🤓 BTC Launch Stats

First things first, how are the new spot-based Bitcoin ETFs are different from the other Bitcoin ETFs (futures-based) that have been trading for years?

First things first, how are the new spot-based Bitcoin ETFs are different from the other Bitcoin ETFs (futures-based) that have been trading for years?

As such, there's a huge amount of capital that's been waiting on the sidelines for this development and will use these new Bitcoin ETFs instead of the less desirable future-based ETFs that have been available

Because of this, many people (including myself) expect a surge of capital inflows into #Bitcoin over the coming weeks and months

Tens of billions of capital, maybe even hundreds.

Tens of billions of capital, maybe even hundreds.

One of the best ways to judge the validity of this thesis is to look at the actual trading of the ETFs themselves on the first days of existence

Just how much demand was there?

Let's talk facts not speculation.

Just how much demand was there?

Let's talk facts not speculation.

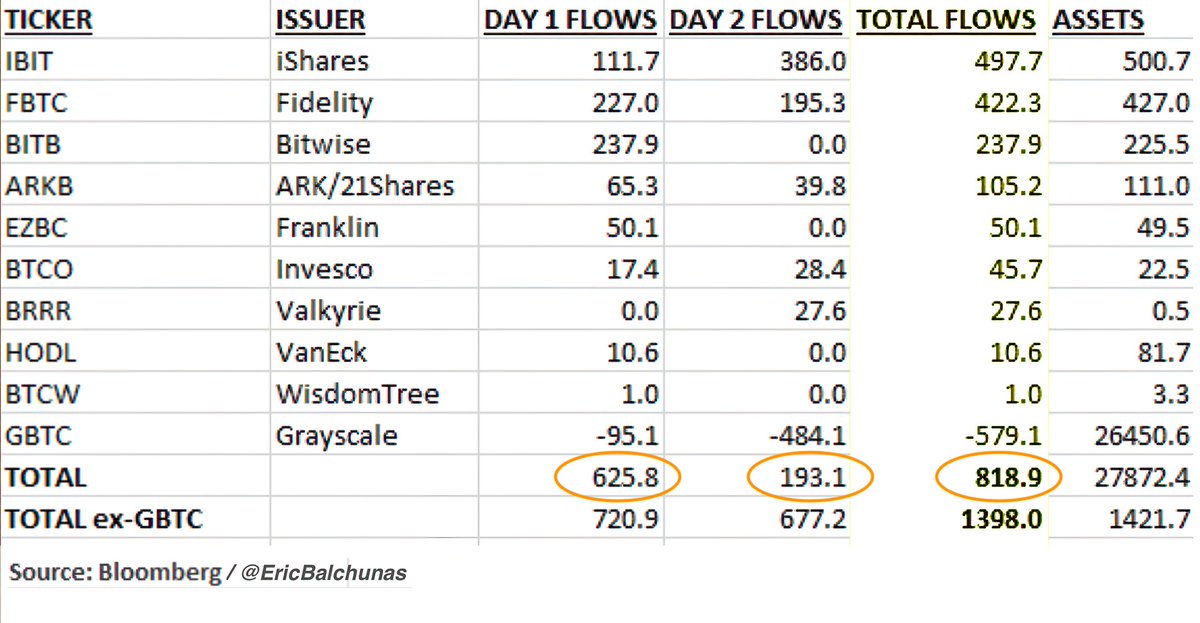

With some analytical insight this weekend from Bloomberg's Senior ETF expert Eric Balchunas (@EricBalchunas), we can extrapolate some findings

First, let's look at the total volume of trading in the first two days, to see the level of actual activity in these ETFs.

First, let's look at the total volume of trading in the first two days, to see the level of actual activity in these ETFs.

But we have to do a small adjustment here to get closer to the actual demand volume.

And so, we are going to subtract GBTC's volume from the total

Just trust me for a moment, we will get to why in a moment.

And so, we are going to subtract GBTC's volume from the total

Just trust me for a moment, we will get to why in a moment.

So, the total volume we will assume was actual new interest was $2.3B on Day 1 and $1.3B on Day 2, for a total of $3.6B in the first two days of trading

Still a whoa at first glance.

Still a whoa at first glance.

