most opportunities. As pradeep Bonde say's you need to "ORGANIZE LIKE CRAZY". So here is how I organize my watchlist.

First of all I scan the whole universe on weekends with top 1 Month, 3 Month & 6 Month gainer on @ChartinkConnect with some basic filters of liquidity& Mcap.

First of all I scan the whole universe on weekends with top 1 Month, 3 Month & 6 Month gainer on @ChartinkConnect with some basic filters of liquidity& Mcap.

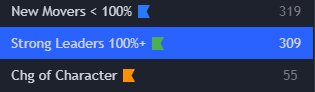

As MADRASFERT made its first leg with 30%+ move it came in scan - mark with blue flag. Like that you will get lot of stocks & I manually flag them & wait for the right setup formation to trade them on continuation setups.

I do this every weekend & prepare my FOCUS LIST where I select the stocks from these 2 lists which are setting up for next leg.

🟡 Yellow Flag List -

On daily basis I go through Top gainers of universe ( Stocks above 4.5%+) & look for stocks that are showing some stock PA with

🟡 Yellow Flag List -

On daily basis I go through Top gainers of universe ( Stocks above 4.5%+) & look for stocks that are showing some stock PA with

PP volumes ( HVY/HVQ/ HVE). For ex - Recently many chemical stocks shown some action. Though there is not confirmed uptrend yet I marked them yellow to see "Change of character". If they continue to show such PA for some days & 30%+ I move them in Blue List & wait for my setup.

Some stocks from blue list will make their 100%+ move & I move them to Green List. I try to take chance on stocks mostly on the stocks from green list.

These kind of Organization helps me -

1. To understand how was the market today as if leaders are doing well I'm more

These kind of Organization helps me -

1. To understand how was the market today as if leaders are doing well I'm more

comfortable.

2. To get setups from the selected stocks which are really in strength & connect me with ongoing theme/Sectoral move.

3. I don't need to scan everyday to look for setup - It reduces noise.

This is my way of organizations which makes my process smooth enough.

2. To get setups from the selected stocks which are really in strength & connect me with ongoing theme/Sectoral move.

3. I don't need to scan everyday to look for setup - It reduces noise.

This is my way of organizations which makes my process smooth enough.

You can customize as per your need with such combinations.

That's it for the day friends. If you have any questions regrading scanning , organizations etc. feel free to comment down below, I'm happy to share.

If you liked this thread do like ♥️& retweet 🔁for max reach.

That's it for the day friends. If you have any questions regrading scanning , organizations etc. feel free to comment down below, I'm happy to share.

If you liked this thread do like ♥️& retweet 🔁for max reach.

Loading suggestions...