

It shows how a company has financed its growth.

The more debt a company uses, the more money it can save due to a ‘tax shield.’

This is because companies don’t have to tax interest payments.

One important connection is between debt and equity.

It shows how a company has financed its growth.

The more debt a company uses, the more money it can save due to a ‘tax shield.’

This is because companies don’t have to tax interest payments.

And this is what analyzing is.

Look for connections and assess whether that's a good or a bad sign for the company.

There is no general right or wrong.

What can be right in one situation might be wrong in another.

Use your common sense.

This is the most important thing.

Look for connections and assess whether that's a good or a bad sign for the company.

There is no general right or wrong.

What can be right in one situation might be wrong in another.

Use your common sense.

This is the most important thing.

If you learned something, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing, and visit my Website ;)

Have a great day!

Follow me @MnkeDaniel to learn more about Investing, and visit my Website ;)

Have a great day!

I share everything I've learned about investing in my free newsletter every Sunday. I cover all important topics in (mostly) less than 6 minutes long.

Far over 15,000 people subscribe.

If you're interested, you can sign up here:

danielmnke.com

Far over 15,000 people subscribe.

If you're interested, you can sign up here:

danielmnke.com

Loading suggestions...