This is how you find #crypto winners such as:

$MATIC +45,000%,

$SOL +50,000%,

$TIA +700%,

$ORDI +2100%

How I made millions by keeping track of new altcoins and narratives 👇🏼

$MATIC +45,000%,

$SOL +50,000%,

$TIA +700%,

$ORDI +2100%

How I made millions by keeping track of new altcoins and narratives 👇🏼

Before we dive into this thread, I want to begin with a disclaimer: The realm of cryptocurrency offers a multitude of methods for identifying winners and generating profits.

In this thread, I will keep it brief and to the point, focusing on one technique that has consistently yielded positive results for me throughout the years.

In this thread, I will keep it brief and to the point, focusing on one technique that has consistently yielded positive results for me throughout the years.

It's a well-established fact that people are drawn to new shiny coins.

Newly listed coins, especially those with their primary listing on Binance, hold significant profit potential.

These assets typically come with fresh charts, often featuring staggered unlocks (meaning investors are locked for the initial months of trading), and possess the flexibility to shape new narratives easily.

Newly listed coins, especially those with their primary listing on Binance, hold significant profit potential.

These assets typically come with fresh charts, often featuring staggered unlocks (meaning investors are locked for the initial months of trading), and possess the flexibility to shape new narratives easily.

We can clearly see this with all of the recent Binance primary listings such as $JTO, $TIA, $NTRN, $SEI, $APT

Primary means an altcoin is listed for the first time

However we need to learn to recognize when something is a good buy or not

Many of recent listings have been listing at very high evaluations (2b)+

In my eyes, projects on binance:

Infrastructure around $1b fdv are a good buy

Other projects around $500m fdv are a good buy

Primary means an altcoin is listed for the first time

However we need to learn to recognize when something is a good buy or not

Many of recent listings have been listing at very high evaluations (2b)+

In my eyes, projects on binance:

Infrastructure around $1b fdv are a good buy

Other projects around $500m fdv are a good buy

Bybit has recently also seen a growth of listings that have been doing well.

It worth monitoring these alts also

$BONK and $NEON as an example

It worth monitoring these alts also

$BONK and $NEON as an example

Alright, let's talk about newly listed coins ✅.

However, it's crucial to understand how to distinguish the winners from the losers...

Firstly, in my previous Tradingview guide, I showed you how to create watchlists. Now, go ahead and set up a watchlist named "new listings."

However, it's crucial to understand how to distinguish the winners from the losers...

Firstly, in my previous Tradingview guide, I showed you how to create watchlists. Now, go ahead and set up a watchlist named "new listings."

Follow t.me

with the inclusion of alerts, every time a new asset is listed, please ensure it's promptly added to your watchlist.

Now, let's delve into several critical elements that require thorough research before considering an investment in these newly listed assets.

with the inclusion of alerts, every time a new asset is listed, please ensure it's promptly added to your watchlist.

Now, let's delve into several critical elements that require thorough research before considering an investment in these newly listed assets.

Condition 1: Favorable Token Metrics for Market Purchase.

In our evaluation of each newly listed asset, we aim to thoroughly investigate and gather information regarding the following aspects of token metrics:

- Unlock schedule for Seed/Private Rounds.

- Token pricing in Seed Round/Private Round, as well as other subsequent rounds.

- Identifying the key stakeholders, including investors, advisors, and the core team.

In our evaluation of each newly listed asset, we aim to thoroughly investigate and gather information regarding the following aspects of token metrics:

- Unlock schedule for Seed/Private Rounds.

- Token pricing in Seed Round/Private Round, as well as other subsequent rounds.

- Identifying the key stakeholders, including investors, advisors, and the core team.

Next, our focus shifts to understanding the token's price per unit in various rounds of distribution.

It's essential to consider scenarios where investors receive 25% unlocked tokens at the listing, but if the token's price skyrockets by a factor of x50, it might not represent an attractive investment opportunity.

Similarly, if Binance's launchpool allocation is 10% and the token is listed at a valuation of $2 billion, this may not be the most favorable situation either.

It's essential to consider scenarios where investors receive 25% unlocked tokens at the listing, but if the token's price skyrockets by a factor of x50, it might not represent an attractive investment opportunity.

Similarly, if Binance's launchpool allocation is 10% and the token is listed at a valuation of $2 billion, this may not be the most favorable situation either.

Mastering this kind of risk assessment requires practice and experience in the cryptocurrency markets. I would strongly advise delving into the token metrics and performance of previously listed assets on Binance.

It's worth noting that Binance consistently publishes reports on the assets they list, which can be found here:

binance.com

It's worth noting that Binance consistently publishes reports on the assets they list, which can be found here:

binance.com

Next, it's crucial to ascertain the identities of the investors, members of the advisory board, and the core team.

Do the investors have a track record of swiftly liquidating their allocations, or do they tend to retain and even increase their holdings over time?

Are there any advisors associated with this project who have experience or affiliations with other cryptocurrency exchanges?

Do the investors have a track record of swiftly liquidating their allocations, or do they tend to retain and even increase their holdings over time?

Are there any advisors associated with this project who have experience or affiliations with other cryptocurrency exchanges?

Once we've grasped the token metrics, let's now explore the ideal characteristics of a newly listed chart that would pique our interest for potential investment:

Do you recall the $MATIC listing on Binance that resulted in an astounding 1000% surge? This serves as an illustrative example of the type of chart we find appealing for newly listed assets:

We are on the lookout for a chart that demonstrates a gradual decline followed by a stair-step pattern, preferably unfolding over a few days. Additionally, it's especially enticing when this pattern emerges in adverse market conditions or during a bearish day. Such a chart formation often suggests significant potential for future growth.

