From Glory to Governance Gaps: Unmasking the Gold Curtains of Rajesh Exports

#Forensic Analysis covering

Financial Discrepancies amounting to 25% of Balance Sheet Size

RPTs Disclosure Lapses

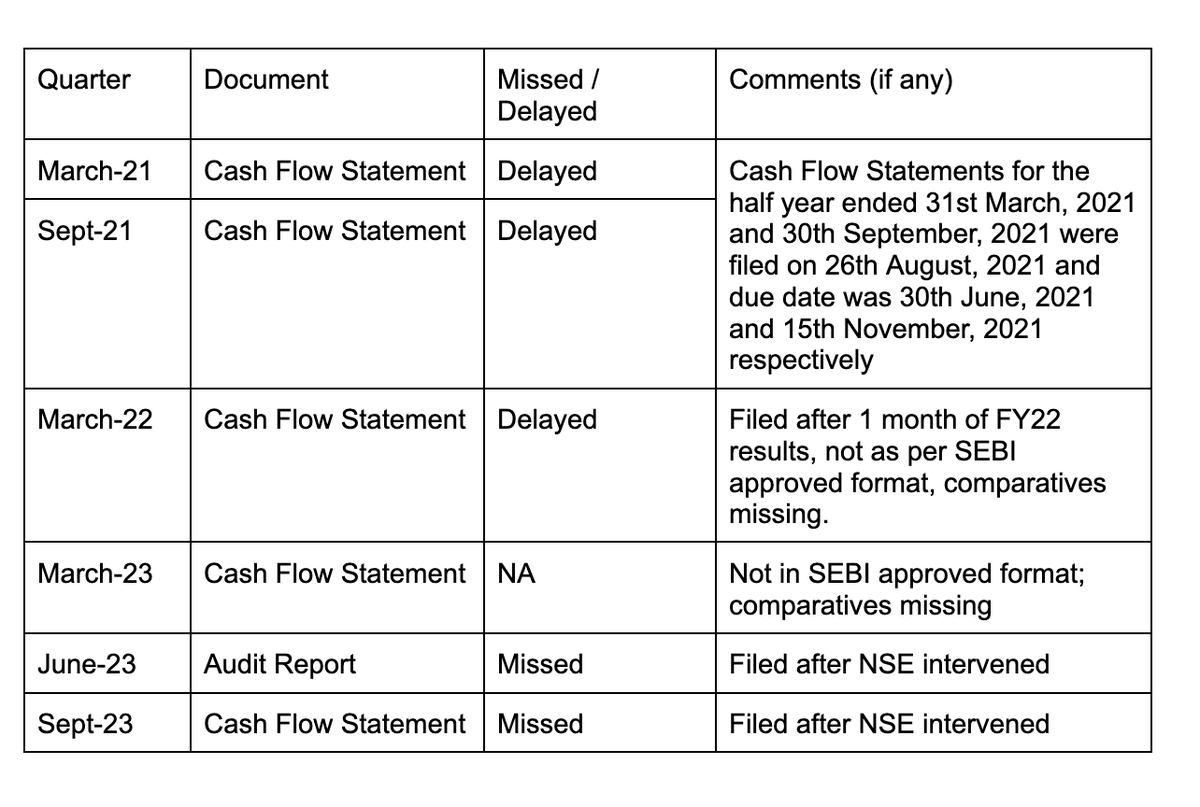

Persistent delay in filing cash flows statement & audit report

Thread🧵

#Forensic Analysis covering

Financial Discrepancies amounting to 25% of Balance Sheet Size

RPTs Disclosure Lapses

Persistent delay in filing cash flows statement & audit report

Thread🧵

Before we move to summary :

Do subscribe to thecore.in which brings you exclusive reporting, insights & views on business, manufacturing and technology.

@the_core_in has published full forensic analysis done by us here:

thecore.in

@govindethiraj

Do subscribe to thecore.in which brings you exclusive reporting, insights & views on business, manufacturing and technology.

