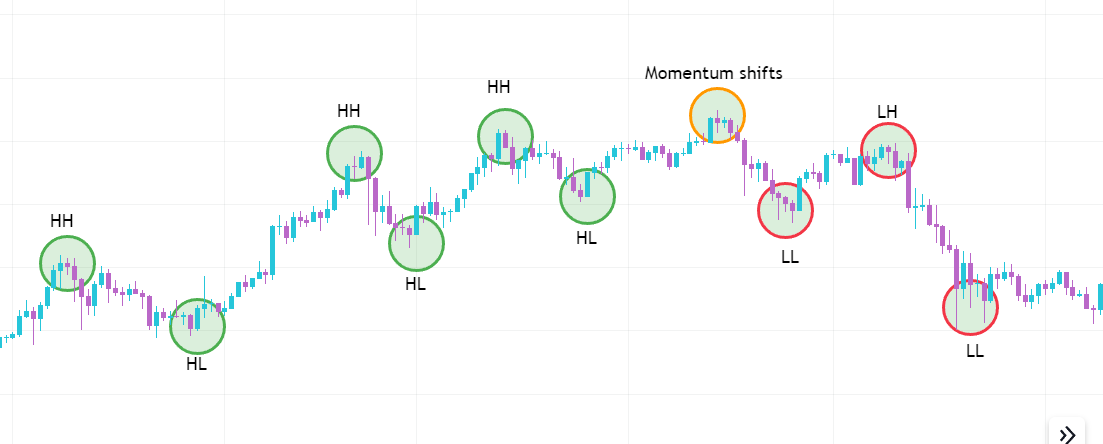

1/ Market Cycles are a simple framework to make sense of common market patterns. People have different terms ways to explain market cycles but in Wyckoff's method, you have

- Accumulation

- Mark up

- Distribution

- Mark down

- Accumulation

- Mark up

- Distribution

- Mark down

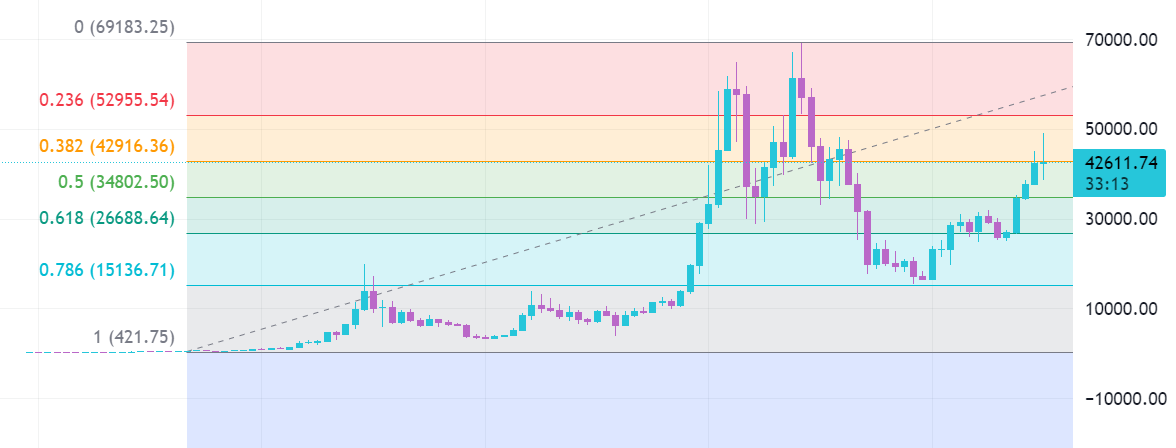

3/ Using the BTC ETF as an example, people bought into the upcoming news because

- The ETF news could bring in new institutional money to BTC.

- A spot ETF listing would bring more legitimacy to Crypto as an alternative asset class.

- The ETF news could bring in new institutional money to BTC.

- A spot ETF listing would bring more legitimacy to Crypto as an alternative asset class.

4/ The main word here is "could." There are no guarantees that this could actually but it doesn't matter as long as the speculative value was there.

The more bullish the market is, the more leeway there is for speculation.

The more bullish the market is, the more leeway there is for speculation.

7/ When you see consolidation after the mark up, this is prime time for alts to shine. Since early buyers are now "richer," there is more liquidity in the markets which means more money to throw into new alt narratives.

9/ Now that early buyers are "richer," greed tells us that people will take the profit and potentially roll it in to other assets that haven't pumped as much. This is usually what leads to the infamous altcoin rallies.

11/ Eventually the selling is no longer rational. People are calling for price to go lower but BTC starts a new accumulation phase.

This is where the best opportunity, but it's hard to buy because everyone will tell you otherwise. Cut out the noise and look at the stats.

This is where the best opportunity, but it's hard to buy because everyone will tell you otherwise. Cut out the noise and look at the stats.

13/ With that said, markets are not predictable. Instead of viewing this as a rigid structure, adapting this into a mental framework can help you spot when the odds are in your favor.

When the trend is in your favor, profits multiply and trading losses become smaller.

When the trend is in your favor, profits multiply and trading losses become smaller.

14/ As a whole, the best periods to pay attention are

- When an asset is below its fair value due to irrational selling

- when there is momentum in the early stages of an uptrend

- when liquidity enters a new narrative.

- When an asset is below its fair value due to irrational selling

- when there is momentum in the early stages of an uptrend

- when liquidity enters a new narrative.

If you enjoyed this thread, a Like, Follow, & Retweet helps out a lot!

This thread is for entertainment purposes only. Not Financial Advice.

This thread is for entertainment purposes only. Not Financial Advice.

Loading suggestions...