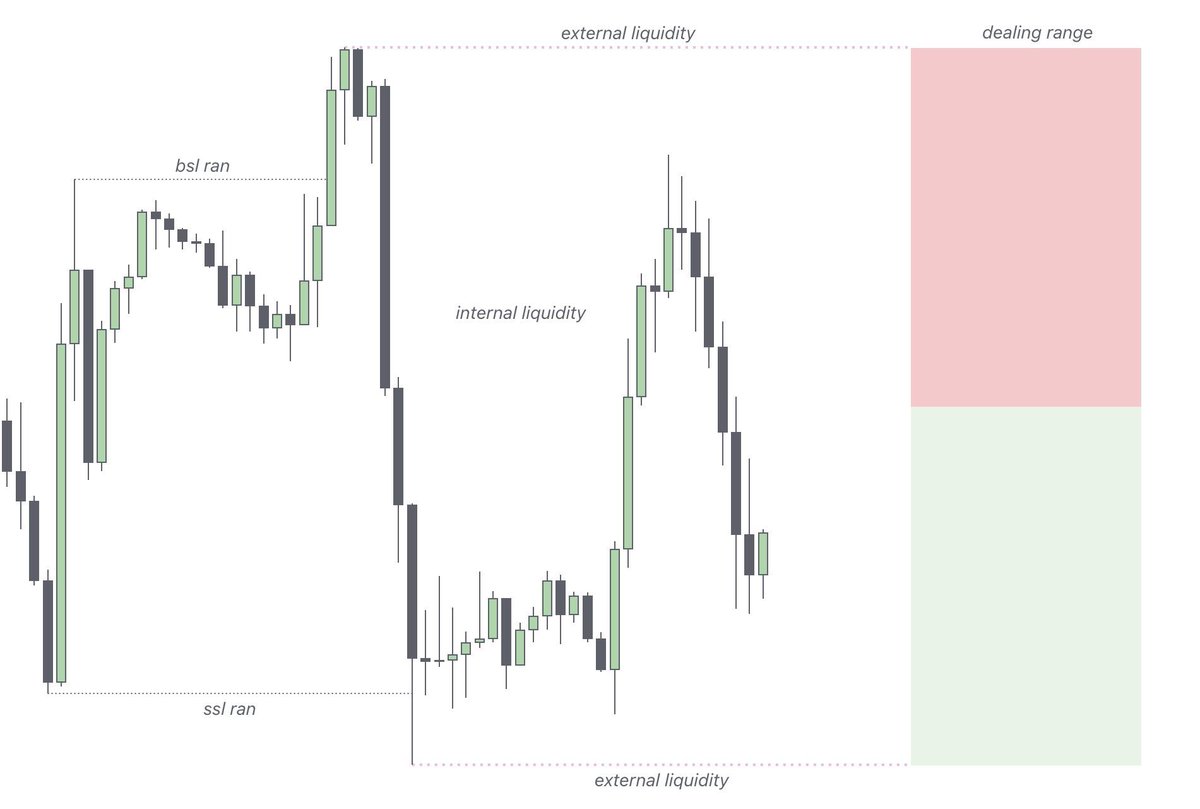

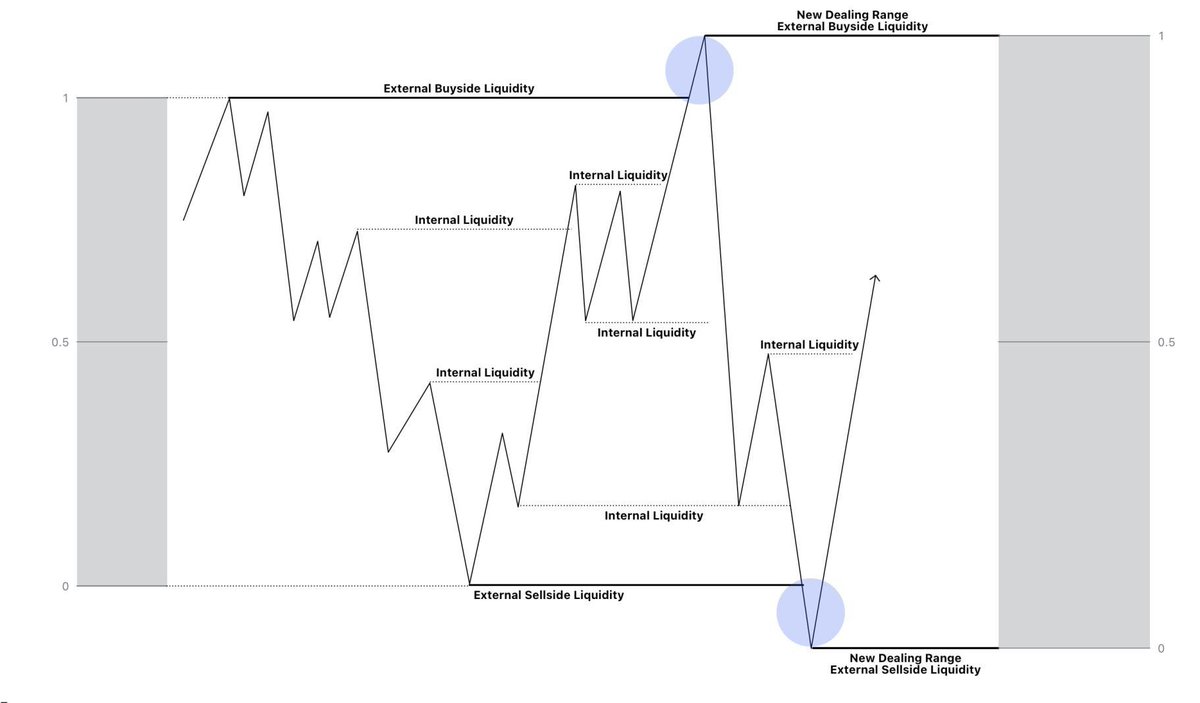

A dealing range is defined as the most recent range where both buyside and sellside liquidity has been taken.

Establishing a deep relationship with dealing ranges & the PD array matrix is an absolute game changer. Things really clicked for me once I understood this fully. x.com

Establishing a deep relationship with dealing ranges & the PD array matrix is an absolute game changer. Things really clicked for me once I understood this fully. x.com

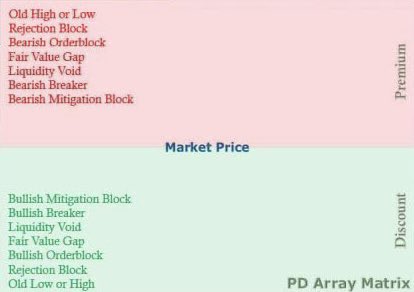

Once you have your dealing range, you can begin to focus on breaking down the PD arrays within it based on the PD array matrix. Each dealing range will consistent of different PD arrays.

The PD array matrix is a hierarchy, meaning certain PD arrays take precedence over others. Each pd array within a dealing range can be viewed as a wall to support/reject price. Extremely profitable models can be built around dealing ranges alone. x.com

