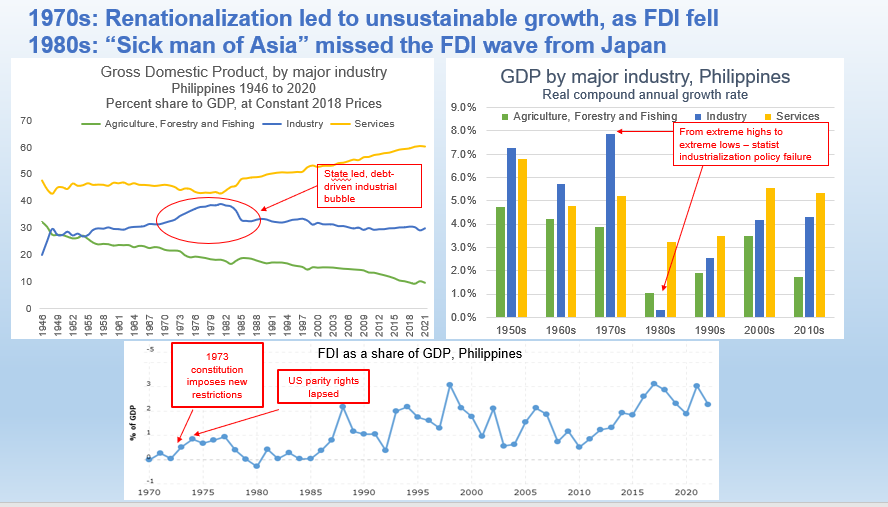

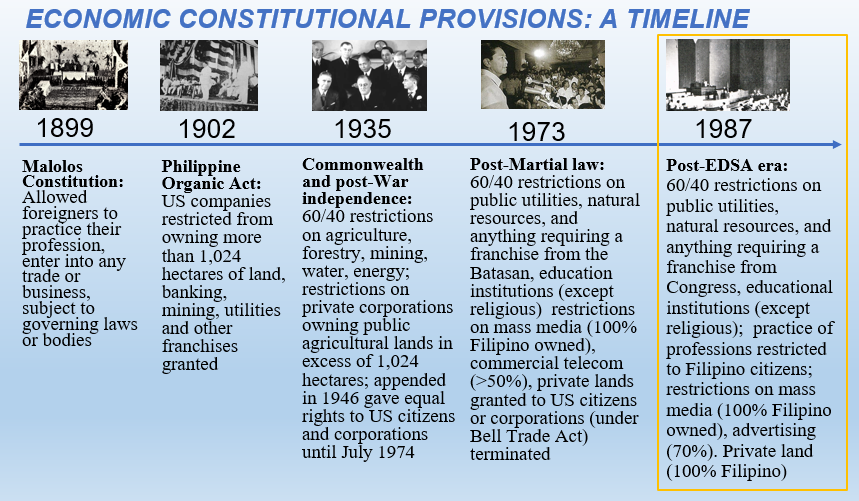

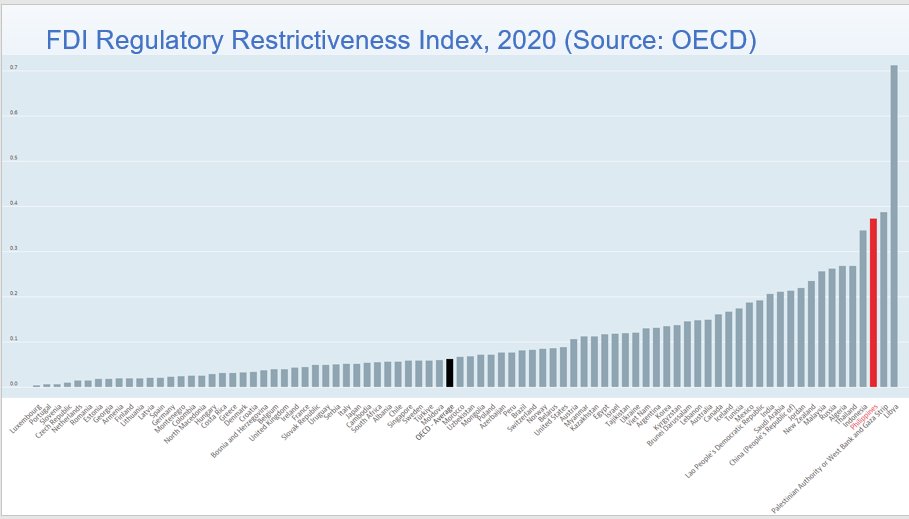

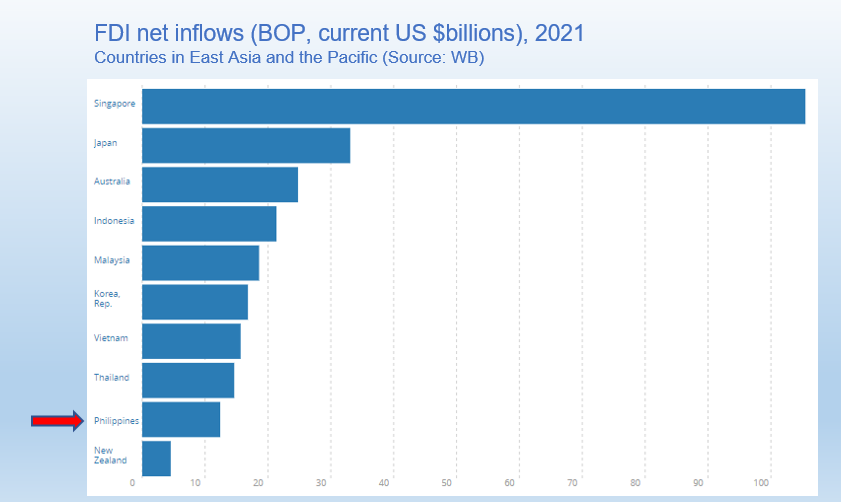

