Last Friday, I wrote about Understanding Risk and Resources. Today, I am writing the second part of it - Understanding Risk, Resources and how to achieve Optimum Performance in Trading.

As you have gone through the work of people who achieved optimum performance in trading consistently like @DanZanger @Qullamaggie etc., you will realize one common thing - their techniques and tactics are nothing special or much different than ours.

Unfortunately, we think it is their techniques which are the reason for success.

While this can run many workshops, webinars, courses - it is not going to help you take the next leap in trading.

Yet we spend countless hours going through the same crap we already know, again and again, and jump upon anything new, any new jargon we find - hoping it to help us achieve optimum performance.

While this can run many workshops, webinars, courses - it is not going to help you take the next leap in trading.

Yet we spend countless hours going through the same crap we already know, again and again, and jump upon anything new, any new jargon we find - hoping it to help us achieve optimum performance.

Contrary to the popular beliefs, it is also not your psychology which is holding you back.

No amount of external content consumption, in the form of books or webinars or workshops are going to fix your psychology.

It only helps the psychologists, not you!

No amount of external content consumption, in the form of books or webinars or workshops are going to fix your psychology.

It only helps the psychologists, not you!

So, what makes the likes of Qullamaggie & Dan Zanger exceptional traders, and what exactly is holding us back?

It is their in-depth understanding of Risk and Resources in Trading which helps them produce extraordinary results even from ordinary opportunities.

It is their in-depth understanding of Risk and Resources in Trading which helps them produce extraordinary results even from ordinary opportunities.

Last week I asked you all, do you know your resources well in Trading.

I got several replies, but many of them don't directly contribute to the outcome.

x.com

I got several replies, but many of them don't directly contribute to the outcome.

x.com

I explained what I consider as resources in trading, but before that, I want to explain what I consider as a resource -

"Anything which has a limited availability and is a direct input to produce the outcome is a resource."

"Anything which has a limited availability and is a direct input to produce the outcome is a resource."

As of now, I can identify total six resources in trading -

1) Capital

2) Time

3) Risk

4) Market Environment

5) Trading Opportunities

6) Move Post Entry

Feel free to add more as you spot one.

x.com

1) Capital

2) Time

3) Risk

4) Market Environment

5) Trading Opportunities

6) Move Post Entry

Feel free to add more as you spot one.

x.com

Now we need to bifurcate resources in two categories - rarity and controllability.

Simple questions -

1) Is the resource a rare resource?

2) Can we control them through any means?

Rarity depends on how limited the availability is. For example, the odds of getting a royal flush in poker is just 1 out of 649,739 hands.

Simple questions -

1) Is the resource a rare resource?

2) Can we control them through any means?

Rarity depends on how limited the availability is. For example, the odds of getting a royal flush in poker is just 1 out of 649,739 hands.

Based on controllability, we can divide resource in two categories -

Trader controlled Resources

Market controlled Resouces

Resources we control, we can bring or borrow them and limit them. We can't say the same about market-controlled resources.

Trader controlled Resources

Market controlled Resouces

Resources we control, we can bring or borrow them and limit them. We can't say the same about market-controlled resources.

Now we will look at each opportunity through rarity and controllability to understand their nature.

1) Capital -

- Capital is a resource because it is limited and is an input to produce results. But is it rare?

No, capital is not a rare resource. We can put our own capital and can borrow it as well. We can control the capital.

1) Capital -

- Capital is a resource because it is limited and is an input to produce results. But is it rare?

No, capital is not a rare resource. We can put our own capital and can borrow it as well. We can control the capital.

2) Time -

- We invest time in many forms in trading. Often, we don't realize, but it is limited and is an extremely important resource.

Time we give a trade to work directly impacts the frequency of our trading. Reduced frequency directly impacts the outcome.

Is time a rare resource? No. Can we control time? Yes.

- We invest time in many forms in trading. Often, we don't realize, but it is limited and is an extremely important resource.

Time we give a trade to work directly impacts the frequency of our trading. Reduced frequency directly impacts the outcome.

Is time a rare resource? No. Can we control time? Yes.

3) Risk -

- Risk is what plays the most important role in our trading decisions. Our capability to take risks is limited and it is an input to produce outcome.

Is risk a rare resource? No. Can we control risk? Yes.

