13 Stock Chart Patterns that You should know 📈💹

A thread 🔗💬

A thread 🔗💬

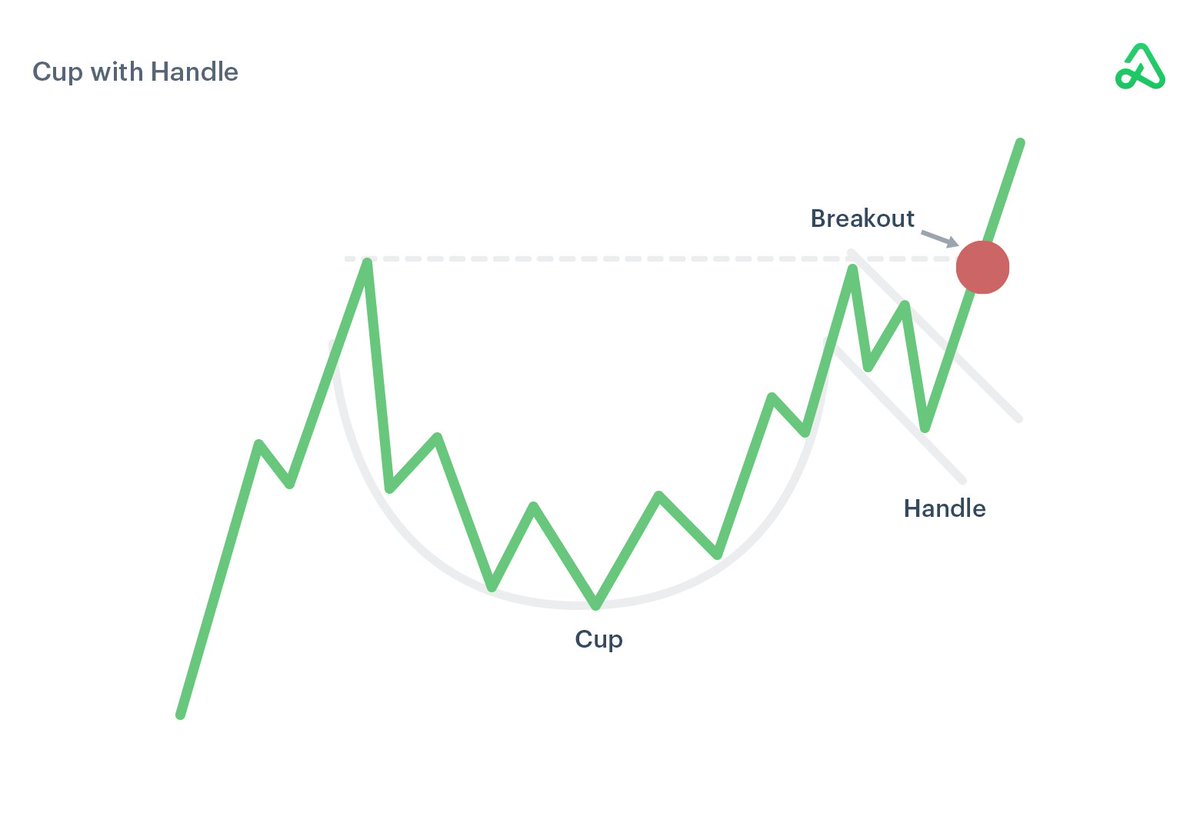

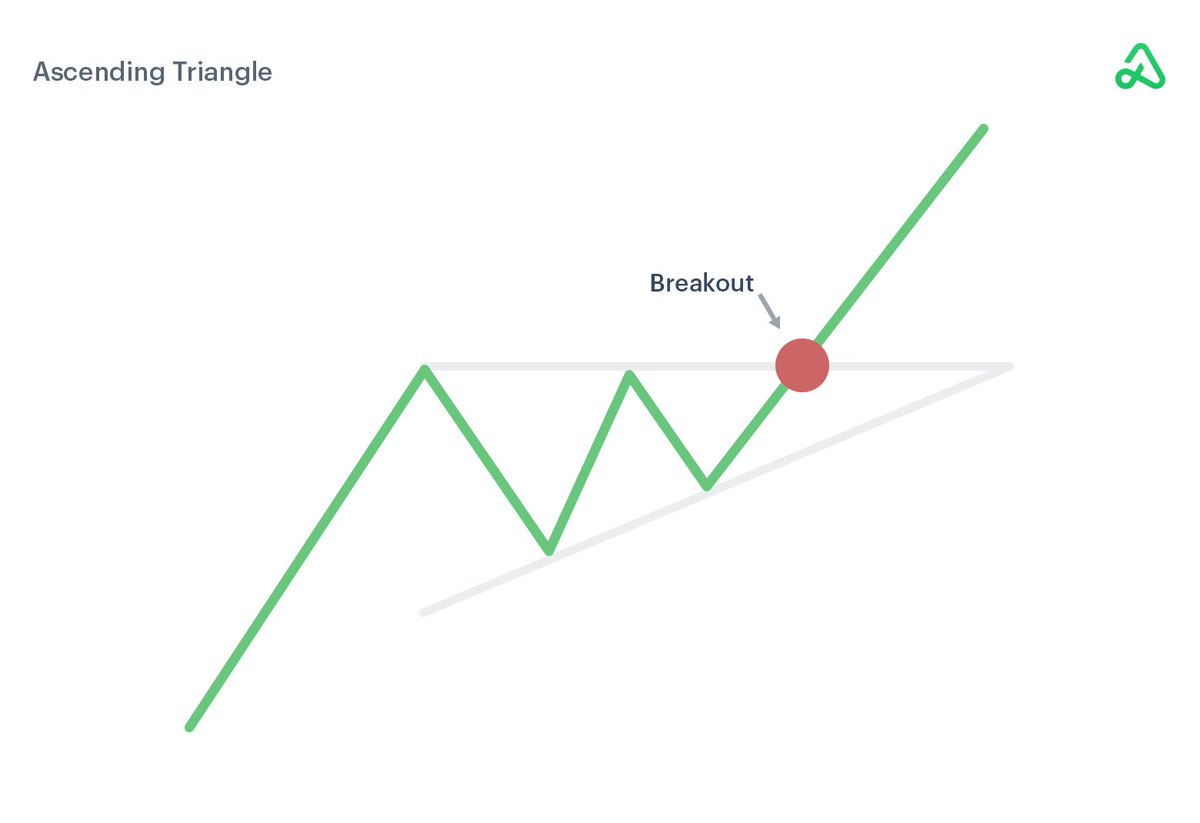

