The cash flow statement shows how much cash goes in and out a company over a certain period.

You want to invest in companies that make money and manage their cash position well.

You want to invest in companies that make money and manage their cash position well.

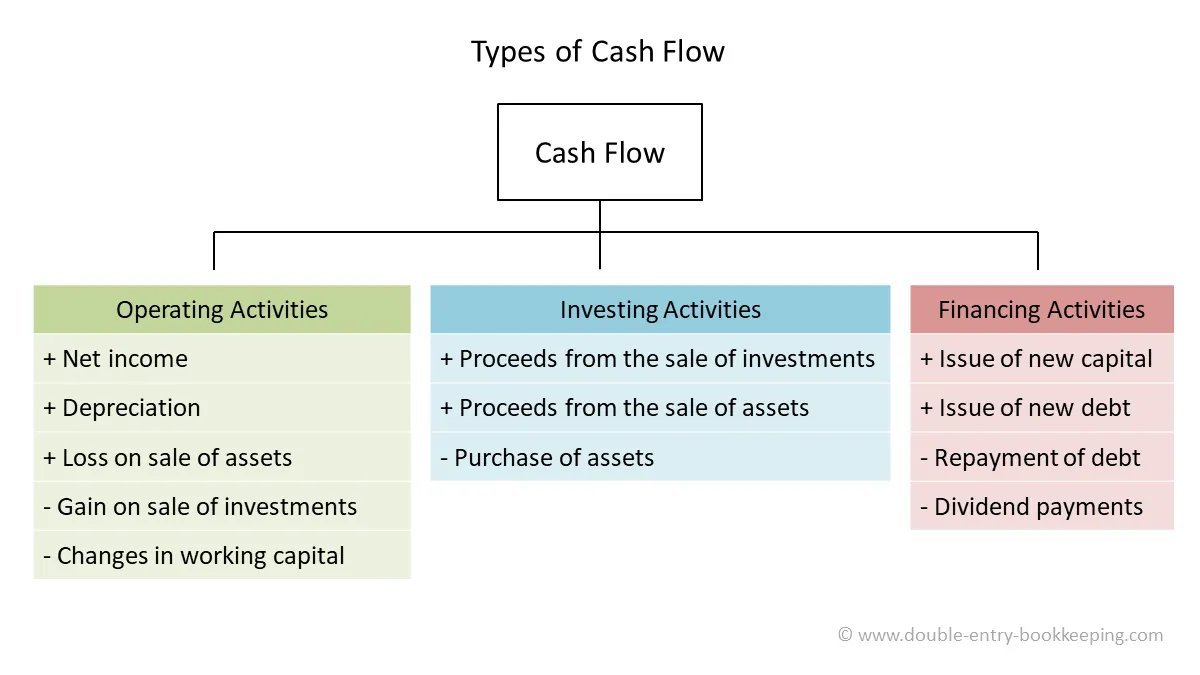

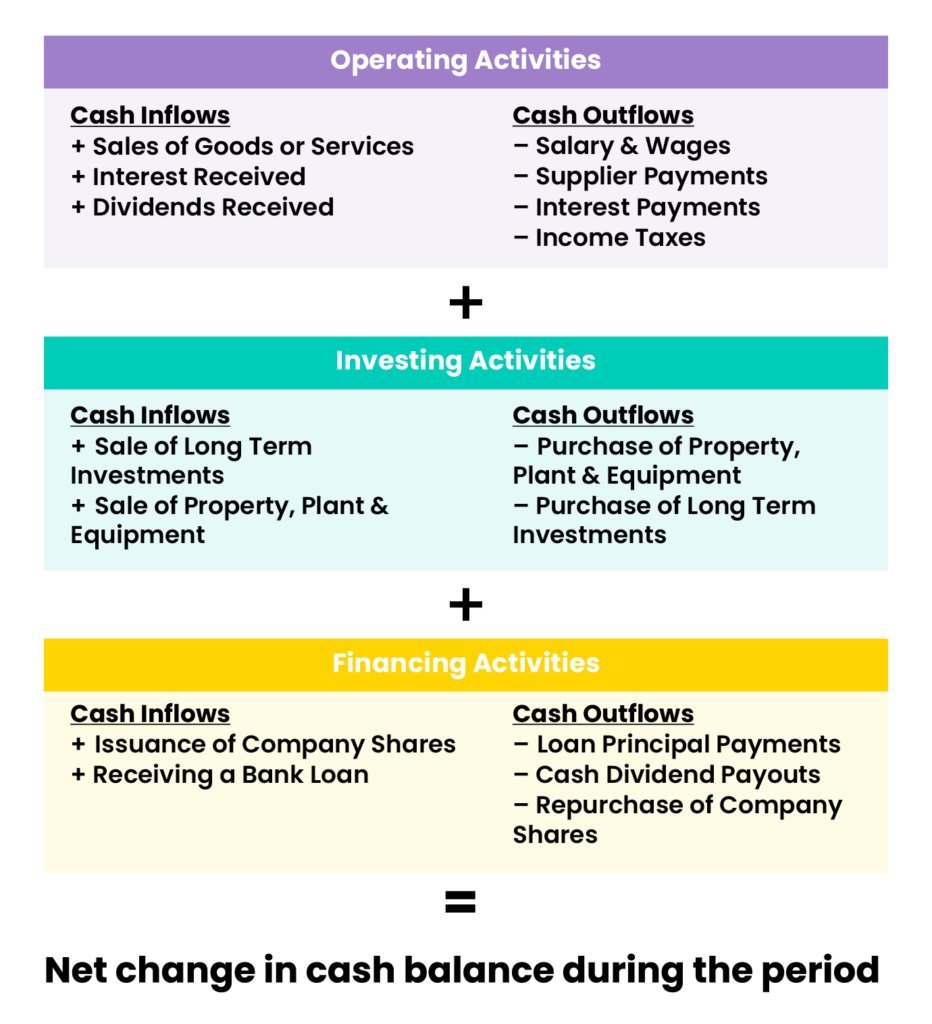

A Cash Flow statement consists of 3 parts:

1️⃣ Cash Flow from Operating Activities

2️⃣ Cash Flow from Investing Activities

3️⃣ Cash Flow from Financing Activities

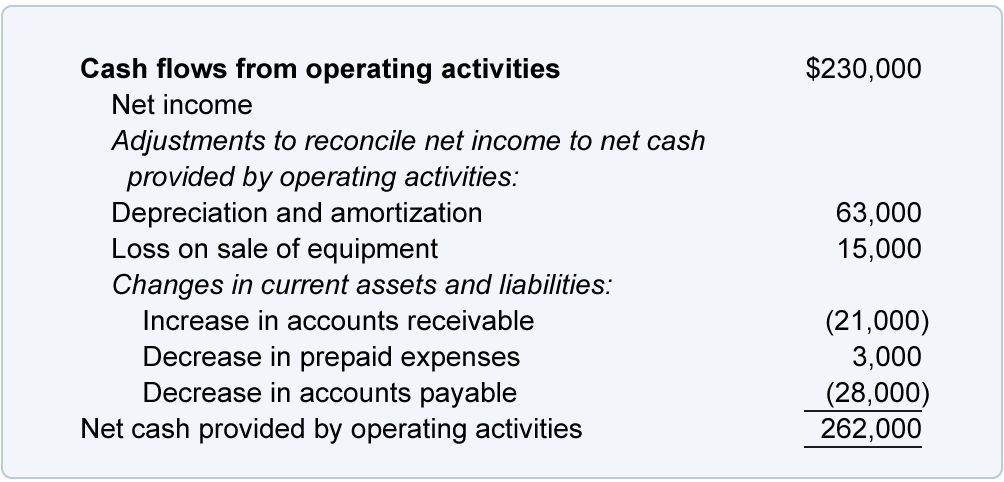

1️⃣ Cash Flow from Operating Activities

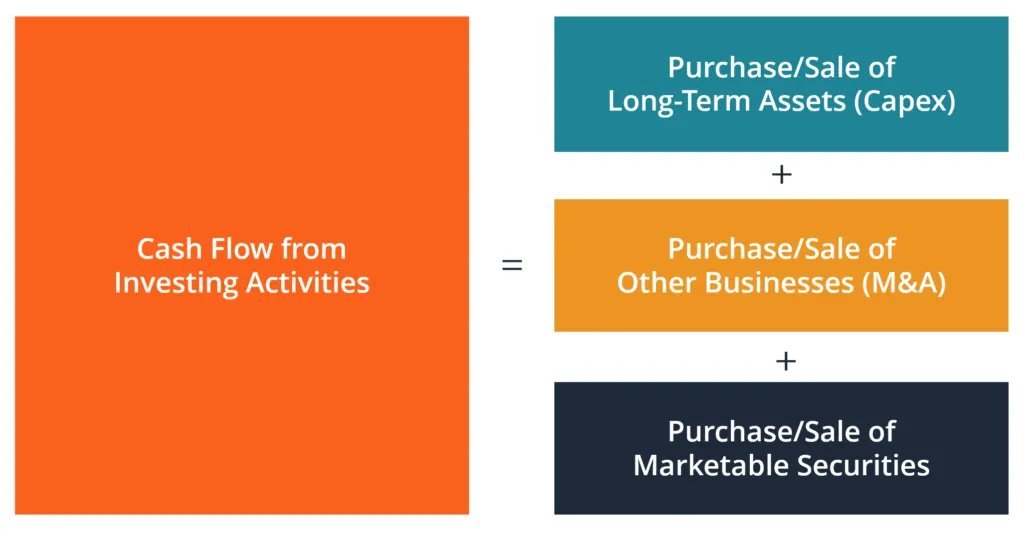

2️⃣ Cash Flow from Investing Activities

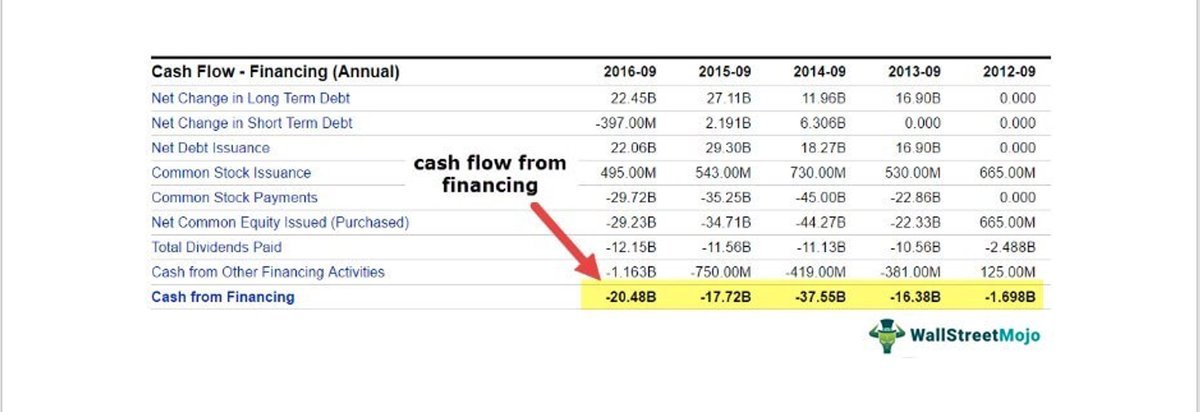

3️⃣ Cash Flow from Financing Activities

Questions to ask yourself:

1️⃣ Is the company profitable (positive operating CF)?

2️⃣ How robust is the operating CF (not too volatile)?

3️⃣ Does the operating CF grow attractively over time (> 7%)?

1️⃣ Is the company profitable (positive operating CF)?

2️⃣ How robust is the operating CF (not too volatile)?

3️⃣ Does the operating CF grow attractively over time (> 7%)?

Questions to ask yourself:

1️⃣ How capital intensive is the company (CAPEX)?

2️⃣ Is M&A important for the company?

3️⃣ Does the company invest a lot in other marketable securities?

1️⃣ How capital intensive is the company (CAPEX)?

2️⃣ Is M&A important for the company?

3️⃣ Does the company invest a lot in other marketable securities?

Now we can calculate the free cash flow.

Free cash flow is one of THE most important financial metrics.

Free cash flow = cash flow from operating activities - CAPEX.

Want to learn more about free cash flow? Take a look here:

Free cash flow is one of THE most important financial metrics.

Free cash flow = cash flow from operating activities - CAPEX.

Want to learn more about free cash flow? Take a look here:

Questions to ask yourself:

1️⃣ Does the company mainly use equity or debt to finance itself?

2️⃣ How much dividends does the company pay?

3️⃣ Does the company issue equity or debt regularly?

1️⃣ Does the company mainly use equity or debt to finance itself?

2️⃣ How much dividends does the company pay?

3️⃣ Does the company issue equity or debt regularly?

That's it for today.

If you liked this, you'll LOVE my free Financial Analysis course.

Grab it here: compounding-quality.ck.page

If you liked this, you'll LOVE my free Financial Analysis course.

Grab it here: compounding-quality.ck.page

Loading suggestions...