3. Value

The choice in investing is not about growth or value.

It's about value today or value tomorrow.

But the further out the value is, the harder it is to assess it.

And without a reasonable estimate of value, there can be no intelligent investing.

The choice in investing is not about growth or value.

It's about value today or value tomorrow.

But the further out the value is, the harder it is to assess it.

And without a reasonable estimate of value, there can be no intelligent investing.

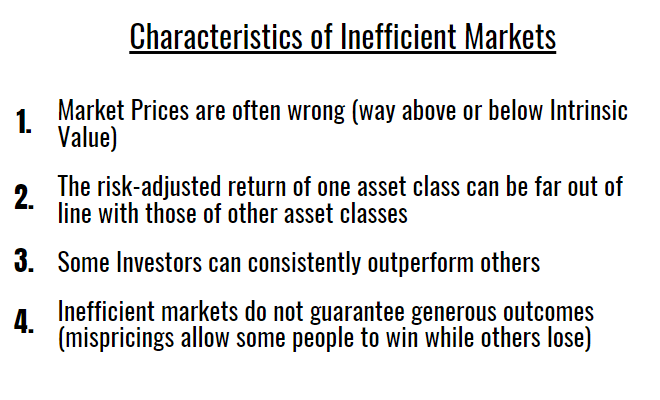

4. The Relationship between Price and Value

Value and price always belong together.

A great company at the wrong price is a bad investment.

A bad company at a great price can be a good investment.

Only in investing, people like something when its price rises...

Value and price always belong together.

A great company at the wrong price is a bad investment.

A bad company at a great price can be a good investment.

Only in investing, people like something when its price rises...

6. Being Attentive to Cycles

There are two rules regarding Cyclicality:

1. Most things will prove to be cyclical

2. Some of the greatest opportunities come when people forget Rule Number 1.

Cycles are self-correcting in nature. That helps the attentive investor.

There are two rules regarding Cyclicality:

1. Most things will prove to be cyclical

2. Some of the greatest opportunities come when people forget Rule Number 1.

Cycles are self-correcting in nature. That helps the attentive investor.

8. Combating Negative Influences

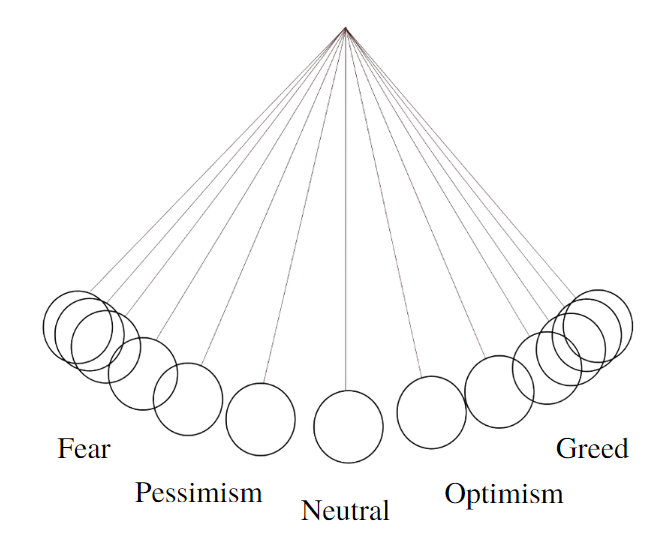

Fear and greed are the driving forces in markets. Buffett also made a case for envy.

Either way, keeping your emotions in check is inevitable for great performance.

The fiercest opponent is your own mind.

Fear and greed are the driving forces in markets. Buffett also made a case for envy.

Either way, keeping your emotions in check is inevitable for great performance.

The fiercest opponent is your own mind.

9. Contrarianism

The majority of investors are trend followers.

This creates the self-reinforcing cycles we talked about.

Because of that, instead of "buy high, sell low (impossible to predict), buy when they hate them and sell when they love them.

The majority of investors are trend followers.

This creates the self-reinforcing cycles we talked about.

Because of that, instead of "buy high, sell low (impossible to predict), buy when they hate them and sell when they love them.

10. Finding Bargains

Almost all investors start out investing in the Apple's and Microsoft's out there.

The bargains, however, are where others don't look.

Boring small and mid-caps double, triple, or even tenfold all the time.

Almost all investors start out investing in the Apple's and Microsoft's out there.

The bargains, however, are where others don't look.