We are on the lookout for a chart that demonstrates a gradual decline followed by a stair-step pattern, preferably unfolding over a few days. Additionally, it's especially enticing when this pattern emerges in adverse market conditions or during a bearish day. Such a chart formation often suggests significant potential for future growth.

We are actively seeking trend reversals based on low timeframe moving averages for our buying strategy (as demonstrated in the 4-hour chart above). I recommend reading my tutorial on Moving Averages for more insight into this approach.

When it comes to setting our take profit targets, we rely on the golden ratio Fibonacci extensions, specifically the 1.618 level. This choice is influenced by the absence of well-defined resistance levels on freshly listed charts.

Keep an eye out for our upcoming guide on Fibonacci retracements, as it will provide valuable insights into this aspect of our trading strategy.

When it comes to setting our take profit targets, we rely on the golden ratio Fibonacci extensions, specifically the 1.618 level. This choice is influenced by the absence of well-defined resistance levels on freshly listed charts.

Keep an eye out for our upcoming guide on Fibonacci retracements, as it will provide valuable insights into this aspect of our trading strategy.

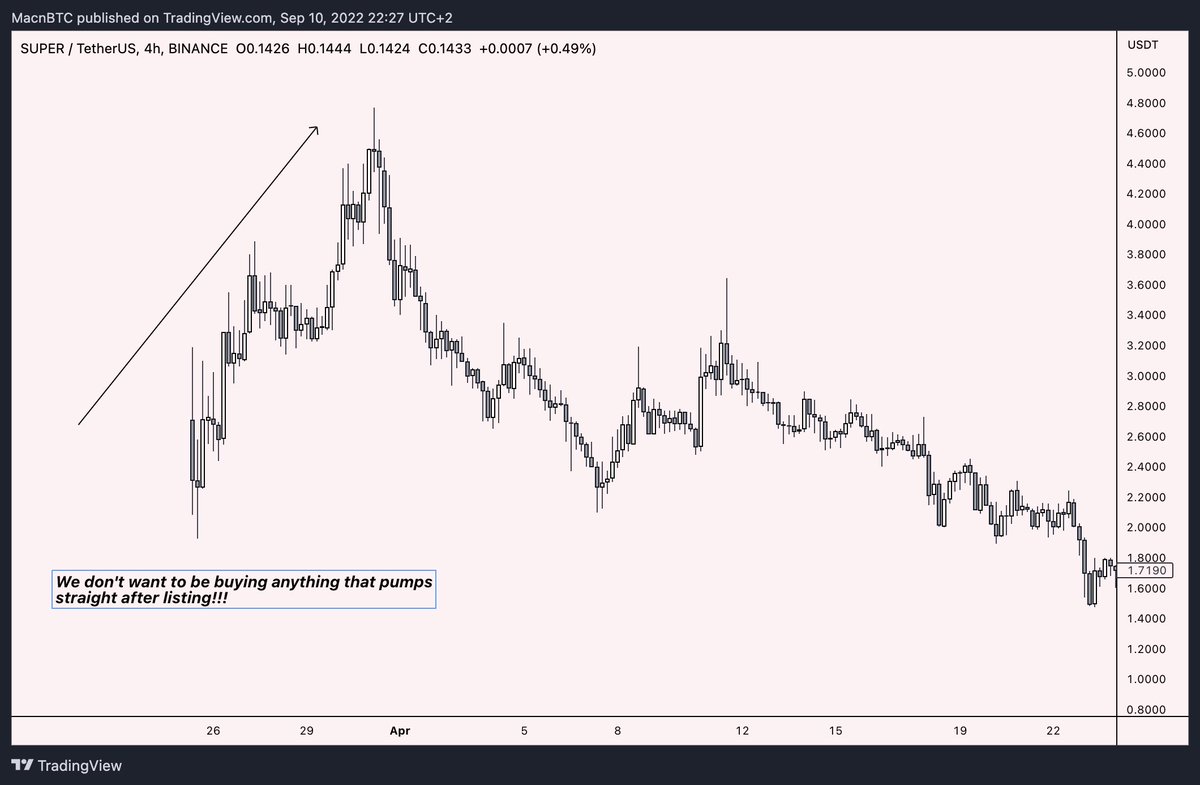

This is how we DON'T want a new chart to look like...

We don't want to be buying anything that pumps straight after listing! When I mean straight I mean the same day or day after listing

This is a technique used by market makers to generate the most amount of short term liquidity aka (buyers) to distribute (sell) the most amount of tokens

However there are exceptions to this ( $ORDI )

It all depends on how the token is distributed and WHO owns the tokens.

We don't want to be buying anything that pumps straight after listing! When I mean straight I mean the same day or day after listing

This is a technique used by market makers to generate the most amount of short term liquidity aka (buyers) to distribute (sell) the most amount of tokens

However there are exceptions to this ( $ORDI )

It all depends on how the token is distributed and WHO owns the tokens.

FTX has a reputation for adding newly listed assets and quickly boosting their prices upon listing to attract a surge of short-term liquidity from buyers. However, this is often followed by a rapid sale of these assets. Be cautious and exercise due diligence to avoid getting caught in this pattern.

Over the past few weeks, numerous newly listed assets have shown remarkable performance, and all it took was staying vigilant. Some notable examples include $TIA, $SEI, and $ORDI, $JTO, $NTRN.

Fortunately, in the world of cryptocurrencies, new opportunities are constantly emerging! 👽

Fortunately, in the world of cryptocurrencies, new opportunities are constantly emerging! 👽

Loading suggestions...