Not shown in the schedule above, IBIT traded 37 million shares on Day 1 and 23 million on Day 2, FBTC traded 17 million and 11 million

That's almost 90 million shares between those two ETFs in two days

And these are not penny stocks, with IBIT trading at $25 and FBTC at $38.

That's almost 90 million shares between those two ETFs in two days

And these are not penny stocks, with IBIT trading at $25 and FBTC at $38.

As Eric pointed out in a Tweet re: first day trading: "By all metrics: volume, # of trades, flows, media coverage it was smashing success, historical."

And the volumes in WisdomTree's BTCW, the tiniest of the crew, was larger than 95% of over 500 ETFs launched in the past year.

And the volumes in WisdomTree's BTCW, the tiniest of the crew, was larger than 95% of over 500 ETFs launched in the past year.

OK, so volume and attention was there. But what about actual investment?

Is there more capital in the Bitcoin ecosystem as a result of the ETFs yet?

In the 'wise' words of Jerry Maguire, 'show me the money!'

Is there more capital in the Bitcoin ecosystem as a result of the ETFs yet?

In the 'wise' words of Jerry Maguire, 'show me the money!'

Solid, but disappointing for many, as we were all looking for multiple billions of dollars to arrive on Day 1

But there are a number of factors we must consider that we may not have anticipated prior to the launch of these ETFs

We will outline those, too.

But there are a number of factors we must consider that we may not have anticipated prior to the launch of these ETFs

We will outline those, too.