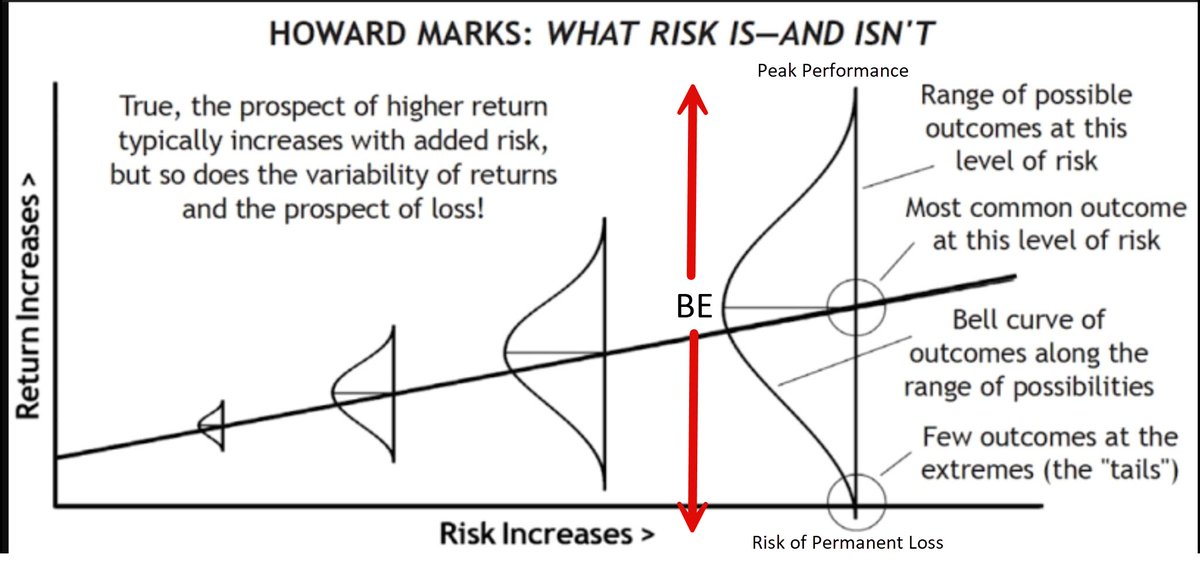

Now an interesting insight about risk in trading - I was reading a thread on Howard Mark's memo upon risk. And this was the image which describes how risk and return is proportionate.

It also describes the probabilities of different outcomes through different amount of risk involved.

- Risk is what plays the most important role in our trading decisions. Our capability to take risks is limited and it is an input to produce outcome.

Is risk a rare resource? No. Can we control risk? Yes.

Now an interesting insight about risk in trading - I was reading a thread on Howard Mark's memo upon risk. And this was the image which describes how risk and return is proportionate.

It also describes the probabilities of different outcomes through different amount of risk involved.

While what Howard Marks describes as risk is the risk of permanent loss or loss of entire capital instead of volatility risk, the risk of drawdown in trading or investing which is temporary and recoverable.

I mentioned this risk of permanent loss as risk of ruin in my thread last Friday.

But in my opinion, the graph is also apt to describe volatility risk along with the risk of ruin, if we consider the lower extreme as the risk of ruin, and the most common outcome as breakeven point in results.

The upside from the breakeven point is the gain probability with the extreme being the peak performance possible through trading.

Whatever is below BE point is loss and the bell curve suggests the probability of the loss to incur.

Don't become fanatical about the graph, rather try to understand the idea.

I mentioned this risk of permanent loss as risk of ruin in my thread last Friday.

But in my opinion, the graph is also apt to describe volatility risk along with the risk of ruin, if we consider the lower extreme as the risk of ruin, and the most common outcome as breakeven point in results.

The upside from the breakeven point is the gain probability with the extreme being the peak performance possible through trading.

Whatever is below BE point is loss and the bell curve suggests the probability of the loss to incur.

Don't become fanatical about the graph, rather try to understand the idea.

We can consider Jesse Livermore's making of a $100 Million in 5 days of crash in 1929 as almost the peak performance a trader can achieve. Consider George Soros and Stanley Drukenmiller's breaking of Bank of England too as peak performance.

While Jesse Livermore's becoming bankrupt after that represents the risk of ruin as well.

