Why $TIA is going to be this cycle's (3,3)

This is going to be a long read, but I hope it will be an entertaining one for those that are students of the laws of crypto ponzinomics, human greed, and market bubbles.

So let's get started! 🧵

This is going to be a long read, but I hope it will be an entertaining one for those that are students of the laws of crypto ponzinomics, human greed, and market bubbles.

So let's get started! 🧵

This piece will be separated into 4 sections:

1) What is Celestia?

2) What's the narrative around $TIA?

3) What similarities does $TIA have and (3,3)?

4) What I'm doing to prepare for this

1) What is Celestia?

2) What's the narrative around $TIA?

3) What similarities does $TIA have and (3,3)?

4) What I'm doing to prepare for this

Before you get mad at me, I am not claiming that Celestia is a ponzi. In fact, I think it’s one of the most important technological advancements we’ve seen in a long time.

I highly recommend following @nosleepjon and reading some of his substack articles.

I highly recommend following @nosleepjon and reading some of his substack articles.

TLDR: Celestia makes it easier/cheaper for new projects to deploy new rollups & blockchains.

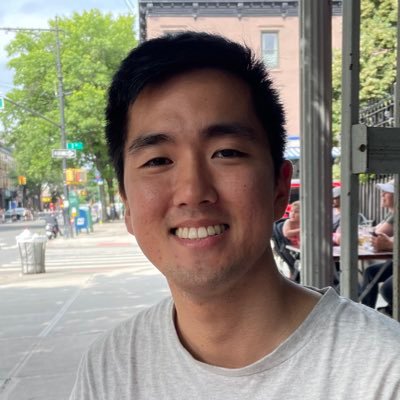

For example, @MantaNetwork saved >99% in fees by using Celestia for Data Availability (DA) instead of Ethereum. These are significant cost savings that can be passed down to users.

For example, @MantaNetwork saved >99% in fees by using Celestia for Data Availability (DA) instead of Ethereum. These are significant cost savings that can be passed down to users.

Here's another resource that might help you understand it better.

Since I don't want this post to be too long, I'll move onto the narrative behind the $TIA token and what's led to the crazy price surge since the TGE on November.

Since I don't want this post to be too long, I'll move onto the narrative behind the $TIA token and what's led to the crazy price surge since the TGE on November.