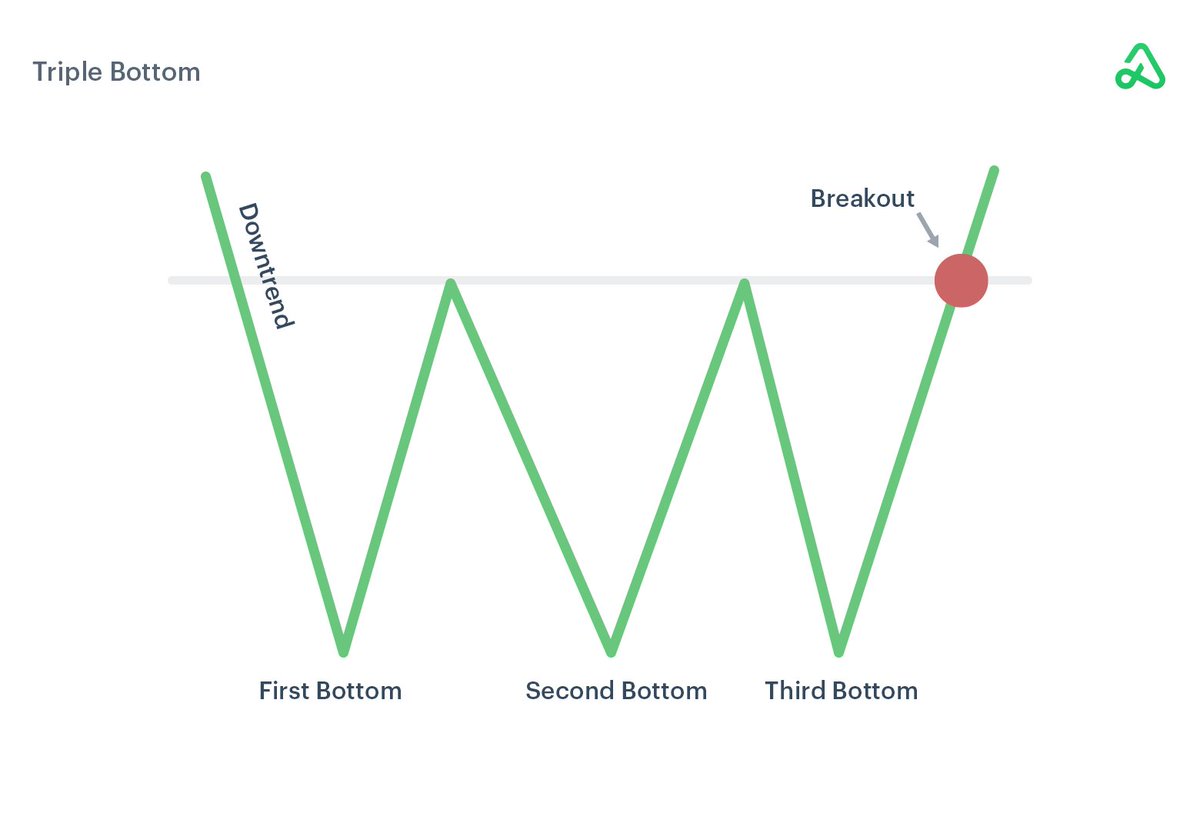

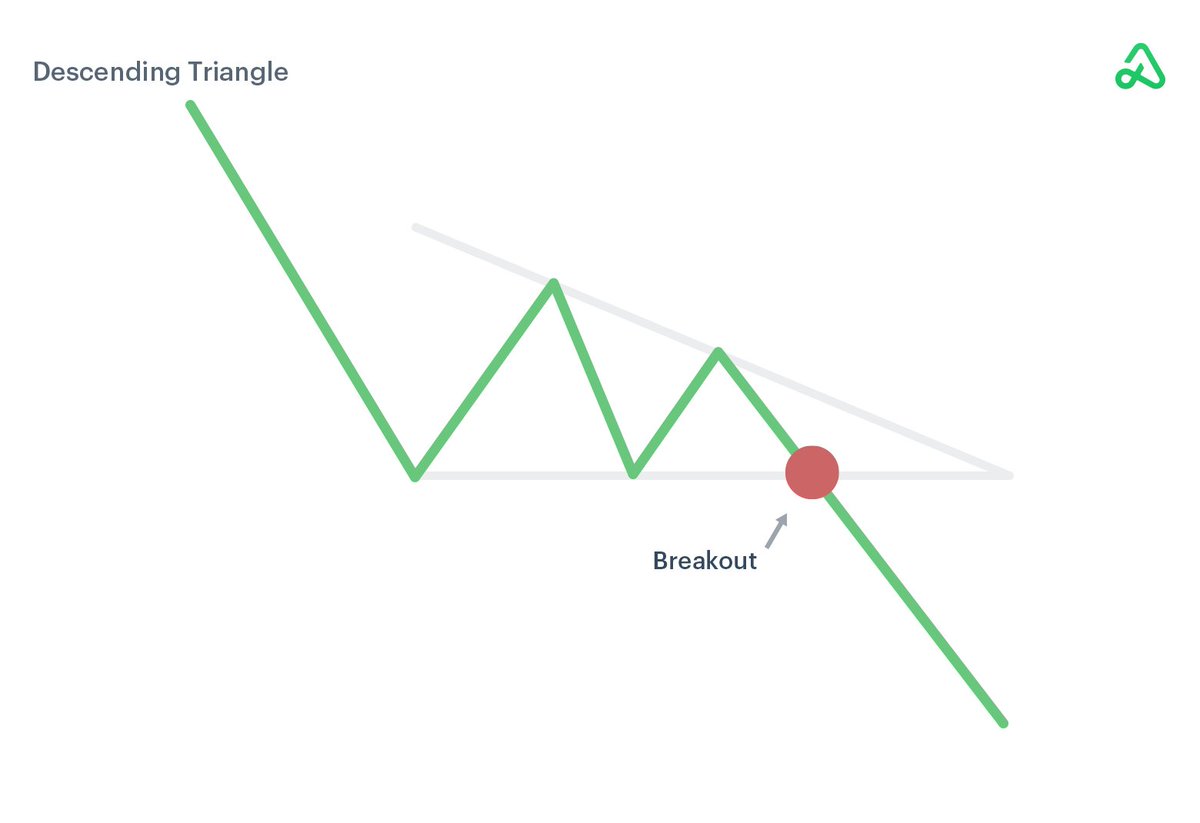

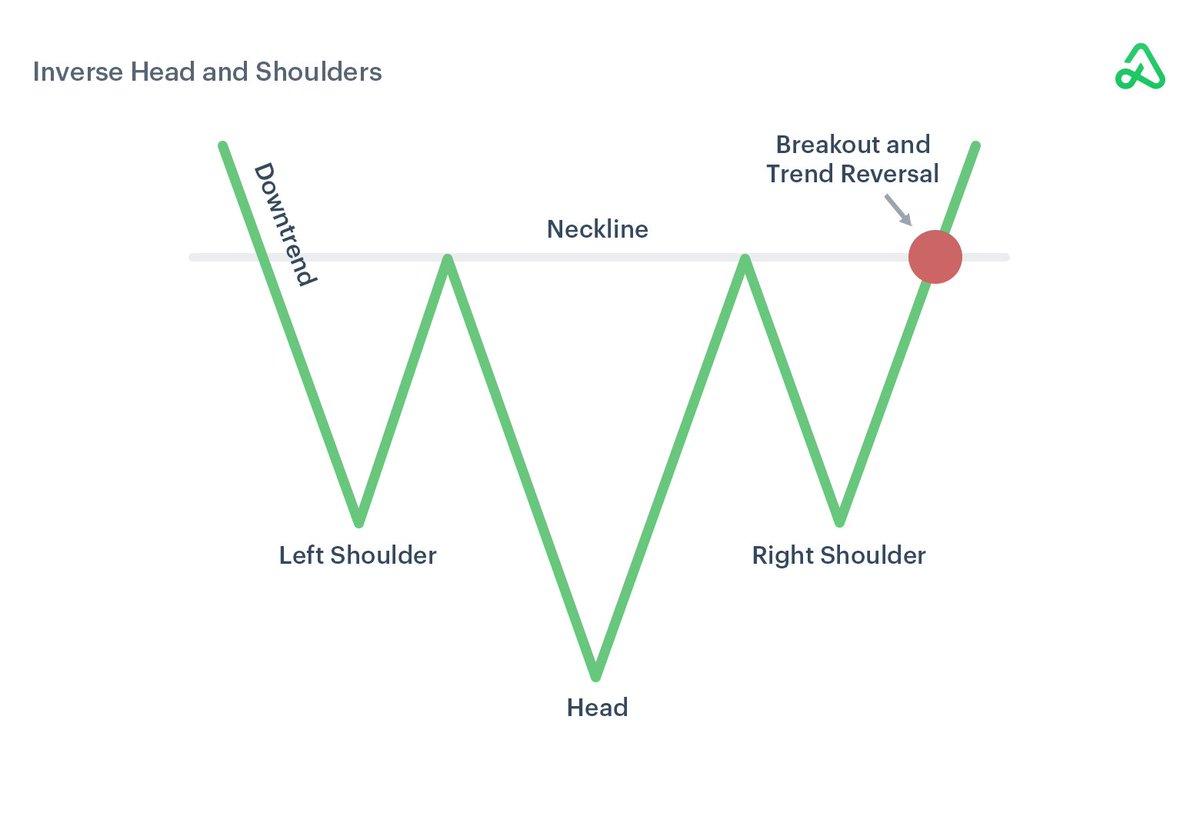

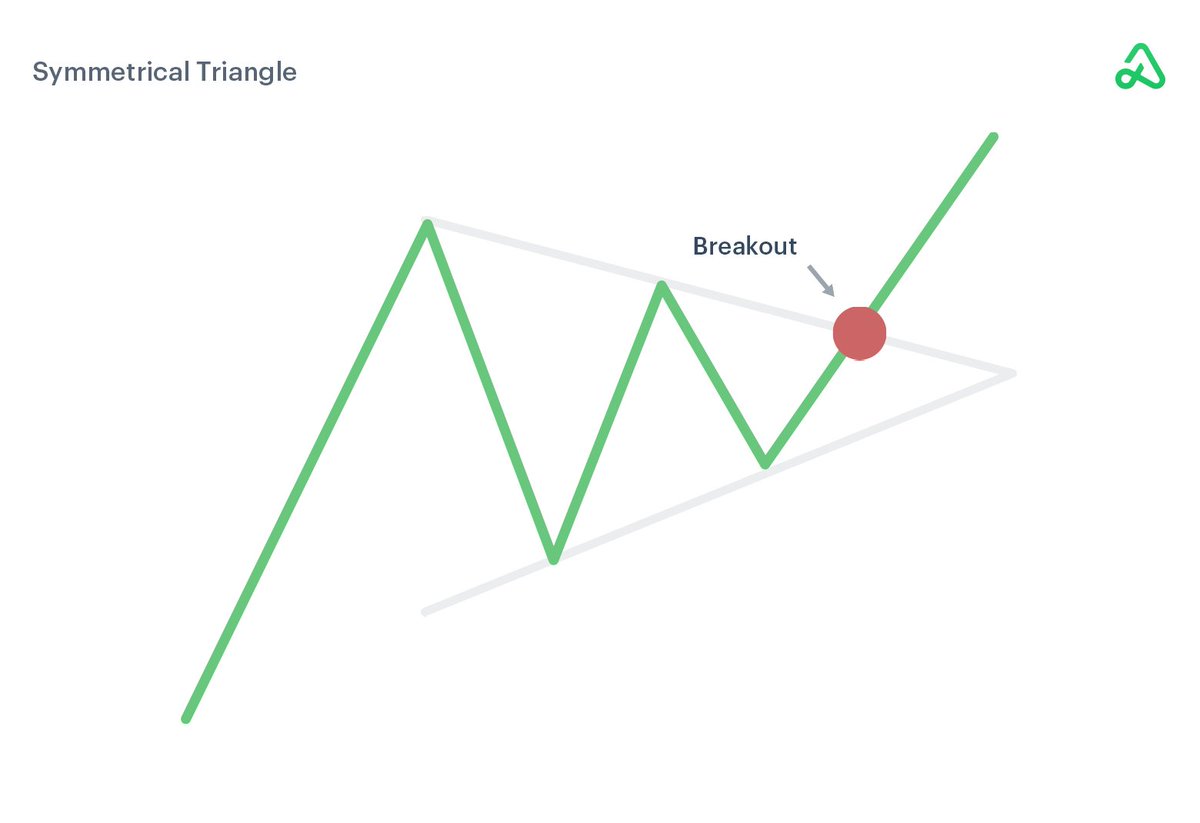

