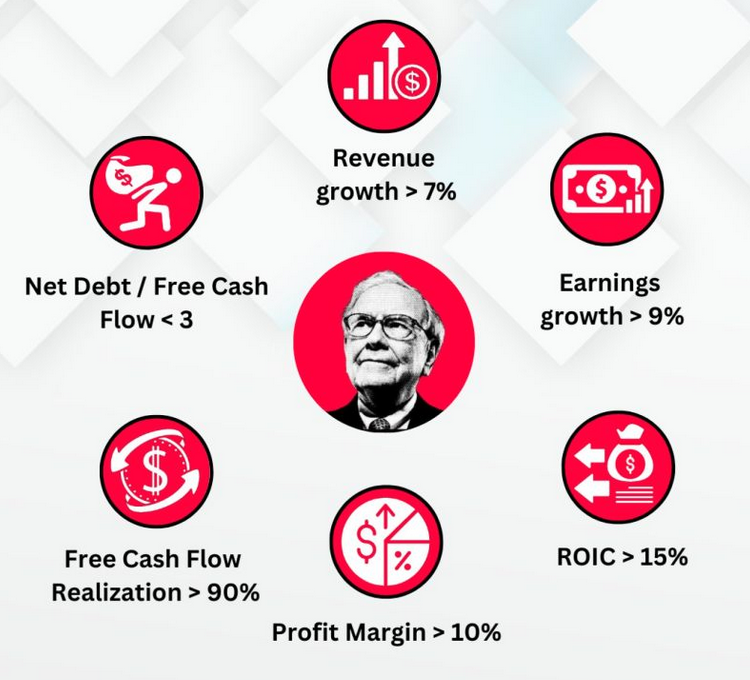

Here are the 4 criteria Buffett uses to select stocks:

1) Invest in companies you understand

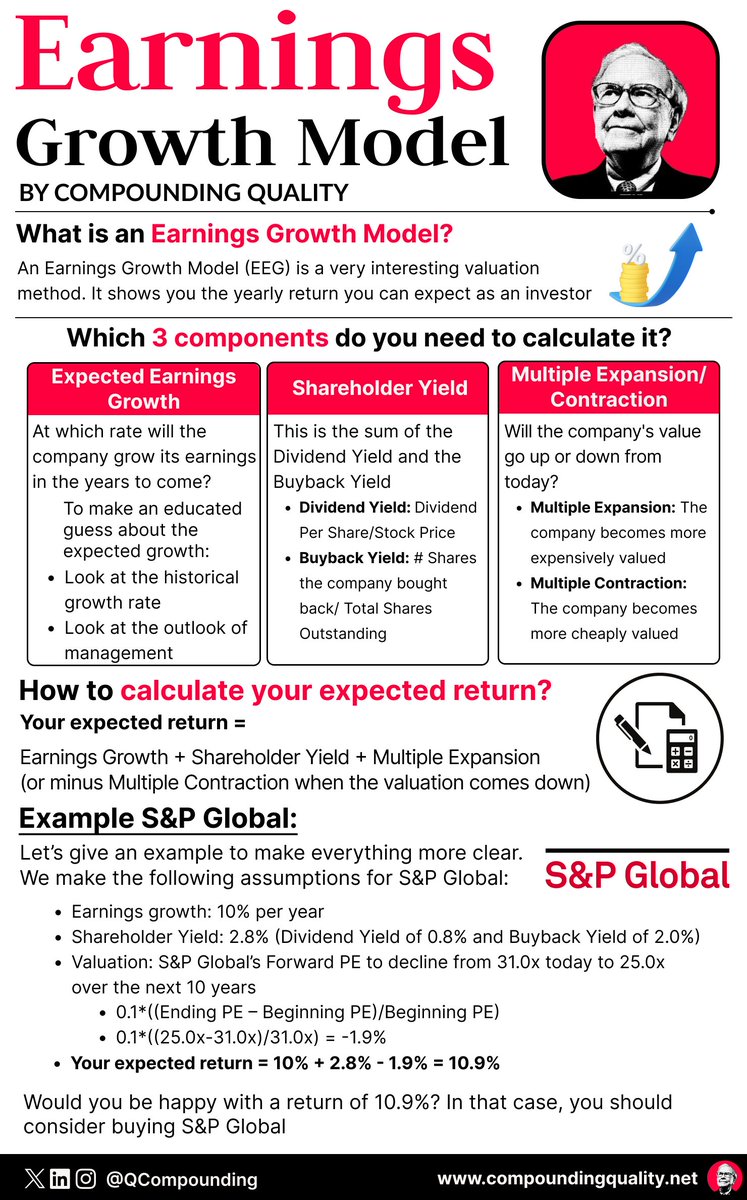

2) That can grow their free cash flow at attractive rates

3) Led by outstanding mangers

4) Trading at a fair valuation levels

1) Invest in companies you understand

2) That can grow their free cash flow at attractive rates

3) Led by outstanding mangers

4) Trading at a fair valuation levels

How can you find these companies?