@the_core_in has published full forensic analysis done by us here:

thecore.in

@govindethiraj

thecore.in/finance/behind…

Governance Lapses, Murky Books: Behind The Falling Credibility Of …

The company’s market capitalisation today stands at a little over Rs 10,000 crore, after a value des...

thecore.in

The Core: Reporting, Insights & Views

The Core is an online publication that provides insights and investigations on mainstream business a...

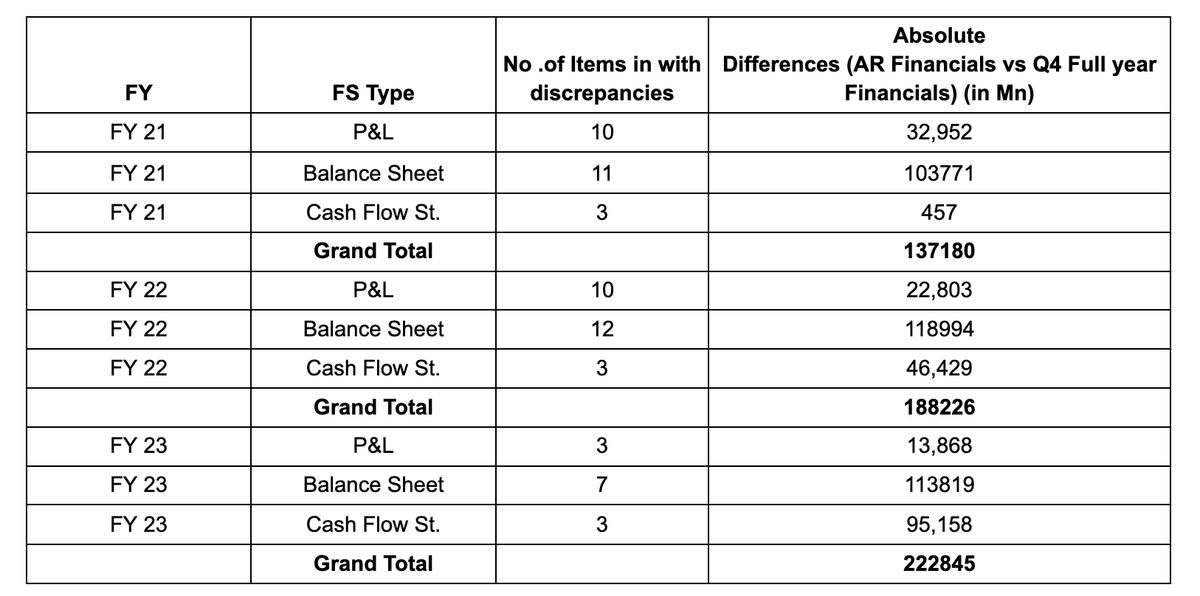

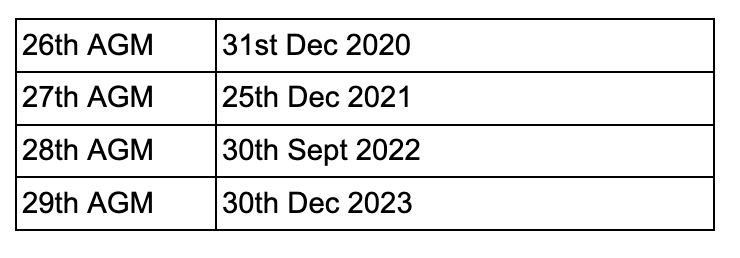

2. Financial Inconsistencies Persist: Three Consecutive Years of Discrepancies (FY20 to FY23)

Rajesh Exports' preliminary full-year financials released during Q4 do not align with the final financials published in the Annual Report.

This uncommon and serious red flag in a large-cap company raises questions about the correctness, completeness, and genuineness of the financials. Almost all financial items have discrepancies.

Below table summarizes the discrepancies amounting to INR 5,48,251 Million (almost 25% of the its balance sheet size).

Rajesh Exports' preliminary full-year financials released during Q4 do not align with the final financials published in the Annual Report.

This uncommon and serious red flag in a large-cap company raises questions about the correctness, completeness, and genuineness of the financials. Almost all financial items have discrepancies.