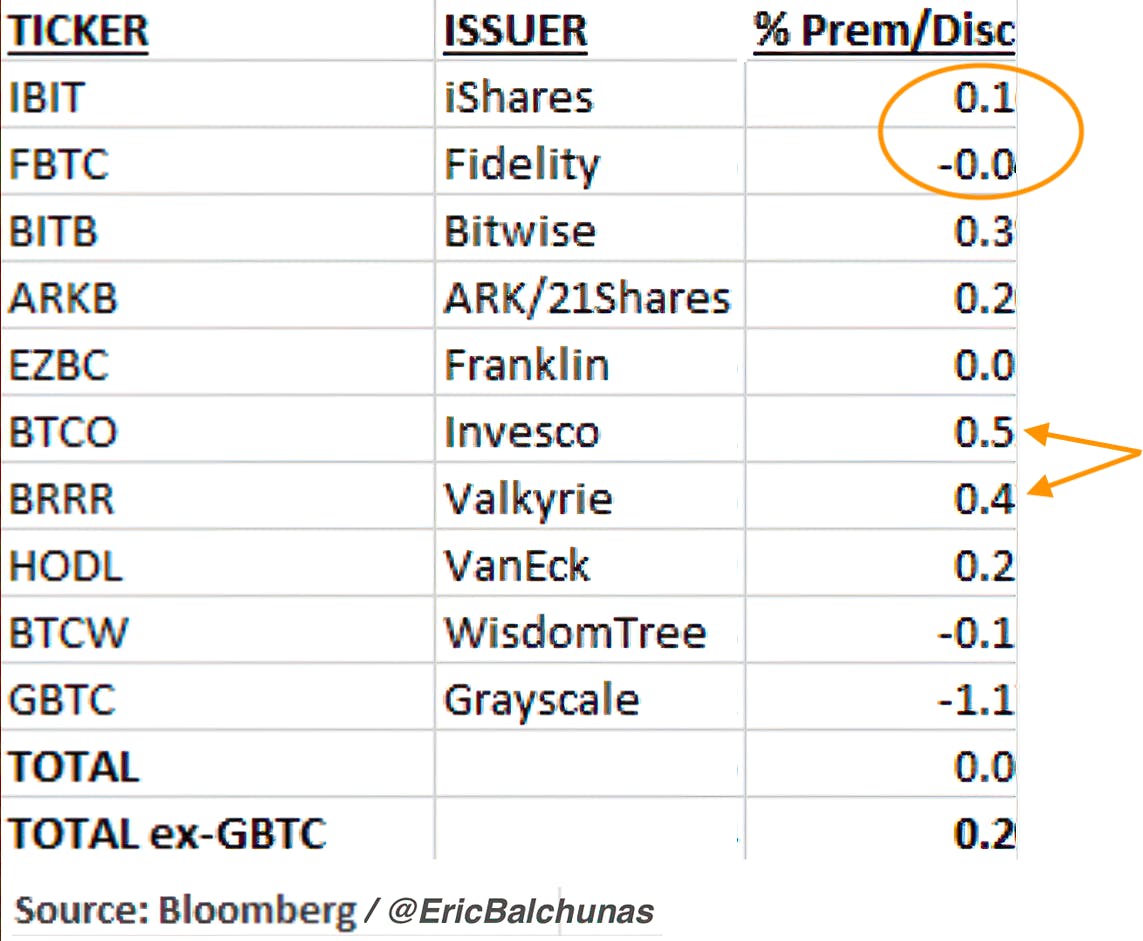

One metric that is less scientific but quite significant, is the actual market making of the ETFs and the amount of trading friction caused by moving in and out of them

As expected, each ETF had wide and volatile Bid/Ask spreads in the early hours of trading.

As expected, each ETF had wide and volatile Bid/Ask spreads in the early hours of trading.

This, however, decreased by both measures substantially over the course of the first two days

In fact, by the end of trading on Friday, I noticed that IBIT and FBTC each held just a penny or two spread in the Bid/Ask of their respective markets

Pretty remarkable, IMO

Why?

In fact, by the end of trading on Friday, I noticed that IBIT and FBTC each held just a penny or two spread in the Bid/Ask of their respective markets

Pretty remarkable, IMO

Why?

We'll keep this high level and simple, but basically, ETFs have both market makers (known as Authorized Participants) and actual investors who are buyers and sellers in the market each day.

Small Bid/Ask spreads means that the APs (market makers) were extremely comfortable with the ability to manage the liquidity inflow and outflow to keep spreads tight and allow for entry and exit fees (trading friction of buying and selling) quite low.

Looking further, we also see that the NAVs of each of these ETFs ended the second day extremely efficiently when compared to the underlying amount of Bitcoin they represent

Huh?

Huh?

