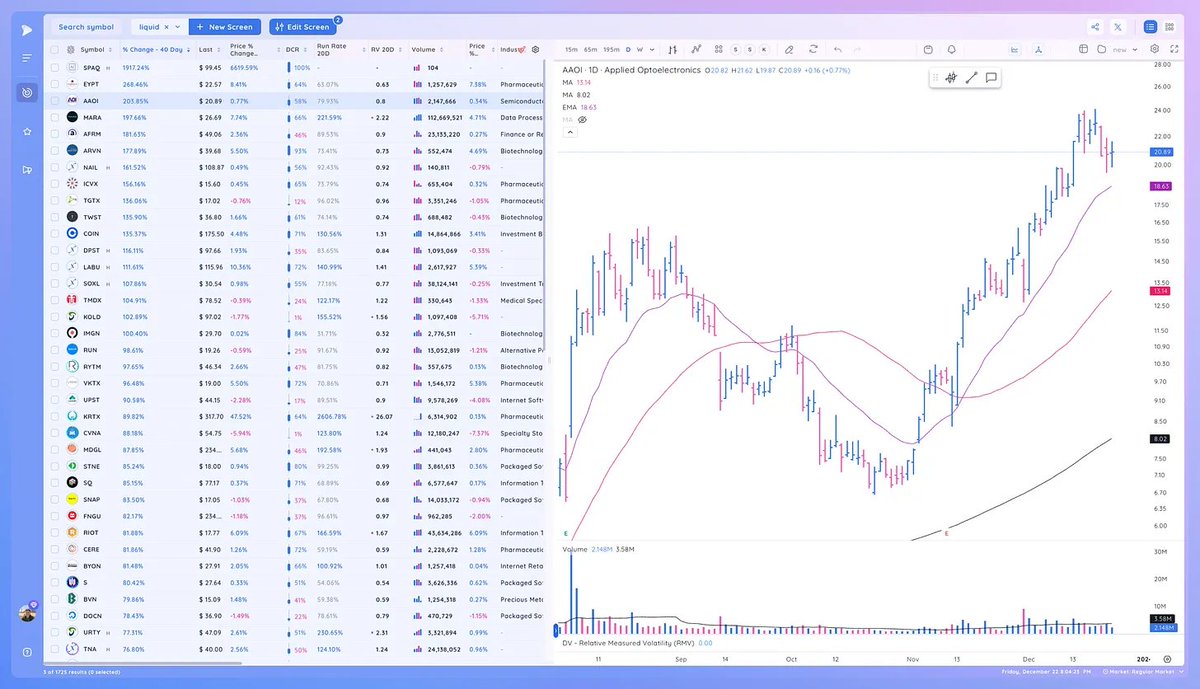

I created a scan with basic liquidity restrictions in Deepvue and sorted it by Performance over the past 40 days

Here are the top 150 Results

AAOI MARA AFRM ARVN NAIL ICVX TGTX TWST COIN DPST LABU SOXL TMDX KOLD IMGN RUN RYTM VKTX UPST KRTX CVNA MDGL STNE SQ SNAP FNGU RIOT CERE BYON S BVN DOCN URTY TNA CABA SONO IBP W BLD M CUK ACLX TECL DUOL CCL FOUR PATH SNDX NOVA SHOP TNDM BBIO MHO EXPE TQQQ LYFT CRSP SDGR ROKU GPS PVH BURL BPMC TPG PODD HASI FROG AMKR WAL DAVA SWTX BLDR ZG DOCU NTRA MTH LMND PLAY PINS FAS NCLH RCL YPF ANF GNRC Z TMF TRU AMR RYAAY SLG WIX IOT SSD GTLB MPWR XRX MAC ARKK CBAY GGAL FL NET COHR UBER TXG DDOG TREX U AZEK MNDY SVIX SIG DXCM ARKW ESTC RBLX LGIH BEAM AYX TWLO KKR BBWI VSCO INFA MSTR TOL RGEN AMD CRWD UPRO EXR SPXL METC BOH JLL WING UWM FRPT INTC VNO MKSI DHI FND TRIP X EFX LITE