Below table summarizes the discrepancies amounting to INR 5,48,251 Million (almost 25% of the its balance sheet size).

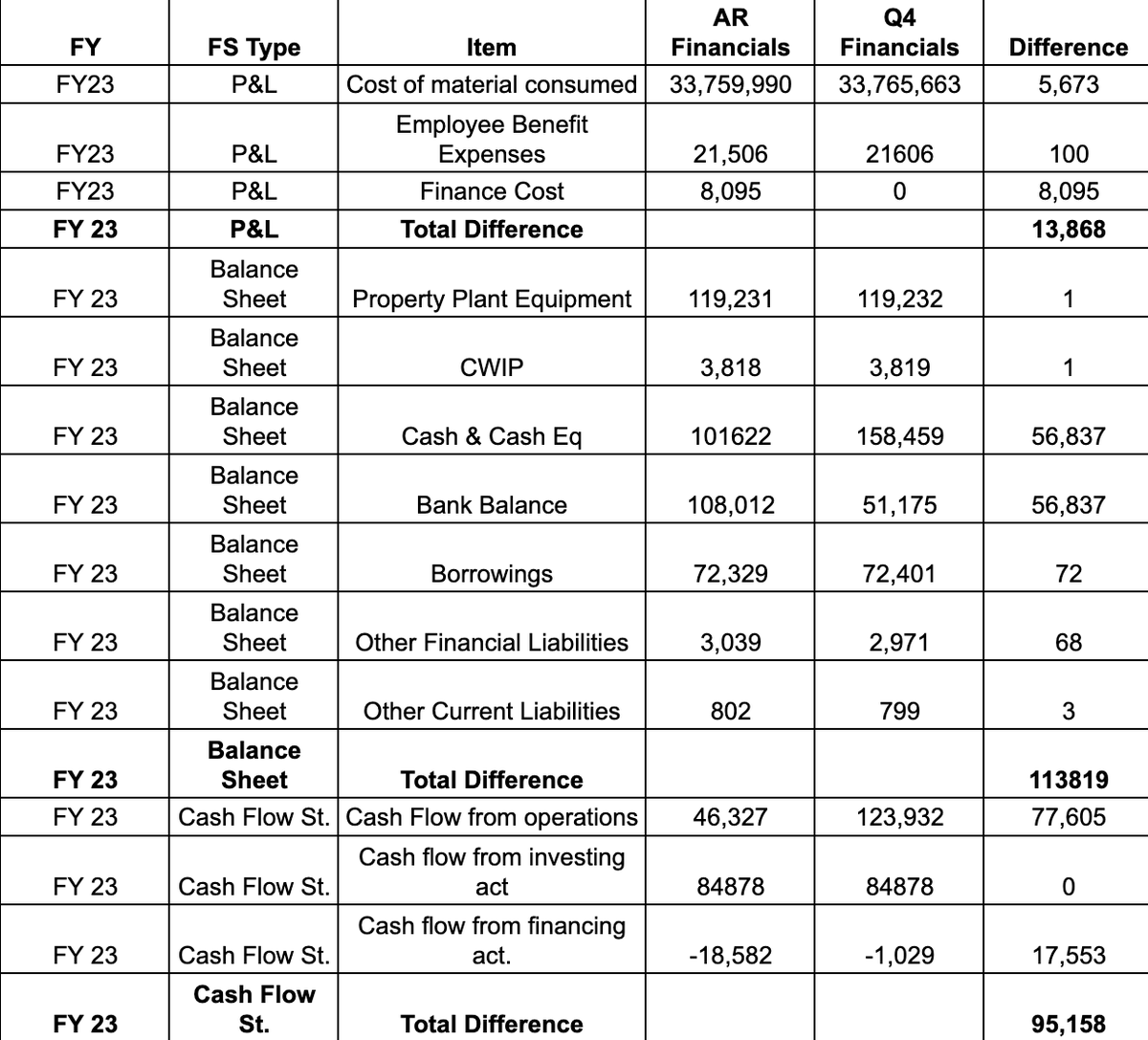

A sample FY23 discrepancy is attached for reference

Detailed discrepancies can be accessed here : #gid=0" target="_blank" rel="noopener" onclick="event.stopPropagation()">docs.google.com

Detailed discrepancies can be accessed here : #gid=0" target="_blank" rel="noopener" onclick="event.stopPropagation()">docs.google.com

3. Is employee benefit expenses inflated? Is the number of employees depleted?

Employee benefit expenses amount to INR 215 crores for 141 employees, therefore each employee is earning around INR 1.5 crore per annum ( INR 1.3 cr if considered on salary & wages). This is obviously quite high as compared to industry norms.