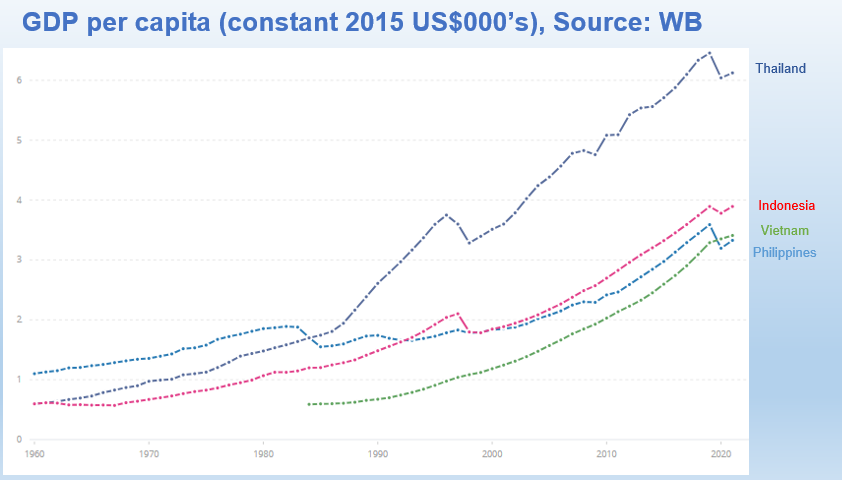

Are restrictions to FDI in the 1987 charter passé? youtu.be #AmendThePHcharter @SenatePH @sonnyangara #philippines #reformPH

