7 Personal Finance Rules that will help you save more money

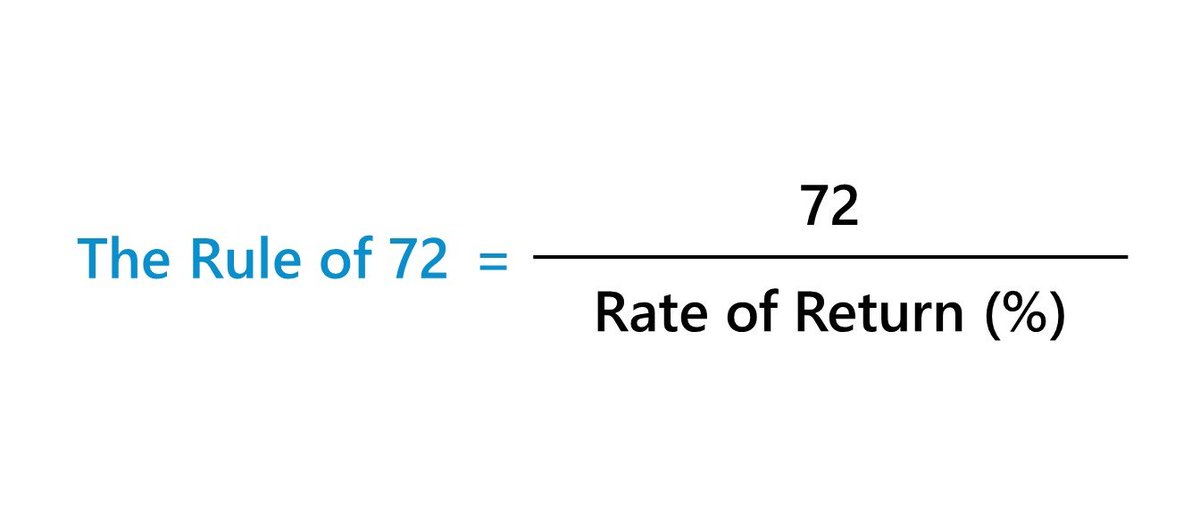

1) Rule of 72

2) 100- Age Rule

3) 50-30-20 Rule

4) 1st Week Rule

5) 6X Emergency Fund

6) 40% EMI Rule

7) 25X Retirement Rule.

1) Rule of 72

2) 100- Age Rule

3) 50-30-20 Rule

4) 1st Week Rule

5) 6X Emergency Fund

6) 40% EMI Rule

7) 25X Retirement Rule.

2) 100- Age Rule

You want to know how much % of your assets you should invest in equity?

Subtract 100 by your ago to find out.

Example: when you're 40 years old you should invest 60% of your assets in stocks.

You want to know how much % of your assets you should invest in equity?

Subtract 100 by your ago to find out.

Example: when you're 40 years old you should invest 60% of your assets in stocks.

3) 50-30-20 Rule

Here's how to budget your income:

➡️ 50% Spend on needs (bills, education, transport, food etc)

➡️ 30% on wants (Holidays, Movies, restaurants etc)

➡️ 20% Savings and investments

Here's how to budget your income:

➡️ 50% Spend on needs (bills, education, transport, food etc)

➡️ 30% on wants (Holidays, Movies, restaurants etc)

➡️ 20% Savings and investments

4) 1st Week Rule

The best way to create wealth is to pay yourself first.

Invest 10-20% of your income and always put it aside in the first week of the month.

The best way to create wealth is to pay yourself first.

Invest 10-20% of your income and always put it aside in the first week of the month.

5) 6X Emergency Fund

Before you invest, make sure you have an emergency fund.

Your emergency fund should be equal to 6x your monthly income.

If you earn $6k a month, your emegency fund should have $36k.

Before you invest, make sure you have an emergency fund.

Your emergency fund should be equal to 6x your monthly income.

If you earn $6k a month, your emegency fund should have $36k.

6) 40% EMI Rule

The maximum loan you can take should not eat up more that 40% of your net monthly income.

You earn $10k per month? In that case you take a mortgage for maximum $4k per month.

The maximum loan you can take should not eat up more that 40% of your net monthly income.

You earn $10k per month? In that case you take a mortgage for maximum $4k per month.

7) 25X investment Rule

This rule says that u can think about retirement when u have funds worth 25 times your annual expenses.

You need $50,000 per year to live? In that case you should have at least $1.25 million to retire.

This rule says that u can think about retirement when u have funds worth 25 times your annual expenses.

You need $50,000 per year to live? In that case you should have at least $1.25 million to retire.

That's it for today.

2024 just started.

You want to secure your financial future?

Here are our 10 favorite stocks for 2024 👇

compounding-quality.ck.page

2024 just started.

You want to secure your financial future?

Here are our 10 favorite stocks for 2024 👇

compounding-quality.ck.page

Loading suggestions...