What to Look For

1. Thesis - what are your beliefs about Crypto? Which ones do you have the strongest conviction in?

2. Strength - Focusing on where you're strong, & what you enjoy researching

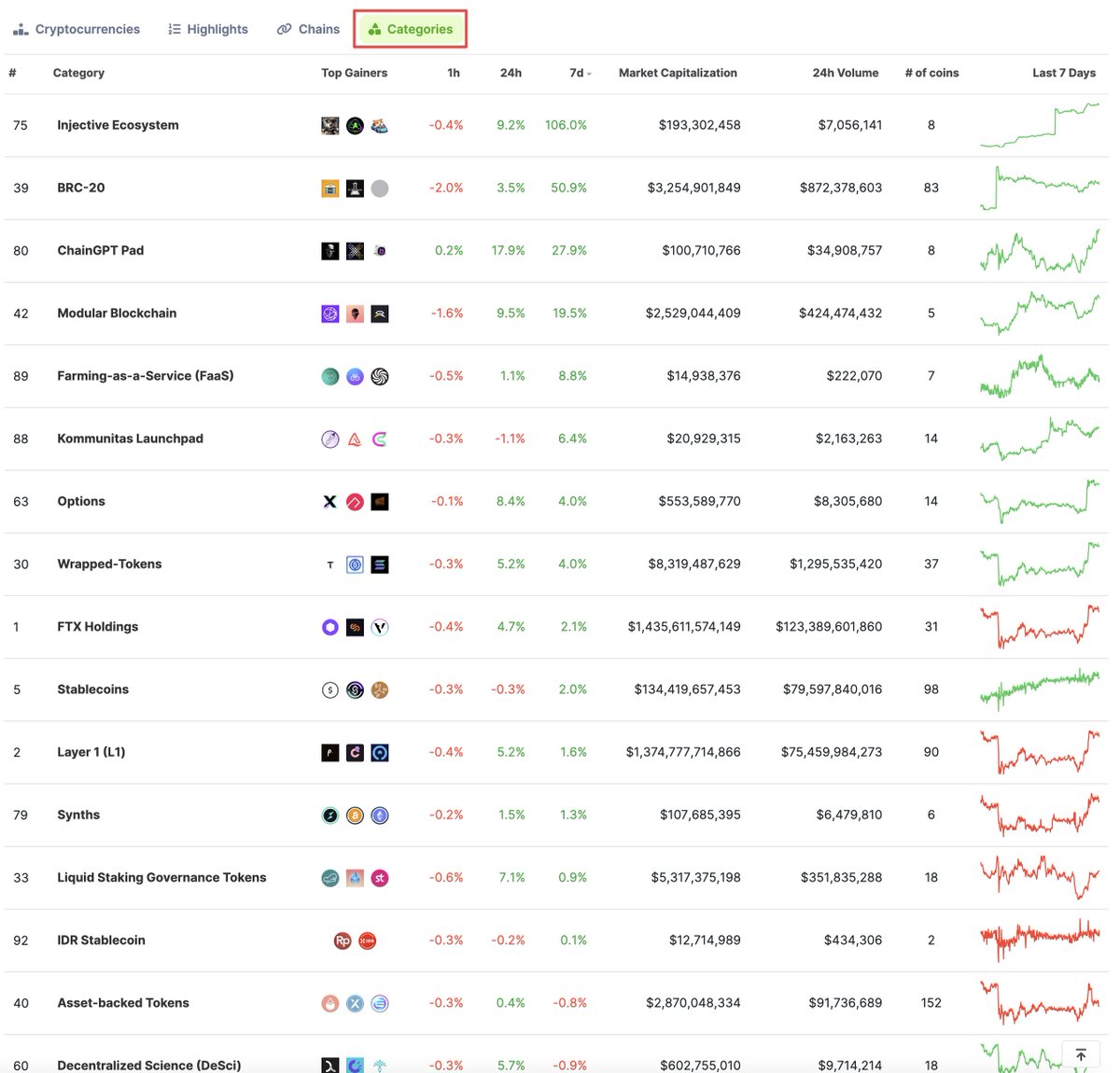

3. Timing - It's hot now or has the potential to be hot soon.

1. Thesis - what are your beliefs about Crypto? Which ones do you have the strongest conviction in?

2. Strength - Focusing on where you're strong, & what you enjoy researching

3. Timing - It's hot now or has the potential to be hot soon.

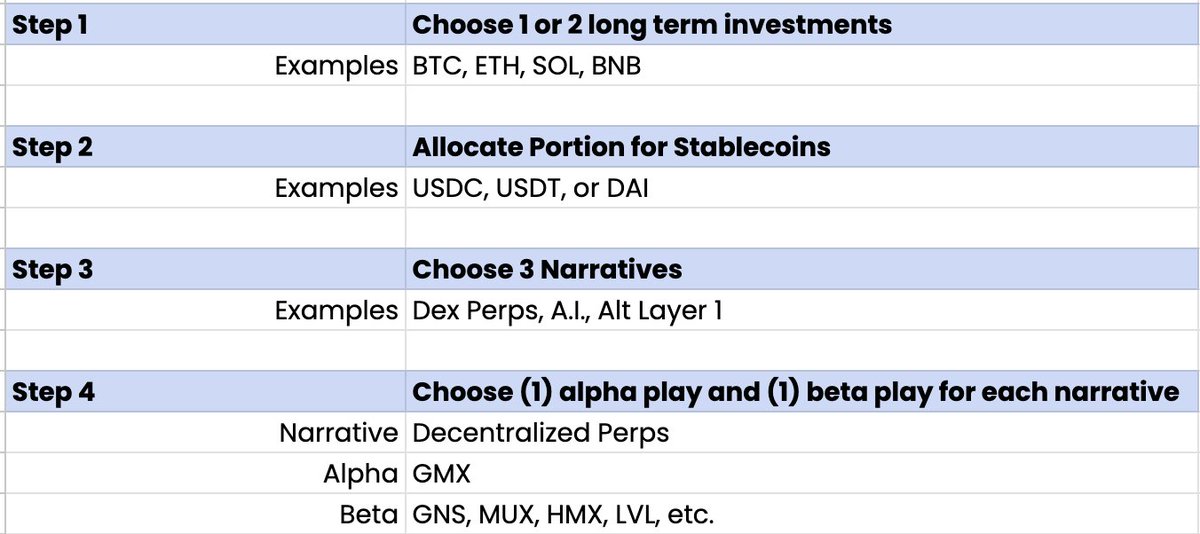

Example

• I'm not into GameFi - too many variables such as gameplay, gamefi tokenomics, etc. There's going to be a few winners but I don't have an edge here, and don't have interest.

• I believe A.I. has a ton of potential. It's something that retail understands + A.I. hype.

• I'm not into GameFi - too many variables such as gameplay, gamefi tokenomics, etc. There's going to be a few winners but I don't have an edge here, and don't have interest.

• I believe A.I. has a ton of potential. It's something that retail understands + A.I. hype.