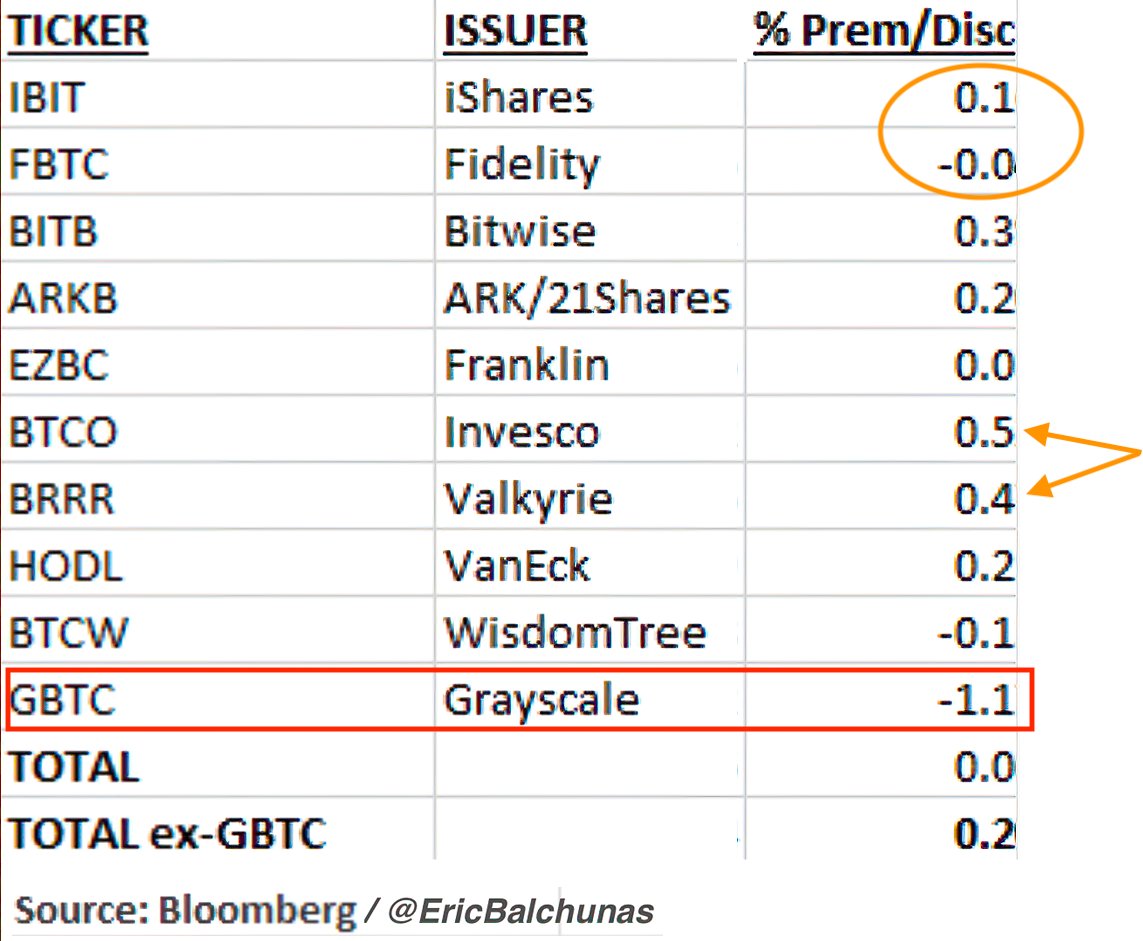

This means the launch was highly successful for all of these ETFs, with just Invesco and Valkyrie holding slight premiums to the underlying amount of Bitcoin held in each of their ETFs.

What's important here is the substantial benefit these ETFs now provide to those wanting exposure to actual #Bitcoin rather than the paper-settled futures version of BITO, which was expensive and lagged performance significantly over longer periods of time.

Even more importantly, it nearly completely closed the GBTC discount to actual #Bitcoin that holders had to endure, which fluctuated widely and was over 25% for long periods of time

In other words, a terrible proxy for Bitcoin itself

On that, let's talk about GBTC for a moment.

In other words, a terrible proxy for Bitcoin itself

On that, let's talk about GBTC for a moment.

😡 Unlocking GBTC

It's difficult to understand this week's activity without understanding the picture regarding GBTC

See, GBTC is now an ETF that was converted from a publicly traded Trust.

It's difficult to understand this week's activity without understanding the picture regarding GBTC

See, GBTC is now an ETF that was converted from a publicly traded Trust.

Long story short and in essence, many of the original holders of this GBTC Trust have been sitting on shares that were priced at a discount on the NYSE to actual Bitcoin for years

They were locked into the ownership with the original issuance of the shares.

They were locked into the ownership with the original issuance of the shares.

And so, they have been waiting for GBTC conversion to a Spot ETF in order to sell their shares for full value

As a result, most of the volume in GBTC this week was *selling*, not buying

This is why we extracted it from the calculations above.

As a result, most of the volume in GBTC this week was *selling*, not buying

This is why we extracted it from the calculations above.

Now, some of you may be saying, wait, even of they were selling in the market, there had to be buyers on the other side of those sales, right?

So wouldn't they count?

Enter the Authorized Participants (APs).

So wouldn't they count?

Enter the Authorized Participants (APs).

In order to create a competitive and attractive security for investment, APs buy and sell on behalf of ETF managers (i.e., Blackrock, Fidelity, etc.)

Then they either create or redeem ETF shares to match AUM to Market Value of the ETF.

Then they either create or redeem ETF shares to match AUM to Market Value of the ETF.

I.e., they buy and sell actual #Bitcoin to match the buying and selling of the ETFs

And so, with GBTC sellers of shares unlocked by the ETF conversion, APs redeemed shares and sold underlying Bitcoin, reducing the GBTC ETF Net Asset Value.

And so, with GBTC sellers of shares unlocked by the ETF conversion, APs redeemed shares and sold underlying Bitcoin, reducing the GBTC ETF Net Asset Value.

Many of the sellers of GBTC shares then (likely) turned around and bought one of the other ETFs instead

Maybe it was out of frustration with GBTC, having been locked up for so long with a terrible discount to Bitcoin.

Maybe it was out of frustration with GBTC, having been locked up for so long with a terrible discount to Bitcoin.