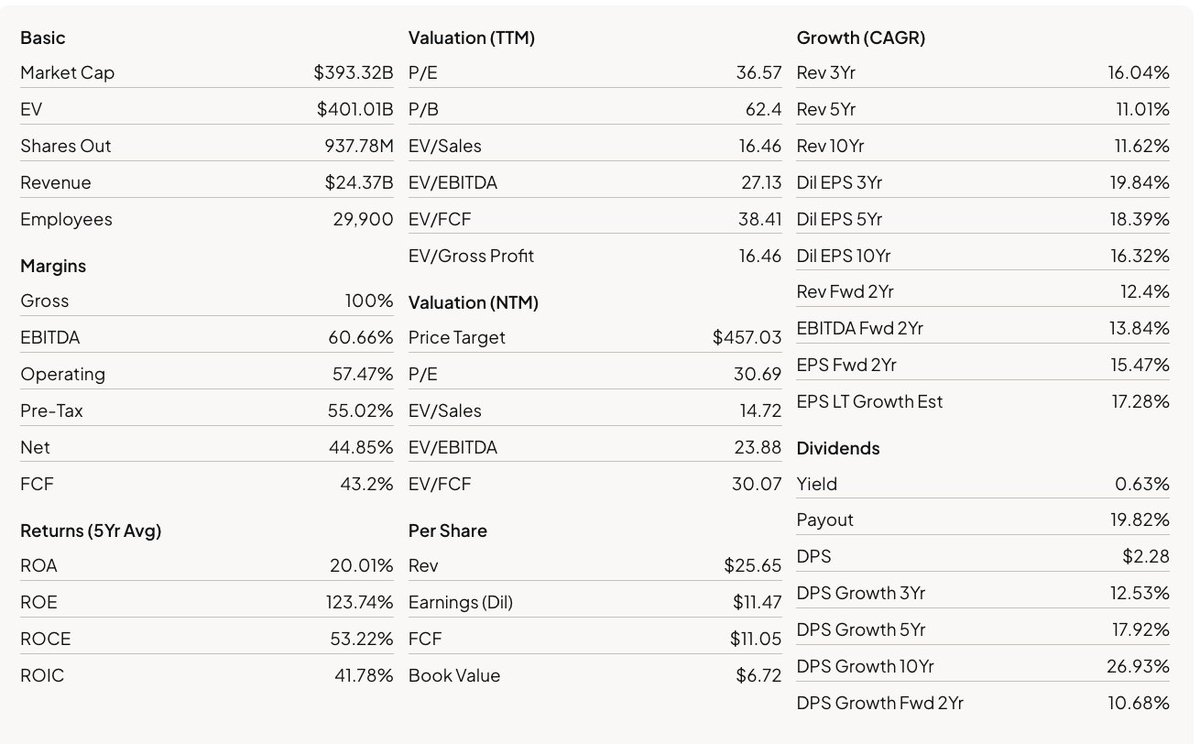

Use a stock screener like Finchat to screen for great companies.

Use a stock screener like Finchat to screen for great companies.

The next thing you should do is to look at the company's history.

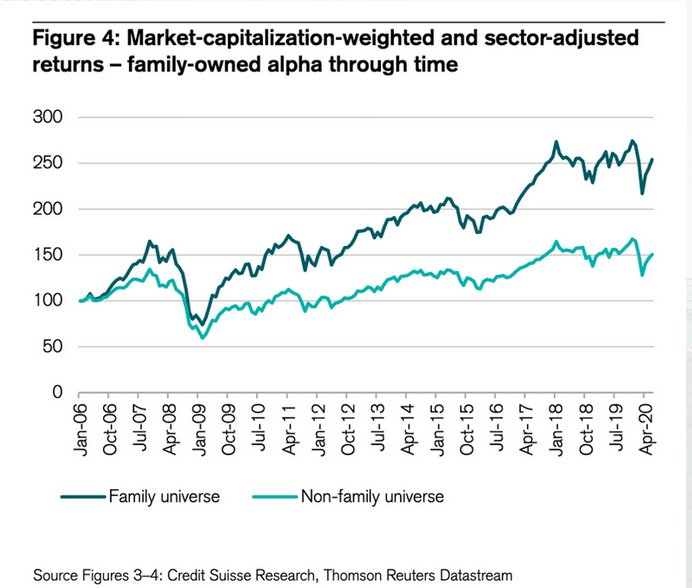

You want to invest in companies that performed well in the past.

Why?

- It gives an indication that the company is a great capital allocator

- Management thinks and acts like a shareholder

You want to invest in companies that performed well in the past.

Why?

- It gives an indication that the company is a great capital allocator

- Management thinks and acts like a shareholder

The next thing you should do is research the company

You should always stay within your circle of competence

Look at the company's annual report:

- How do they make money?

- Who are the main customers?

- What does the product solve?

- ...

You should always stay within your circle of competence

Look at the company's annual report:

- How do they make money?

- Who are the main customers?

- What does the product solve?

- ...

That's it for today.

If you liked this, you'll love the summary I made from reading all public writings of Warren Buffett (5,000 pages).

It's like a free book. Grab it here: compounding-quality.ck.page

If you liked this, you'll love the summary I made from reading all public writings of Warren Buffett (5,000 pages).

It's like a free book. Grab it here: compounding-quality.ck.page

Loading suggestions...