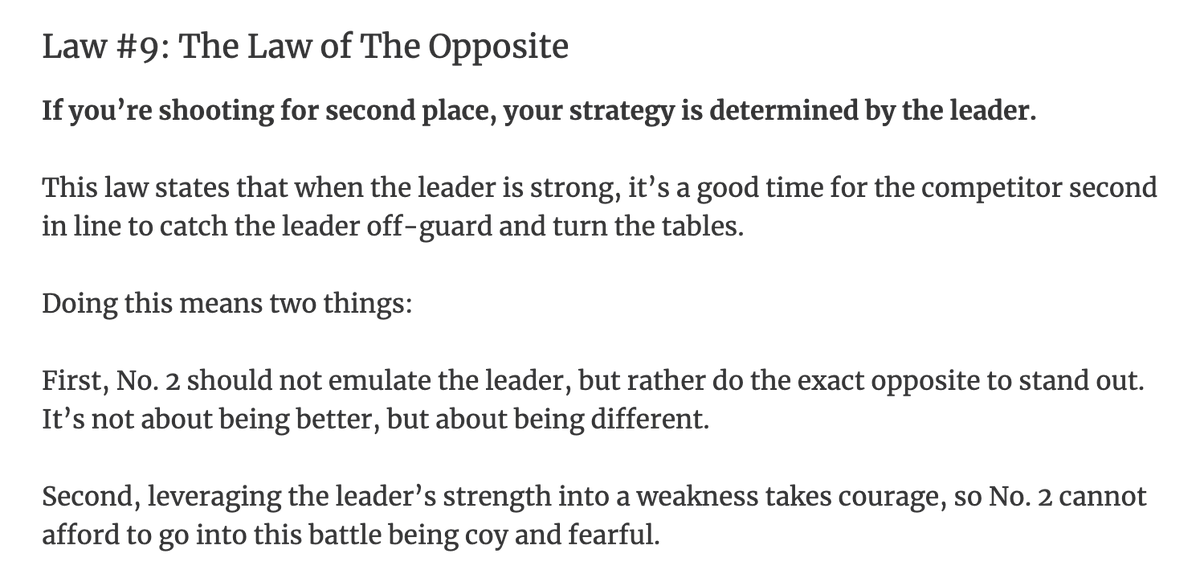

Why Alpha Plays?

Alpha play = leading protocol of each narrative.

Examples:

• Perps = $GMX

• A.I. = $TAO

• Liquid Staking = $LDO

I've observed that most people would be far more profitable if they simply stuck to the alpha plays (than constantly chasing betas).

Alpha play = leading protocol of each narrative.

Examples:

• Perps = $GMX

• A.I. = $TAO

• Liquid Staking = $LDO

I've observed that most people would be far more profitable if they simply stuck to the alpha plays (than constantly chasing betas).

Why?