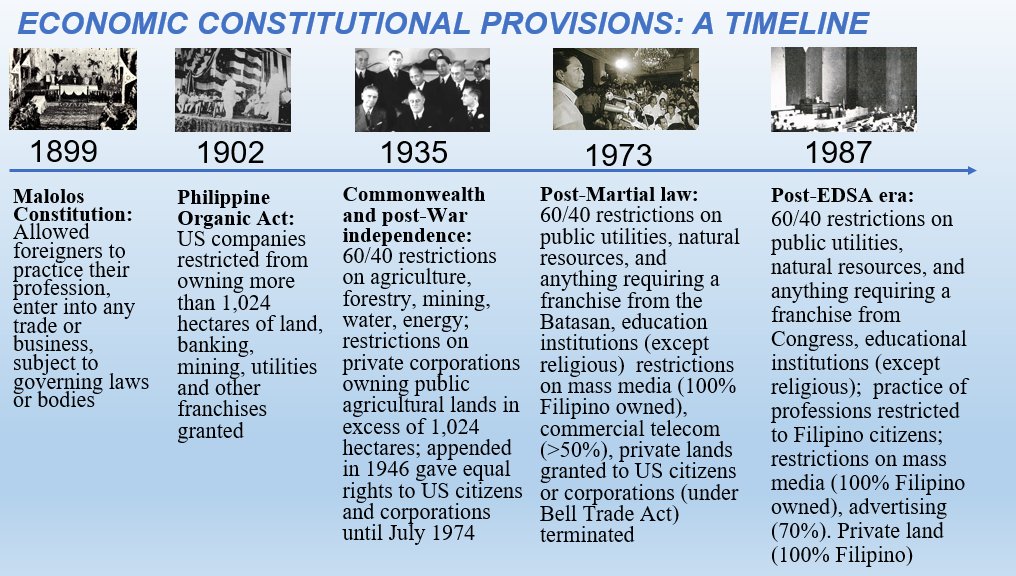

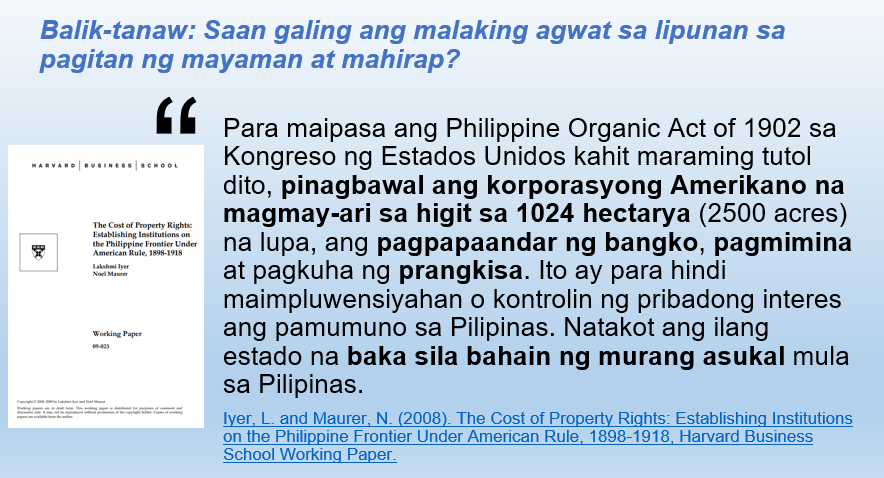

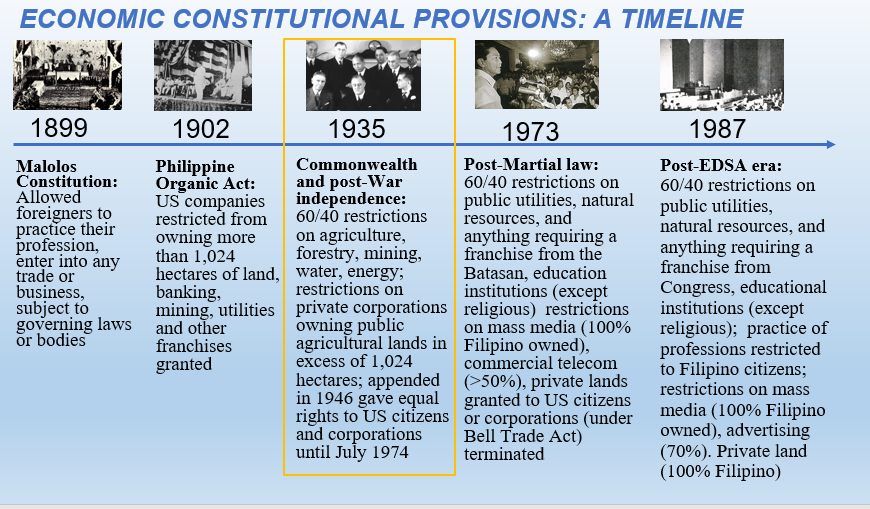

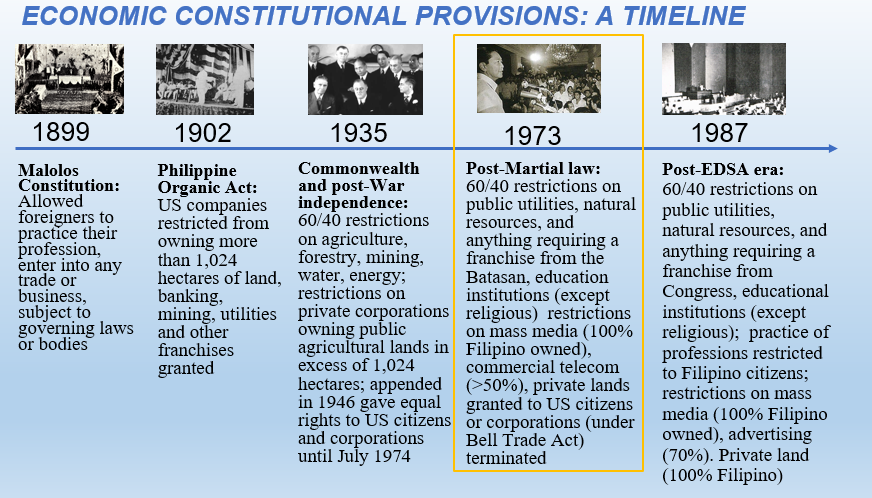

The 1899 #Malolos constitution did not contain restrictions to foreign participation in our economy. By a strange twist of fate, it was the US annexation of the #Philippines that caused these restrictions on foreign ownership to be inserted in the Philippine Organic Act of 1902.

