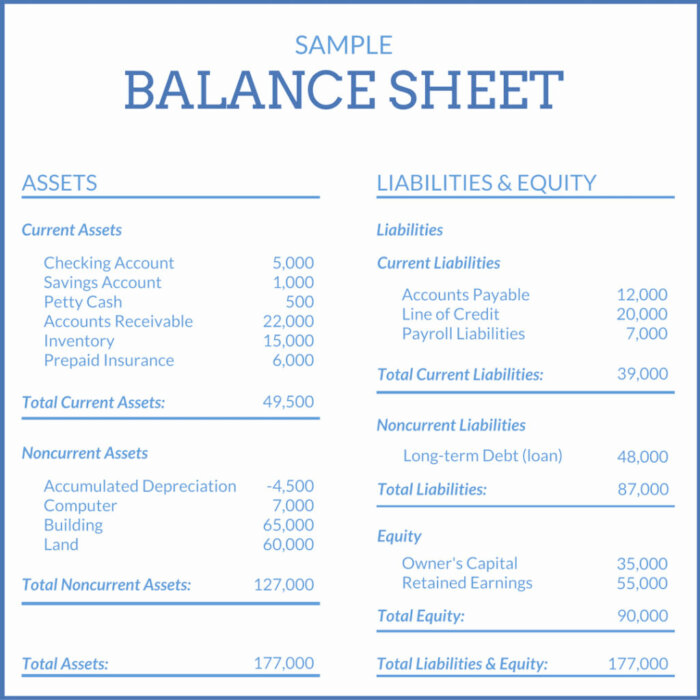

The balance sheet shows you 3 things:

1️⃣ Assets

2️⃣ Liabilities

3️⃣ Shareholders equity

1️⃣ Assets

2️⃣ Liabilities

3️⃣ Shareholders equity

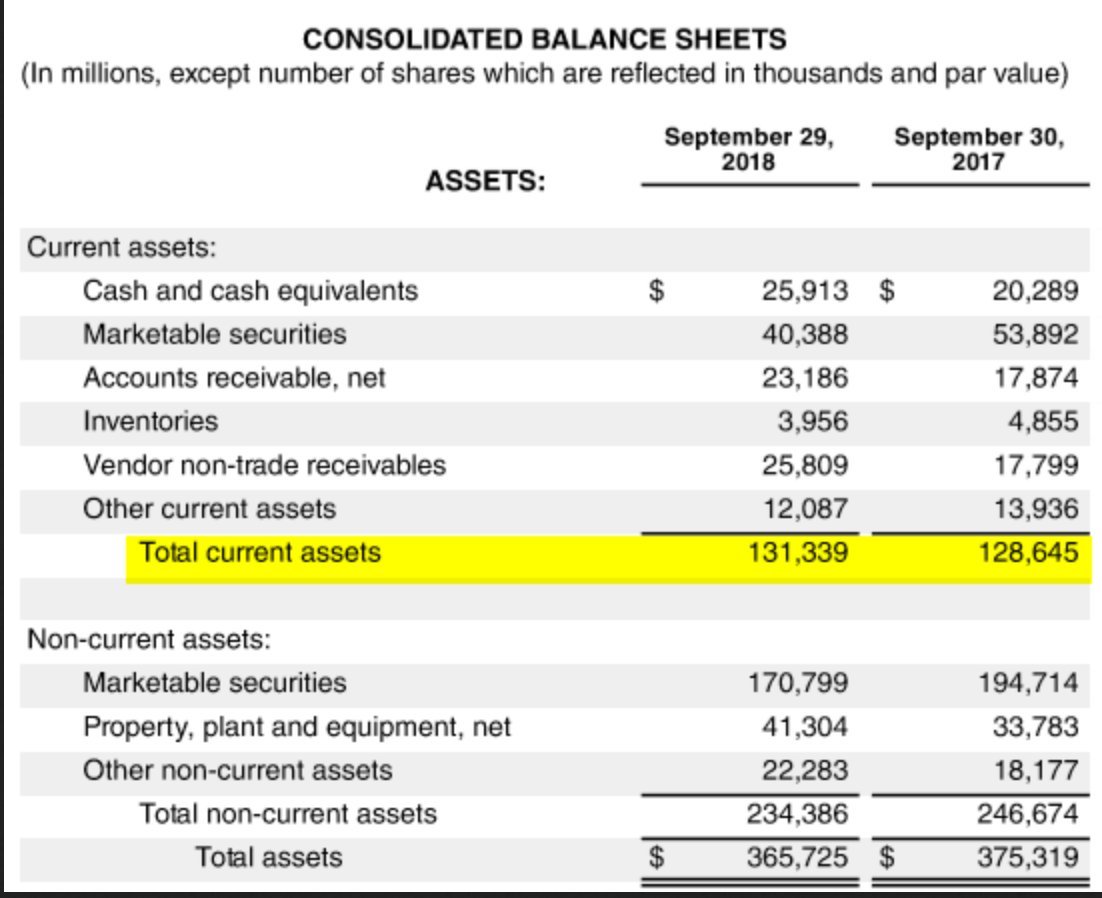

Questions to ask yourself about the company's assets:

1️⃣ How much cash and cash equivalents does the company have?