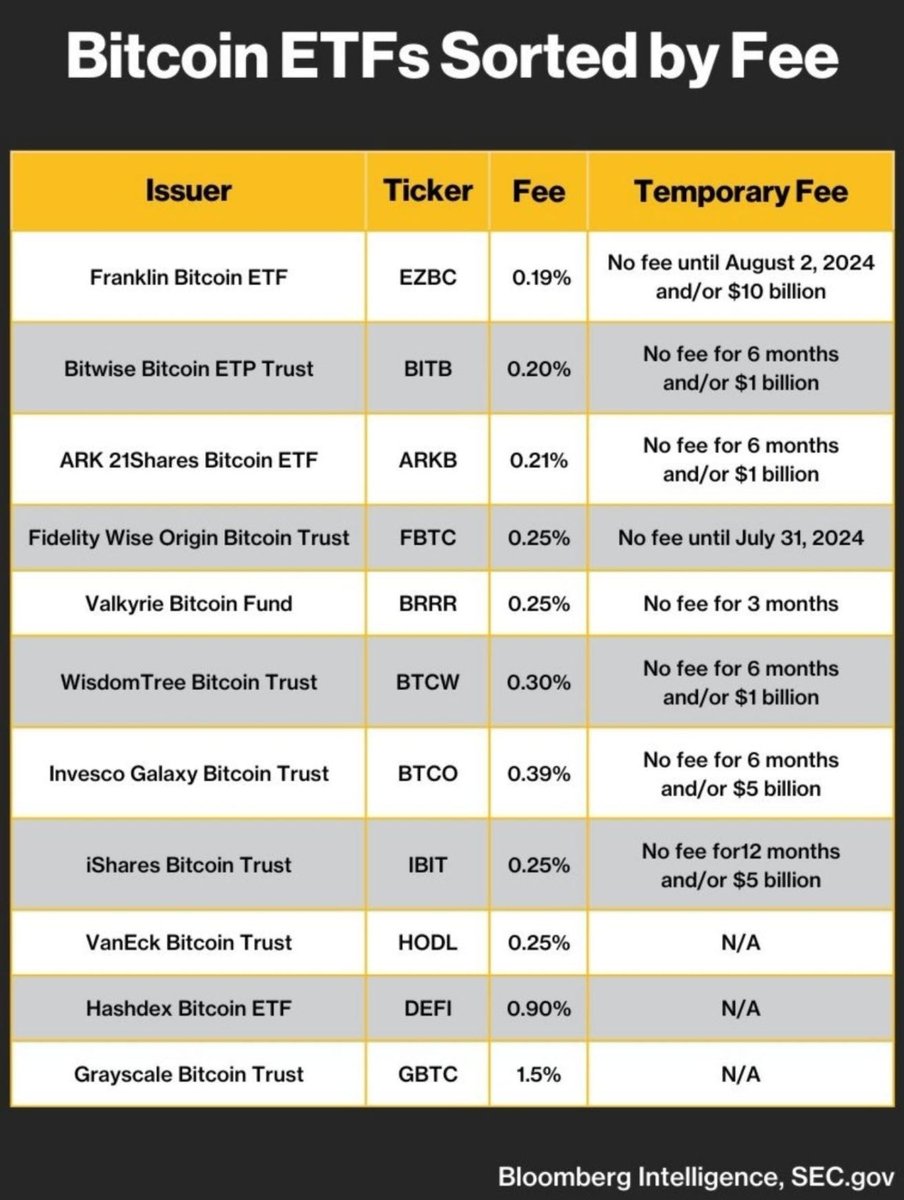

Because DEFI never converted, the next closest fee to GBTC is HODL, which is still 1.25% cheaper than GBTC annually

I mean, what is Grayscale thinking?!?!

I mean, what is Grayscale thinking?!?!

My guess is that they figure they will retain enough unsuspecting or ignorant investors that it won't matter, and the internal cost/benefit analysis showed that keeping fees high would work out in the long run.

For them, that is.

For them, that is.

See, when new investors come into the space, just like with gold ETFs, they often ask: which is the largest ETF in the space? What has the most liquidity?

And, assuming those are the safest, then they just blindly buy them.

And, assuming those are the safest, then they just blindly buy them.

Perhaps Grayscale ends up winning at this fees game, we will see. As of now, they are the largest ETF in NAV terms by a factor

Over 50X larger than either IBIT (Blackrock) or FBTC (Fidelity)

But things change fast in markets and lighting fast in Bitcoin markets.

Over 50X larger than either IBIT (Blackrock) or FBTC (Fidelity)

But things change fast in markets and lighting fast in Bitcoin markets.