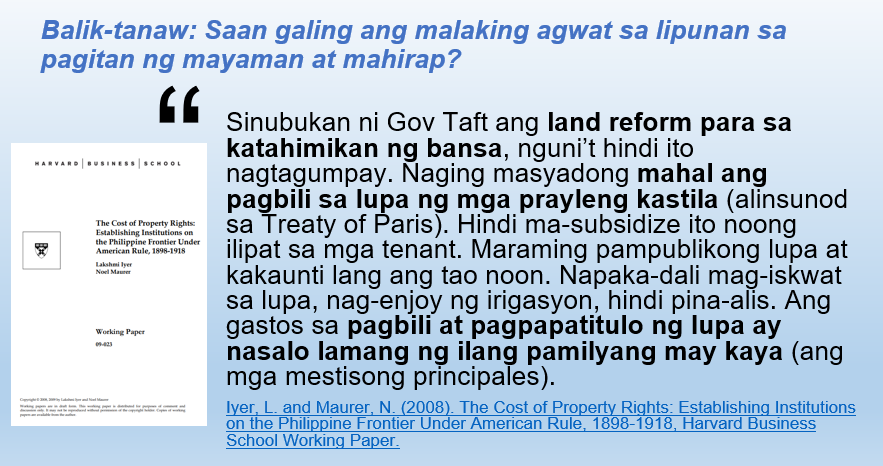

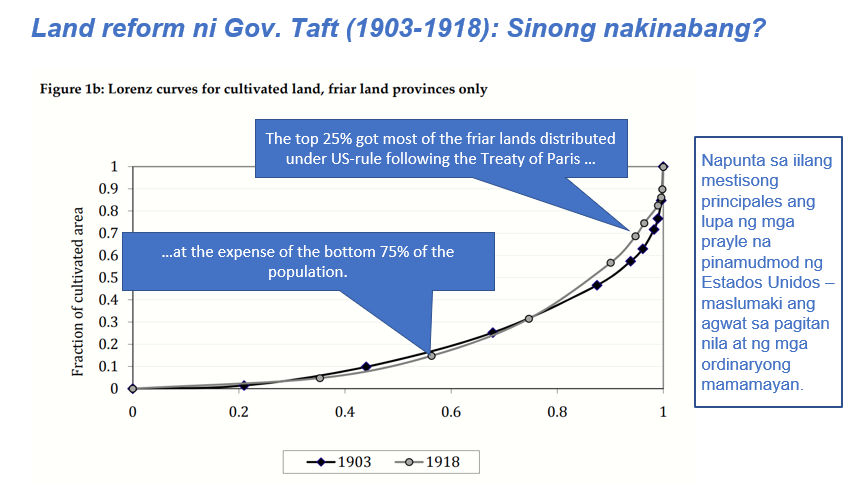

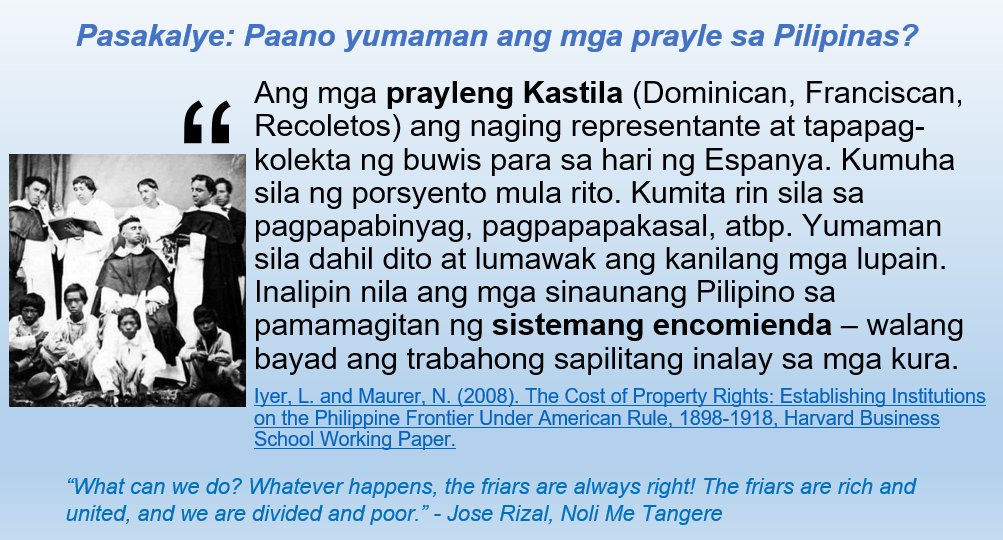

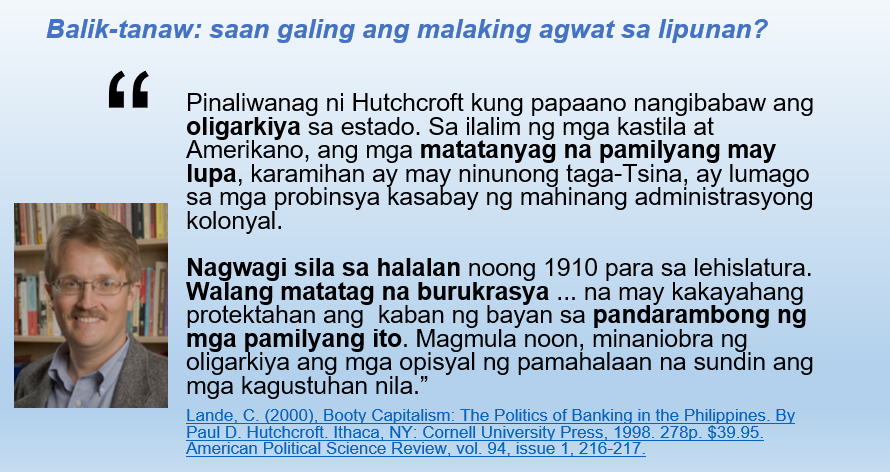

The Spanish friars from the religious orders administered the Philippine colony on behalf of the Spanish Crown. They got to own most of the productive lands and used the system of encomienda a form of slave labour to till them. #Gomburza