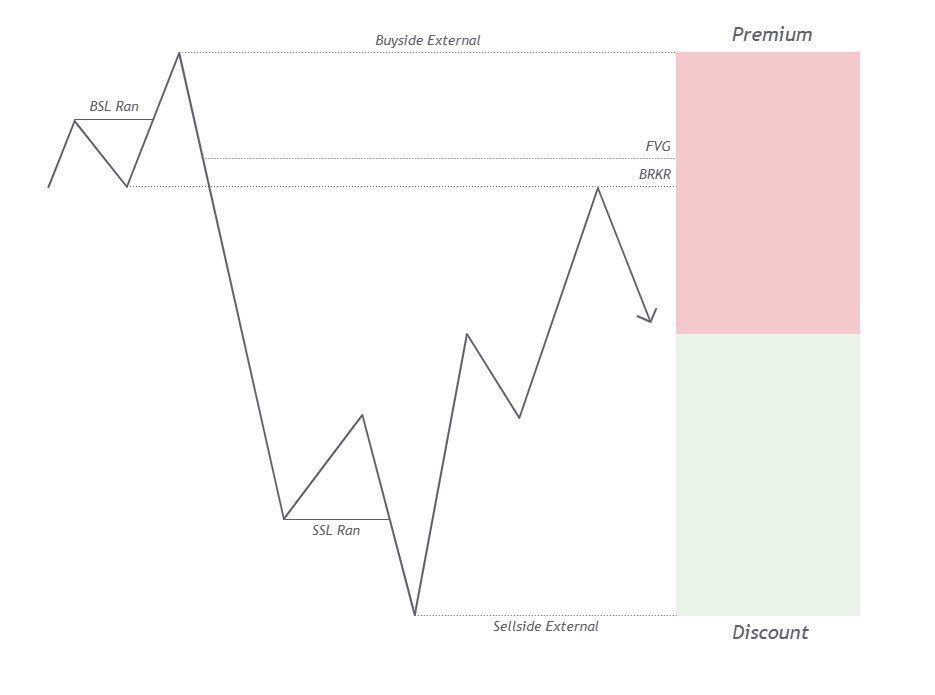

You can see above the PD array matrix is labeled with discount and premium. Price is always just moving from premium array —> discount array, discount array —> premium array. Once we have our dealing range, we take a fibonacci tool (0.0, 0.5, 1.0) and measure it from high to low.

As always, price is fractal. Below is a picture portraying the fractal nature of dealing ranges. This is not my picture, all credit to @Dangstrat for this one.

@Dangstrat Identify your dealing range. Mark out the PD arrays that formed within that dealing range. Now check your PD array matrix to see what takes higher precedence. You want to view each PD array as a wall that price could respect. If one pd array fails, you move on to the next wall.

@Dangstrat It goes much, much deeper than this. However, for simplicity sake; I am going to refrain from going more in depth on this thread. If you guys have any questions feel free to reach out!

Loading suggestions...