But what about the rest of the space? Why didn't more money come into the ETFs, net of GBTC?

Where are all the billions and billions and billions of new institutional dollars?

Where are all the billions and billions and billions of new institutional dollars?

😣 Chokepoint 3.0?

For those who don't remember, a short history of banking-led Chokepoints

The original Operation Chokepoint was a 2013 DoJ initiative, which investigated banks who did business with firearm dealers, payday lenders and other online companies (read: online porn)

For those who don't remember, a short history of banking-led Chokepoints

The original Operation Chokepoint was a 2013 DoJ initiative, which investigated banks who did business with firearm dealers, payday lenders and other online companies (read: online porn)

Bending to the will of the DoJ, and to avoid them crawling up their wazoos, banks terminated many relationships with companies who were on red flag lists

Then, during Chokepoint 2.0 banks terminated relationships with any company red-listed due to cryptocurrency activity.

Then, during Chokepoint 2.0 banks terminated relationships with any company red-listed due to cryptocurrency activity.

In the words of U.S. Senator Bill Hagerty:

“'Operation Choke Point 2.0' refers to the coordinated effort by the Biden administration's financial regulators to suffocate our domestic crypto economy by de-banking the industry."

“'Operation Choke Point 2.0' refers to the coordinated effort by the Biden administration's financial regulators to suffocate our domestic crypto economy by de-banking the industry."

Onto Chokepoint 3.0, The Bitcoin choking

With the Bitcoin ETFs now available, hundreds of trillions of dollars that otherwise not had access to #Bitcoin can now jump into the asset class and begin allocating accordingly.

With the Bitcoin ETFs now available, hundreds of trillions of dollars that otherwise not had access to #Bitcoin can now jump into the asset class and begin allocating accordingly.

After all, the superhighways are built

Volume and trading and settlement and custody is all taken care of, using the same traditional rails as institutional investors and investment advisors are extremely knowledgable about and comfortable with

The Bitcoin superhighway is ready

Volume and trading and settlement and custody is all taken care of, using the same traditional rails as institutional investors and investment advisors are extremely knowledgable about and comfortable with

The Bitcoin superhighway is ready

One problem

A number of large and important brokerage firms have *blocked* the on-ramps to this superhighway for their customers.

A number of large and important brokerage firms have *blocked* the on-ramps to this superhighway for their customers.

Vanguard even issued a damning statement: “Spot Bitcoin ETFs will not be available for purchase on the Vanguard platform.…[as] these products do not align with ... a well-balanced, long-term investment portfolio."

Strange, considering their mission statement: 'Our core purpose is simple—to take a stand for all investors, to treat them fairly, and to give them the best chance for investment success'

Also strange as Vanguard is a top holder of MSTR, a well-known Bitcoin proxy these days.

Also strange as Vanguard is a top holder of MSTR, a well-known Bitcoin proxy these days.

And Vanguard also allowed their customers to buy and hold futures-based Bitcoin ETF, BITO. A terrible long-term proxy for #Bitcoin, BTW

Though, they have apparently pulled that access now, too 🤨

Vanguard is not alone, however.

Though, they have apparently pulled that access now, too 🤨

Vanguard is not alone, however.

Merrill Lynch, owned by Bank of America, is also not allowing customers to buy spot ETFs

UBS is only offering the ETFs to eligible wealth management clients

And Citigroup only provides access to institutional clients, but is 'exploring options for high-net-worth individuals'.

UBS is only offering the ETFs to eligible wealth management clients

And Citigroup only provides access to institutional clients, but is 'exploring options for high-net-worth individuals'.

Of course there are many more banks and brokerages doing the same thing, preventing tens of trillions of dollars of access to these new SEC-approved ETFs that trade and settle on highly regulated exchanges through SEC-approved measures and tight exchange oversight.