1. Attention flows toward the market leader - especially with retail

2. Betting on the alpha is safer compared to getting rugged by higher-risk betas.

3. Simple. It's easier to bet on the leader than to determine which of the 15+ forks to choose.

1. Attention flows toward the market leader - especially with retail

2. Betting on the alpha is safer compared to getting rugged by higher-risk betas.

3. Simple. It's easier to bet on the leader than to determine which of the 15+ forks to choose.

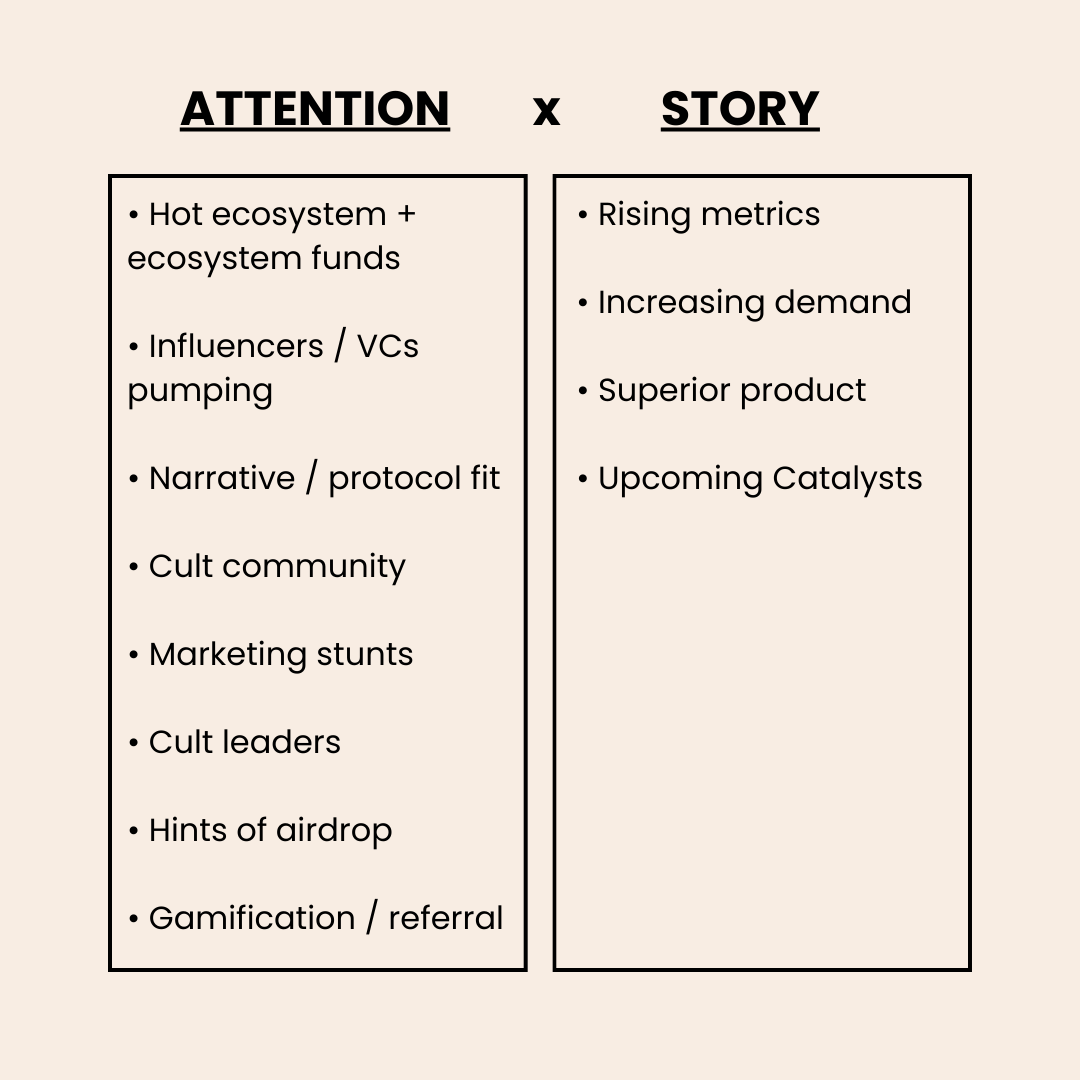

Attention Framework

The average Crypto user has the attention span of a goldfish.

A good product is essential, but the price won't pump if a protocol doesn't know the dark arts of marketing and distribution.

So, I look for protocols that understand this.

The average Crypto user has the attention span of a goldfish.

A good product is essential, but the price won't pump if a protocol doesn't know the dark arts of marketing and distribution.

So, I look for protocols that understand this.

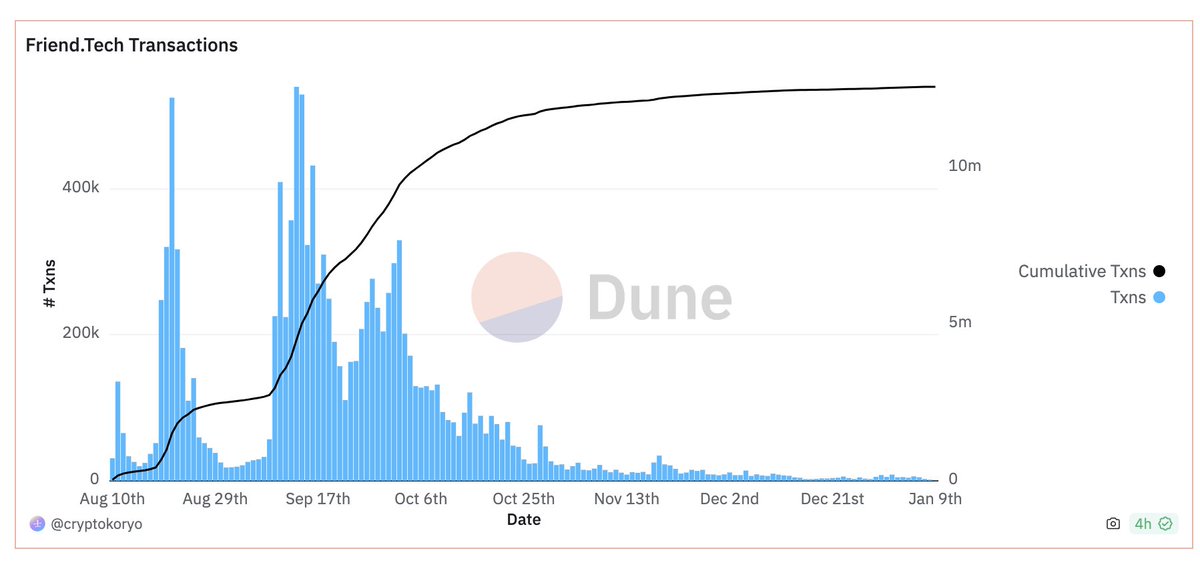

Stories

People buy because they believe the price will go up.