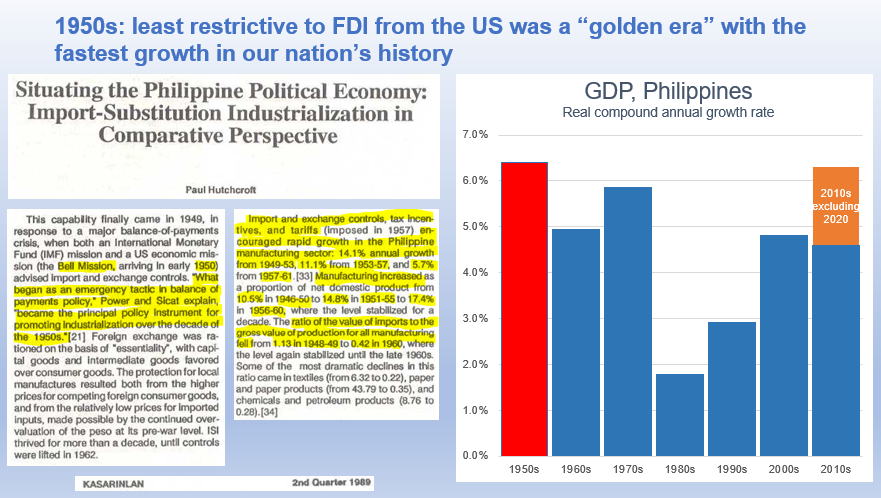

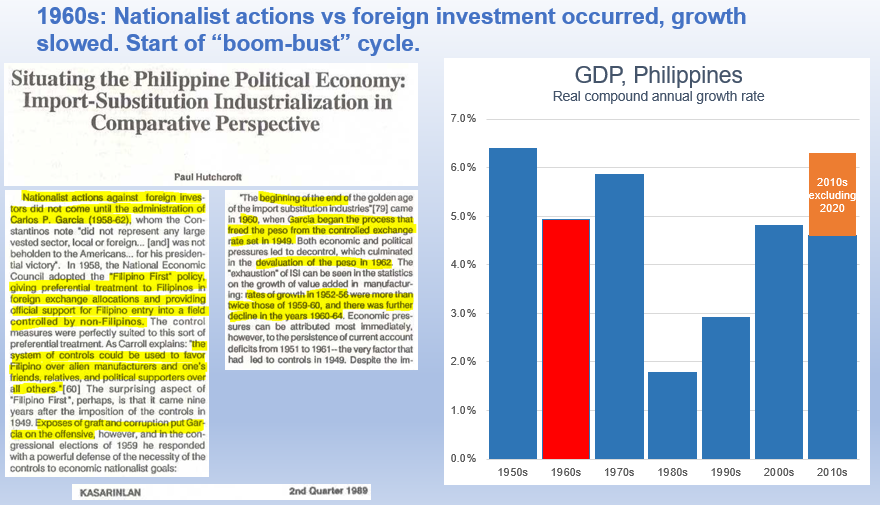

Though considered a stain on our national sovereignty, the parity rights granted to US investors, led to rapid growth in the 50s, through trade and monetary policies that biased the importation of capital and intermediary goods for production, over consumer goods #goldenage

Loading suggestions...