Just see the reactions to one of my posts on X, two days ago: x.com

Now

Before we get too worked up and frustrated with legacy banking and controls over how you use your own money, we must consider a few things

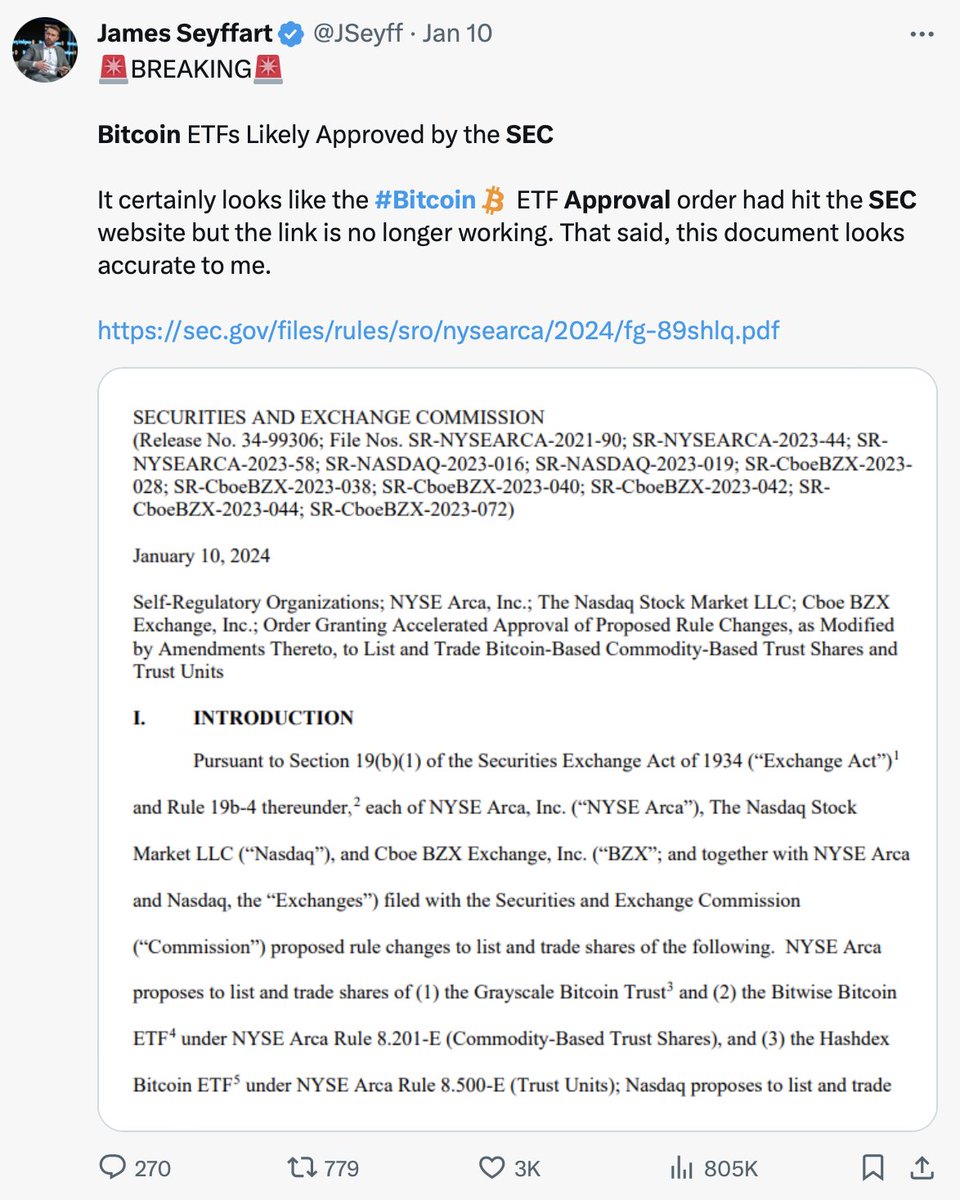

First, the SEC approval process was mangled and messy.

Before we get too worked up and frustrated with legacy banking and controls over how you use your own money, we must consider a few things

First, the SEC approval process was mangled and messy.

We had countless filings and amendments to filings and, though we had whispers of probable approvals, we got virtually zero publicly disclosed insight from the SEC itself along the way.

Imagine Amazon or Apple trying to initiate an IPO and the SEC refusing to approve them for years and years and then finally, in a set of fits of capitulation, requiring them to file amendment after amendment after amendment and then...

@JSeyff And then...

Finally approving them a few hours later

With a short and salty statement that reeked of reluctance.

Finally approving them a few hours later

With a short and salty statement that reeked of reluctance.

What a 💩-show

So, it is no surprise that some brokers were not even set up properly to handle trading and compliance of these new ETFs that began trading the next morning

It normally takes weeks and weeks to get all this in order and set up.

