NOT ADVICE How to learn from 2023!

Study ALL the stocks that went up at least 2X SPY in 2023

1. Sort by percent gain

2. VIP use the exact same chart settings you use daily

3. Unless you specialize in acquisitions, junk off the bottom, lotto biotechs that got FDA approval or gapped up on a good study...ignore those...don't use BS 20/20 hindsight!

4. One at a time, trace back to the day/week when the real move started. Make an annotation on that bar, then move to the next

5. Again, one at a time, change the date back to the day BEFORE the stock's real move started & make sure the chart has all your normal settings (indicators, moving averages, etc.)

6. The next step requires 100% intellectual honesty or don't waste your time & go watch Netflix with a bag of chips

7. 🗝️ Advance one bar at a time. Ask yourself on EVERY bar when would you have bought, added, reduced or sold.

8. Do that until the stock has clearly topped. Some of the stocks you'll never have bought...that's 100% okay and normal.

9. Make notes of your observations. If you have a theory for a new rule, write it down & test it on the other stocks

Tips (NOT ADVICE) don't rush through these. If you can only do one a day at first...then just do one a day.

This is NOT a race...

This is a classic fish tank study (Model Book) ...sometimes you'll need to go back to the beginning and start over one bar at a time...that's normal

If you aren't having fun & this is boring to you..#MTFU!

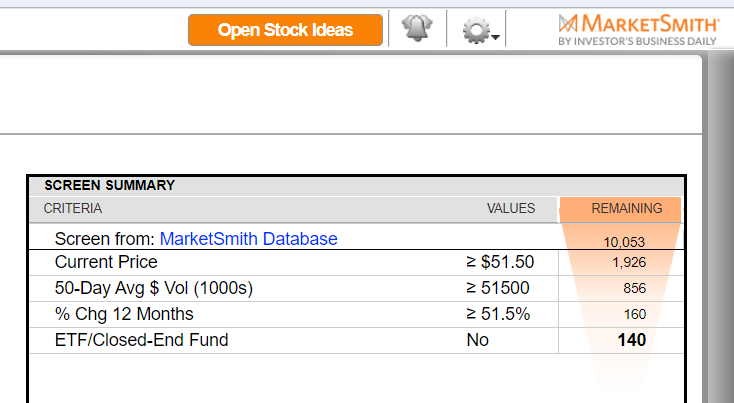

Here's a sample screen to start with, feel free to make it looser...just not as loose as Lucy😉😜🤘

#HappyNewYear @MarketSmith @IBDinvestors

Study ALL the stocks that went up at least 2X SPY in 2023

1. Sort by percent gain

2. VIP use the exact same chart settings you use daily

3. Unless you specialize in acquisitions, junk off the bottom, lotto biotechs that got FDA approval or gapped up on a good study...ignore those...don't use BS 20/20 hindsight!

4. One at a time, trace back to the day/week when the real move started. Make an annotation on that bar, then move to the next

5. Again, one at a time, change the date back to the day BEFORE the stock's real move started & make sure the chart has all your normal settings (indicators, moving averages, etc.)

6. The next step requires 100% intellectual honesty or don't waste your time & go watch Netflix with a bag of chips

7. 🗝️ Advance one bar at a time. Ask yourself on EVERY bar when would you have bought, added, reduced or sold.

8. Do that until the stock has clearly topped. Some of the stocks you'll never have bought...that's 100% okay and normal.

9. Make notes of your observations. If you have a theory for a new rule, write it down & test it on the other stocks

Tips (NOT ADVICE) don't rush through these. If you can only do one a day at first...then just do one a day.

This is NOT a race...

This is a classic fish tank study (Model Book) ...sometimes you'll need to go back to the beginning and start over one bar at a time...that's normal

If you aren't having fun & this is boring to you..#MTFU!

Here's a sample screen to start with, feel free to make it looser...just not as loose as Lucy😉😜🤘

#HappyNewYear @MarketSmith @IBDinvestors

Loading suggestions...