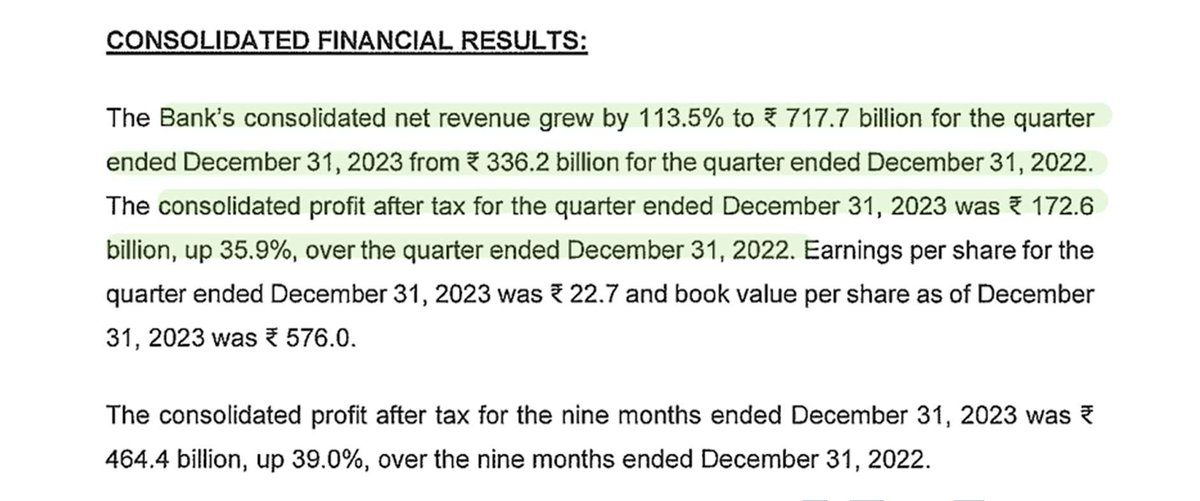

Everything looks hunky-dory.

Now let us go into details.

THE DEVIL IS IN THE DETAILS!!!