What raises eyebrows is that the company stated in their annual reports that no employee is entitled to receive emoluments of more than INR 60 lacs per annum.

Employee benefit expenses amount to INR 215 crores for 141 employees, therefore each employee is earning around INR 1.5 crore per annum ( INR 1.3 cr if considered on salary & wages). This is obviously quite high as compared to industry norms.

What raises eyebrows is that the company stated in their annual reports that no employee is entitled to receive emoluments of more than INR 60 lacs per annum.

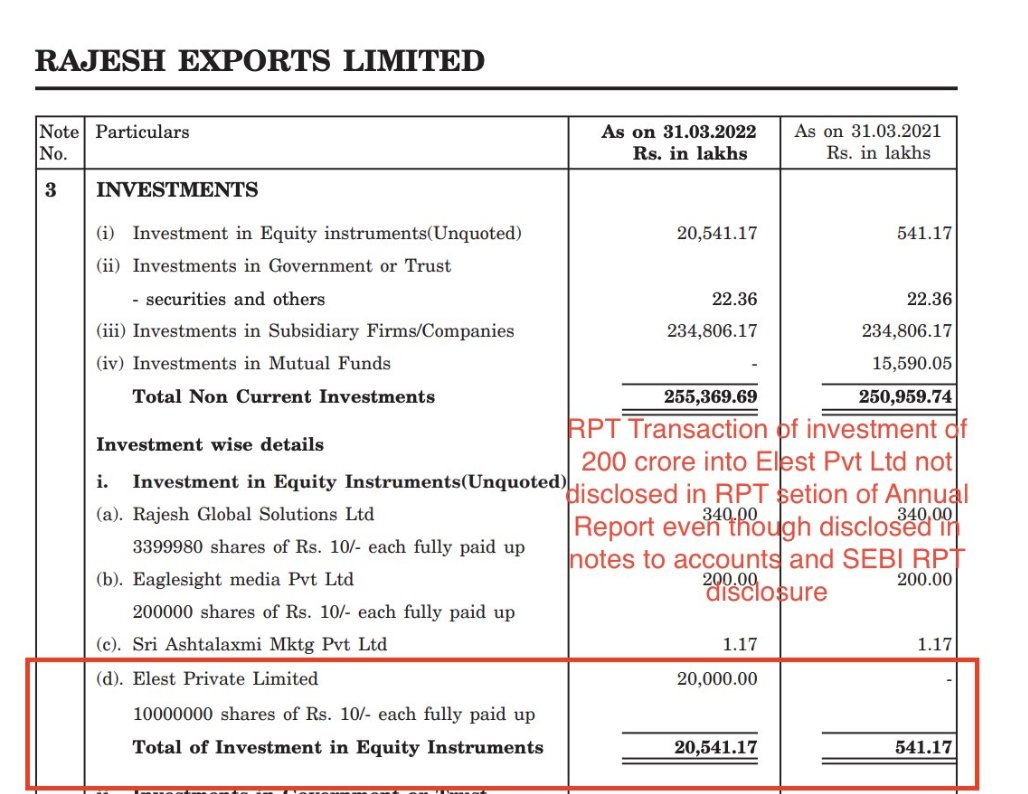

4. RPT disclosure lapses

In multiple exchange filings on related party disclosures the company has said they don’t have any related party transactions. While regulation also required disclosure of related balances too.