Stories are the reasons why they believe others will buy after them.

• Rising metrics

• Increasing demand

• Superior product - cheaper & faster than ETH

• Upcoming catalysts such as Version 2 or Binance listing

People buy because they believe the price will go up.

Stories are the reasons why they believe others will buy after them.

• Rising metrics

• Increasing demand

• Superior product - cheaper & faster than ETH

• Upcoming catalysts such as Version 2 or Binance listing

Simple Stories Sell

New liquidity will come from unsophisticated investors.

Think..."What can your dumb cousin easily explain & shill to his friends?"

They'll have no idea why "Curve" tokens are valuable.

Simple narratives include A.I., RWA, and Web 3 gaming.

New liquidity will come from unsophisticated investors.

Think..."What can your dumb cousin easily explain & shill to his friends?"

They'll have no idea why "Curve" tokens are valuable.

Simple narratives include A.I., RWA, and Web 3 gaming.

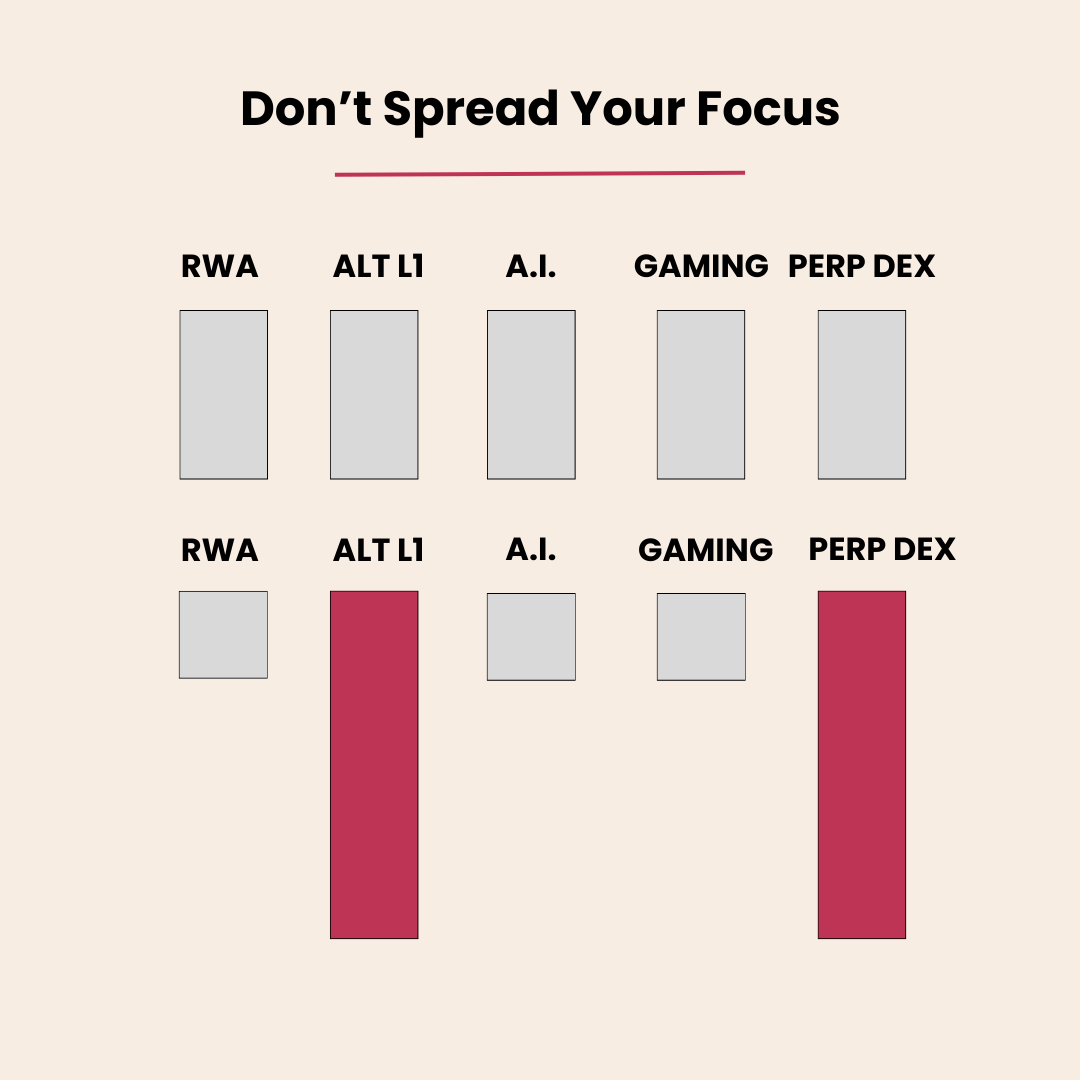

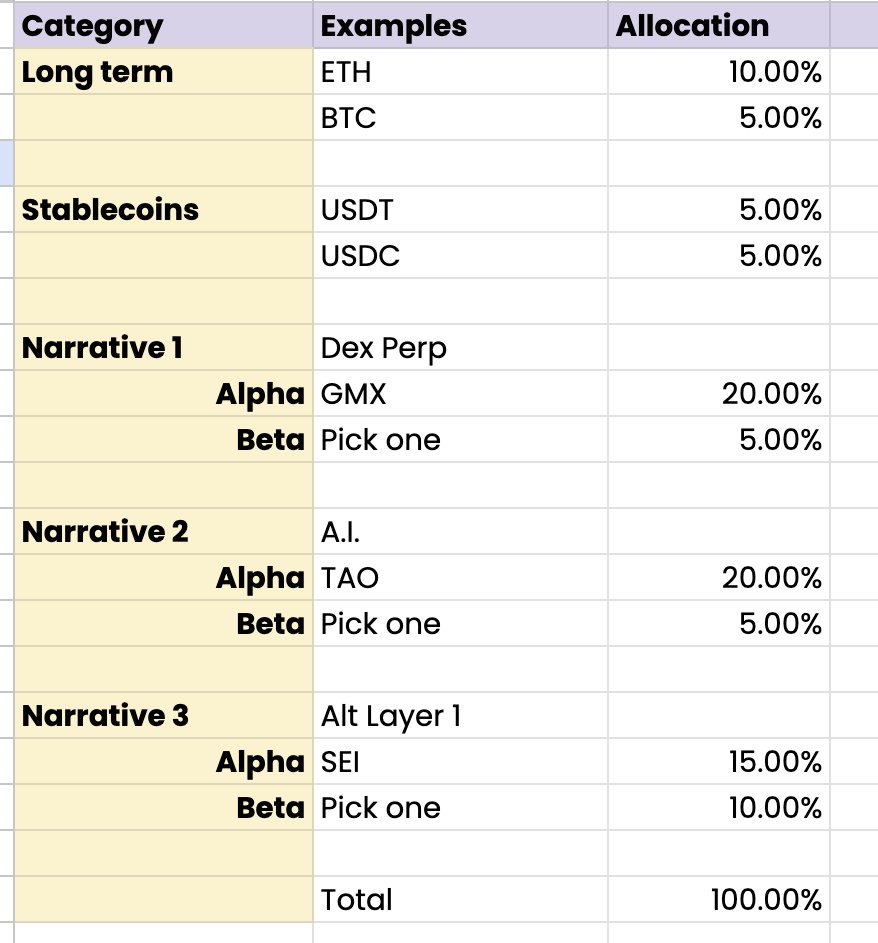

Portfolio Mistakes

• Over diversifying: 5 - 7 protocols is the sweet spot

• Mistiming the market. Aggressive now, conservative towards the end of the cycle

• Holding onto losers.

• Too much rotation.

• Over diversifying: 5 - 7 protocols is the sweet spot

• Mistiming the market. Aggressive now, conservative towards the end of the cycle

• Holding onto losers.

• Too much rotation.

Increasing Income

It's the gold rush, and trading isn't the only way to make money.