2️⃣ How much goodwill does the company have?

3️⃣ Does the company have a lot of intangible assets?

1️⃣ How much cash and cash equivalents does the company have?

2️⃣ How much goodwill does the company have?

3️⃣ Does the company have a lot of intangible assets?

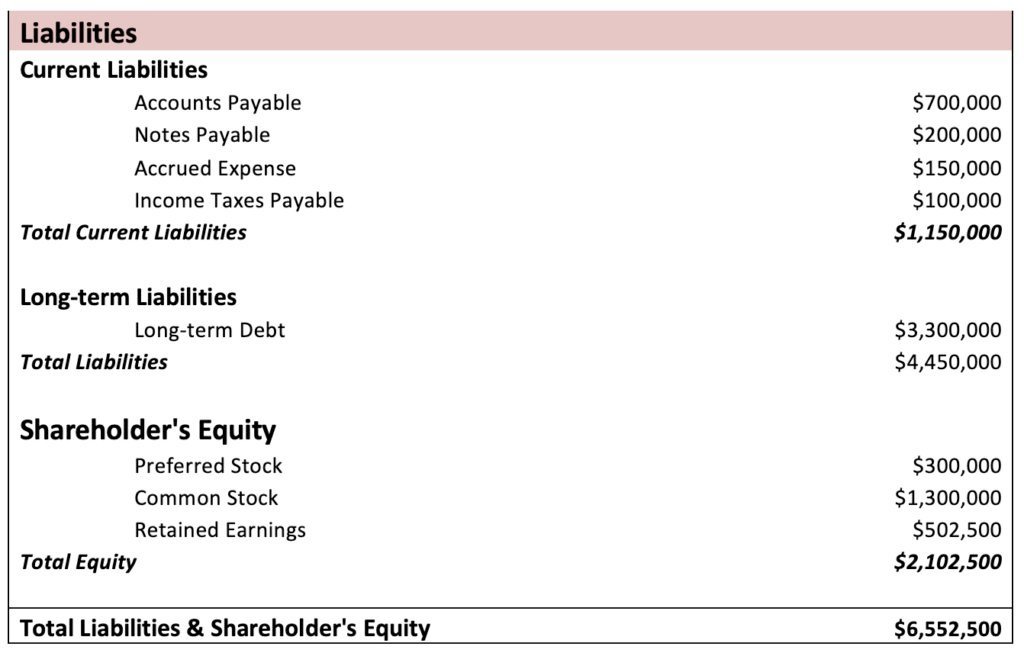

Questions to ask yourself about the company's liabilities:

1️⃣ Does the company have more ST or LT liabilities?

2️⃣ Does the company have more cash than short-term debt?

3️⃣ Are total liabilities increasing or decreasing? And why?

1️⃣ Does the company have more ST or LT liabilities?

2️⃣ Does the company have more cash than short-term debt?

3️⃣ Are total liabilities increasing or decreasing? And why?

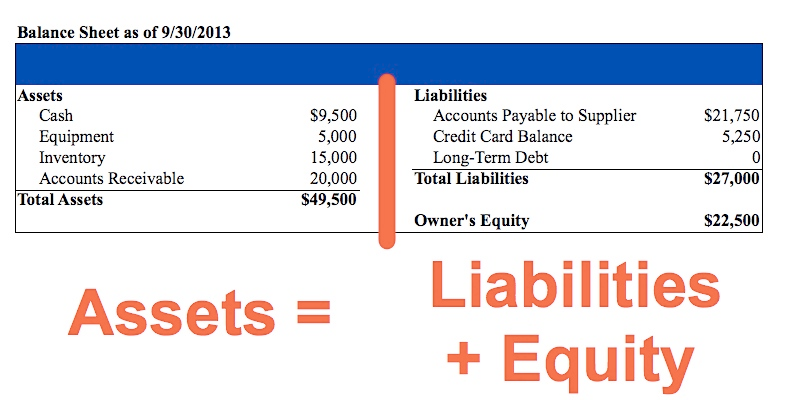

Questions to ask yourself about the company's shareholders equity:

1️⃣ Does the company have retained earnings?

2️⃣ Are there a lot of preferred stocks?

3️⃣ Does the company buy back shares?

1️⃣ Does the company have retained earnings?

2️⃣ Are there a lot of preferred stocks?

3️⃣ Does the company buy back shares?

That's it for today.

If you liked this, you'll love my free Financial Analysis course.

Grab it here: compounding-quality.ck.page

If you liked this, you'll love my free Financial Analysis course.

Grab it here: compounding-quality.ck.page

Loading suggestions...