Looking at multiple transactions in the annual report, it is observed that the company has multiple related party transactions and balances. Ex - A 200 cr investment into a promoter-related entity was not disclosed in 6 month RPT disclosures

In multiple exchange filings on related party disclosures the company has said they don’t have any related party transactions. While regulation also required disclosure of related balances too.

Looking at multiple transactions in the annual report, it is observed that the company has multiple related party transactions and balances. Ex - A 200 cr investment into a promoter-related entity was not disclosed in 6 month RPT disclosures

5. Incomplete details on group companies in MCA form

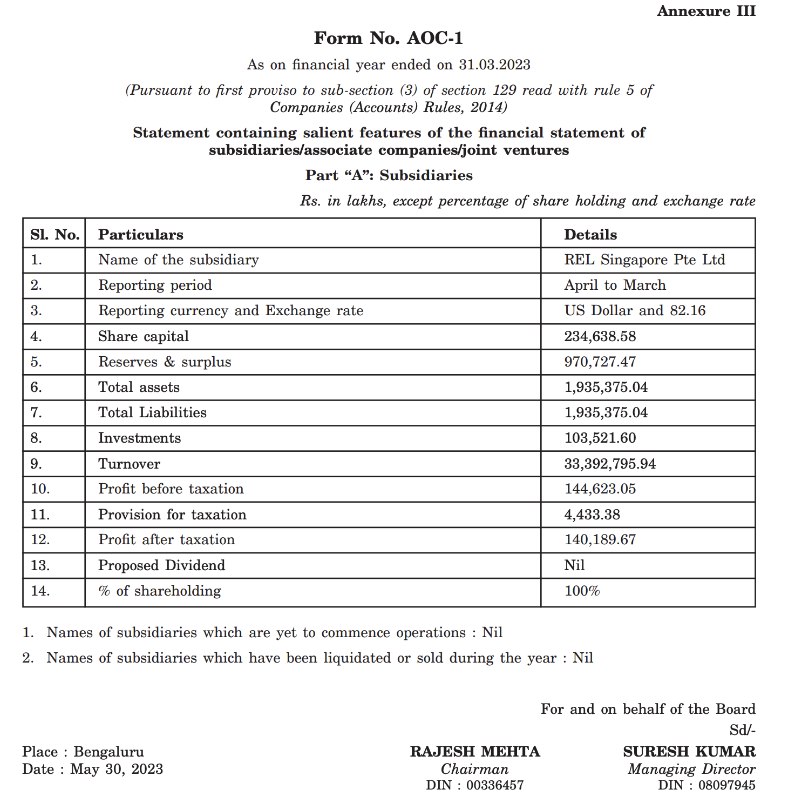

There are multiple subsidiaries and associate entities mentioned in the various transactions in annual report but Form AOC-1 which gives details of subsidiaries, JVs, and associated companies has disclosed only one subsidiary

Non-disclosure of :

Global Refineries SA

ACC Energy Storage Pvt Ltd

There are multiple subsidiaries and associate entities mentioned in the various transactions in annual report but Form AOC-1 which gives details of subsidiaries, JVs, and associated companies has disclosed only one subsidiary

Non-disclosure of :