There are:

1) Airdrops

2) Getting a Web 3 job

3) Starting a side hustle

Every extra $100 you can earn is dry powder you can use to earn even more.

It's the gold rush, and trading isn't the only way to make money.

There are:

1) Airdrops

2) Getting a Web 3 job

3) Starting a side hustle

Every extra $100 you can earn is dry powder you can use to earn even more.

Cut the Losers

The trend is your friend, and everything is momentum-based. Too many people marry their bags & hope it'll break even again.

You can set a simple rule.

Example: "If the token goes down by 15%, I'm cutting it."

Cut losers and add to your winners.

The trend is your friend, and everything is momentum-based. Too many people marry their bags & hope it'll break even again.

You can set a simple rule.

Example: "If the token goes down by 15%, I'm cutting it."

Cut losers and add to your winners.

The Trend is Your Friend

After a protocol pump, it's easy to think, "Oh, it already went up 10x - I'm too late."

It can pump even further. We underestimate the power of FOMO and retail liquidity.

Don't forget that PRICE IS A NARRATIVE.

After a protocol pump, it's easy to think, "Oh, it already went up 10x - I'm too late."

It can pump even further. We underestimate the power of FOMO and retail liquidity.

Don't forget that PRICE IS A NARRATIVE.

The Best Research

Download a burner wallet and fund it with a few hundred bucks. Spend an hour every day just trying out new apps.

Sometimes, you won't understand a product just from reading a thread about it. You have to use it.

Plus, you'll get more airdrops this way.

Download a burner wallet and fund it with a few hundred bucks. Spend an hour every day just trying out new apps.

Sometimes, you won't understand a product just from reading a thread about it. You have to use it.

Plus, you'll get more airdrops this way.