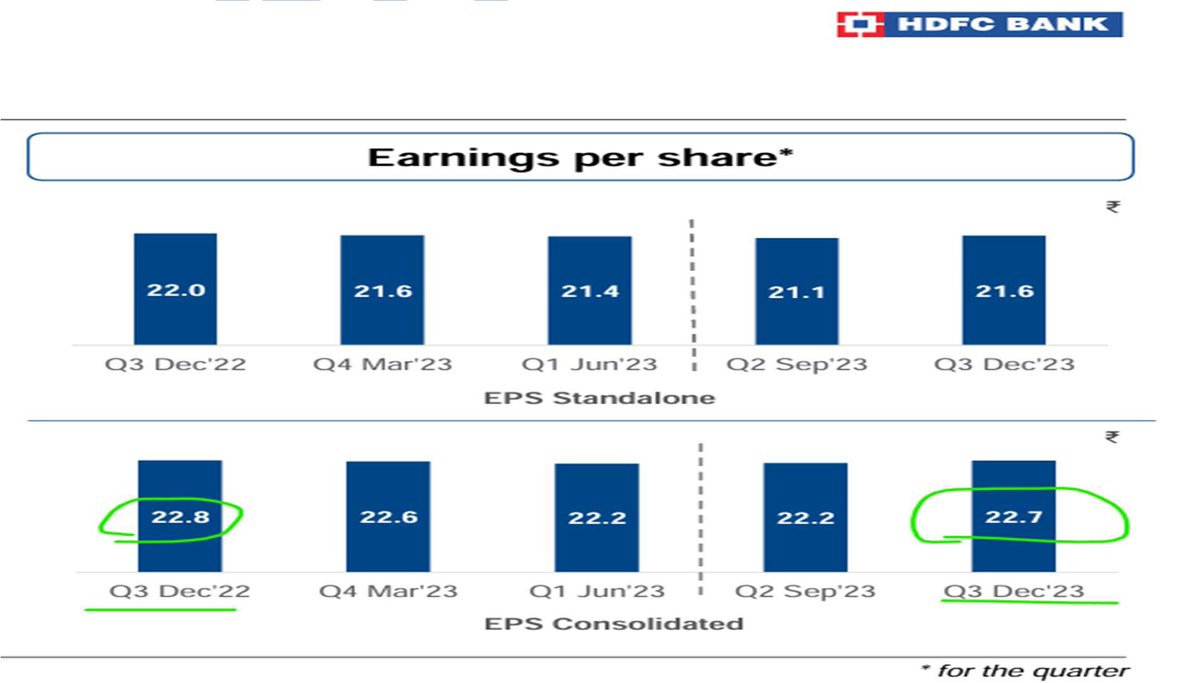

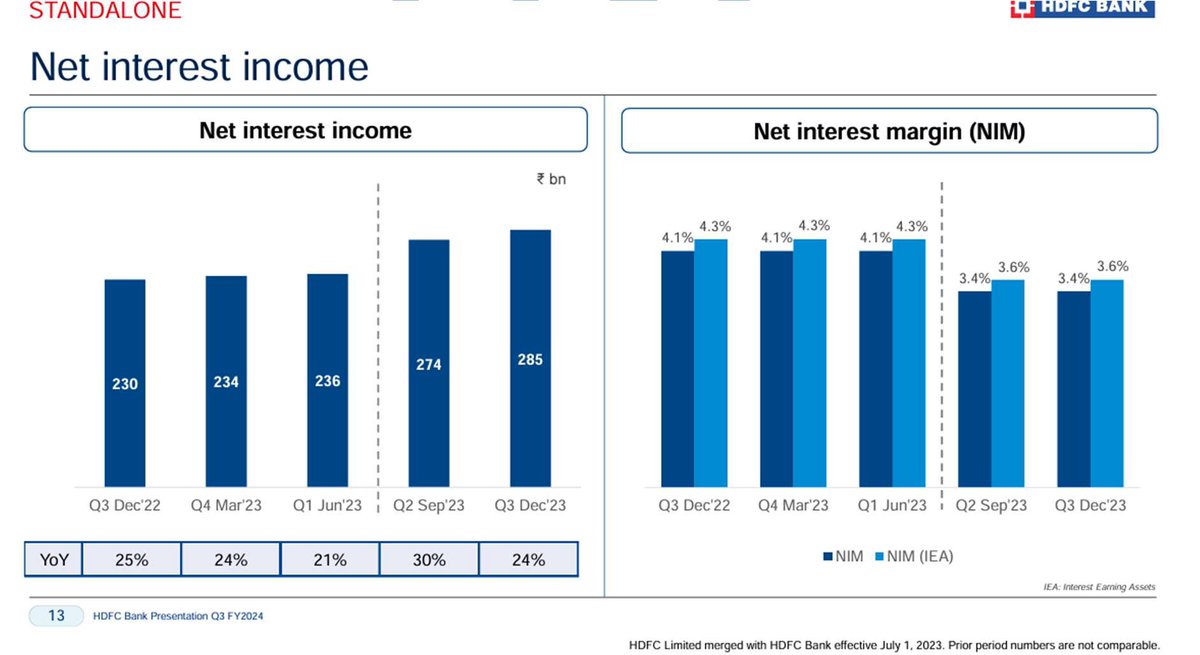

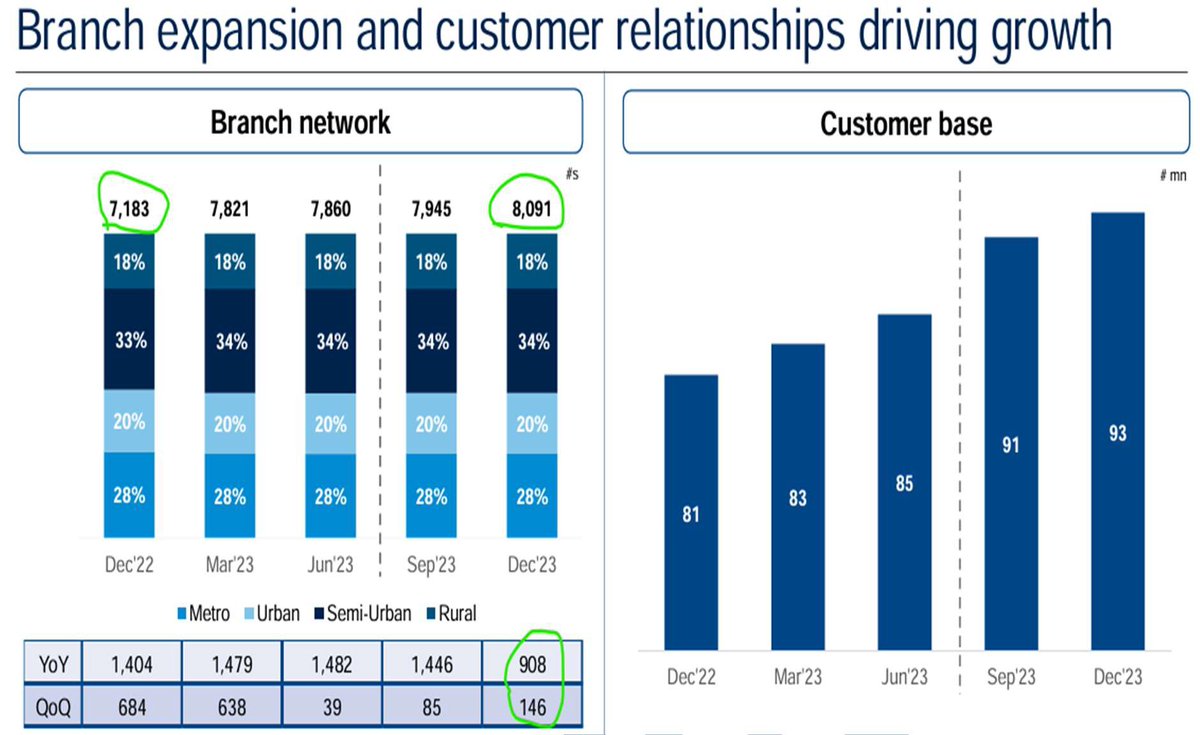

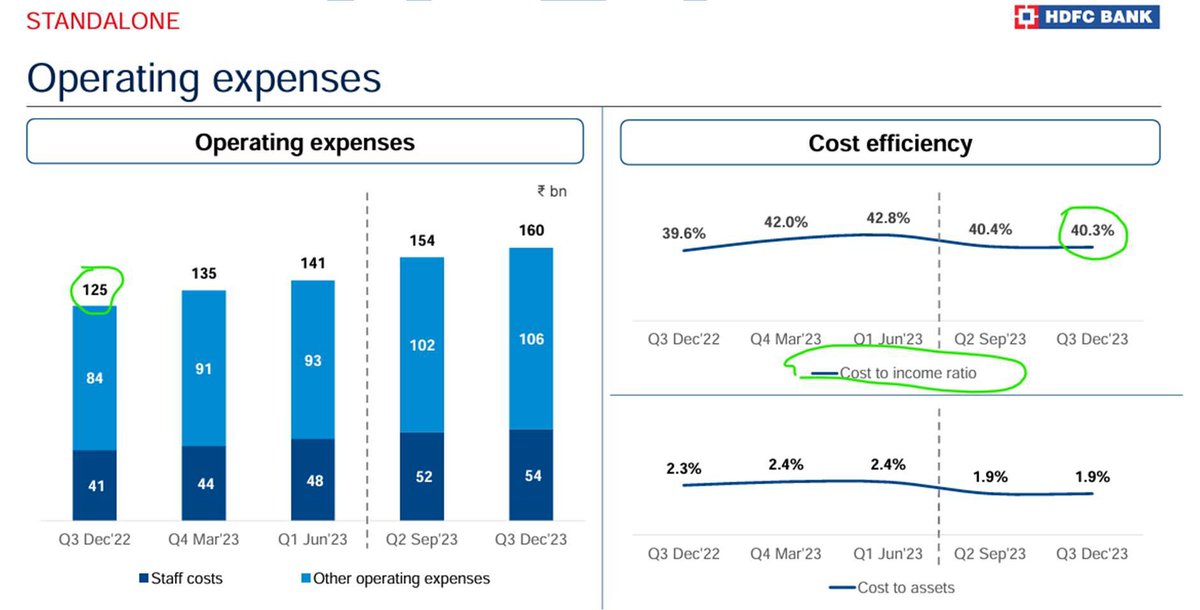

The above figure represents the results after the merger of HDFC twins. Post merger, the number of shares outstanding has gone up.