Qullamaggie and Dan Zanger, through their risk-taking abilities along with astute risk management can be considered very close to the peak performance a trader can achieve.

While Jesse Livermore's becoming bankrupt after that represents the risk of ruin as well.

Qullamaggie and Dan Zanger, through their risk-taking abilities along with astute risk management can be considered very close to the peak performance a trader can achieve.

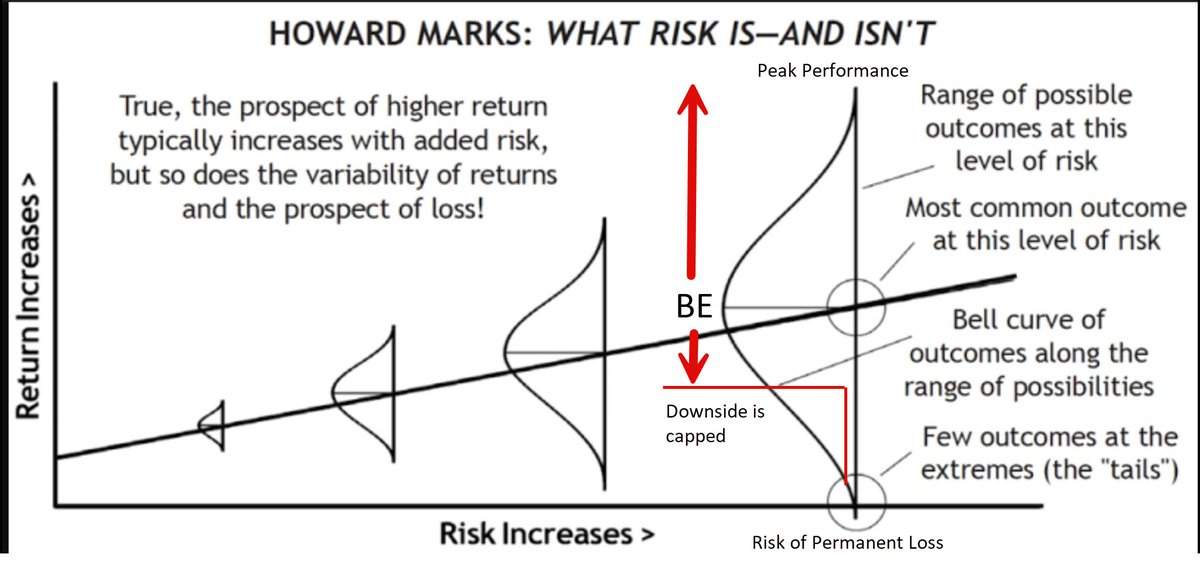

While the graph here shows both the upside and downside being same, what is the biggest advantage in trading is - the curve here will not be even on both sides rather it will be skewed.

Even with the very basic risk management we follow - putting a SL and position sizing according to risk on portfolio, you cap the downside while letting the upside remain totally uncapped and open.

This almost eliminates the probability of risk of ruin in trading hence what all we have to deal with is the volatility risk.

(again please don't become a "graphnazi")

Even with the very basic risk management we follow - putting a SL and position sizing according to risk on portfolio, you cap the downside while letting the upside remain totally uncapped and open.

This almost eliminates the probability of risk of ruin in trading hence what all we have to deal with is the volatility risk.

(again please don't become a "graphnazi")

All the trading material you consume through books, courses, videos and webinars do not understand this basic difference between the risk of ruin and the volatility risk.

Hence, we are always advised to keep drawdowns as low as possible at the cost of return but ironically at the same time are told how much money Dan Zanger or Qullamaggie made and how by following their techniques you too can make.

Hence, we are always advised to keep drawdowns as low as possible at the cost of return but ironically at the same time are told how much money Dan Zanger or Qullamaggie made and how by following their techniques you too can make.

Coming back to the resources we were discussing -

4) Market Environment -

- A favorable market environment is required to obtain the best results of your efforts as often imperfection too can be rewarded in favorable markets causing people to consider luck as skill while even precision gets punished in the bad ones.

A bull market is not a rare resource, but if you think it is limited. It is limited because it only comes for a limited time, and you will see a limited number of cycles only in your trading career.

Now, can you control the market environment? You say!