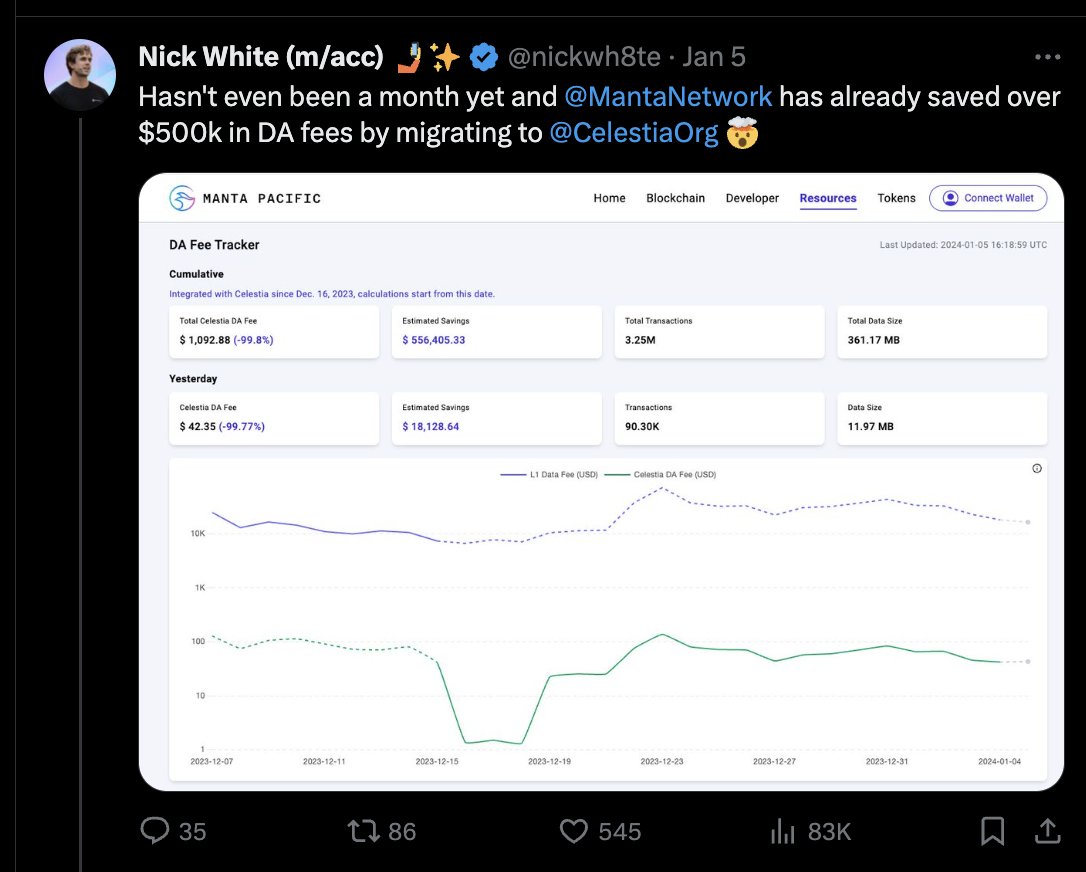

I believe $TIA is the purest way to gain exposure to the airdrop narrative in 2024-25. We've already had two airdrops to TIA stakers (@Sagaxyz__ and @dymension) and many more confirmed, such as @MantaNetwork.

Let's explore the implications of this a bit further.

Let's explore the implications of this a bit further.

Celestia makes it easier for new rollups to launch. Some rollups will airdrop to TIA stakers. L1/L2 tokens command a premium in the market.

So we see this narrative taking form: “It doesn’t matter what the price of TIA is because the airdrops will more than make up for it.”

So we see this narrative taking form: “It doesn’t matter what the price of TIA is because the airdrops will more than make up for it.”

For example, my $DYM airdrop already covers my cost basis for $TIA at the current implied price of $4 on @aevoxyz. So the position has already paid for itself, if I choose to dump my airdrop. I'm not going to, but that's a topic for another discussion.

$TIA staking also fits my thesis in the return of the alt-L1 trade. Instead of trying to pick and choose an L1/L2 token for the upcoming cycle, why not stake TIA and passively receive airdrops?

It's a psychologically comfortable narrative for most.

It's a psychologically comfortable narrative for most.

I'm also seeing parallels in the Solana/Cosmos thesis. Many teams have been building throughout the bear market, raising tons of money from VCs. Some will airdrop to $ATOM $OSMO $TIA stakers, which will only strengthen the narrative from here.

But what makes this the (3,3) of this cycle? Here's the progression:

1) Market sees big airdrops (i.e. $DYM)

2) Market expects more airdrops

3) People dream about the size of these airdrops

4) Buyers become more and more price insensitive because of airdrop expectations

1) Market sees big airdrops (i.e. $DYM)

2) Market expects more airdrops

3) People dream about the size of these airdrops

4) Buyers become more and more price insensitive because of airdrop expectations

We can simplify the market pricing of $TIA to this generic function:

Valuation of TIA = Future Value Accrual to the Data Availability Layer + Memetics + Narrative + Future Expectations of Airdrops to TIA stakers

But let's be real, no one knows how to value this thing

Valuation of TIA = Future Value Accrual to the Data Availability Layer + Memetics + Narrative + Future Expectations of Airdrops to TIA stakers