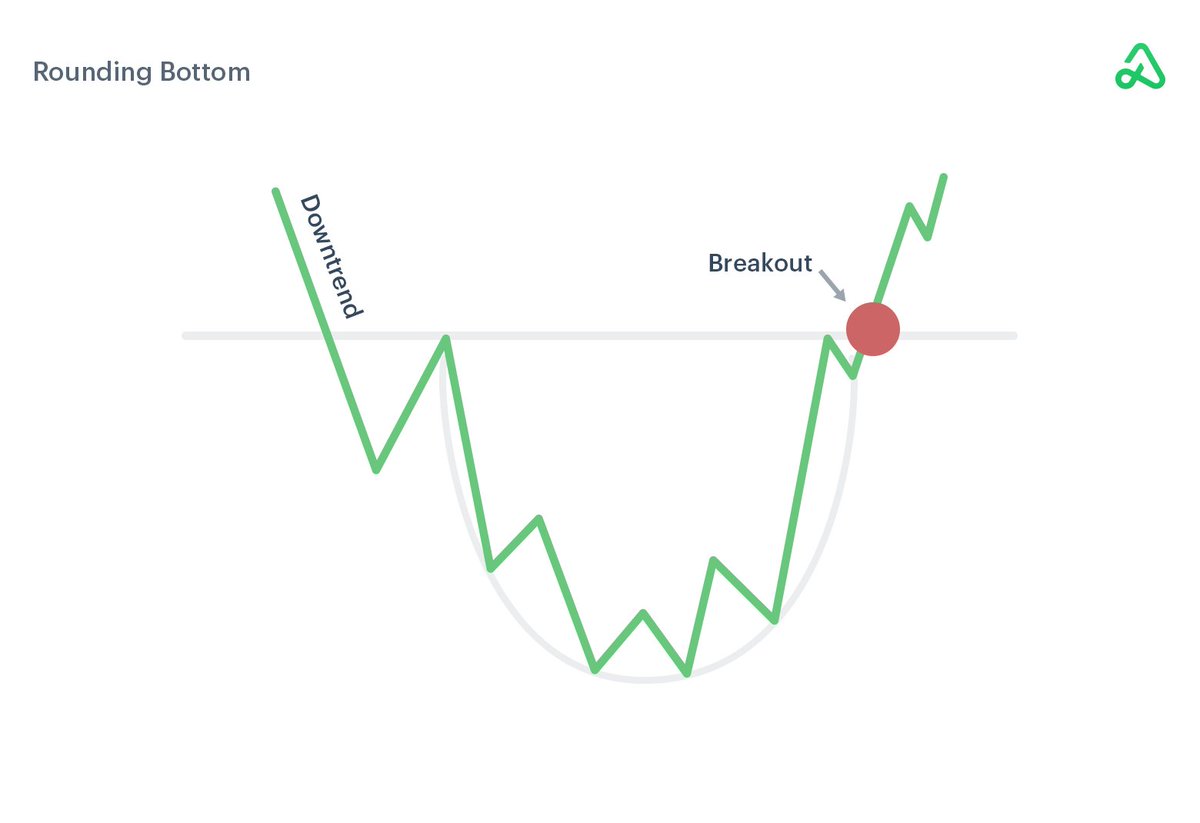

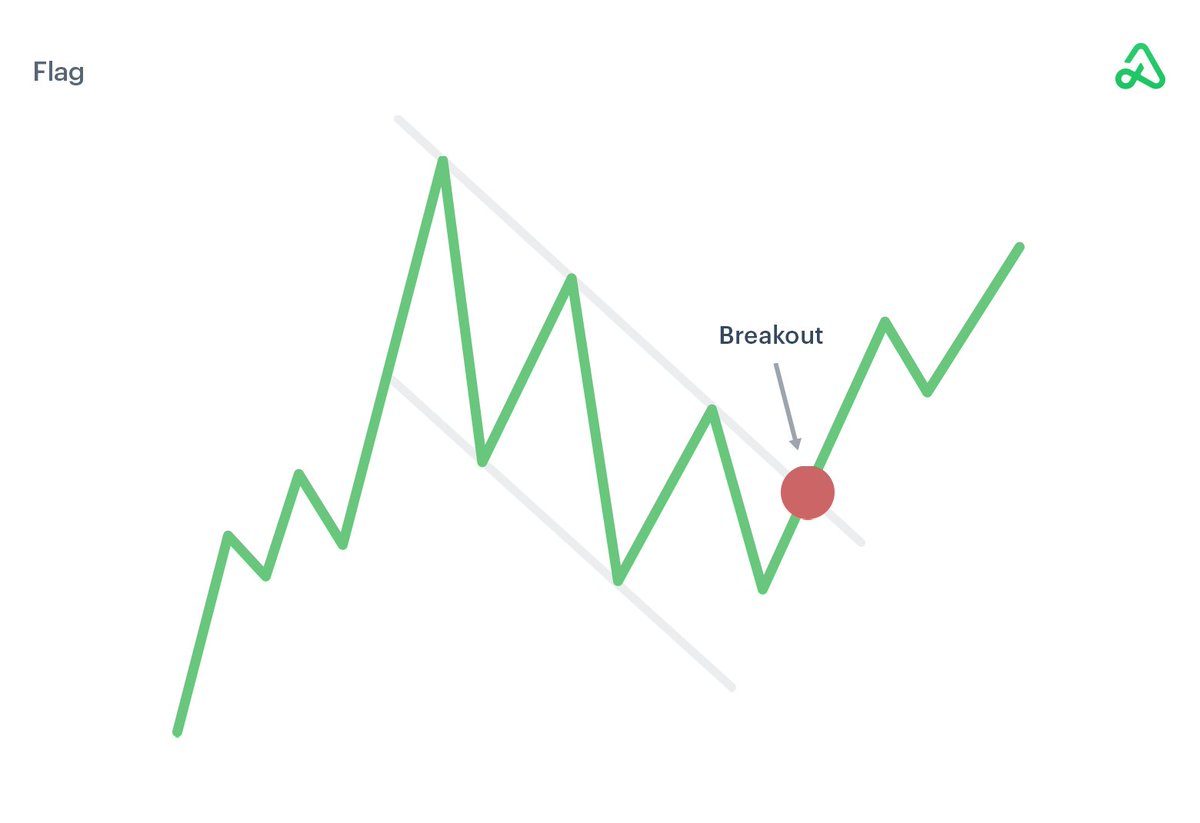

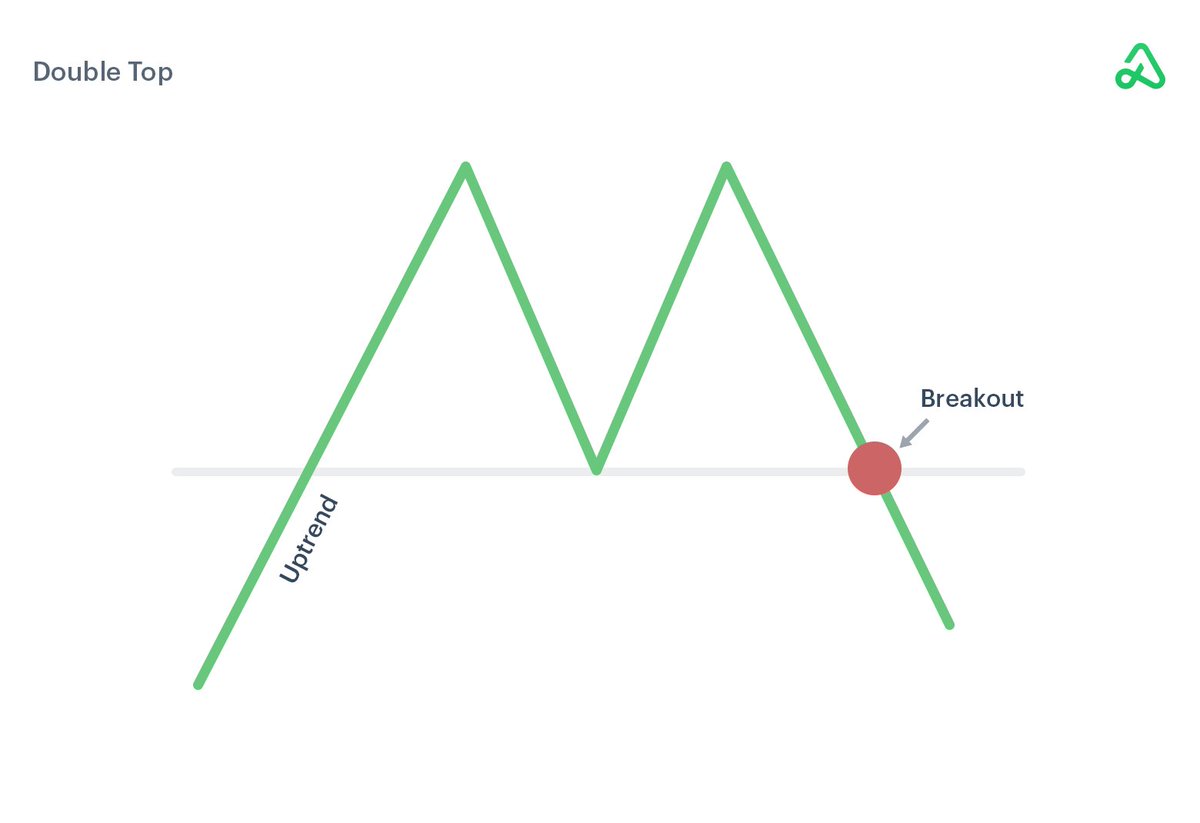