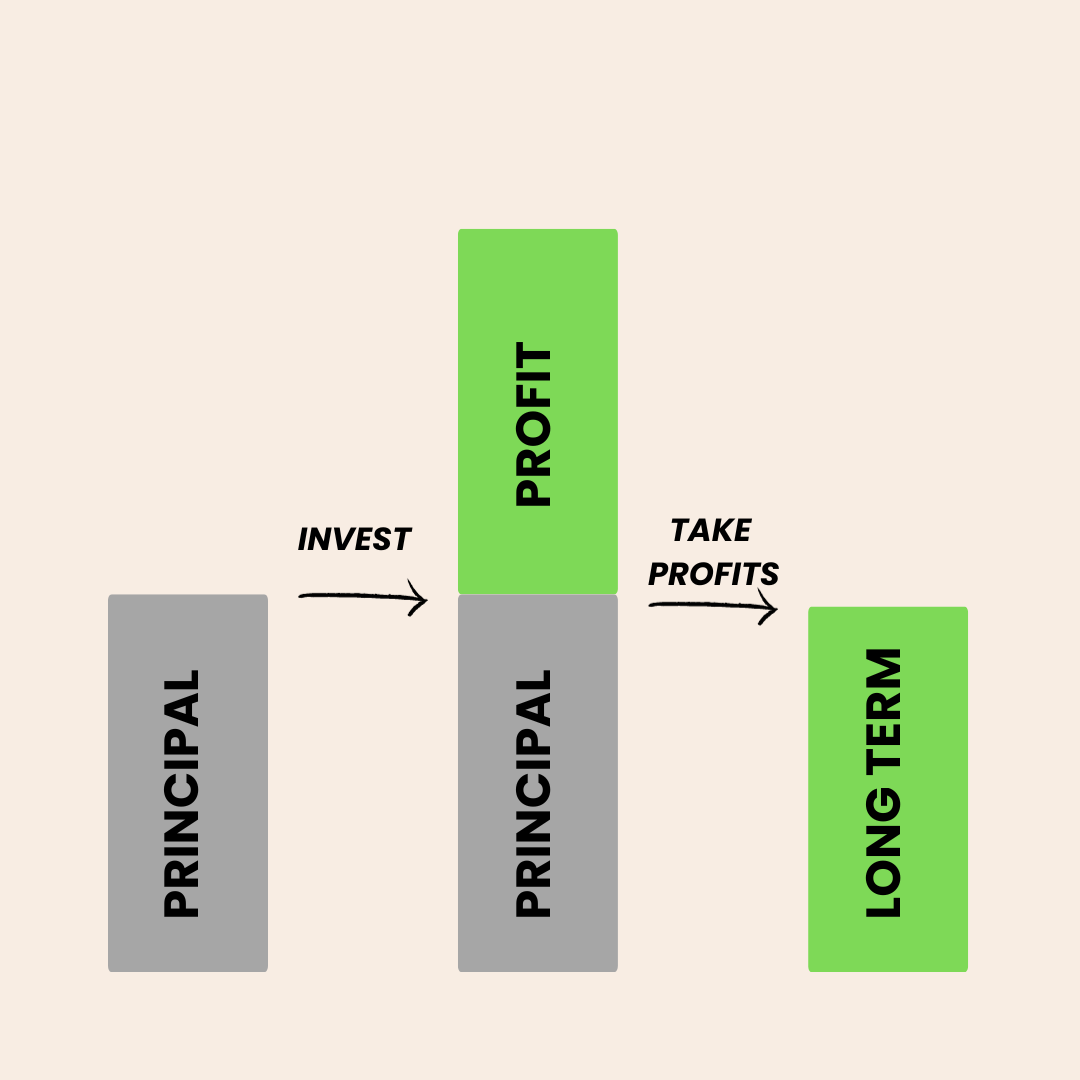

Taking Profits

1. Don't try to time the top - DCA out.

2. Take profits into your long-term bags or Stables

3. Taking profits & putting them into riskier plays isn't taking profits.

4. Set simple rules. Ex: "If the bag 3x, I will take out the principal and convert it to USDT"

1. Don't try to time the top - DCA out.

2. Take profits into your long-term bags or Stables

3. Taking profits & putting them into riskier plays isn't taking profits.

4. Set simple rules. Ex: "If the bag 3x, I will take out the principal and convert it to USDT"

Get out of the Bubble

CT is its own echo chamber.

Hang out on YouTube, TikTok, Reddit, & Instagram to see what your exit liquidity is thinking.

Also, English Twitter is a bubble. Find ways to see what the Chinese / Korean traders think.

CT is its own echo chamber.

Hang out on YouTube, TikTok, Reddit, & Instagram to see what your exit liquidity is thinking.

Also, English Twitter is a bubble. Find ways to see what the Chinese / Korean traders think.

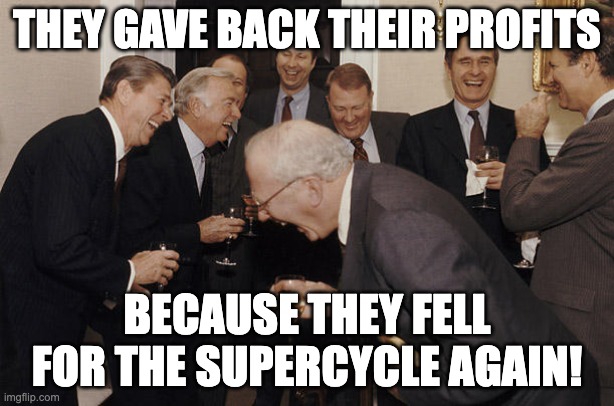

Finding the 10x is the easy part.

You fuck up by not being happy with the 10x. And lose it all trying to chase after that 25x.

If you've made profits that can increase your life, then SECURE it. Or have fun being exit liquidity for the big boys.

You fuck up by not being happy with the 10x. And lose it all trying to chase after that 25x.

If you've made profits that can increase your life, then SECURE it. Or have fun being exit liquidity for the big boys.

Alright, that's it.

There's a lot more, but we've reached the attention span limit of Twitter.

This thread took 40 hrs to write, but 7+ years of being in the trenches to learn the lessons.

If you enjoyed this tweet, help me out by liking and sharing the original tweet below.

There's a lot more, but we've reached the attention span limit of Twitter.

This thread took 40 hrs to write, but 7+ years of being in the trenches to learn the lessons.

If you enjoyed this tweet, help me out by liking and sharing the original tweet below.

جاري تحميل الاقتراحات...