So, it is no surprise that some brokers were not even set up properly to handle trading and compliance of these new ETFs that began trading the next morning

It normally takes weeks and weeks to get all this in order and set up.

I cannot blame some of the trading houses and brokerages for not being quite ready yet

The SEC sure didn't help with the process and anticipation. Only those who were extremely well positioned and eager to handle the new business were ready

Thank you Fidelity.

The SEC sure didn't help with the process and anticipation. Only those who were extremely well positioned and eager to handle the new business were ready

Thank you Fidelity.

And for those who were not, they may lose some customers unwilling to wait for access

As for Vanguard and Merrill customers, yes it's extremely frustrating if you want immediate access

It was quite a surprise to me that these firms completely shut out their clients to the ETFs.

As for Vanguard and Merrill customers, yes it's extremely frustrating if you want immediate access

It was quite a surprise to me that these firms completely shut out their clients to the ETFs.

But you can simply take your investment business elsewhere

I had a great experience with Fidelity (no surprise, as they have been in the crypto space for a long now), and I know of many people fleeing Vanguard for Fidelity.

I had a great experience with Fidelity (no surprise, as they have been in the crypto space for a long now), and I know of many people fleeing Vanguard for Fidelity.

I don't blame them

This is America, after all. You can vote with your feet and your wallet

I personally think you should have access to all publicly listed securities and assets, regardless of what your broker or bank believes.

This is America, after all. You can vote with your feet and your wallet

I personally think you should have access to all publicly listed securities and assets, regardless of what your broker or bank believes.

This is called *freedom*

That said, where is all of this going, and will the ETFs, in fact, have an impact on #Bitcoin itself in the long run?

That said, where is all of this going, and will the ETFs, in fact, have an impact on #Bitcoin itself in the long run?

🥵 Long-Term Verdict

As we now see, this stuff is messy and complicated and takes time to shake out

Between GBTC, brokers putting plumbing in place (other than Vanguard and Merrill), and investment advisors having conversations with their clients, this will take some time.

As we now see, this stuff is messy and complicated and takes time to shake out

Between GBTC, brokers putting plumbing in place (other than Vanguard and Merrill), and investment advisors having conversations with their clients, this will take some time.

Again, there is a ton of capital that has never had true access to Bitcoin until now

But there are many pipes and roads and onramps that still need to be built

Even if all the roads and on-ramps were ready, capital like this does not typically all flood in at once.

But there are many pipes and roads and onramps that still need to be built

Even if all the roads and on-ramps were ready, capital like this does not typically all flood in at once.

It trickles at first

And then it flows

Eventually.

And then it flows

Eventually.

The Volatility Champ

And for the OGs, you know better than anyone else:

*Bitcoin rarely does what 'everyone' expects it to do*

And for the OGs, you know better than anyone else:

*Bitcoin rarely does what 'everyone' expects it to do*

And so, just when you think the ETFs have fizzled out

When #Bitcoin grinds sideways for a bit, with bouts of selloffs and recoveries

Frustrating newcomers, and shaking them out.

When #Bitcoin grinds sideways for a bit, with bouts of selloffs and recoveries

Frustrating newcomers, and shaking them out.

That's when, in my personal opinion, it happens

That is when we get the eyeball-piercing, face-melting, short-sale-obliterating...

*God Candle*

That is when we get the eyeball-piercing, face-melting, short-sale-obliterating...

*God Candle*

Or perhaps a series of smaller Demi-God candles, adding up to one

Until then, be patient, my friends

This is not a sprint. It is not a marathon, or even triathlon.

Until then, be patient, my friends

This is not a sprint. It is not a marathon, or even triathlon.

This is more like a *Triple Deca Ultratriathlon*

Go ahead and look it up. If you've been a Bitcoin investor for a while, you'll know what I mean

I truly believe we will all be rewarded for it.

Go ahead and look it up. If you've been a Bitcoin investor for a while, you'll know what I mean

I truly believe we will all be rewarded for it.

This thread is a summary of a recent issue of 💡The Informationist, the free newsletter that simplifies one financial concept for you weekly.

You can join 30K+ readers here: jameslavish.com

You can join 30K+ readers here: jameslavish.com

جاري تحميل الاقتراحات...