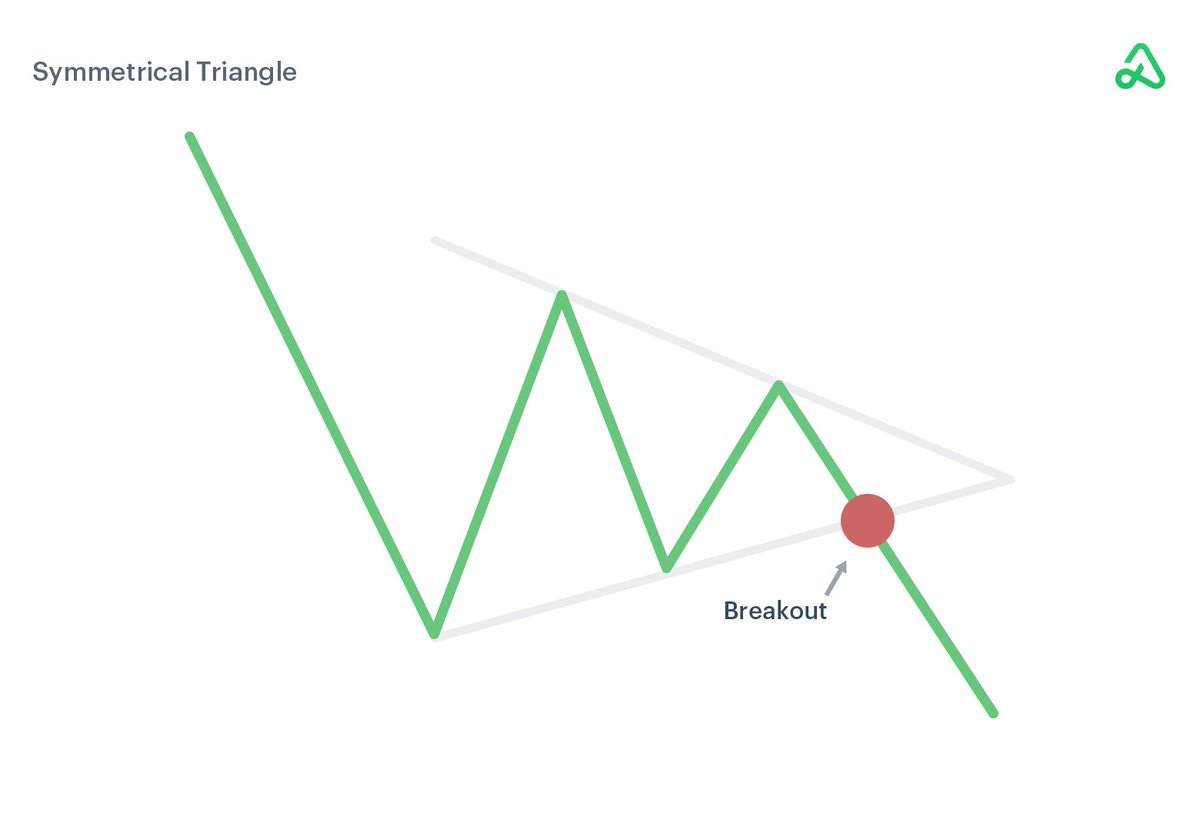

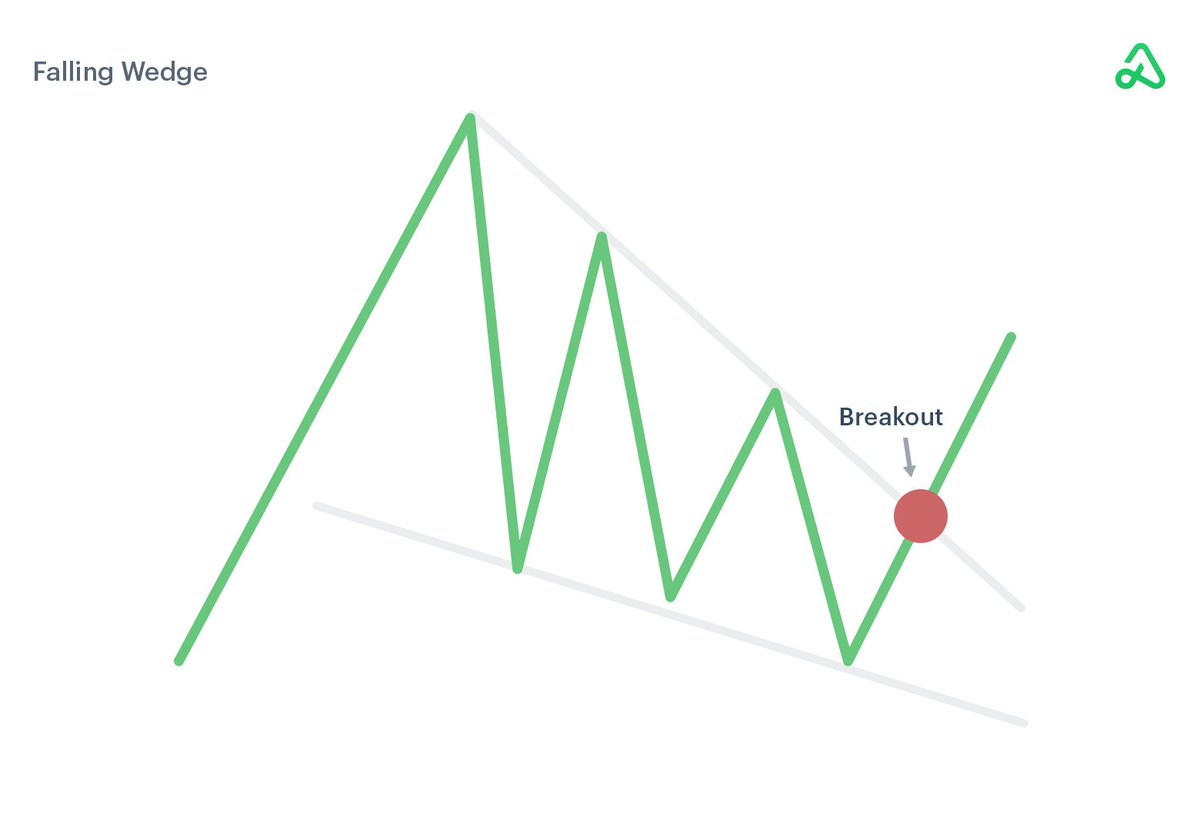

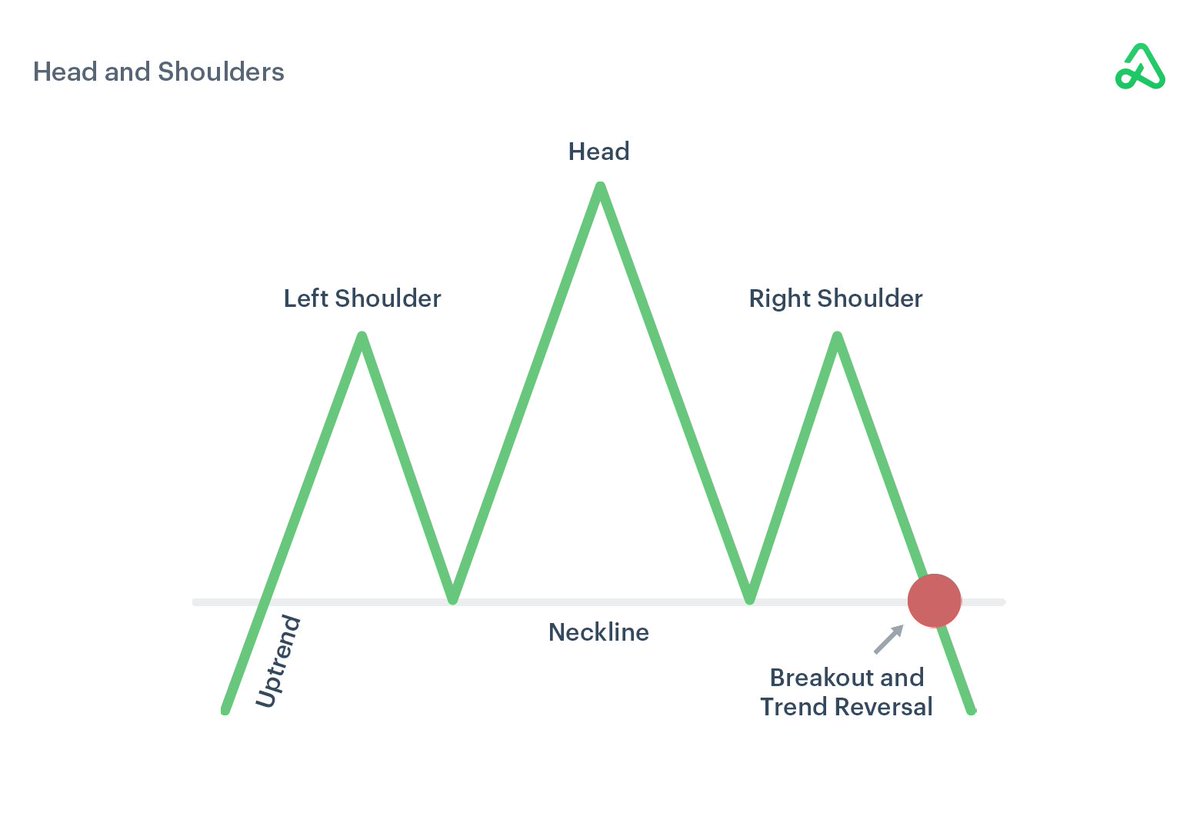

On a very basic level, stock chart patterns are a way of viewing a series of price actions that occur during a stock trading period. It can be over any time frame – monthly, weekly, daily, and intra-day.

That's all about this thread !

I hope you've found this thread helpful.

Follow us @chartians for more.

For live stocks and options trade updates, you can join our Telegram Channel ⤵️

telegram.me

Like/Repost the quote below if you can:

I hope you've found this thread helpful.

Follow us @chartians for more.

For live stocks and options trade updates, you can join our Telegram Channel ⤵️

telegram.me

Like/Repost the quote below if you can:

Loading suggestions...