Mental models are like tools for understanding the world.

Having many different mental models helps you make smart choices.

Having many different mental models helps you make smart choices.

2. Margin of safety

Leaving room for mistakes is important.

Like building a bridge for 20 tons when it only needs to hold 10 tons.

In investing, paying less than what something's worth is a smart move, just like getting something worth $1 for 50 cents.

Leaving room for mistakes is important.

Like building a bridge for 20 tons when it only needs to hold 10 tons.

In investing, paying less than what something's worth is a smart move, just like getting something worth $1 for 50 cents.

3. Inversion

Charlie, as a weatherman, learned to protect pilots by understanding potential dangers.

Similarly, focus on how a company might fail rather than just how it could succeed financially.

Charlie, as a weatherman, learned to protect pilots by understanding potential dangers.

Similarly, focus on how a company might fail rather than just how it could succeed financially.

4. When The Odds Are In Your Favor Bet Big

“The wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don't. It's just that simple.” — Charlie Munger

“The wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don't. It's just that simple.” — Charlie Munger

5. The Law of Large Numbers

The more you study, the better your answers.

Investing in a weak company once might work out by chance. But if you keep doing it, luck won't hold up.

The more you study, the better your answers.

Investing in a weak company once might work out by chance. But if you keep doing it, luck won't hold up.

6. Makes Friends with the Eminent Dead

Even though Benjamin Franklin and Albert Einstein aren't here to talk to, we can still learn a lot from what they wrote.

"The man who does not read good books has no advantage over the man who can't read them." - Mark Twain

Even though Benjamin Franklin and Albert Einstein aren't here to talk to, we can still learn a lot from what they wrote.

"The man who does not read good books has no advantage over the man who can't read them." - Mark Twain

7. Be a Swiss Army Knife

“To a man with a hammer, everything looks like a nail.” ― Mark Twain

Every problem needs its own specific solution.

“To a man with a hammer, everything looks like a nail.” ― Mark Twain

Every problem needs its own specific solution.

8. Compounding

If you doubled a penny every day for 30 days, the amount on day 30 would be $5,368,709.12.

If you doubled a penny every day for 30 days, the amount on day 30 would be $5,368,709.12.

9. Opportunity Cost

Deciding on one thing means saying no to something else.

If you invest in Alphabet, you're choosing not to invest that money in Apple.

Investing is about choosing where your money can grow the most.

Deciding on one thing means saying no to something else.

If you invest in Alphabet, you're choosing not to invest that money in Apple.

Investing is about choosing where your money can grow the most.

10. The power of incentives

Brokers want you to trade stocks, while managers want you to see their company as strong.

It's crucial to think about what motivates people's actions.

Brokers want you to trade stocks, while managers want you to see their company as strong.

It's crucial to think about what motivates people's actions.

11. Think for yourself

Make your own choices. Don't just follow everyone else.

"The stock investor is neither right nor wrong because others agreed or disagreed with him." - Benjamin Graham

Make your own choices. Don't just follow everyone else.

"The stock investor is neither right nor wrong because others agreed or disagreed with him." - Benjamin Graham

12. Simplicity

Making investments more complicated doesn't always bring more rewards.

Simply regularly investing in an index fund often performs better than most actively managed funds.

Making investments more complicated doesn't always bring more rewards.

Simply regularly investing in an index fund often performs better than most actively managed funds.

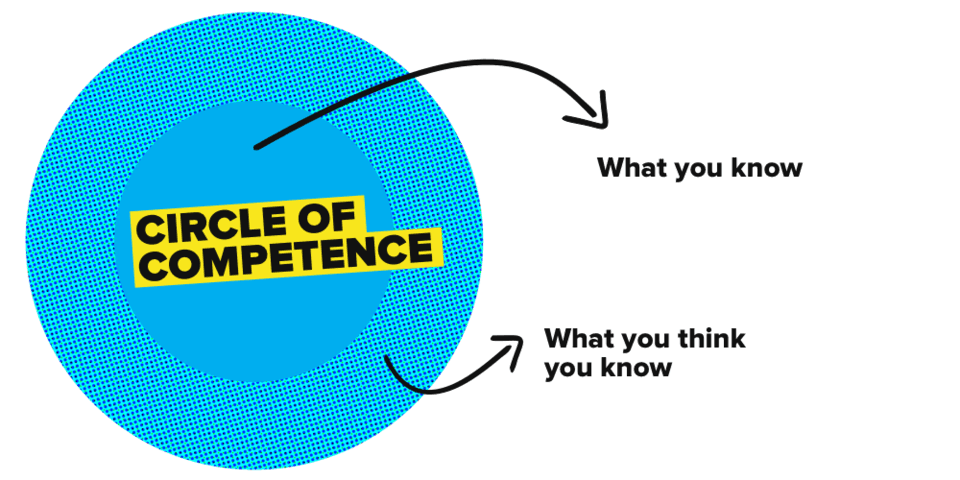

13. Use Filters

To find good companies, filter out the bad ones:

- Avoid companies with weak growth history.

- Stick to what you understand, avoid what you don't.

- Skip companies unlikely to beat the overall market.

To find good companies, filter out the bad ones:

- Avoid companies with weak growth history.

- Stick to what you understand, avoid what you don't.

- Skip companies unlikely to beat the overall market.

14. Second Order Thinking

Consider the bigger or future impacts of choices, not just the immediate results.

1st order: "This stock will grow earnings, I'll buy."

2nd order: "But if earnings don't meet expectations, I won't invest."

Consider the bigger or future impacts of choices, not just the immediate results.

1st order: "This stock will grow earnings, I'll buy."

2nd order: "But if earnings don't meet expectations, I won't invest."

15. Manage expectations

Happiness comes from what happens versus what you thought would happen.

If you expect all stocks to double in a year, you'll likely end up disappointed.

Happiness comes from what happens versus what you thought would happen.

If you expect all stocks to double in a year, you'll likely end up disappointed.

That's it for today.

If you liked this, you'll love this source of wisdom from Charlie Munger.

It's a compilation of everything he has ever said and written.

Grab it here: compounding-quality.ck.page

If you liked this, you'll love this source of wisdom from Charlie Munger.

It's a compilation of everything he has ever said and written.

Grab it here: compounding-quality.ck.page

Loading suggestions...