Here are the top 150 Results

AAOI MARA AFRM ARVN NAIL ICVX TGTX TWST COIN DPST LABU SOXL TMDX KOLD IMGN RUN RYTM VKTX UPST KRTX CVNA MDGL STNE SQ SNAP FNGU RIOT CERE BYON S BVN DOCN URTY TNA CABA SONO IBP W BLD M CUK ACLX TECL DUOL CCL FOUR PATH SNDX NOVA SHOP TNDM BBIO MHO EXPE TQQQ LYFT CRSP SDGR ROKU GPS PVH BURL BPMC TPG PODD HASI FROG AMKR WAL DAVA SWTX BLDR ZG DOCU NTRA MTH LMND PLAY PINS FAS NCLH RCL YPF ANF GNRC Z TMF TRU AMR RYAAY SLG WIX IOT SSD GTLB MPWR XRX MAC ARKK CBAY GGAL FL NET COHR UBER TXG DDOG TREX U AZEK MNDY SVIX SIG DXCM ARKW ESTC RBLX LGIH BEAM AYX TWLO KKR BBWI VSCO INFA MSTR TOL RGEN AMD CRWD UPRO EXR SPXL METC BOH JLL WING UWM FRPT INTC VNO MKSI DHI FND TRIP X EFX LITE

Keep in mind that many of these are Biotech Gaps up which are not always tradable/catchable but all of these made significant moves.

To trade these names, they first have to get on your radar, so think to yourself what screen/part of your routine identified these type of stocks near or since the start of the cycle.

Be realistic with yourself about when they would have gotten on your radar and how.

Are you running a weekly performance screen, RS Screen, breaking above the 21ema…? When did they meet your technical buy criteria? Could you have managed risk?

Are you running a weekly performance screen, RS Screen, breaking above the 21ema…? When did they meet your technical buy criteria? Could you have managed risk?

Let's Analyze 10 of these moves, when they started, and when you could have entered.

I'll show what they looked like before and during their moves.

We'll cover stocks/etfs that fit the Crypto, Semis, AI, Software, and homebuilder themes.

I'll show what they looked like before and during their moves.

We'll cover stocks/etfs that fit the Crypto, Semis, AI, Software, and homebuilder themes.

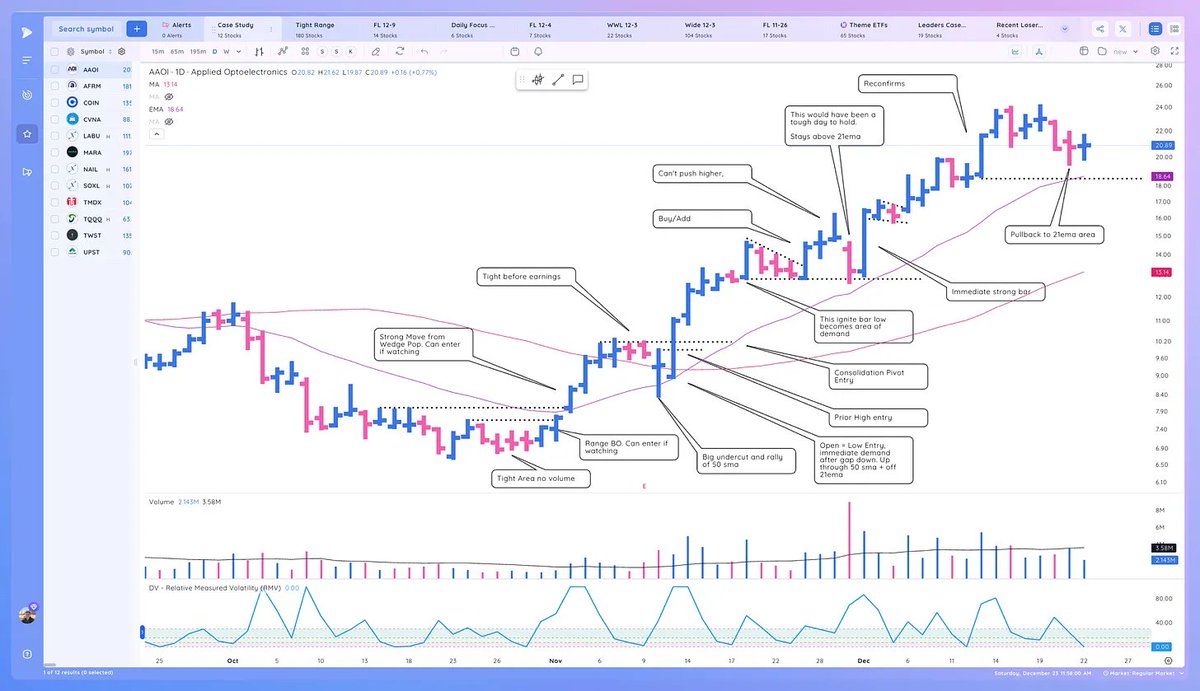

AAOI - This was the top performance enhancer in the prior market cycle when semis started ripping.