Now let us go into details.

THE DEVIL IS IN THE DETAILS!!!

The above figure represents the results after the merger of HDFC twins. Post merger, the number of shares outstanding has gone up.

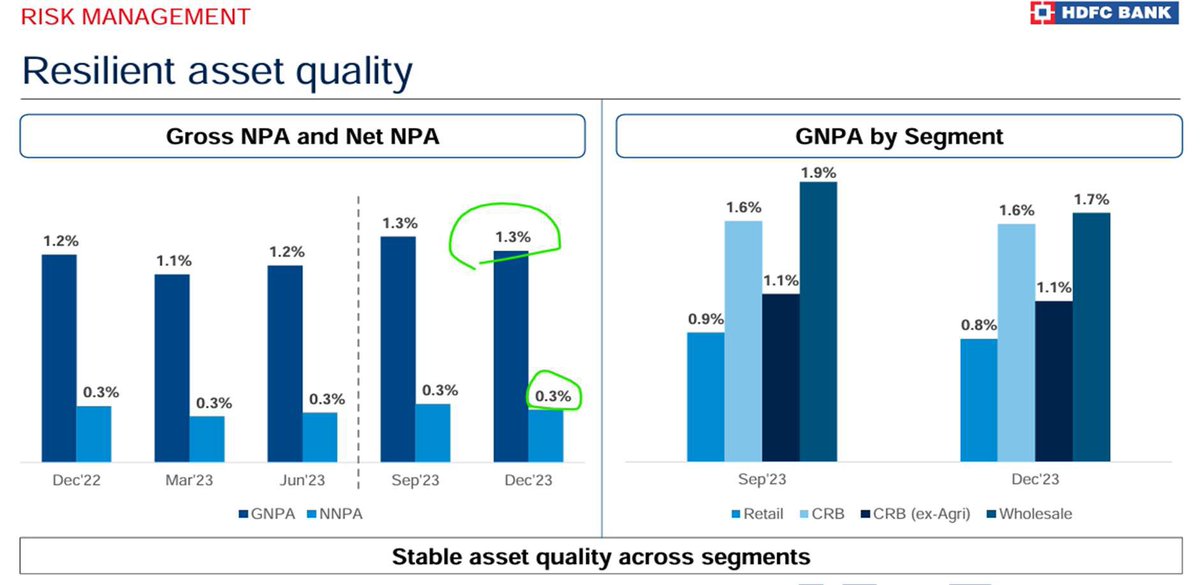

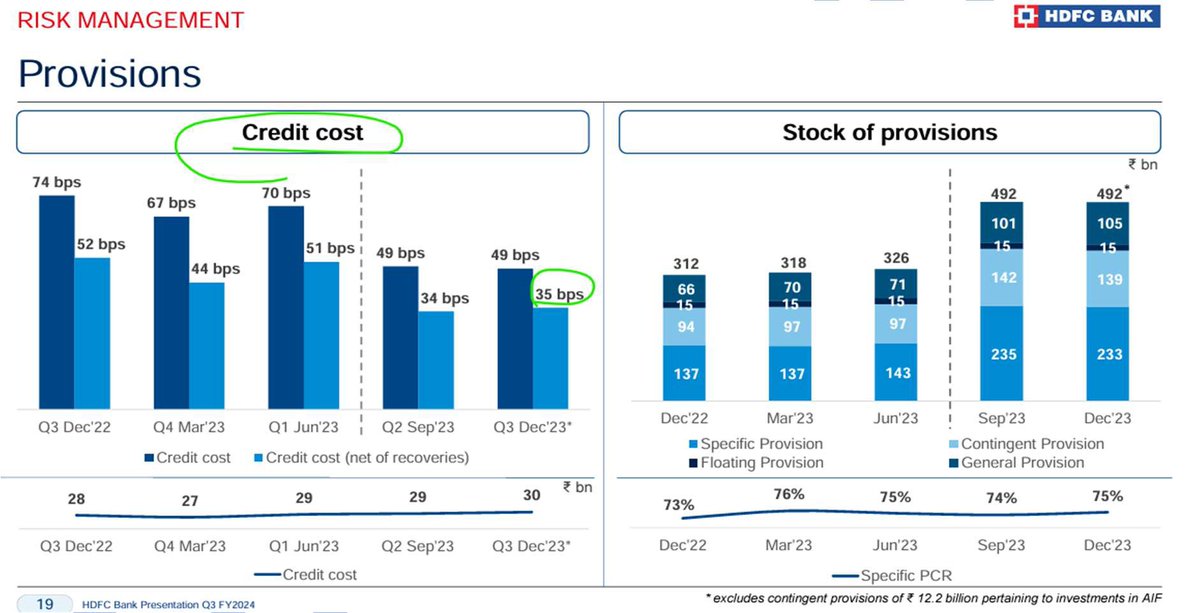

risk management:

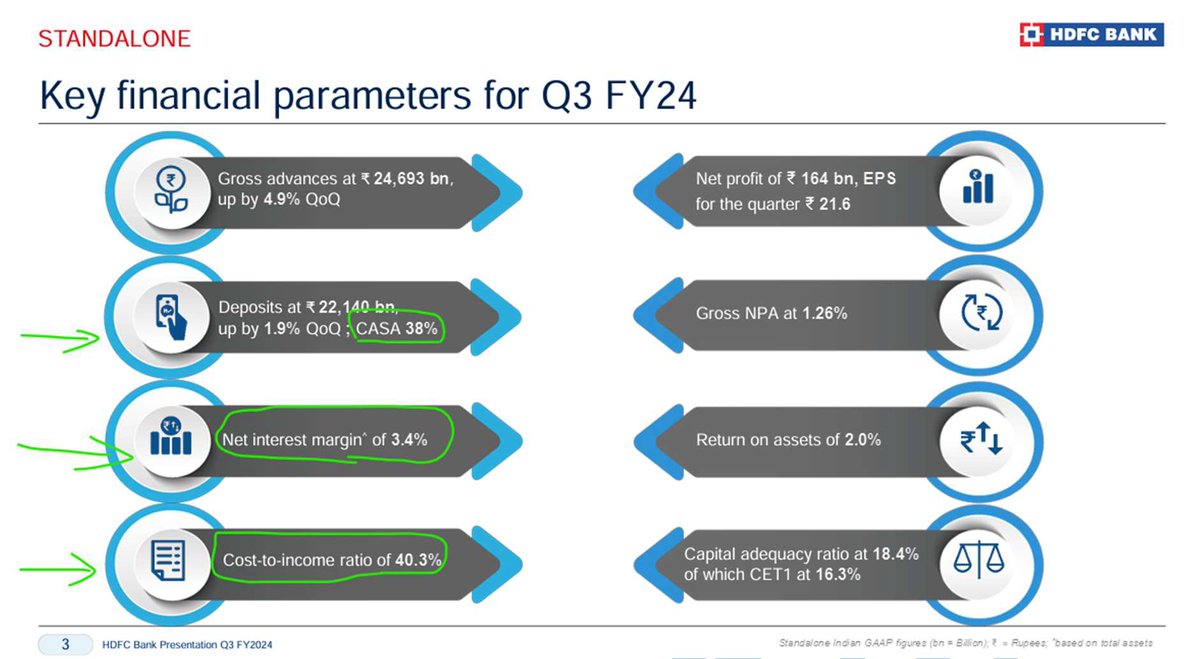

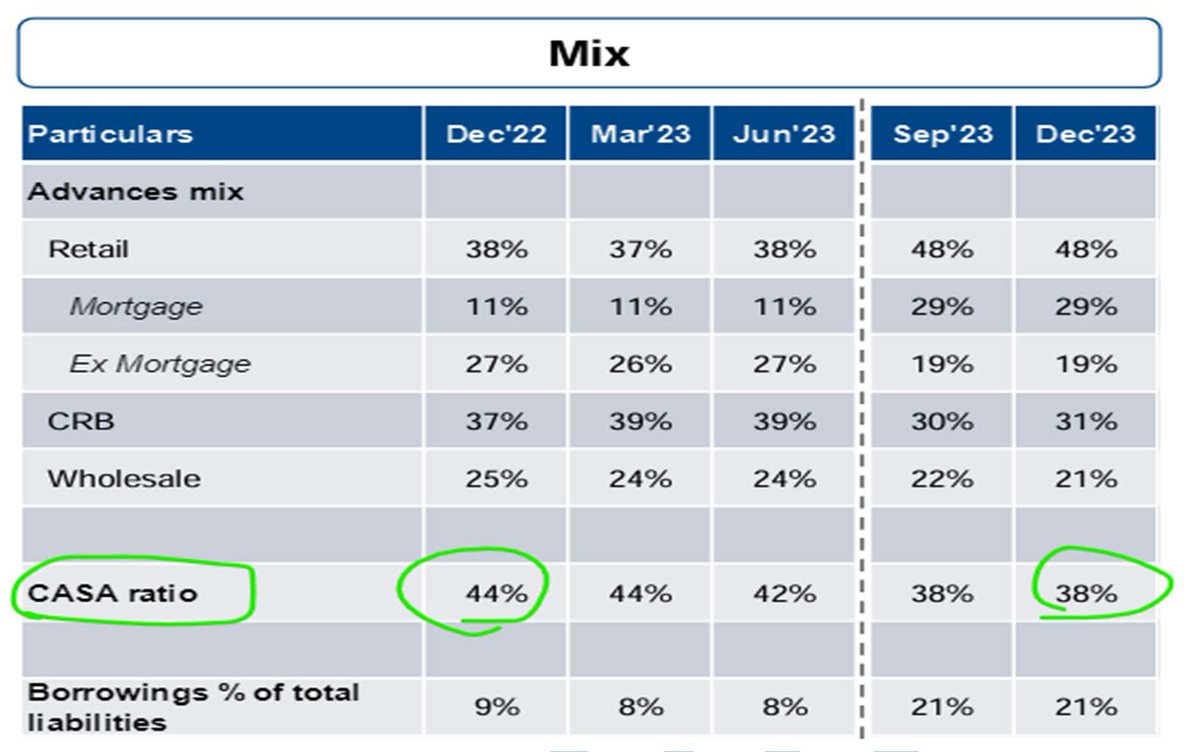

Regarding the aspect of asset quality HDFC Bank could be considered as the leader in the entire banking segment.

Its Net NPA accounts to 0.31% and the credit cost accounts to 0.35%.

HDFC Bank might start earning better Net Interest Margins and a better Cost to Income factor once the interest rates start going down.

#hdfcbank

Regarding the aspect of asset quality HDFC Bank could be considered as the leader in the entire banking segment.

Its Net NPA accounts to 0.31% and the credit cost accounts to 0.35%.

HDFC Bank might start earning better Net Interest Margins and a better Cost to Income factor once the interest rates start going down.

#hdfcbank

#valuation

#HDFCBANK

We are valuating HDFC Bank using the “Present value of a growing perpetuity”

5yr Average of PAT (5 yrs including TTM) = 40705 cr

With a Discount rate of 7% and Growth rate of 5% the present

value of the growing perpetuity is

40705/(0.07-0.05) = 20,35,250 cr.

If we consider 50% margin of safety then the value will be 10,17,625 cr

The present Market cap of HDFC Bank is 11,31,000 cr.

So, the Bank is fairly valued even after considering the P/E and P/Bv values.

Its said - Buy a Dollar for Penny

its almost same case here.

More correction more value.

not a buy sell recommendation just analysis

#HDFCBANK

#HDFCBANK

We are valuating HDFC Bank using the “Present value of a growing perpetuity”

5yr Average of PAT (5 yrs including TTM) = 40705 cr

With a Discount rate of 7% and Growth rate of 5% the present

value of the growing perpetuity is

40705/(0.07-0.05) = 20,35,250 cr.

If we consider 50% margin of safety then the value will be 10,17,625 cr

The present Market cap of HDFC Bank is 11,31,000 cr.

So, the Bank is fairly valued even after considering the P/E and P/Bv values.

Its said - Buy a Dollar for Penny

its almost same case here.

More correction more value.

not a buy sell recommendation just analysis

#HDFCBANK

Loading suggestions...