Global Refineries SA

ACC Energy Storage Pvt Ltd

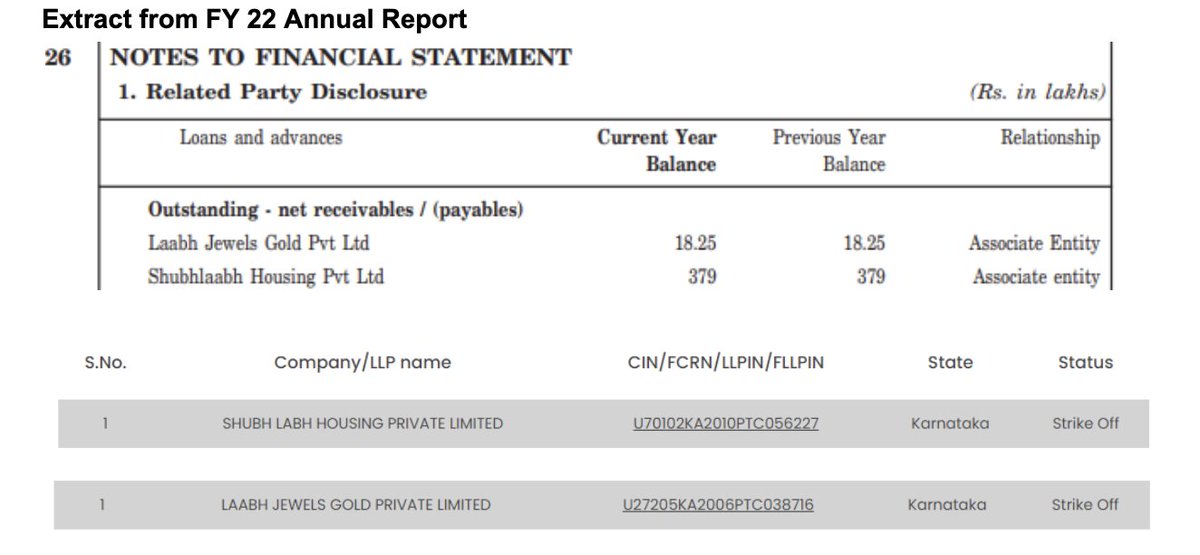

7. Unsettled Receivables Balances with Struck-Off Companies Yet to be Written Off

In the related party disclosure, two balances from affiliated companies, Laabh Jewels Gold Pvt Ltd and Shubhlaabh Housing Pvt Ltd, are struck off. Despite this, the receivable balances from these companies have not been written off and are still reflected as outstanding.

In the related party disclosure, two balances from affiliated companies, Laabh Jewels Gold Pvt Ltd and Shubhlaabh Housing Pvt Ltd, are struck off. Despite this, the receivable balances from these companies have not been written off and are still reflected as outstanding.

8. On the CSR front - the company has not spent 2% of its PAT on CSR for consecutively two years because of a lack of CSR projects.

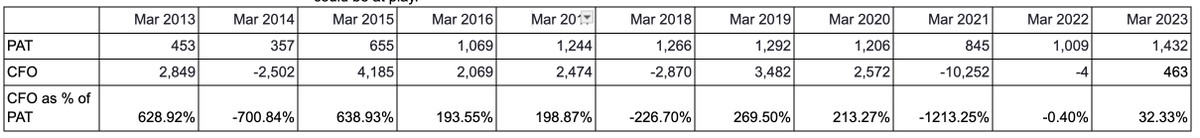

10. Cash Flow from operations as a % of Profit after Tax ideally should be between 80% to 120%.

A company's accounting profits should seamlessly convert into cash flows. An unsettling ratio, particularly a low CFO/PAT significantly below one, should spark concerns about the company's practices.

Possible issues include the adoption of aggressive revenue recognition techniques and an extended credit period to customers in anticipation of inflating revenue figures could be at play.

A company's accounting profits should seamlessly convert into cash flows. An unsettling ratio, particularly a low CFO/PAT significantly below one, should spark concerns about the company's practices.

Possible issues include the adoption of aggressive revenue recognition techniques and an extended credit period to customers in anticipation of inflating revenue figures could be at play.

Rajesh Exports, once a shining star in the gold market, now stands as a cautionary tale of governance pitfalls.

Despite its esteemed position, the company's descent from its peak market value is a glaring indicator of underlying issues.

This forensic analysis unravels a series of red flags, revealing a narrative of corporate governance lapses that demand investor scrutiny and caution.

Despite its esteemed position, the company's descent from its peak market value is a glaring indicator of underlying issues.

This forensic analysis unravels a series of red flags, revealing a narrative of corporate governance lapses that demand investor scrutiny and caution.

We spent months in covering these kinds of deep dives. This takes lot of resources, time and effort to bring this to retail investors.

All that's for FREE. So do consider sharing and following @BeatTheStreet10 🙏🙏🙏🙏🙏

Also do Retweet for wider coverage

x.com

All that's for FREE. So do consider sharing and following @BeatTheStreet10 🙏🙏🙏🙏🙏

Also do Retweet for wider coverage

x.com

Loading suggestions...