But let's be real, no one knows how to value this thing

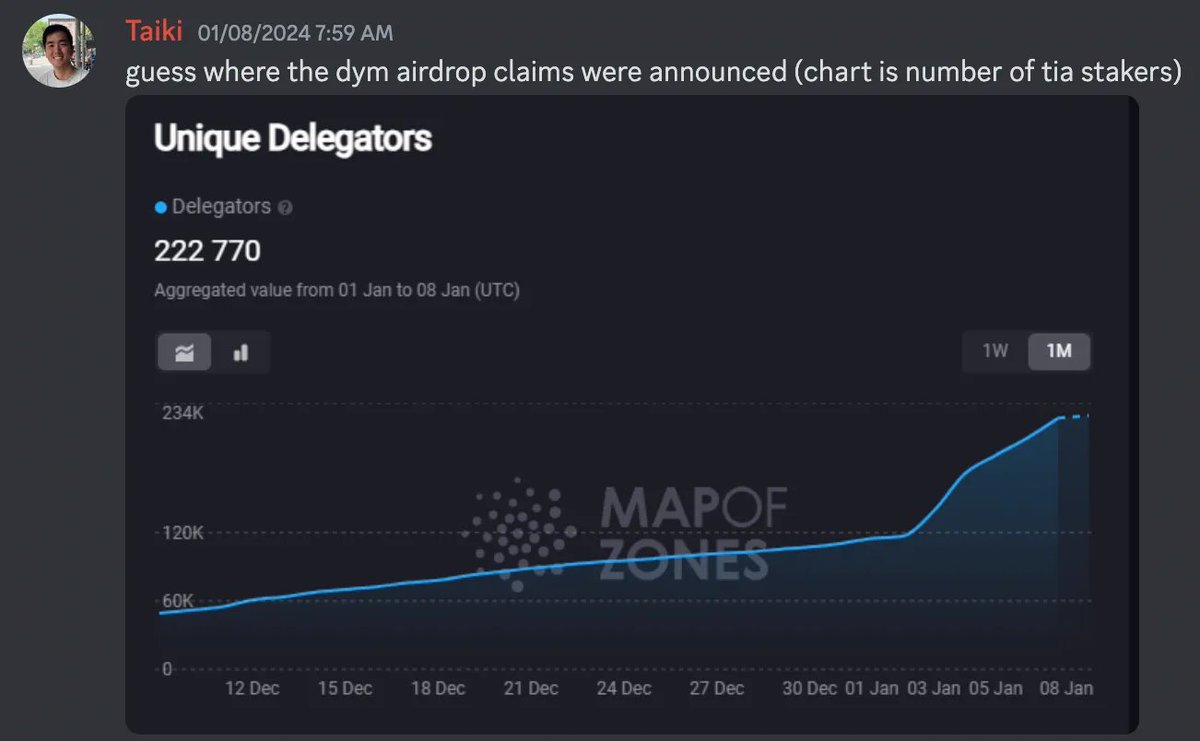

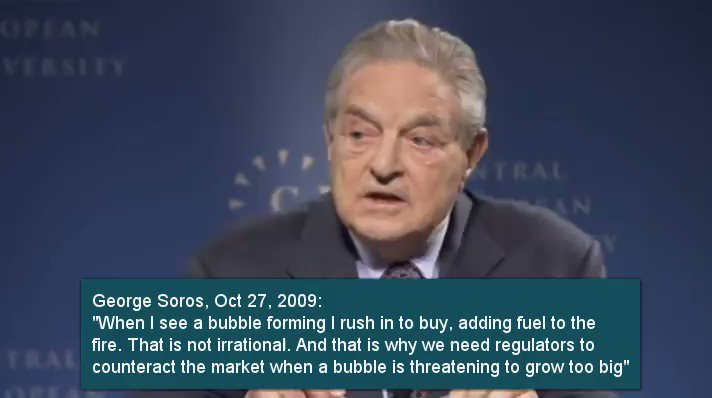

“Price of OHM can go 99% and you'll be ok because the APY will make up for it.”

“Price of TIA doesn’t matter because the airdrops will make up for it.”

They are two completely different projects, but the narrative is similarities. It has the characteristics of a future bubble.

“Price of TIA doesn’t matter because the airdrops will make up for it.”

They are two completely different projects, but the narrative is similarities. It has the characteristics of a future bubble.