4) Market Environment -

- A favorable market environment is required to obtain the best results of your efforts as often imperfection too can be rewarded in favorable markets causing people to consider luck as skill while even precision gets punished in the bad ones.

A bull market is not a rare resource, but if you think it is limited. It is limited because it only comes for a limited time, and you will see a limited number of cycles only in your trading career.

Now, can you control the market environment? You say!

5) Trading Opportunities -

- You can't trade without tradable opportunities (some call it setups, but it can be different for different style of traders).

While many can say that a market is a favorable market because it provides ample opportunites, which is true, but why opportunities need separate mention is due to the rarity they can have and also because even bad market gives mouthwatering opportunites (hence they emerge independently as well).

- You can't trade without tradable opportunities (some call it setups, but it can be different for different style of traders).

While many can say that a market is a favorable market because it provides ample opportunites, which is true, but why opportunities need separate mention is due to the rarity they can have and also because even bad market gives mouthwatering opportunites (hence they emerge independently as well).

Now think of this situation, when Drukenmiller wanted to go 100% short on British Pound and Soros gave him a disdainful look and scolded him for going ONLY 100% short.

WHY? Because that was a lifetime opportunity, an opportunity which made them legends.

Also think about Michael Burry going short on US home loan market, when everyone thought of him being a crazy person. And now we have a movie on Burry and that legendary short trade.

Or even the recent one, when Hindenburg made a killing by shorting Adani stocks.

x.com

WHY? Because that was a lifetime opportunity, an opportunity which made them legends.

Also think about Michael Burry going short on US home loan market, when everyone thought of him being a crazy person. And now we have a movie on Burry and that legendary short trade.

Or even the recent one, when Hindenburg made a killing by shorting Adani stocks.

x.com

What matters in each of these instances is the rarity of the opportunity. Every setup has its own rarity, every investment opportunity has its own rarity, every short trade taken on macro or research has its own rarity.

Can we control them? Obviously not!

Can we control them? Obviously not!

6) Move Post Entry -

- Count the number of trades which moved up 100% after you entered? I can guarantee you it will get counted on your fingers.

When you brag about buying a stock which moved up 100% after entry, you aren't bragging about the move it produced, rather about the rarity of it and how much importance it keeps to you.

Now tell me how many moved 20% after you entered? It is not that rare.

But can we control the move we can get above entry? No!

- Count the number of trades which moved up 100% after you entered? I can guarantee you it will get counted on your fingers.

When you brag about buying a stock which moved up 100% after entry, you aren't bragging about the move it produced, rather about the rarity of it and how much importance it keeps to you.

Now tell me how many moved 20% after you entered? It is not that rare.

But can we control the move we can get above entry? No!

With the above explanation, we can separate the Trader-controlled resources from the Market-controlled resources -

1) Trader-controlled Resources - Capital, Time & Risk.

2) Market-controlled Resources - Environment, Opportunities and Move Post Entry

1) Trader-controlled Resources - Capital, Time & Risk.

2) Market-controlled Resources - Environment, Opportunities and Move Post Entry

The key to achieving optimum performance is not in the techniques of how any trader trades, rather it is upon how well he utilized opportunities when he was provided with a resource which is rare and isn't controlled by him.

And they did it by maximizing the availability of resources they can control - capital, time and risk - as and when the rare opportunity arrived.

Optimum performance in any situation can be obtained only when you understand the outcomes well, are well prepared for all the consequences possible and take calculated moves. Moves that can help you achieve extraordinary results from ordinary opportunites.

But what we often end up doing is to produce ordinary results from extraordinary opportunites.

And this is what stands between us and our dreams - the dreams of achieving super performance, the dreams of becoming like our ideal, the dreams of changing our lives, the dreams of becoming the best in the business, some day!

The End!

And they did it by maximizing the availability of resources they can control - capital, time and risk - as and when the rare opportunity arrived.

Optimum performance in any situation can be obtained only when you understand the outcomes well, are well prepared for all the consequences possible and take calculated moves. Moves that can help you achieve extraordinary results from ordinary opportunites.

But what we often end up doing is to produce ordinary results from extraordinary opportunites.

And this is what stands between us and our dreams - the dreams of achieving super performance, the dreams of becoming like our ideal, the dreams of changing our lives, the dreams of becoming the best in the business, some day!

The End!

Loading suggestions...