Questions to ask yourself:

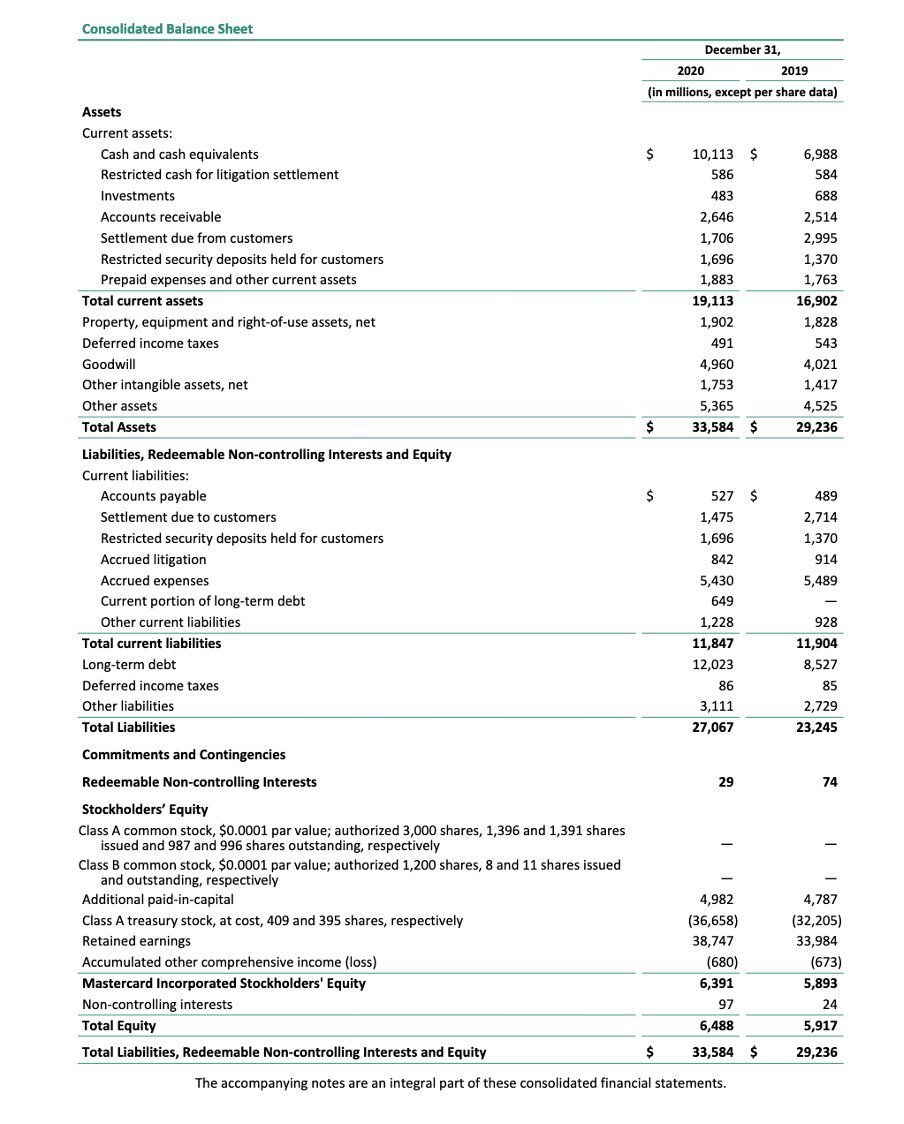

1️⃣ Does the company have a lot of debt?

2️⃣ How much cash does the company have?

3️⃣ How much goodwill has the company compared to its total assets?

1️⃣ Does the company have a lot of debt?

2️⃣ How much cash does the company have?

3️⃣ How much goodwill has the company compared to its total assets?