Boring small and mid-caps double, triple, or even tenfold all the time.

11. Patient Opportunism

Great investors are patient and opportunistic.

They don't chase investments. They research companies. Get a sense of intrinsic value.

And wait until the market is willing to sell it to them for less.

People who chase investments almost always overpay.

Great investors are patient and opportunistic.

They don't chase investments. They research companies. Get a sense of intrinsic value.

And wait until the market is willing to sell it to them for less.

People who chase investments almost always overpay.

12. Knowing What You Don't Know

"It's not what you don't know that gets you in trouble, it's what you know that just ain't so." - Mark Twain

Be very honest about what you know.

You don't need to be part of every new invention. In Investing, you can win by knowing a niche well.

"It's not what you don't know that gets you in trouble, it's what you know that just ain't so." - Mark Twain

Be very honest about what you know.

You don't need to be part of every new invention. In Investing, you can win by knowing a niche well.

13. The Role of Luck

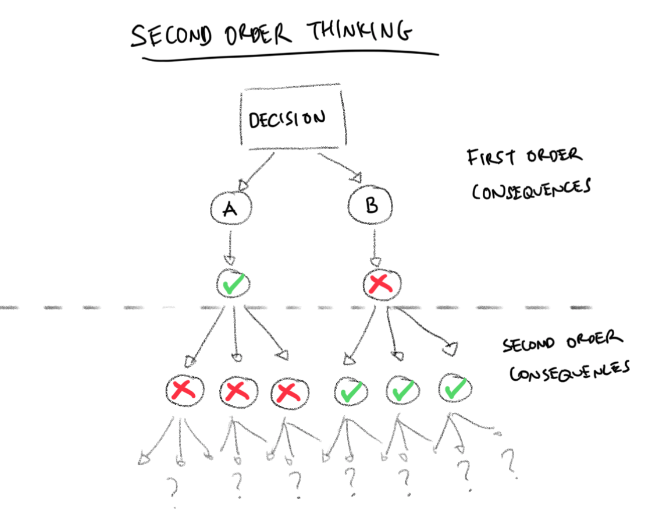

Nassim Taleb coined the term "alternative histories."

Things can play out in many ways. We only see one playing out, but there were countless alternatives.

The most likely things fail to happen all the time. Consider that when you make investment decisions

Nassim Taleb coined the term "alternative histories."

Things can play out in many ways. We only see one playing out, but there were countless alternatives.

The most likely things fail to happen all the time. Consider that when you make investment decisions

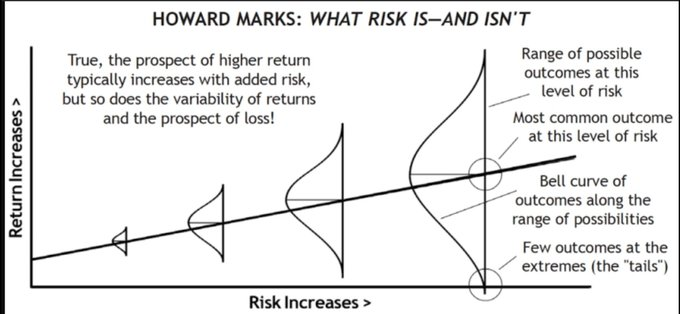

14. Investing Defensively

The great money is in compounding.

For compounding to succeed, you may never disturb the process.

Because of that, prioritize avoiding losers over pursuing big winners.

Always implement a margin of safety!

The great money is in compounding.

For compounding to succeed, you may never disturb the process.

Because of that, prioritize avoiding losers over pursuing big winners.

Always implement a margin of safety!

15. Pulling It All Together

The foundation for successful investing - is value!

You must have a good idea of what an asset is worth.

When you have that, avoid all psychological pitfalls and wait for the market to present you a buying opportunity.

The foundation for successful investing - is value!

You must have a good idea of what an asset is worth.

When you have that, avoid all psychological pitfalls and wait for the market to present you a buying opportunity.

Here's my Article on Mark's Understanding of Risk:

danielmnke.com

danielmnke.com

That's it for today!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

x.com

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

x.com

Get Access to:

- My Stock Research

- The Best Investing PDFs

- Bookshelf (Recommendations)

- My Portfolio

danielmnke.com

- My Stock Research

- The Best Investing PDFs

- Bookshelf (Recommendations)

- My Portfolio

danielmnke.com

Loading suggestions...