It all starts with revenue.

Revenue is the money a company generates by selling its products/services.

You want a company that manages to report consistently increasing revenues over the years.

Revenue is the money a company generates by selling its products/services.

You want a company that manages to report consistently increasing revenues over the years.

Pre-tax income (earnings before tax)

The net income of a company before taxes are subtracted.

Pre-tax income = operating income - interest expenses

The net income of a company before taxes are subtracted.

Pre-tax income = operating income - interest expenses

Net income

Net income = pre-tax income - taxes

You want a company that translates most revenue into net income.

Net income = pre-tax income - taxes

You want a company that translates most revenue into net income.

Questions to ask yourself about an income statement:

1️⃣ Are revenues steadily increasing over time?

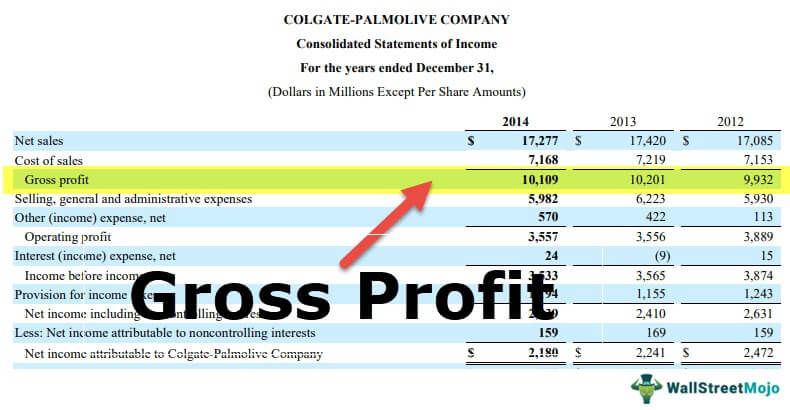

2️⃣ Does the company need a lot of COGS to sell its products?

3️⃣ How much revenue is translated into net income?

1️⃣ Are revenues steadily increasing over time?

2️⃣ Does the company need a lot of COGS to sell its products?

3️⃣ How much revenue is translated into net income?

That's it for today.

If you liked this, you'll love my free Financial Analysis course.

Grab it here: compounding-quality.ck.page

If you liked this, you'll love my free Financial Analysis course.

Grab it here: compounding-quality.ck.page

Loading suggestions...