We’ve all been told that in order to increase returns, we must take greater risk.

Mohnish has flipped this idea on its head.

Dhandho investors optimize their investments by investing in companies with huge upside and only limited downside.

Mohnish has flipped this idea on its head.

Dhandho investors optimize their investments by investing in companies with huge upside and only limited downside.

This approach was first implemented by the Patels, who went from nothing to owning over 50% of the motel market in the United States, despite only being 0.2% of the population.

The Patel’s identified a business opportunity in a distressed industry and went all in.

The Patel’s identified a business opportunity in a distressed industry and went all in.

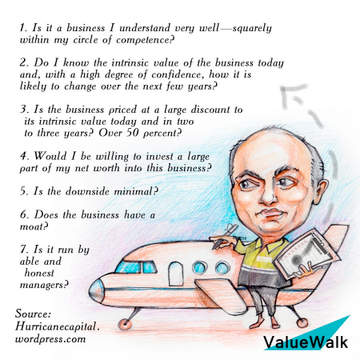

Mohnish outlines 9 core principles of the Dhandho Framework:

1️⃣ Focus on buying existing businesses

Rather than trying to create the next hot tech start-up, Pabrai prefers to invest in an existing business.

These companies are easier to access and have a large opportunity set.

1️⃣ Focus on buying existing businesses

Rather than trying to create the next hot tech start-up, Pabrai prefers to invest in an existing business.

These companies are easier to access and have a large opportunity set.

2️⃣ Buy simple businesses in industries with a slow rate of change

The most reliable investments are those operating in industries with little change that are easy to understand and difficult to disrupt.

“We see change as the enemy of investments.” — Warren Buffett

The most reliable investments are those operating in industries with little change that are easy to understand and difficult to disrupt.

“We see change as the enemy of investments.” — Warren Buffett

3️⃣ Buy distressed businesses in distressed industries

Poor sentiment by investors is what allows for market prices to reach bargain levels.

“Be fearful when others are greedy, and greedy when others are fearful.” — Warren Buffett

Poor sentiment by investors is what allows for market prices to reach bargain levels.

“Be fearful when others are greedy, and greedy when others are fearful.” — Warren Buffett

4️⃣ Buy businesses with a durable competitive advantage

Without a moat, it’s only a matter of time before disruption occurs and profits falter.

Without a moat, it’s only a matter of time before disruption occurs and profits falter.

5️⃣ Bet heavily when the odds are in your favor

Great opportunities are rare in the stock market.

So when you find an investment that you are very certain has favorable odds, you need to size your bet accordingly.

Great opportunities are rare in the stock market.

So when you find an investment that you are very certain has favorable odds, you need to size your bet accordingly.

6️⃣ Find arbitrage opportunities

Arbitrage is simply profiting by exploiting price differences in two different markets.

This is a no-lose proposition, which is the perfect hunting ground for the Dhandho Investor.

Arbitrage is simply profiting by exploiting price differences in two different markets.

This is a no-lose proposition, which is the perfect hunting ground for the Dhandho Investor.

7️⃣ Buy at a big discount to intrinsic value

Buying well below the intrinsic value ensures a margin of safety.

If the future unfolds worse than you expected, then you don’t lose much money.

Buying well below the intrinsic value ensures a margin of safety.

If the future unfolds worse than you expected, then you don’t lose much money.

8️⃣ Look for low-risk, high-uncertainty businesses

Low risk enables little downside. High uncertainty keeps the crowd from buying in.

This is a wonderful combination because it gives you a lot of upside potential with limited downside.

“Heads, I win; tails, I don’t lose much”

Low risk enables little downside. High uncertainty keeps the crowd from buying in.

This is a wonderful combination because it gives you a lot of upside potential with limited downside.

“Heads, I win; tails, I don’t lose much”

9️⃣ It’s better to be a copycat than an innovator

It is very hard to innovate successfully.

It's way better to copy what works than to create something new.

Mohnish is quite well known for cloning and shamelessly taking the best ideas from great investors.

It is very hard to innovate successfully.

It's way better to copy what works than to create something new.

Mohnish is quite well known for cloning and shamelessly taking the best ideas from great investors.

Mohnish offers a number of ways to find bargains in distressed markets:

• Look for negative news headlines

• Analyze stocks trading at 52-week lows

• Keep an eye out on super investor portfolios

• Subscribe to stock publications like Value Line

• Look for negative news headlines

• Analyze stocks trading at 52-week lows

• Keep an eye out on super investor portfolios

• Subscribe to stock publications like Value Line

Stocks are priced correctly most of the time.

This means Mohnish needs to analyze thousands of stocks to find a few undervalued ones.

There is no shortcut for hard work.

This means Mohnish needs to analyze thousands of stocks to find a few undervalued ones.

There is no shortcut for hard work.

There are plenty of ways to win the game, you just need to find the approach that works best for you.

One of the keys to Mohnish’s success is making large bets when he’s confident the odds are favorable.

One of the keys to Mohnish’s success is making large bets when he’s confident the odds are favorable.

That's it for today.

If you liked this, you'll love the summary I made from reading all public writings of Warren Buffett (5,000 pages).

It's like a free book. Grab it here: compounding-quality.ck.page

If you liked this, you'll love the summary I made from reading all public writings of Warren Buffett (5,000 pages).

It's like a free book. Grab it here: compounding-quality.ck.page

Loading suggestions...