Investor's Guide: Prepayment and Interest Savings in Home Loans

(1/6)🏠 Owning a home in India is a cherished aspiration. But currently, most achieve this dream by opting for a home loan due to various factors such as insufficient savings and financial obligations towards other objectives. 🧵🧵🧵

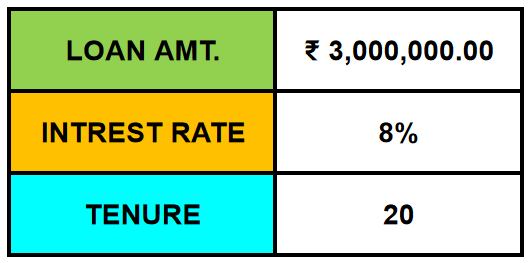

(2/6)⚖️ Before diving into a home loan, planning is vital. Our Excel sheet details a 30 lakh loan over 20 years at 8% interest. It shows an estimated interest payment of 30 lakhs. Want to trim that down? 🤔

(3/6)💡 Let's explore prepayment. Prepayment in a loan refers to paying off a part or the entire outstanding loan amount before it is due or before the designated loan term ends.

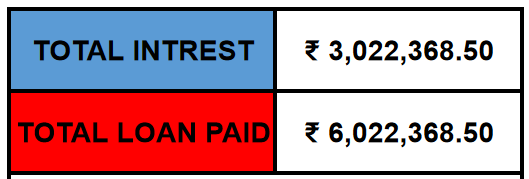

Before diving into prepayment, it's key to recognize that initially, most of your EMI covers the interest, but as time progresses, a larger portion starts chipping away at the principal. This shift can be observed in below image 👇👇👇

(1/6)🏠 Owning a home in India is a cherished aspiration. But currently, most achieve this dream by opting for a home loan due to various factors such as insufficient savings and financial obligations towards other objectives. 🧵🧵🧵

(2/6)⚖️ Before diving into a home loan, planning is vital. Our Excel sheet details a 30 lakh loan over 20 years at 8% interest. It shows an estimated interest payment of 30 lakhs. Want to trim that down? 🤔

(3/6)💡 Let's explore prepayment. Prepayment in a loan refers to paying off a part or the entire outstanding loan amount before it is due or before the designated loan term ends.

Before diving into prepayment, it's key to recognize that initially, most of your EMI covers the interest, but as time progresses, a larger portion starts chipping away at the principal. This shift can be observed in below image 👇👇👇

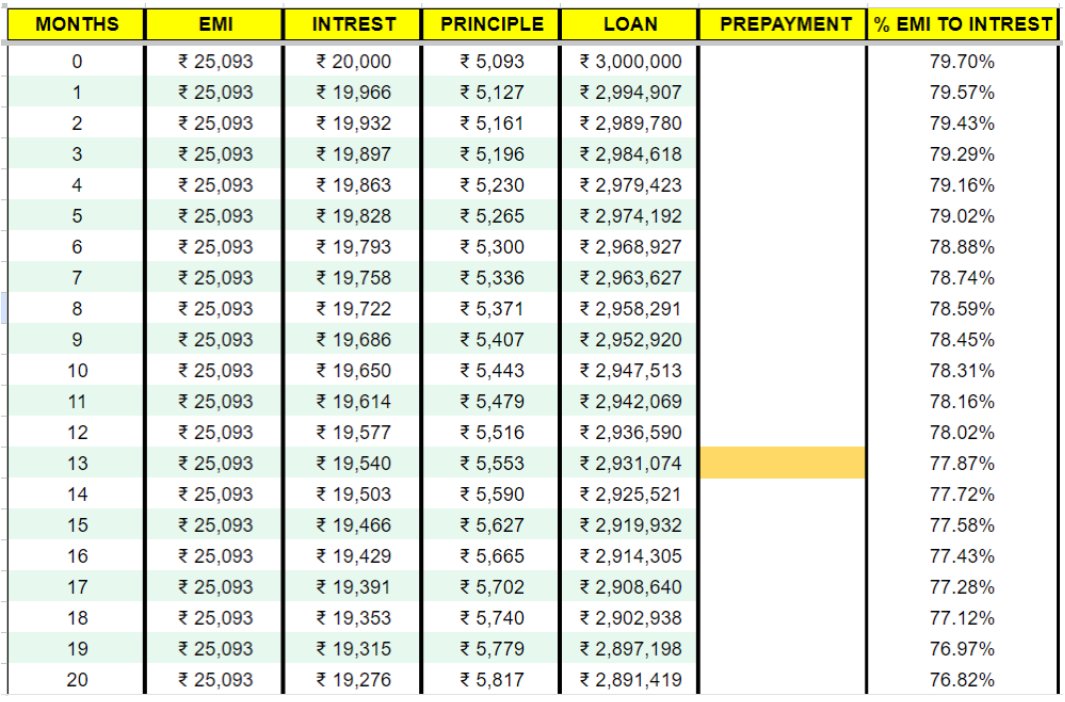

(4/6) 💰 Let's consider how a prepayment of 50,000 in the 13th month can reduce your interest by around 1.5 lakhs. This happens because the amount you've paid directly reduces the loan balance, consequently not accruing interest for the remaining loan term. This results in significant savings, interest payment. 👇👇

(5/6) 📊 Your task? Calculate the interest savings from a 50,000 payment in the 26th month. We're eager to know your answer! 🤝 and also find the link below for the excel sheet - #gid=1904300215" target="_blank" rel="noopener" onclick="event.stopPropagation()">docs.google.com and don’t forget to retweet for helping others as well.

(6/6) Thanks for reading! Let's crunch numbers and strategize to make homeownership more financially rewarding! 🌟

The excel sheet is designed to check your EMI and tenure upto 30 years . Please make changes accordingly 😊

📚 At SOIC, we empower investors with Fundamental and Business analysis. Become a Complete Investor with us! Check out SOIC Membership: soic.in

(5/6) 📊 Your task? Calculate the interest savings from a 50,000 payment in the 26th month. We're eager to know your answer! 🤝 and also find the link below for the excel sheet - #gid=1904300215" target="_blank" rel="noopener" onclick="event.stopPropagation()">docs.google.com and don’t forget to retweet for helping others as well.

(6/6) Thanks for reading! Let's crunch numbers and strategize to make homeownership more financially rewarding! 🌟

The excel sheet is designed to check your EMI and tenure upto 30 years . Please make changes accordingly 😊

📚 At SOIC, we empower investors with Fundamental and Business analysis. Become a Complete Investor with us! Check out SOIC Membership: soic.in

Loading suggestions...