Questions to ask yourself:

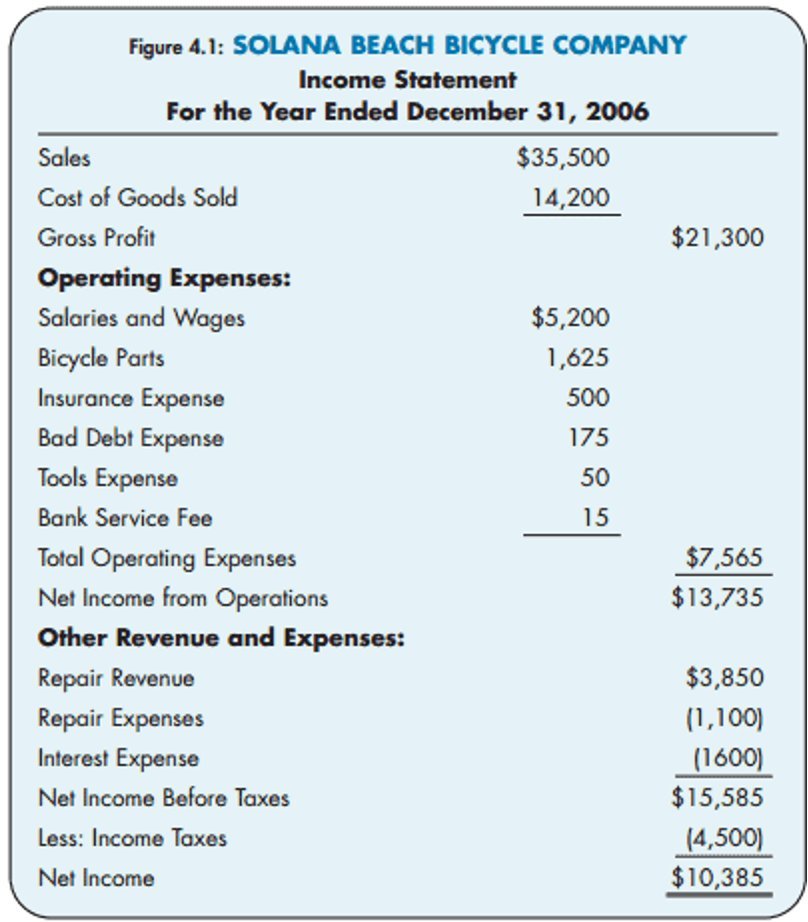

1️⃣ Is the company already profitable?

2️⃣ Does the company have a lot of costs of goods sold compared to its sales?

3️⃣ How much of the sales are translated into profit (net income)?

1️⃣ Is the company already profitable?

2️⃣ Does the company have a lot of costs of goods sold compared to its sales?

3️⃣ How much of the sales are translated into profit (net income)?

Questions to ask yourself:

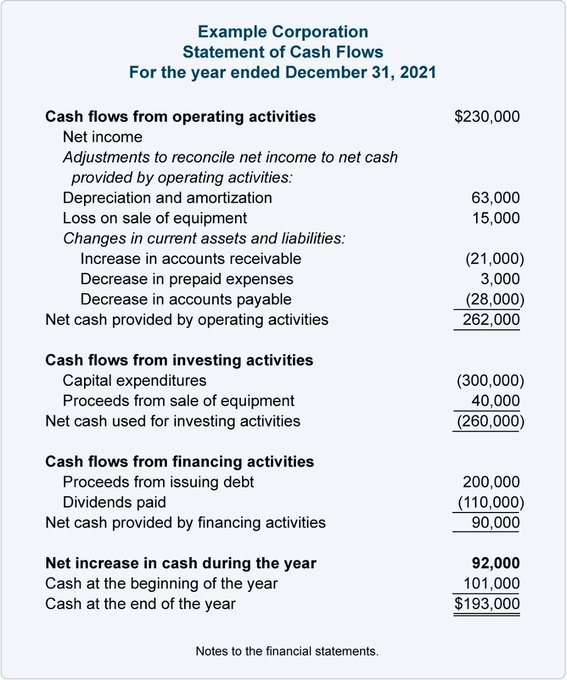

1️⃣ Are most earnings translated into operating cash flow?

2️⃣ Does the company have a positive free cash flow (operating cash flow – CAPEX)?

3️⃣ Did the company manage to increase its cash position compared to last year?

1️⃣ Are most earnings translated into operating cash flow?

2️⃣ Does the company have a positive free cash flow (operating cash flow – CAPEX)?

3️⃣ Did the company manage to increase its cash position compared to last year?

That's it for today.

If you liked this, you'll LOVE my free Financial Analysis course.

Grab it here: compounding-quality.ck.page

If you liked this, you'll LOVE my free Financial Analysis course.

Grab it here: compounding-quality.ck.page

Loading suggestions...