Unless you were focused on it because of the strength of the prior move, likely first actionable spot was after earnings Nov 10. It is up over 100% from the strong bar after the earnings upside reversal

Unless you were focused on it because of the strength of the prior move, likely first actionable spot was after earnings Nov 10. It is up over 100% from the strong bar after the earnings upside reversal

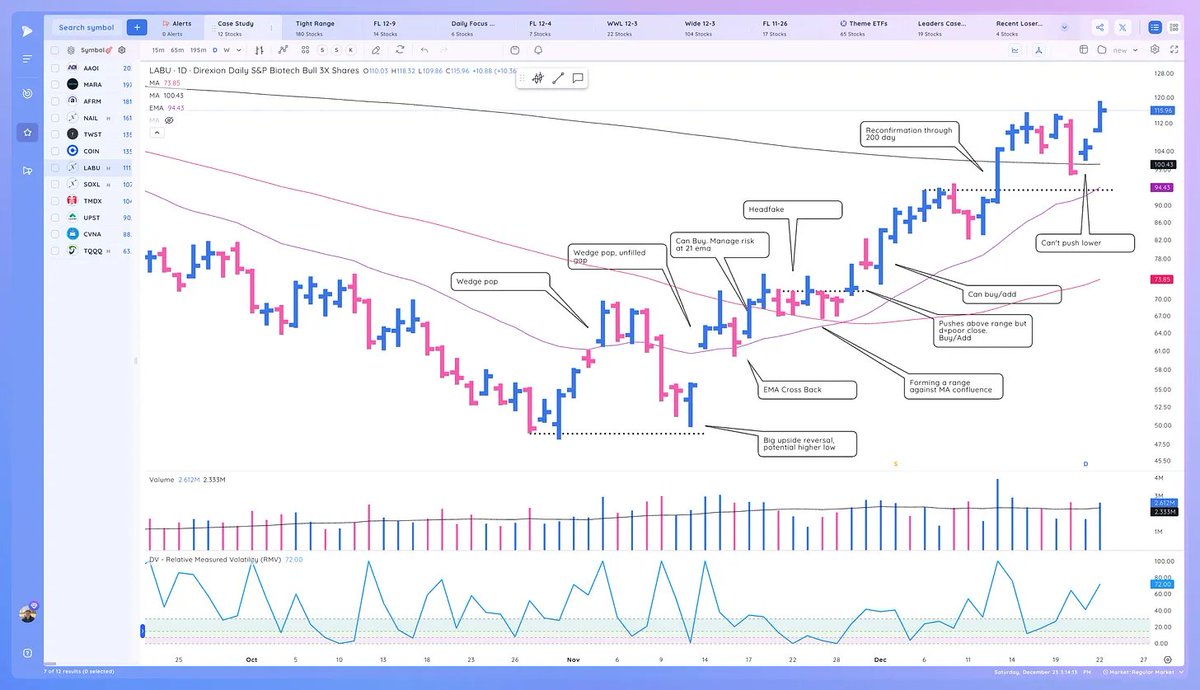

MARA - Bitcoin started a new cycle before stocks and the crypto theme pushed higher early. Here Is what it looked like Nov 2, already at the EMA crossback part of the cycle.

This one was frustrating even after the market bottomed as it chopped and breakout buys would not work until Nov 15. It is up 151% since the Nov 22 Outside Reversal spot

When Crypto is working MARA typically trends so that is one way it would be on your radar. Also looking at stocks above 21ema when market below.

This one was frustrating even after the market bottomed as it chopped and breakout buys would not work until Nov 15. It is up 151% since the Nov 22 Outside Reversal spot

When Crypto is working MARA typically trends so that is one way it would be on your radar. Also looking at stocks above 21ema when market below.

I hope you found this quick thread and chart annotations of the winners helpful.

If you did please retweet 🔁 this linked tweet

x.com?

If you did please retweet 🔁 this linked tweet

x.com?

Loading suggestions...