"But Taiki, you're also making these videos!!!"

Yes, but Celestia just launched 2 months ago and we've only had two airdrop snapshots go live. I expect so many more in 2024-25.

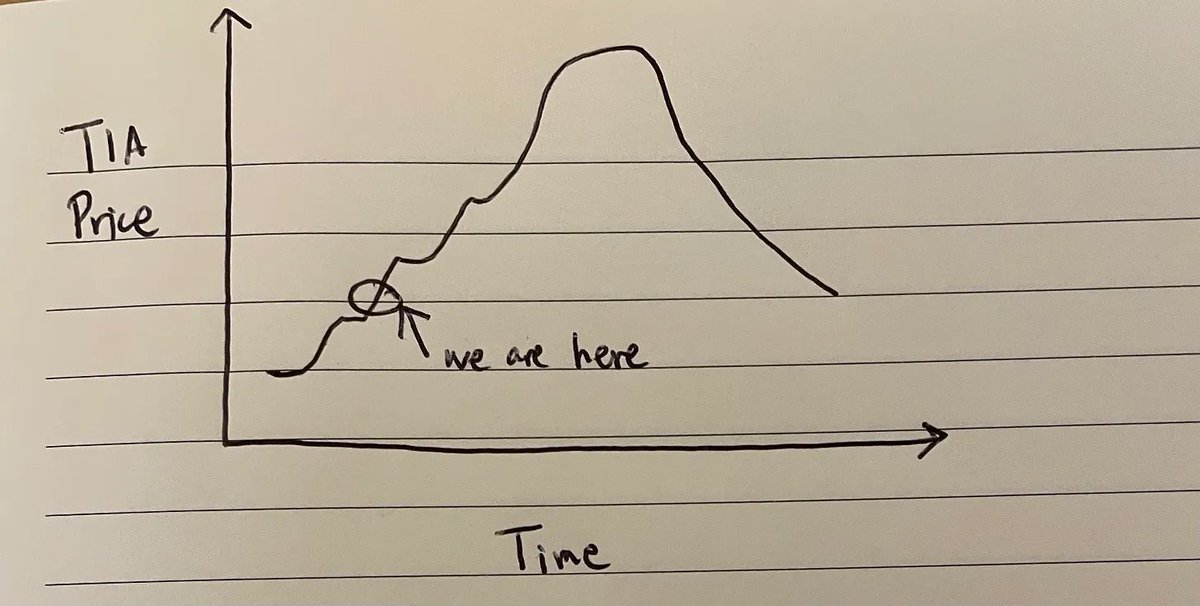

There will be a time where staking TIA won't make sense. But I don't think we're there yet.

Yes, but Celestia just launched 2 months ago and we've only had two airdrop snapshots go live. I expect so many more in 2024-25.

There will be a time where staking TIA won't make sense. But I don't think we're there yet.

I think TIA is going to be an amazing bull market hold and an extremely painful bear market hold.

People will unwind once they realize the valuation doesn’t make sense and airdrops get diluted. The 21 day unbonding period will make this even a harsher reality.

People will unwind once they realize the valuation doesn’t make sense and airdrops get diluted. The 21 day unbonding period will make this even a harsher reality.

So, what's the plan?

I am staking TIA; I'll hold some airdrops and I'll sell some airdrops. When do I sell $TIA? Honestly I have no idea.

My current plan is to start unwinding my TIA positions once Coinbase is the #1 on the Apple app store, or when majors start hitting ATHs.

I am staking TIA; I'll hold some airdrops and I'll sell some airdrops. When do I sell $TIA? Honestly I have no idea.

My current plan is to start unwinding my TIA positions once Coinbase is the #1 on the Apple app store, or when majors start hitting ATHs.

I am also writing this on January 13, 2024. If you are reading this in the future, my opinions may have changed. I could also be incredibly wrong, but that's the risk of putting my thoughts on the internet.

Let me know your thoughts.

Let me know your thoughts.

Loading suggestions...